February 29, 2024

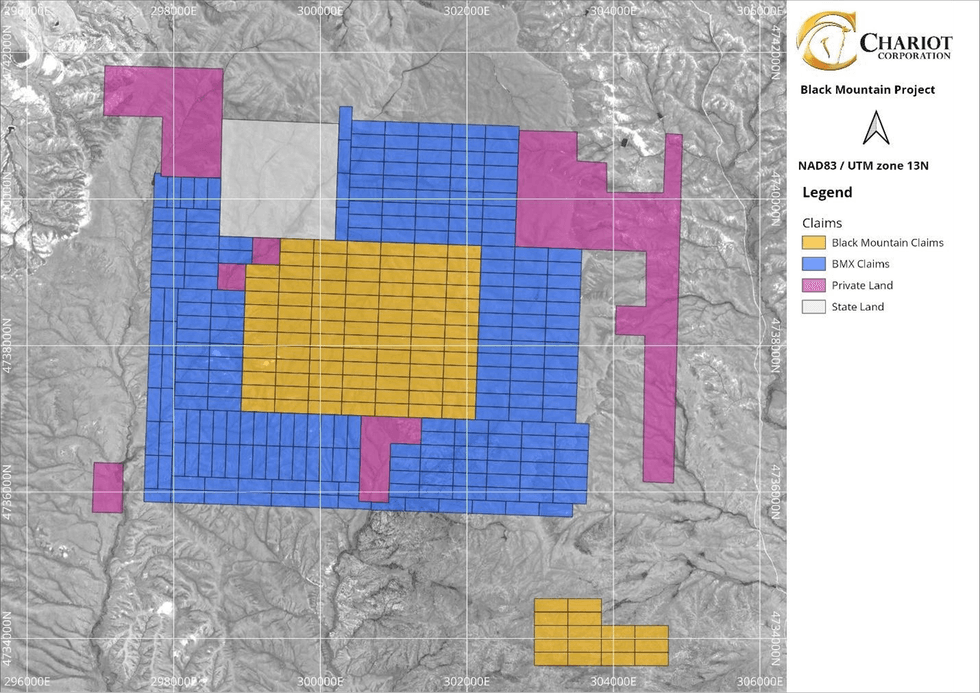

Chariot Corporation Limited (“Chariot”, “CC9” or the “Company”) is pleased to announce that it has significantly expanded the footprint of the Black Mountain project (“Black Mountain“) by staking and filing with the Bureau of Land Management (”BLM”) 218 unpatented lode mining claims (“Claims”) totalling 1,807 ha of tenure (“BMX Claims”).

HIGHLIGHTS

- Chariot expands Black Mountain project by 218 contiguous claims resulting in a 206% increase in project tenure area

- Black Mountain project now comprises 352 claims covering 2,686 ha of tenure

- Chariot has increased its ownership interests in its Wyoming Lithium Portfolio to 93.9%

The BMX Claims are contiguous to the Company’s existing Black Mountain Claims and represent a 206% increase in the footprint of Black Mountain (see Figure 1).

The BMX claims were staked as a buffer and to cover possible extensions to the pegmatite dike swarms under shallow cover at Black Mountain.

Increased Ownership of Wyoming Lithium Portfolio

On 9 January 2024, Chariot increased its ownership of Wyoming Lithium Pty Ltd (“WLPL”) from 91.9% to 93.9% via a share subscription to reimburse Chariot for exploration expenses incurred at the Wyoming Lithium Projects.

Chariot’s Preeminent Position in Wyoming

The Company owns seven (7) hard rock lithium projects in Wyoming (“Wyoming Lithium Portfolio”), which is a State that is poised to become an important future supplier of a critical mineral for the U.S.A. (see Figure 2). Each of the projects comprising Chariot’s Wyoming Lithium Portfolio is located in an area without any known land-use encumbrances.

A summary of Chariot’s current land position in Wyoming is summarised below in Table 1 and Figure 2.

Click here for the full ASX Release

This article includes content from Chariot Corporation, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CC9:AU

The Conversation (0)

07 February 2025

Chariot Corporation

Largest lithium exploration land holdings in the US

Largest lithium exploration land holdings in the US Keep Reading...

27 March 2025

Second Amendment to Black Mountain Purchase Option

Chariot Corporation (CC9:AU) has announced Second Amendment to Black Mountain Purchase OptionDownload the PDF here. Keep Reading...

26 March 2025

Convertible Note Financing of up to A$2.0 Million

Chariot Corporation (CC9:AU) has announced Convertible Note Financing of up to A$2.0 MillionDownload the PDF here. Keep Reading...

18 February 2025

High-Potential WA Lithium & Gold Tenements Secured

Chariot Corporation (CC9:AU) has announced High-Potential WA Lithium & Gold Tenements SecuredDownload the PDF here. Keep Reading...

31 January 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Chariot Corporation (CC9:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

26 November 2024

Black Mountain Phase 2 Program has Commenced

Chariot Corporation (CC9:AU) has announced Black Mountain Phase 2 Program has CommencedDownload the PDF here. Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00