February 21, 2024

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) is pleased to provide an update on exploration activities within the Company’s large 100%-owned Bangemall Project in the Gascoyne region of Western Australia.

- Fixed loop EM survey continues at Mount Vernon Project

- Evidence of differentiated sill and mafic cumulate rocks

- Shallow EM conductor confirmed at Trouble Bore Project

Miramar is exploring for Norilsk-style nickel, copper and platinum group element (Ni-Cu-PGE) mineralisation related to 1070Ma aged Kulkatharra Dolerite sills, part of the Warakurna Large Igneous Province and the same age as the large Nebo-Babel Ni-Cu deposits in the West Musgraves.

The fixed loop electromagnetic (FLTEM) survey underway within the Mount Vernon project areas has recommenced after a short break due to extreme weather conditions throughout the Gascoyne region.

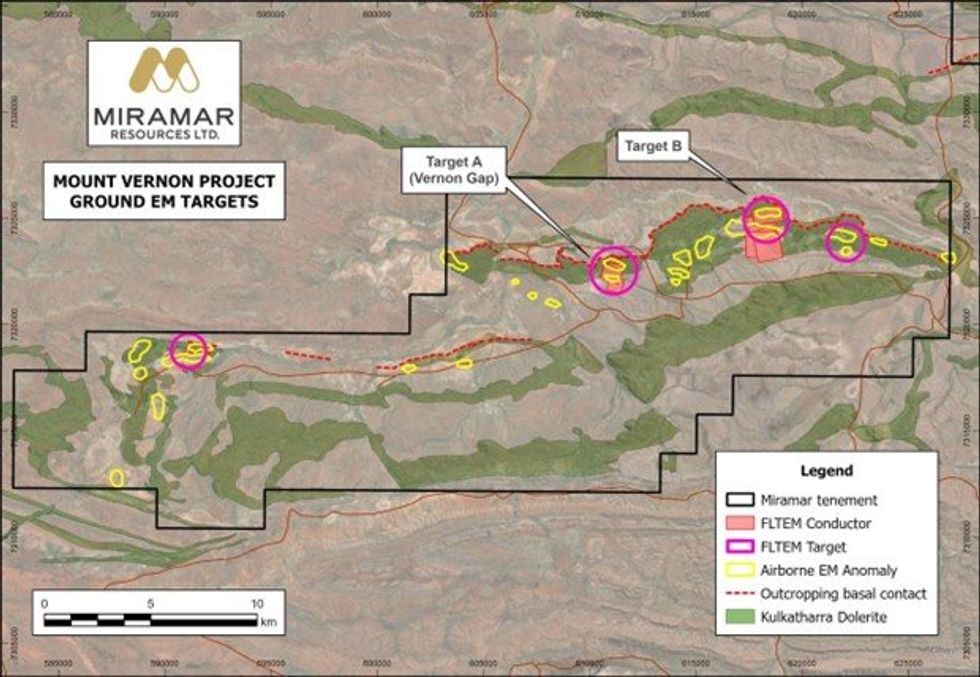

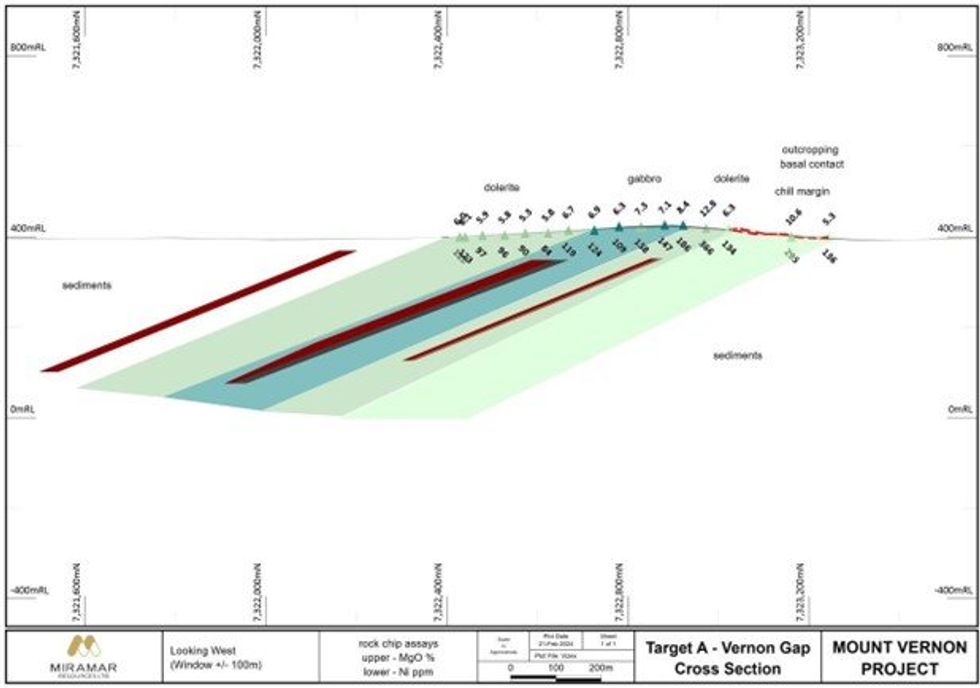

As discussed in the ASX release on 13 February 2024, the FLTEM survey at Mount Vernon has so far identified multiple late-time conductors at the first two targets tested to date (Figure 1), with modelling of the data indicating south-dipping conductive plates near the base of the dolerite sill where nickel-copper sulphides may have accumulated (Figure 2).

In addition to the EM results, evidence that the dolerite sill has undergone differentiation, and could therefore host Ni-Cu-PGE sulphide mineralisation, includes the following, as shown in Figure 2:

- Variation in grain size from very fine-grained chill margins at the extremities to coarser-grained gabbro in the centre of the sill.

- Increasing magnesium oxide (MgO), nickel and PGE results towards the bottom (northern margin) of the sill

- Nickel-chromium-titanium (Ni-Cr-Ti) ratios suggesting the presence of mafic cumulate rocks which are an important component of this style of mineralisation

The FLTEM survey will test two further targets within the Mount Vernon Project where strong late-time airborne EM anomalies are seen within and/or underneath the northernmost dolerite sill.

Miramar’s Executive Chairman, Mr Allan Kelly, said the Company believed the Bangemall Project had the potential for a style of Ni-Cu-PGE mineralisation not previously seen in WA.

“We are the first company to explore for this style of mineralisation in the Bangemall region and are systematically progressing our targets towards the maiden drilling programme,” he said.

“At Mount Vernon, we identified multiple targets from our airborne EM survey and have now confirmed two of these with ground EM surveys and rock chip sampling,” he added.

“It is worth noting that, in contrast to many existing WA nickel deposits, the style of mineralisation we are looking for in the Bangemall occurs as large and very valuable orebodies that are basically immune to short-term swings in the nickel price,” Mr Kelly said.

“Like the discovery of Nebo-Babel in 2000, or Nova-Bollinger in 2012, if we can show proof of concept of the Norilsk-style deposit model at Mount Vernon and/or Trouble Bore, it opens up the entire Bangemall region as a new nickel-copper province, one where we have built a dominant landholding,” he added.

Trouble Bore

Prior to taking a short break due to extreme weather conditions in the region, the geophysical contractors completed a reconnaissance moving loop electromagnetic (MLEM) survey over the 3 kilometre long historic late-time SkyTEM anomaly at the recently granted Trouble Bore Target.

The SkyTEM anomaly occurs at the intersection of a dolerite sill and a potential N-S trending feeder dyke both of which are mostly buried beneath later sediments (Figure 3).

Evidence of the dolerite sill is seen in outcrop along strike in either direction.

A single historic RC hole drilled in 2013 targeted channel iron deposits and did not intersect the dolerite sill or test the SkyTEM anomaly. There is no recorded historical geochemical sampling in the area.

The recent MLEM survey confirmed the historic SkyTEM anomaly, with subsequent modelling suggesting a shallow, sub-horizontal conductor with a moderate conductance of approximately 200 Siemens.

Given the interpreted geological setting of the EM anomaly compared with known Ni-Cu-PGE deposits, especially step 2 of Figure 4, Miramar has submitted a Program of Work (POW) application for drilling at Trouble Bore.

The Company already has POW approval for drilling at Mount Vernon and will apply for co-funding under the WA Government’s Exploration Incentive Scheme (EIS) for drilling at both Mount Vernon and Trouble Bore.

Click here for the full ASX Release

This article includes content from Miramar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

copper-stocksasx-m2rresource-stocksasx-stocksgold-explorationgold-stocksnickel-stockscopper-investingcopper-explorationnickel-exploration

M2R:AU

The Conversation (0)

06 February 2024

Miramar Resources

Aiming to create shareholder value through the discovery of world-class mineral deposits

Aiming to create shareholder value through the discovery of world-class mineral deposits Keep Reading...

21h

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

30 January

Top 5 Canadian Mining Stocks This Week: Vangaurd Mining Gains 141 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released November’s gross domestic product (GDP) data on Friday (January... Keep Reading...

30 January

Quarterly Activities and Cashflow Report

Redstone Resources (RDS:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

23 January

Freeport-McMoRan Plans 2026 Grasberg Restart After Deadly Mud Rush

Freeport-McMoRan (NYSE:FCX) is preparing to bring one of the world’s most important copper assets back online, laying out plans for a phased restart of the Grasberg mine in Indonesia following a deadly mud rush that halted operations late last year.The Arizona-based miner said remediation and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00