Tartisan Nickel Corp. (CSE:TN)(OTC PINK:TTSRF)(FSE:A2D) ("Tartisan", or the "Company") is pleased to provide an update on the exploration program at the Company's flagship Kenbridge Nickel Property where a 10,000 meter diamond drilling program is in progress. The drill program is designed to test the on strike and down dip potential for additional nickel sulphide mineralization to enhance the size and grade of the Kenbridge Deposit

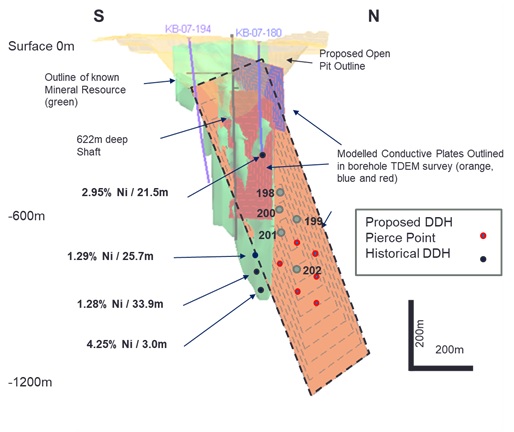

As previously reported, two drill rigs have been mobilized to the site and are currently operating. A total of 3,200m of drilling has been completed to date (32% of the proposed 10,000m program). The first 3 drill targets have been completed (drill holes 198, 199 and 200 outlined on attached diagram) and a total of 137 samples have been delivered to TSL Labs in Saskatoon, Saskatchewan for analysis. The drill rigs are currently drilling the 4th and 5th drill holes (201 and 202).

Tartisan CEO Mark Appleby states, "The Tartisan 2021 drill program is testing multiple high probability targets as we look to add to the Mineral Resource Estimate at the Kenbridge Deposit, and additionally have proposed drilling a 400 meter conductor at the Kenbridge North site. Tartisan is committed to the rapid advancement of the Kenbridge Nickel Project, a source of the critical metals (nickel & copper) required for electric vehicles and battery storage to the North American supply chain".

Fig 1: Long section of the Kenbridge Deposit showing the proposed drill targets. Completed or Holes in Progress, are outlined in gray circles. |

Grant of Stock Options

The Company also reported today that two million stock options have been granted to directors, officers, and consultants to the Corporation, exercisable for a period of five years, at the exercise price of sixty cents per share.

About Tartisan Nickel Corp.

Tartisan Nickel Corp. is a Canadian based mineral exploration and development company whose flag ship asset is the Kenbridge Nickel Deposit located in the Kenora Mining District, Ontario. Tartisan also owns; the Sill Lake Silver Property in Sault St. Marie, Ontario as well as the Don Pancho Manganese-Zinc-Lead-Silver Project in Peru.

Tartisan Nickel Corp. owns an equity stake in; Eloro Resources Limited, Class 1 Nickel and Technologies Limited, Peruvian Metals Corp. and Silver Bullet Mines Inc.

Tartisan Nickel Corp. common shares are listed on the Canadian Securities Exchange (CSE:TN)(OTC PINK:TTSRF)(FSE:A2D). Currently, there are 112,754,829 shares outstanding (122,050,344 fully diluted).

Dean MacEachern P.Geo. is the Qualified Person under NI 43-101 and has read and approved the technical content of this News Release.

For further information, please contact Mark Appleby, President & CEO and a Director of the Company, at 416-804-0280 (info@tartisannickel.com). Additional information about Tartisan Nickel Corp. can be found at the Company's website at www.tartisannickel.com or on SEDAR at www.sedar.com.

This news release may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

The Canadian Securities Exchange (operated by CNSX Markets Inc.) has neither approved nor disapproved of the contents of this press release.

SOURCE: Tartisan Nickel Corp.

View source version on accesswire.com:

https://www.accesswire.com/659066/Tartisan-Nickel-Corp-Provides-Update-on-the-10000-Meter-Drill-Program-at-the-Kenbridge-Nickel-Deposit-and-Grants-Stock-Options