June 05, 2024

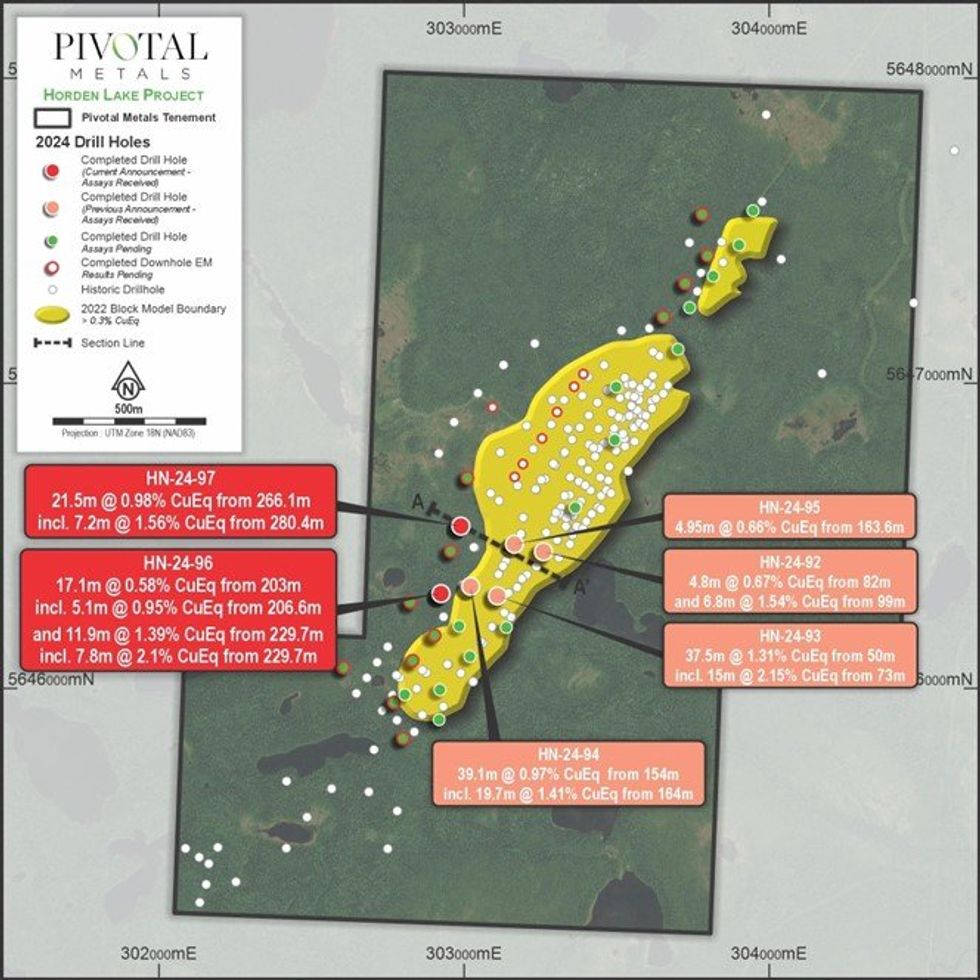

Pivotal Metals Limited (ASX:PVT) (‘Pivotal’ or the ‘Company’) is pleased to provide the assay results of two further drill holes from its 2024 diamond drill program completed at its 100% owned Horden Lake Project in Quebec, Canada.

Highlights

- High grade copper mineralisation extended down-plunge in hole HN-24-97, the first step-out hole reported from the 2024 drill program.

- 21.5m @ 0.98% CuEq1 (0.56% Cu, 0.12% Ni, 0.07g/t Au, 0.09g/t Pd) plus additional 0.03g/t Pt, 119ppm Co, 8.3g/t Ag from 266.1m

Including 7.2m @ 1.56% CuEq from 280.4m - Deepest hole in this zone, 80-110m diagonally down-plunge from the two nearest historic holes

- 21.5m @ 0.98% CuEq1 (0.56% Cu, 0.12% Ni, 0.07g/t Au, 0.09g/t Pd) plus additional 0.03g/t Pt, 119ppm Co, 8.3g/t Ag from 266.1m

- HN-24-96 extends downwards and infills high grade mineralisation in 130m gap between previously drilled holes.

- 17.1m @ 0.58% CuEq (0.25% Cu, 0.1% Ni, 0.03g/t Au, 0.06g/t Pd) plus additional 0.03g/t Pt, 95ppm Co, 3.9g/t Ag from 203m

Including 5.1m @ 0.95% CuEq from 206.6m - 11.9m @ 1.39% CuEq (0.42% Cu, 0.33% Ni, 0.03g/t Au, 0.13g/t Pd) plus additional 0.04g/t Pt, 230ppm Co, 4.8g/t Ag from 229.7m.

Including 7.8m @ 2.1% CuEq from 229.7m

- 17.1m @ 0.58% CuEq (0.25% Cu, 0.1% Ni, 0.03g/t Au, 0.06g/t Pd) plus additional 0.03g/t Pt, 95ppm Co, 3.9g/t Ag from 203m

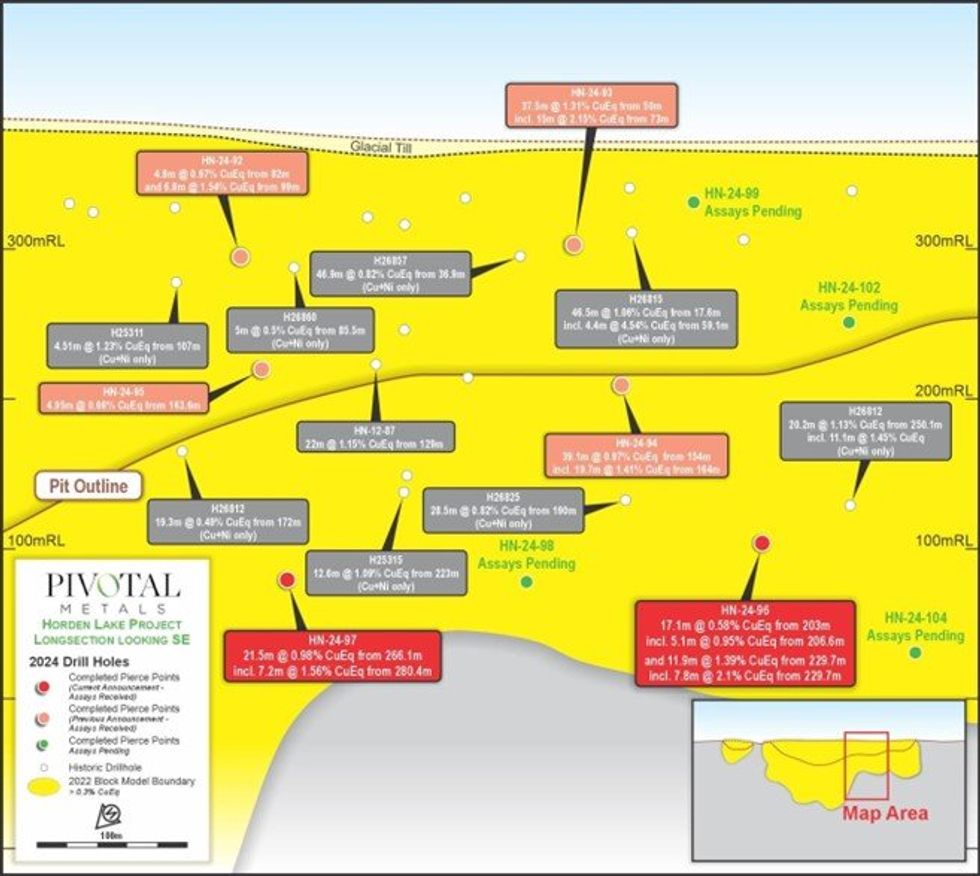

- Mineralisation now defined to 200-230m vertical depth in the vicinity of these holes. This is less than half the ~550m depth that mineralisation has been defined to in the central part of Horden Lake.

- Significant gold, silver, palladium, platinum and cobalt metals delineated once again, which were not assayed in this part of the deposit during previous drill campaigns.

- Consistent news-flow ahead, including results from the remaining 5,780m / 28 diamond drill holes and downhole EM surveys to be released, followed by a mineral resource update and metallurgical test-work in H2.

Managing Director, Mr Fairhall said:

“Down plunge extensions are a key pillar of the significant upside story at Horden Lake. The southern flank of the deposit has only been drilled to around 200m, whereas mineralisation is defined to ~550m in the central portion. These high grade results in the south demonstrate the strong potential for resource growth at depth, with the deposit remaining completely open across its full strike extent. In addition, we anticipate increasing the metal content of the resource through inclusion of the significant palladium, gold, cobalt, platinum and silver assays we are seeing which were never before assayed for in this portion of the deposit.

We have a significant amount of news-flow in the pipeline as we release further assays and the results of downhole surveys as they become available.”

Overview

Horden Lake is a copper dominant Cu-Ni-Au-PGM-Co Project located 131km north-northwest of Matagami, in Quebec Canada. The Project hosts an indicated and inferred mineral resource estimate of 28mt at 1.5% CuEq, as a result of over 52,464m of drilling already completed on the property. Pivotal has recently completed a 7,097m / 34 hole diamond drilling campaign. 705m / 4 holes have been reported prior to this announcement.

The objectives of the drilling program were to infill missing by-product multi-element assay information, target resource expansion potential (which remains open at depth across its full extent) and collect a distribution of metallurgical sample for a complete test work program. Downhole EM surveys have also been completed to dimension future exploration potential and targeting.

Drill Hole Discussion

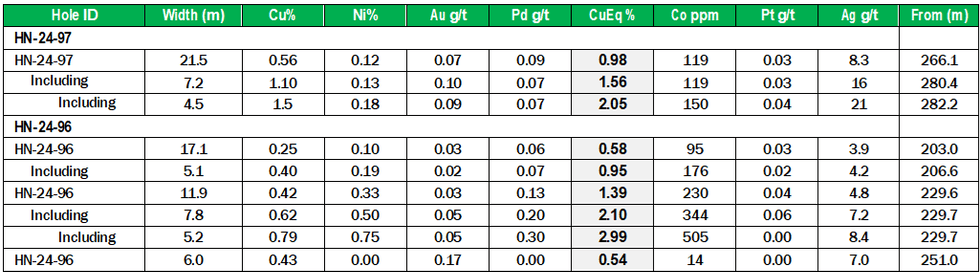

Holes HN-24-96 and HN-24-97 were designed to test step out and infill the deeper extensions in the southern portion of the Horden Lake deposit. Table 1 contains the significant intersections, and Figure 2 is a longitudinal section showing the spatial distribution of historical and new drill hole pierce points.

Hole HN-24-97 is located 140m down-plunge from the 2024 hole HN-24-95 (refer ASX announcement 16 May 2024), and 80m and 110m respectively diagonally down-plunge from holes previously drilled holes H25315 and H26812. Mineralisation falls within one wide intersection of 21.45m grading 0.98% CuEq (0.56% Cu, 0.12% Ni) from 266.1m (Figure 3). Higher grade intersections include 7.17m grading 1.56% CuEq (1.10% Cu, 0.13% Ni) from 280.38m, which includes 4.53m grading 2.05% CuEq (1.48% Cu, 0.18% Ni) from 282.15m. Mineralisation between 266.1 to 282.85 occurs within meta-pyroxenites, meta-gabbros, and mafic dykes and one semi massive sulphide zone. The highest grade zone, 282.85 to 287.55 m occurs within the metasediments with one massive sulphide mineralisation and included a single assay of 4.08% copper over 0.66m at 282.85m. Whilst an inferred zone of mineralisation above 0.3% CuEq was interpreted in this zone, no higher grade zone extended to this area and this intersection shows very encouraging extensions of high grade mineralisation at depth.

Click here for the full ASX Release

This article includes content from Pivotal Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PVT:AU

The Conversation (0)

18 January 2024

Pivotal Metals

Investing in metals for a sustainable energy transition.

Investing in metals for a sustainable energy transition. Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00