SiLeach™ Large-Scale Pilot Plant study exceeds design criteria

HIGHLIGHTS Initial design outcomes for the US$42m large-scale lithium processing pilot plant (“LSPP”) using Lithium Australia’s SiLeach™ technology, exceed all expectations Study outcome betters operating cost target – and without any by-product credits The LSPP can be cash positive with additional cost reduction upside from further optimisation and scale-up to commercial operating parameters Confirms upside …

HIGHLIGHTS

- Initial design outcomes for the US$42m large-scale lithium processing pilot plant (“LSPP”) using Lithium Australia’s SiLeach™ technology, exceed all expectations

- Study outcome betters operating cost target – and without any by-product credits

- The LSPP can be cash positive with additional cost reduction upside from further optimisation and scale-up to commercial operating parameters

- Confirms upside of processing mica mineral resources not currently viable with conventional mineral processing technology End-of-year target for financial investment decision on constructing LSPP

- Immediate focus on further optimisation test work with Murdoch University and ANSTO Minerals, and securing partnerships with existing operators to source mica already mined, but not processed, with resulting low exposure to mining costs

SUMMARY

A new study has found that a proposed large-scale US$42 million lithium processing pilot plant can be cash positive, and indicates that mica material can be a competitive source of commercial lithium products. The study also identifies multiple avenues for further substantial capital and operating cost reductions.

These are the key findings of the initial work released today by Lithium Australia (ASX:LIT) and CPC Project Design Pty Ltd (“CPC”) in their design and evaluation of a Large-Scale Pilot Plant (“LSPP”) based on the application of LIT’s advanced SiLeach™ lithium processing technology. The pilot plant’s design uses a base annual lithium carbonate production of 2,500 tonnes (~1/10th scale of a full scale production plant).

SiLeach™ eliminates the expensive roasting step in conventional lithium processing, with the technology capable of treating lithium bearing minerals currently being disposed of as waste from mining operations around the world, due to a lack of suitable mineral extraction technology.

The LSPP design and execution objective was to construct and operate a facility that demonstrates the scalability of the Sileach™ process with break-even operating costs of US$10,000 per tonne of lithium carbonate. The CPC study shows this should be readily achievable without reliance on byproduct credits.

The study also concludes that:

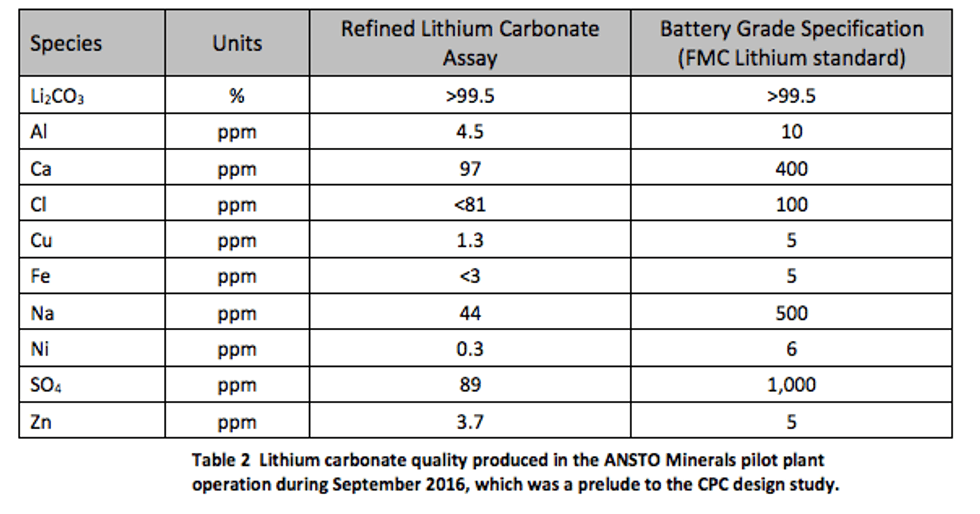

- Recovery of high purity lithium carbonate that meets offtake specification, can be achieved;

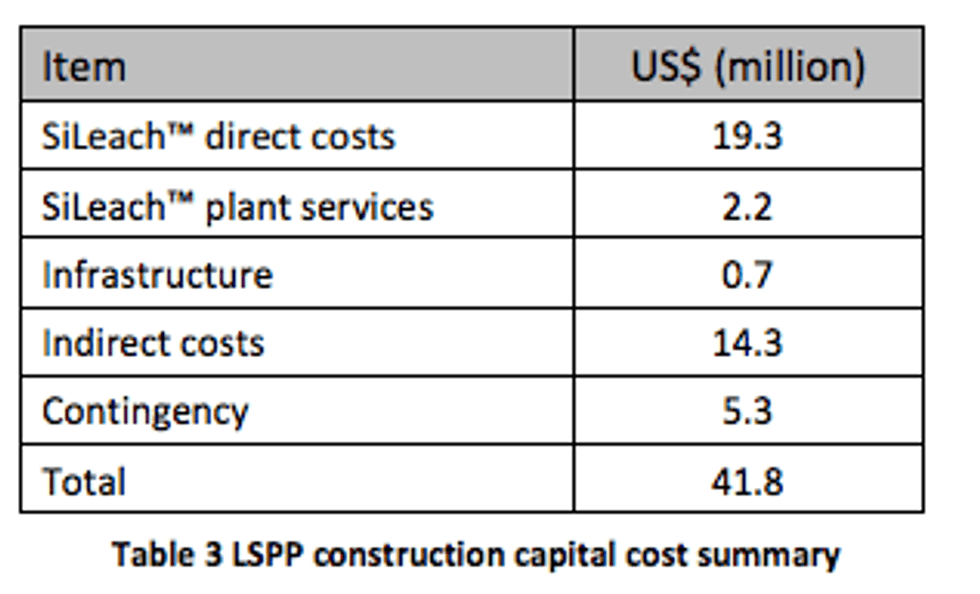

- A LSPP will have a capital construction cost, including contingencies, of US$42 million;

- LSPP operating costs for a Malaysian based case, including the cost of feed material (estimated at US$365 per tonne on a ‘free in store’ basis or US$3,960 per tonne of lithium carbonate) but before accounting for by-product credits, are US$9,200 per tonne of lithium carbonate produced, which is below the LSPP study target break-even operating cost of US$10,000 per tonne of lithium carbonate;

- Hydrometallurgical plant operating costs of around US$5,600 – US$6,400 per tonne of lithium carbonate produced, without consideration of any potential by-product credits;

- By-product credits have potential to significantly reduce operating costs. However LIT has not included by-product value in this study as further test work is required. This work is currently in progress with LIT’s technology partners;

- Potential to make further significant improvements to both capital and operating costs by:

- improved water management, a key driver of the capital cost;

- optimisation of reagent mix and usage; o improved control on neutralisation to minimise lithium losses;

- optimising the trade-off of residence time versus recovery; and

- economies of scale transitioning from pilot plant testing to commercial operations.

LIT’s current preferred supply model is to source lithium mica from waste streams from already operating mines. LIT is also pursuing exploration activity to secure alternative supply. LIT currently has a footprint in Western Australia, South Australia, Queensland, the Northern Territory, Mexico and Germany. The sourcing of this mica is the Company’s priority and this remains a critical requirement for the LSPP.

STRATEGIC RATIONALE

The successful commercialisation of LIT’s SiLeach™ process provides the opportunity to produce lithium chemicals from silicates without the requirement for roasting. Application of the process creates a more direct supply conduit through to the lithium chemical end users, e.g. battery producers, rather than selling a lithium mineral concentrate for downstream “conversion” to lithium chemicals.

SiLeach™ is a disruptive process, capable of generating high-value lithium chemicals, potentially with lower operating costs than conventional processing. SiLeach™ is designed to improve sustainability of lithium resources, by processing minerals that are otherwise considered waste, and allowing greater resource recovery by reducing operating costs.

The CPC study reported herein demonstrates that even at low production levels – and without any by-product credits – SiLeach™ has the potential to generate an operating cash surplus at a small scale. Economies of scale are likely to further reduce operating costs as the process is commercialised. The process optimisations identified during this study should lead to LIT committing to a LSPP with far greater commercial returns than presently demonstrated.

Optimisation studies will be undertaken during 2017, to improve both capital and operating costs, with a view of committing to construction of a LSPP by year end. Results of the optimisations will be reported as they become available.

PREPARATORY WORK

In recognising an opportunity to recover lithium from materials commonly considered to be uneconomic, LIT in 2015 commenced investigating disruptive technologies to achieve a commercial outcome. This led to the development of the 100% LIT-owned SiLeach™ process which is capable of recovering lithium from any silicate including spodumene and lithium micas. This announcement relates to the processing of lithium micas, lepidolite in particular.

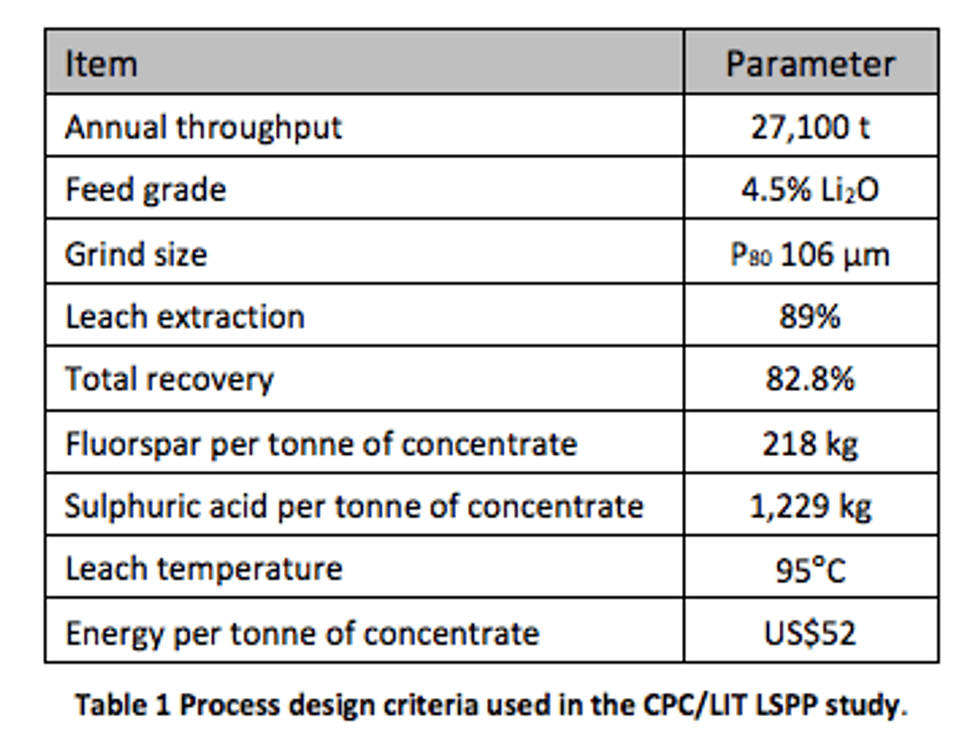

Laboratory scale test work, and pilot plant trials on lepidolite bearing material, undertaken by ANSTO Minerals (a division of the Australian Nuclear Science and Technology Organisation) formed the basis of the process design criteria (as shown in Table 1) prepared by CPC for the purpose of plant design, capital cost estimates, operating cost estimates and infrastructure studies required to evaluate operation of the LSPP.

PROCESS FLOWSHEET

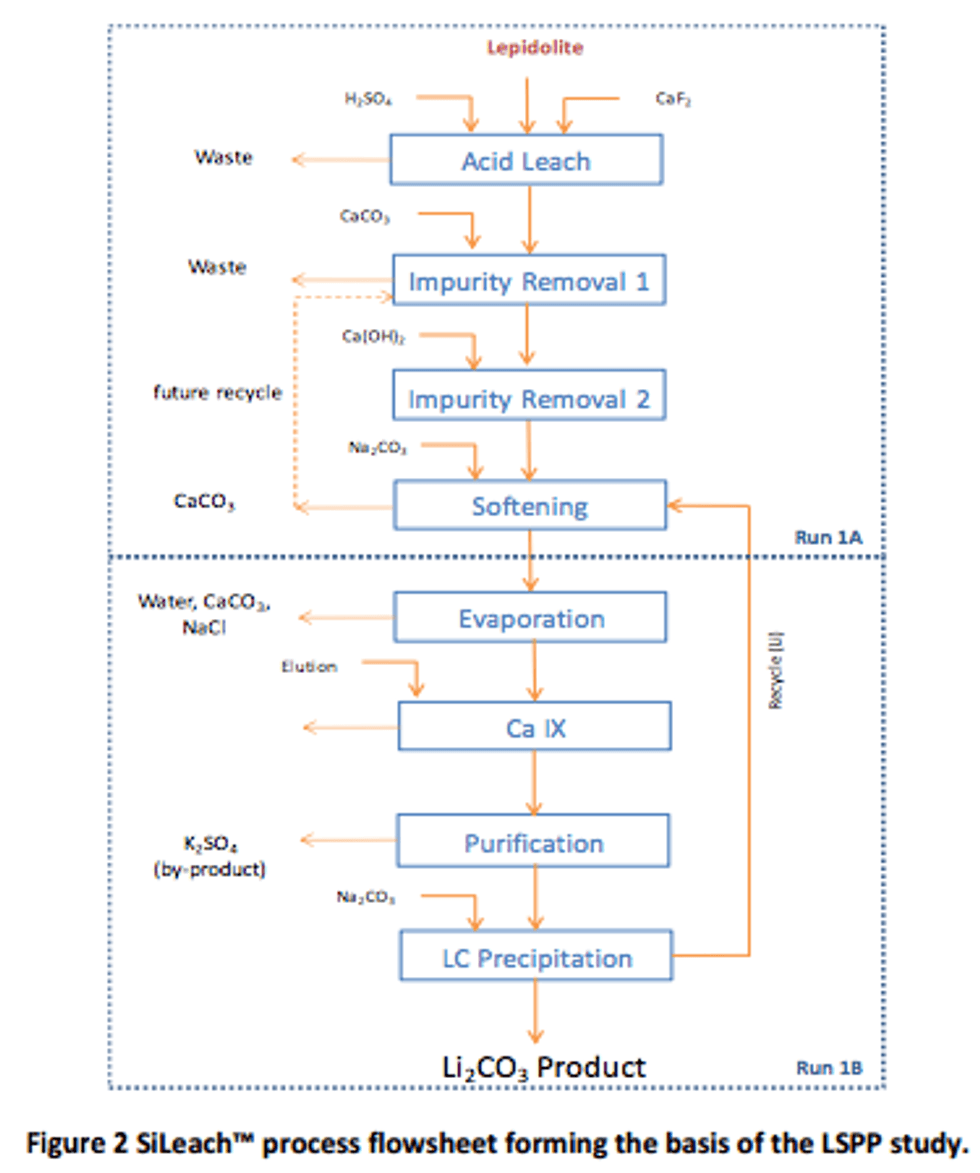

The flowsheet used for the pilot plant testing by ANSTO which generated the data and formed the basis of the process design criteria evaluated by CPC, is shown in Figure 2.

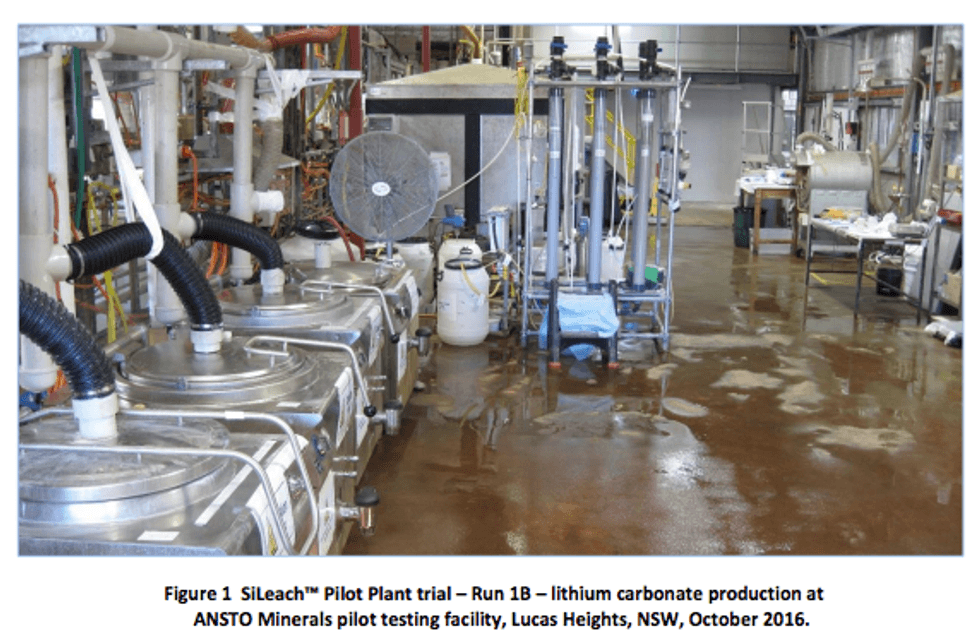

During pilot plant testing, the process was split into two runs, 1A and 1B, operated from 12 to 17 September 2016 and 10 to 12 October 2016. Pilot plant operations resulted in the production of battery grade lithium carbonate as detailed in Table 2.

COST ESTIMATES

Capital and operating costs in this study are based on process data from successful continuous pilot plant trials and as such are more reliable than studies reliant on bench scale or large-scale laboratory test work.

Capital costs are based on comprehensive mechanical equipment schedules with vendor pricing for major components and CPC’s data base for minor component pricing. Operating costs were based on site specific logistics and supplier quotes and exclude the procurement and transport of feed material.

To determine the sensitivity to location, a number of sites were evaluated. Of those sites examined, Malaysia provided both the lowest operating cost, and the lowest capital cost and those costs are reflected in the figures provided in this summary. Taxation and government subsidies were not considered. However, it is appropriate to note that research and development rebates currently available in Australia can make a very significant difference in the financial outcome of operating a pilot plant as contemplated. Subsidies are also available in Europe under some circumstances.

The LSPP capacity chosen was 27,100 tpa concentrate feed and the costs reported were expressed as Q1 2017 costs, including AU$:US$ of 0.75. LSPP construction capital costs, to an accuracy of +/- 35% are summarised in Table 3.

FUTURE OPTIMISATION

Analysis of the CPC study shows that approximately 32% of direct capital cost and 6% of the operating cost in the base case design is associated with evaporation and crystallization unit processes following Impurity Removal 2 (refer Figure 2), which is required to manage the process water balance. LIT has identified two scenarios by which a significant portion of this capital cost can be removed, also resulting in reductions in operating cost.

Murdoch University, under the auspices of a Mineral Research Institute of Western Australia (MRIWA) grant, continues its work program on the production of valuable by-products from the SiLeach™ process solutions. The suite of by-products is likely to include aluminium, silicon, caesium, rubidium and potassium chemicals.

The implementation of process design changes, to improve the management of the water balance, and the recovery of by-product credits, have the potential of providing one of the most cost efficient routes to the production of lithium chemicals.

SPODUMENE RESEARCH PROGRAM

The SiLeach™ pilot plant trial on spodumene feed completed at ANSTO Minerals in February 2017, demonstrated the ability to recover lithium from conventional lithium mineral concentrates without roasting. Most of the challenges with processing spodumene have resulted from mechanical issues associated with gypsum precipitation. LIT has identified a remedy to this issue and intends to continue pilot plant testing SiLeach™ on spodumene concentrates later in the year.

LIT is also in discussions with a number of parties with respect to the application of SiLeach™ for processing spodumene.

NEXT STEPS

LIT will proceed with:

- further test work to understand and realise the potential for by-product credits via its technology partners, Murdoch University and ANSTO Minerals;

- further optimisation studies around the areas of reagent and recovery optimisation, residence times and water balance; and

- pursuing opportunities to source feed from existing operations where the value of accessory lithium minerals is not being captured, due to a lack of suitable technology such as SiLeach™, as well as exploring for and developing LIT-owned mineral deposits.

Lithium Australia Managing Director, Mr Adrian Griffin:

“The LSPP study outcomes are encouraging. They show that a SiLeach™ large scale pilot plant can be potentally profitable – and this without considering by-product credits or further optimisation. This was not the primary aim of the study – we would have been happy with break-even at this scale and stage of the commercialisation program – but we now have additional confidence in pursuing a LSPP as the study outcomes are based on successful pilot-scale test work at one of Australia’s premier mineral research institutions. We will use the remainder of 2017 to optimse the outcomes with a view of committing to construction of such a plant.”

Adrian Griffin

Managing Director

Mobile +61 (0) 418 927 658

Adrian.Griffin@lithium-au.com

About Lithium Australia NL:

LIT is a dedicated developer of disruptive lithium extraction technologies. LIT has strategic alliances with and investments in a number of companies, potentially providing access to a diversified lithium mineral inventory. LIT aspires to create the union between resources and the best available technology and to establish a global lithium processing business.

MEDIA CONTACT:

Adrian Griffin Lithium Australia NL 08 6145 0288 | 0418 927 658

Kevin Skinner Field Public Relations 08 8234 9555 | 0414 822 631

Click here to connect with Lithium Australia (ASX:LIT) to receive an Investor Presentation.

Source: lithium-au.com