January 21, 2024

Pivotal Metals Limited (ASX:PVT) (‘Pivotal’ or the ‘Company’) is pleased to provide its Appendix 5B cash flow statement for the quarter ended 31 December 2023, along with the following operational summary.

Quarter Highlights

- Exploration activities advance across 100% owned Quebec Cu-Ni-PGM projects.

- Horden Lake drill program starting late January 2024

- 2 drill rigs contracted for up to 8,000m diamond drilling.

- All permits in place.

- First assays expected late Q1 2024.

- Horden Lake mineralogical assessment in progress. Results pending.

- Completed BAGB Magnetotelluric “MT” survey, results expected shortly.

- 44 test sites over 7.5km2 coincident with exceptional historic drilling results

- Oversubscribed $2.5m placement completed:

- Funds used to redeem convertible notes to avoid heavily discounted conversion and dilution; and

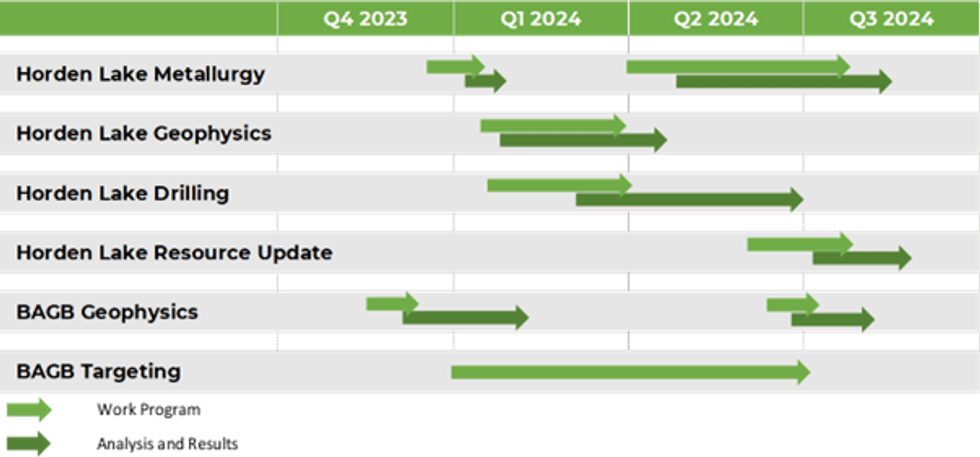

- Support the extensive 2024 work program which includes 8,000m diamond drilling, geophysics, metallurgical testwork and Resource update; and

- Fully fund ‘non flow-through’ qualifying expenditure into 2024.

- Raise included director contributions of $235k (9% of total raise).

- $5.056m cash balance and consistent news-flow is expected as the Company executes its work programs across its properties.

Managing Director Ivan Fairhall said: “Having joined Pivotal Metals in September, I’m pleased to present my first full Quarterly Report which outlines significant progress on all aspects of our exploration endeavours.

The Horden Lake project was dormant for over a decade tied up in private hands, but we are now poised to execute on our detailed plan to add value, de-risk and show the growth potential of this already significant 412kt CuEq indicated and inferred Cu-Ni-PGM resource. We also expect to update the market shortly from our December MT survey over some of the extremely high grade near-surface intersections within the 157km2 BAGB property, which aims to verify the exploration model and target a deeper system of genuine scale overlooked by previous operators.

With a cash boost late in the year, clean balance sheet, and two very exciting exploration and development projects, the Board and I are looking forward to delivering a full operational and news schedule to all shareholders over the coming months.”

OPERATIONAL UPDATE

Horden Lake drill program

The Horden Lake project already hosts a 27.8Mt @ 1.49% CuEq Cu-Ni-PGM JORC compliant Indicated (15.2Mt) Inferred (12.5Mt) and Mineral Resource1 with considerable prospectivity remaining to expand and improve the deposit and de-risk its development potential.

Up to 8,000m of drilling will commence in January 2024. Following a competitive tender process, the Company contracted Orbit Garant Drilling Services “Orbit” for two diamond rigs, with the option for a third rig if required. Headquartered in Val-d’Or, Québec, Orbit is one of Canada’s largest drilling companies, with more than 217 drill rigs providing both underground and surface drilling services in Canada and internationally.

Ancillary preparations for the program were completed and an operational hub has been established in Val d’Or, Quebec. All permits are now in place for the proposed program to support drilling on commencing before the end of January.

The winter program has three principal aims:

- Target increase in grade by collecting Au, Ag, Pt and Co by-product assay data for parts of the deposit that were not assayed for these metals in the past. Only the central part of the deposit has full multi-element assay. The resource estimate currently constrains the gold wireframe to this area (consequently diluting grade across the entire resource). Ag, Pt and Co were assayed in the central part, but have not been domained in the model. Further assay for these metals will be collected and modelled in a future resource update.

- Target increase in tonnage by drilling open areas of limited density or open areas mineralisation that fall outside the 27.8 mt resource envelope. Downhole geophysics will be used to refine targets for further step- out drilling.

- Collect significant sample for metallurgical testwork, with the primary aim to support representative samples of the mineralised lithologies, and target collection of samples for future variability test work to support more detailed engineering studies.

Click here for the full ASX Release

This article includes content from Pivotal Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PVT:AU

The Conversation (0)

18 January 2024

Pivotal Metals

Investing in metals for a sustainable energy transition.

Investing in metals for a sustainable energy transition. Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

22 December 2025

Nickel Price Forecast: Top Trends for Nickel in 2026

Nickel prices were stagnant in 2025, trading around US$15,000 per metric ton (MT) for much of the year.Weighing heavily on the metal was persistent oversupply from Indonesian operations. Meanwhile, sentiment remained weak amid soft demand growth from the construction and manufacturing sectors,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00