- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

July 05, 2023

European Lithium Limited (ASX: EUR, FRA: PF8, OTC: EULIF) (European Lithium or the Company) is pleased to announce Critical Metals Corp. (Critical Metals or CRML) has entered into a share subscription facility for up to US$125.0M from GEM Global Yield LLC SCS (GEM), a Luxembourg based private alternative investment group. Proceeds from the facility are expected to be used to fund the development of the Wolfsberg Lithium Project in Austria (Wolfsberg or Wolfsberg Project).

HIGHLIGHTS

- Critical Metals has signed an agreement for a share subscription facility for up to US$125.0M in transaction funding from Global Emerging Markets (GEM)

- Critical Metals expects to provide an update on further equity funding in the near term

- Funding will principally be used to accelerate the development of the Wolfsberg Lithium Project in Austria.

Tony Sage, Chairman, commented: “Receiving this significant and binding commitment is a huge milestone for the Company. Combined with European Lithium’s recent deal with Saudi Arabian based, Obeikan Investment Group, the Company and Critical Metals have secured approximately 65% of the total expected capex of the Wolfsberg Project and brings us closer to our stated goal to be the first local producer of lithium spodumene for the green energy transition in Europe.”

Under the terms of the definitive agreement, Critical Metals will have access to up to US$125.0M in incremental capital to fund its operations upon closing of the business combination transaction. The facility would enable Critical Metals, in its discretion but subject to the terms and conditions set forth in the definitive agreements, to draw down funds (up to US$125.0M) through the issuance of new shares directly to GEM over a three-year period after the closing of the transaction. Assuming no further redemptions are made by public stockholders of Sizzle Acquisition Corp. (Sizzle) in connection with its shareholder vote to approve the transaction, Critical Metals would now be expected to have access to up to ~US$175.0M in transaction proceeds (comprising of the GEM finance package and existing cash reserves).

The GEM finance package, together with European Lithium’s additional funding secured through the binding term sheet with Obeikan Investment Group (Obeikan)(refer to EUR announcement dated 2 June 2023), are expected to provide Critical Metals and European Lithium with significant capital to accelerate the development of the Wolfsberg Project once the transaction with Sizzle completes.

The Company can report substantial progress has been made in the development plan for the Wolfsberg project with the achievement of several key milestones highlighted by:

- Mining permit secured - spodumene mined from the project successfully demonstrated its capability to supply high-purity lithium (99.6% lithium carbonate equivalent) at pilot plant.

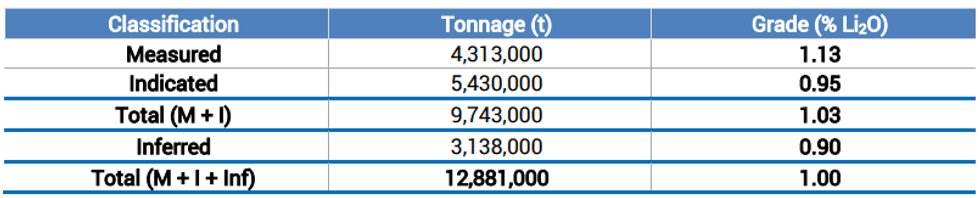

- Mineral Resource Estimate1 - 12.88 Mt of Measured, Indicated and Inferred classified Resources at 1.00% Li2O grade in Zone 1 only:

- Economic viability - Definitive Feasibility Study (DFS)2 that demonstrates a post-tax NPV of US$ 1.5 billion @ WACC13 6%, mined over approximately 15 years.

- Binding offtake agreement with top-tier auto manufacturer secured - direct long term lithium hydroxide supply agreement with BMW4.

- Binding agreement to build hydroxide plant - partnership with Obeikan to build lithium hydroxide processing plant in Saudi Arabia with significant cost savings expected.

- Advanced project with drilling upside – established mine and current resource estimate based only on Zone 1 with drilling undertaken showing prospectivity in Zone 2.

For full details of the DFS, please refer to EUR announcement dated 8 March 2023, “Wolfsberg Lithium Project Definitive Feasibility Study Results”. The Mineral Resources underpinning the Ore Reserve have been prepared by a competent person in accordance with the requirements of the JORC Code (2012). The Competent Person’s Statement(s) are found in the section of this ASX release titled “Competent Person’s Statement(s)”. European Lithium confirms that it is not aware of any new information or data that materially affects the information included in that release. All material assumptions and technical parameters underpinning the estimates in that ASX release continue to apply and have not materially changed.

Click here for the full ASX Release

This article includes content from European Lithium Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EUR:AU

The Conversation (0)

07 September 2023

European Lithium

Developing the Advanced Wolfsberg Lithium Deposit in Austria

Developing the Advanced Wolfsberg Lithium Deposit in Austria Keep Reading...

27 August 2025

CRML signs LOI Offtake Agreement with UCORE (DOD Funded)

European Lithium (EUR:AU) has announced CRML signs LOI Offtake Agreement with UCORE (DOD Funded)Download the PDF here. Keep Reading...

20 August 2025

Outstanding New 2024 Diamond Drill Results Tanbreez Project

European Lithium (EUR:AU) has announced Outstanding New 2024 Diamond Drill Results Tanbreez ProjectDownload the PDF here. Keep Reading...

30 July 2025

Quarterly Activities Report and Appendix 5B

European Lithium (EUR:AU) has announced Quarterly Activities Report and Appendix 5BDownload the PDF here. Keep Reading...

24 July 2025

EUR Sells 0.5m CRML Shares for U$1.8m (A$2.7m)

European Lithium (EUR:AU) has announced EUR Sells 0.5m CRML Shares for U$1.8m (A$2.7m)Download the PDF here. Keep Reading...

09 July 2025

EUR Sells 0.5m CRML Shares for U$1.625m (A$2.5m)

European Lithium (EUR:AU) has announced EUR Sells 0.5m CRML Shares for U$1.625m (A$2.5m)Download the PDF here. Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00