May 01, 2024

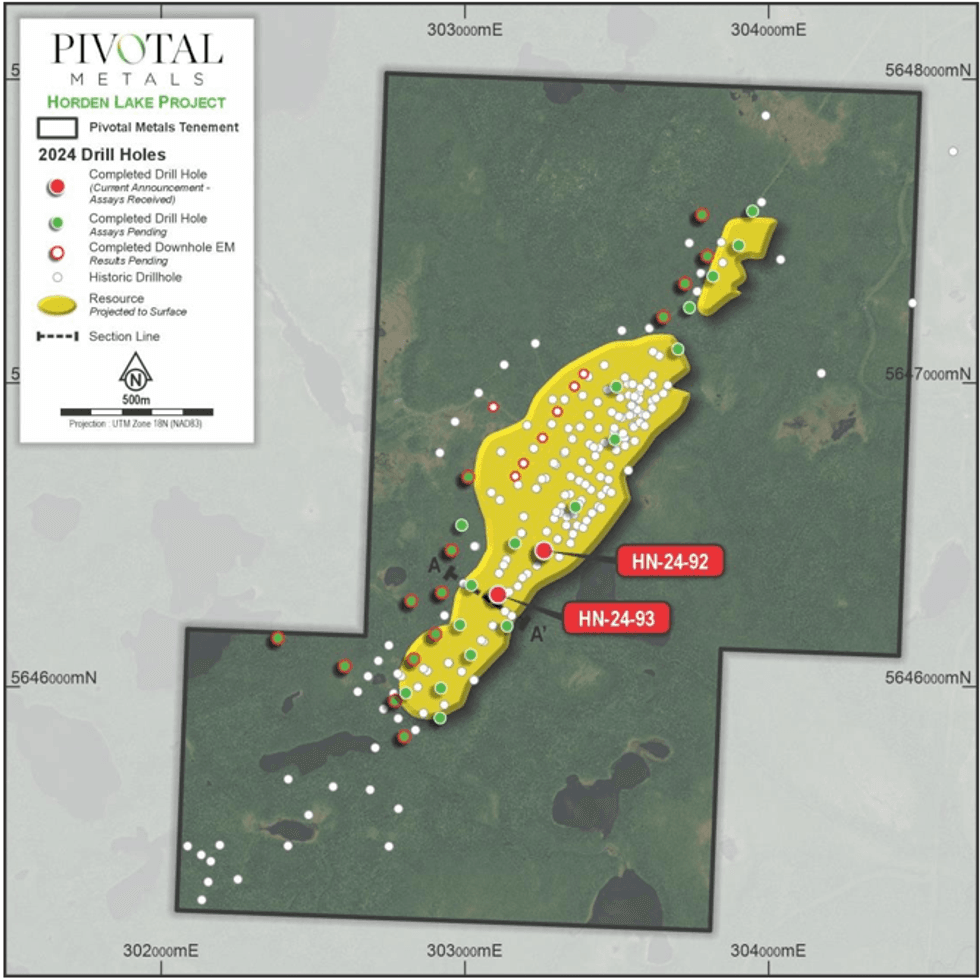

Pivotal Metals Limited (ASX:PVT) (‘Pivotal’ or the ‘Company’) is pleased to provide the first assay results from the first 2 of 34 diamond drill holes completed at its 100% owned Horden Lake Project in Quebec, Canada.

Highlights

- Drilling confirms broad zones of copper rich Cu-Ni-Au-PGM-Co mineralisation at Horden Lake, including 37.5m at 1.31% CuEq.

- Significant gold, silver, palladium, platinum and cobalt metals delineated, which were not assayed for in this part of the deposit during historical drill campaigns.

- The first two drill holes fall within the pit constrained portion of the 28 Mt at 1.5% CuEq Indicated and Inferred Mineral Resource Estimate1,2, and display moderately thicker and better grades than the surrounding historical holes.

- Consistent news-flow ahead, including results from the remaining 6,833 m / 32 diamond drill holes and downhole EM surveys to be released progressively through the quarter, followed by mineral resource update and metallurgical testwork in H2.

Assay Highlights

HN-24-93

- 37.5m @ 1.31% CuEq2 (0.57% Cu, 0.22% Ni, 0.10g/t Au, 0.15g/t Pd) plus additional 0.05g/t Pt, 180ppm Co, 7.2g/t Ag from 51.15m

Including 15.0m @ 2.15% CuEq (0.98% Cu, 0.35% Ni, 0.2g/t Au, 0.18g/t Pd) plus additional 0.04g/t Pt, 261ppm Co, 13.4g/t Ag from 73.65m - 1.2m @ 4.44% CuEq (2.73% Cu, 0.35% Ni, 0.81g/t Au, 0.39g/t Pd) plus additional 0.11g/t Pt, 324ppm Co, 33.1g/t Ag from 87.45m

HN-24-92

- 4.8m @ 0.67% CuEq (0.2% Cu, 0.12% Ni, 0.05g/t Au, 0.18g/t Pd) plus additional 0.07g/t Pt, 96ppm Co, 2g/t Ag from 82m

- 6.75m @ 1.54% CuEq (0.63% Cu, 0.28% Ni, 0.07g/t Au, 0.20g/t Pd) plus additional 0.10g/t Pt, 179ppm Co, 7.2g/t Ag from 99m

Including 3.85m @ 2.14% CuEq (0.85% Cu, 0.40% Ni, 0.09g/t Au, 0.26g/t Pd) plus additional 0.12g/t Pt, 234ppm Co, 9.5g/t Ag from 101.2m

Managing Director, Mr Fairhall said:

“I am very pleased to be sharing the first of many assays from Pivotal’s maiden drilling campaign at Horden Lake. These results showcase the shallow wide zones of copper rich mineralisation that characterises Horden Lake. Importantly they validate the existence of significant gold, palladium, platinum, cobalt and silver which were never previously assayed in this part of the deposit, and will serve as potential upside to our mineral resource update later this year.

We look forward to sharing consistent news-flow in the coming months as we receive more assays and downhole geophysics interpretations, to complement our strategy to grow Horden Lake and demonstrate its high-quality development credentials.”

Overview

Horden Lake is a copper dominant Cu-Ni-Au-PGM-Co Project located 131km north-northwest of Matagami, in Quebec Canada. The Project hosts a 28mt at 1.5% CuEq indicated and inferred mineral resource estimate, as a result of over 52,464m of drilling already completed on the property. Pivotal has recently completed a 7,097m 34 hole diamond drilling campaign. The objectives of the drilling program were to infill missing by-product multi-element assay information, potentially expand the resource (which remains open at depth across its full extent), and collect a distribution of metallurgical sample for a complete test work program. Downhole EM surveys have also been completed to dimension future exploration potential and targetting.

Drill Hole Discussion

Holes HN-24-92 and HN-24-93 were designed to target gaps in the resource blocks, infill and add additional missing metals assay information. Table 1 contains significant intercepts, and Figure 2 is a longitudinal section showing the spatial distribution of historical and new drill holes.

Click here for the full ASX Release

This article includes content from Pivotal Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PVT:AU

The Conversation (0)

18 January 2024

Pivotal Metals

Investing in metals for a sustainable energy transition.

Investing in metals for a sustainable energy transition. Keep Reading...

25 February

Oregon: America’s Premier Domestic Nickel Opportunity

The global race for critical minerals has begun. As the US stares down a future of massive industrial shifts, the strategy is clear: secure the supply chain or get left behind. Demand for nickel is hitting overdrive, fueled by its role in electric vehicle (EV) batteries, high-strength stainless... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

23 February

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00