- WORLD EDITIONAustraliaNorth AmericaWorld

November 15, 2024

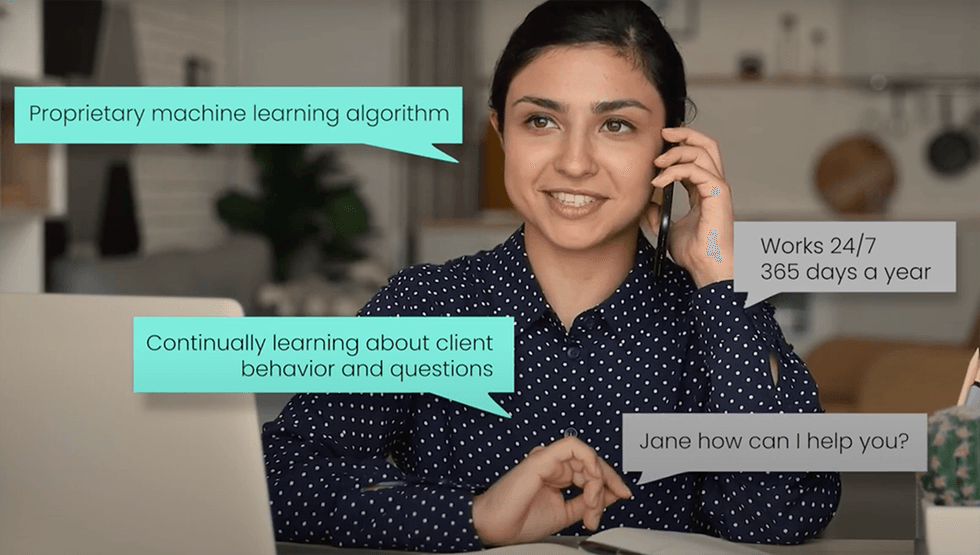

In an industry poised to transform customer engagement, Syntheia (CSE:SYAI) is an innovative conversational AI solution addressing the complex needs of modern communication. Designed to emulate human-like conversations, Syntheia’s platform targets both large enterprises and small-to-medium businesses, which often struggle with customer support inefficiencies and high employee turnover in customer-facing roles. Syntheia offers customers an experience closer to natural human interaction focusing on language processing, tonality, sentiment analysis, and conversational behavior.

The rising demand for customer-centric interactions, the need for operational efficiency, and cost reductions that companies can realize by automating and enhancing their customer support processes lead to explosive growth in AI-driven customer service solutions.

Key Technology

Key TechnologySyntheia’s AssistantNLP platform is designed to handle high volumes of customer queries in multiple languages and across industries, ensuring a scalable, reliable and flexible solution for diverse customer needs. AssistantNLP is also highly accessible, structured around a freemium revenue model that allows businesses to try the service at no cost and then upgrade based on usage and additional features.

Company Highlights

- Syntheia is a conversational AI solution delivering AI-driven, human-like customer service for enterprises and SMBs.

- The AssistantNLP Platform offers 24/7/365 multilingual support, accessible globally.

- Syntheia operates on a freemium revenue model, with scalable plans catering to varied business sizes and needs.

- The conversational AI market is expected to reach $32.62 billion by 2030, with Syntheia well-positioned to capitalize on this growth.

- Syntheia’s algorithms have achieved an 84 percent success rate in data collection and 98 percent in outreach programs, highlighting exceptional efficiency.

- Financially stable, Syntheia has $2 million in cash, no debt and trades on the Canadian Securities Exchange.

This Syntheia profile is part of a paid investor education campaign.*

Click here to connect with Syntheia (CSE:SYAI) to receive an Investor Presentation

SYAI:CC

The Conversation (0)

04 February

AI Infrastructure Moving to the Edge to Transform User Experience

While the first phase of the AI gold rush was defined by massive investments in centralized data centers, 2026 is about proving those billions can translate into fast, reliable AI that people will use every day. One Canadian startup, PolarGrid, is betting that the answer lies at the edge rather... Keep Reading...

29 January

Quarterly Activities/Appendix 4C Cash Flow Report

Unith (UNT:AU) has announced Quarterly Activities/Appendix 4C Cash Flow ReportDownload the PDF here. Keep Reading...

20 January

The Performance Chasm: Is the AI Rally Over or Just Shifting Gears?

The investment landscape of 2025 will be remembered for its historic divide, where the widespread boom in artificial intelligence (AI) created a tale of two worlds in the stock market.On one side, the Magnificent 7 and specialized players like Palantir Technologies (NASDAQ:PLTR) drove massive... Keep Reading...

20 January

Nextech3D.ai Scales National Event Infrastructure to 35 Major U.S. Cities; Launches 58 New AI-Ready Experiences to Meet Enterprise Demand

Strategic Integration of Generative AI 'Semantic Memory' via OpenAI and Pinecone Vector Database Supports Rapid Expansion of Corporate Engagement Platforms TORONTO, ON / ACCESS Newswire / January 20, 2026 / Nextech3D.ai (OTCQB:NEXCF)(CSE:NTAR,OTC:NEXCF)(FSE:1SS), a leader in AI-powered event and... Keep Reading...

16 January

Tech Weekly: Chip Stocks Soar on Taiwan Semiconductor Earnings

Welcome to the Investing News Network's weekly brief on tech news and tech stocks driving the market. We also break down next week's catalysts to watch to help you prepare for the week ahead.Don't forget to follow us @INN_Technology for real-time news updates!Securities Disclosure: I, Meagen... Keep Reading...

16 January

Nextech3D.ai Partners with BitPay to Power Crypto and Stablecoin Payments for Events

Company Strengthens Event Tech Infrastructure with Milestone AWS Migration and Enhanced Blockchain CredentialingAWS Cloud Infrastructure OptimizationSmart Contract UniformityFlexible Asset Standards ERC721/ ERC1155 TORONTO, ON AND NEW YORK CITY, NY / ACCESS Newswire / January 16, 2026 /... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00