July 11, 2022

Innovative geochemical studies undertaken by the University of Tasmania uncovers new targets with signatures similar to known large deposits and provides a focus for ongoing exploration in New South Wales

Corazon Mining Limited (ASX: CZN) (Corazon or Company) is pleased to announce the identification of a new target area for a potential porphyry copper deposit at the Mt Gilmore Project (Mt Gilmore or Project) in New South Wales (NSW).

Key Highlights

- Initial mineral vectoring geochemical studies have been completed by CODES at the University of Tasmania on rock and drill core samples collected from the Mt Gilmore Project

- The studies show the Mt Gilmore Cu-Au-Co trend has a complex hydrothermal history and geochemical characteristics particular to known large porphyry Cu deposits

- Results are extremely encouraging – additional mineral studies and geophysics will assist the definition of targets expected to be easily testable with drilling.

The new porphyry copper target area has been generated from initial results of a mineral chemistry vectoring study conducted by the University of Tasmania. Based on the positive results of this work, Corazon plans to undertake a new phase of targeted fieldwork at the Mt Gilmore Project.

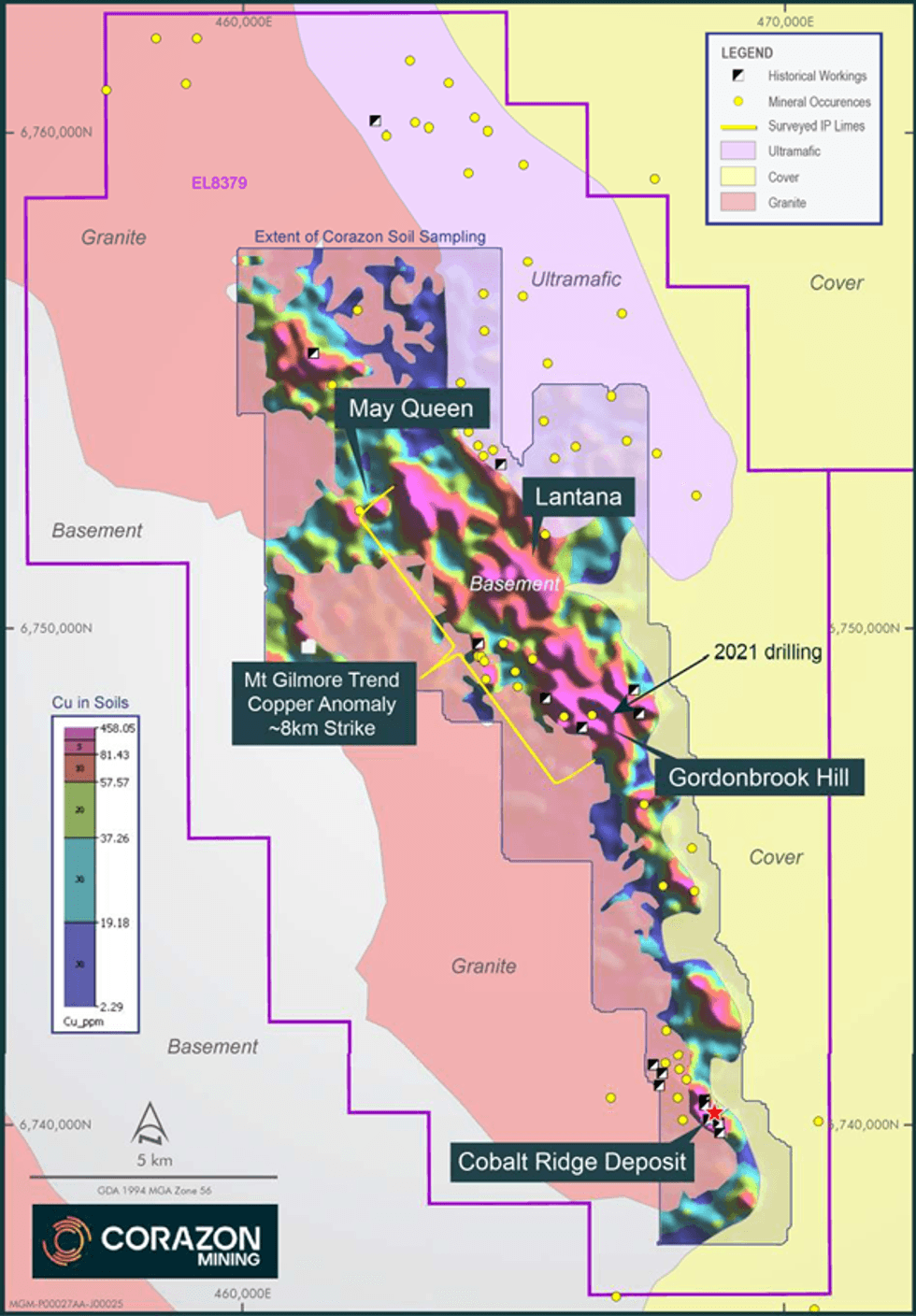

Corazon's Mt Gilmore Project is located within the New England Orogen of northeastern NSW (Figure 1). Geochemical and geophysical surveys completed by Corazon at Mt Gilmore have indicated the potential for concealed intrusion related or porphyry copper-gold hydrothermal systems. However, identifying precise drill targets has been difficult due to the size of the geochemical anomalies (i.e. main target area of ~8km x 2km – Figure 2), poor surface exposure and lack of historical drilling.

In recent years, significant research has been devoted to mineral chemistry studies to assist in the exploration for blind mineral deposits. Work by the Centre for Ore Deposit and Earth Sciences (CODES) at the University of Tasmania has included porphyry vectoring and fertility tools (PVFTs), which use the chemical compositions of hydrothermal minerals to predict the likely direction and distance to mineralised centres, and the potential metal endowment of a mineral district.

Such studies completed by CODES on samples from Mt Gilmore have delivered exceptional early results, supporting the Project’s prospectivity and strong porphyry copper potential.

Figure 1 – Mt Gilmore Project Location

Rationale for Mineral Chemistry Vectoring Studies

Exploration by Corazon at the Mt Gilmore Project has identified a very large copper-cobalt-gold-silver soil geochemical anomaly over the full 22-kilometre strike of exposed basement rocks (Figure 2). This soil geochemical anomalism is supported by high-grade rock-chip samples from outcrops throughout the Project (ASX announcement 5 February 2019).

Reconnaissance induced polarisation (IP) geophysical surveys over the three main anomalies at Gordonbrook Hill, Lantana and May Queen (Figure 2) (ASX announcement 23 July 2019) identified chargeability anomalism at all prospects. Subsequent drilling of the Gordonbrook Hill IP anomaly (ASX announcement 16 June 2021) supported that, despite no strong sulphide mineralisation being identified, the IP method was a very good mapper of alteration. The detail provided by the drilling contributed to conflicting models for the potential style of mineralisation at Gordonbrook Hill.

Advances in the understanding of using mineral chemistry to identify and vector towards porphyry related hydrothermal deposits, including successful case studies, provided the opportunity for Corazon to potentially:

- Define the type of hydrothermal system(s) present at Mt Gilmore and their occurrence in time (relative to other geological features);

- Define the possible size and fertility of any the mineralised system(s); and

- Identify the location(s) in three-dimensions of the heat source that caused the hydrothermal mineralisation.

Rock chip and drill core samples from the May Queen, Gordonbrook Hill and Cobalt Ridge prospects (Figure 2) were submitted to CODES for testwork, sampling a variety of mineralisation/alteration styles over a strike of ~16km within the Mt Gilmore Trend.

Figure 2 – Mt Gilmore Project interpreted geology with a copper in soils geochemical image over the sedimentary/volcaniclastic basement rocks, with mineral occurrences and prospect locations.

Click here for the full ASX release

This article includes content from Corazon Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CZN:AU

Sign up to get your FREE

Corazon Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

26 August 2025

Corazon Mining

A high-grade gold explorer in a proven Australian gold province, with a strategic portfolio of battery and base metal assets.

A high-grade gold explorer in a proven Australian gold province, with a strategic portfolio of battery and base metal assets. Keep Reading...

25 February

Heritage Survey underway PoW Approved for Maiden Drilling

Corazon Mining (CZN:AU) has announced Heritage Survey underway PoW Approved for Maiden DrillingDownload the PDF here. Keep Reading...

04 February

4km Gold Anomaly Defined at Two Pools

Corazon Mining (CZN:AU) has announced 4km Gold Anomaly Defined at Two PoolsDownload the PDF here. Keep Reading...

28 January

Quarterly Appendix 5B Cash Flow Report

Corazon Mining (CZN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

28 January

Quarterly Activities Report

Corazon Mining (CZN:AU) has announced Quarterly Activities ReportDownload the PDF here. Keep Reading...

24 November 2025

Execution of Land Access Agreement

Corazon Mining (CZN:AU) has announced Execution of Land Access AgreementDownload the PDF here. Keep Reading...

25 February

Oregon: America’s Premier Domestic Nickel Opportunity

The global race for critical minerals has begun. As the US stares down a future of massive industrial shifts, the strategy is clear: secure the supply chain or get left behind. Demand for nickel is hitting overdrive, fueled by its role in electric vehicle (EV) batteries, high-strength stainless... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

23 February

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Latest News

Sign up to get your FREE

Corazon Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00