October 14, 2024

International Graphite Limited (ASX: IG6)(ASX: IG6) is pleased to announce outstanding results from bench scale micronising, spheroidising and purification testwork on graphite concentrates generated from the Company’s Springdale Graphite Project, in Western Australia.

HIGHLIGHTS

- Further bench scale micronising, spheroidising and purification testwork completed on Springdale Graphite Project concentrates.

- A two product spherical graphite – SpG11 and SpG18 – yield of up to 76% achieved.

- Purification testwork achieves 99.99% - well above highest purity anode material product specification of 99.97%.

The testing, conducted by industry specialists ProGraphite GmbH, used 23kg of 95.3% loss on ignition (LOI) grade Springdale graphite concentrates to produce purified spheroidised graphite product.

Micronising and spheroidising (milling) testwork investigated several process circuit options resulting in two spheroidised graphite products – SpG18 and SpG11 – and a yield of up to 76% at a product size of D50 18µm (micron) and D50 11µm. The properties of both the SpG18 and SpG11 products exceeded the quality and physical specifications typically required for active anode materials.

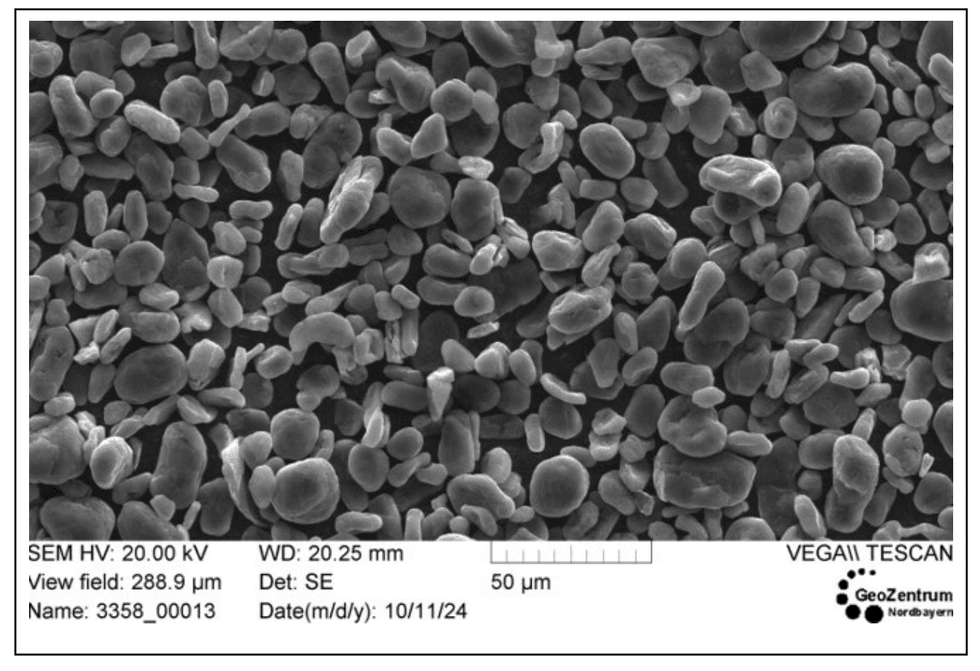

The SpG samples were purified using an acid-based purification process. Purification testwork achieved 99.99% LOI grade, well exceeding the published industry benchmarks for anode materials. Figure 1 shows a Scanning Electron Microscope (SEM) typical image of the purified SpG18 (D50 18µm) sample.

International Graphite Technical Director David Pass said, “This testing was designed to optimise the milling processes with the goal of improving product output. The results are highly encouraging and show there is significant potential to increase yield well beyond the projections in our original scoping study1.

“The purification results have also reinforced original findings that Springdale graphite can achieve the purity standards industry typically requires for the production of active anode materials.”

Managing Director and CEO Andrew Worland said, “These results are another significant milestone in the development our mine-to-market production strategy and further evidence that our 100% owned Springdale Mineral Resource is a vital asset perfectly suited to the high growth lithium-ion battery anode sector.

“The unique operating expertise and intellectual property we are gaining from our R&D processing facilities in Collie is making an invaluable contribution to the development of our downstream flowsheet. This, coupled with further testwork, will significantly advance our battery anode feasibility studies.”

Figure1 SEM Image of SpG18 graphite sample

The purified SpG sample material will be used in future coating testwork and to advance process flowsheet development and equipment selection for the production of active anode material for batteries.

Click here for the full ASX Release

This article includes content from International Graphite, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IG6:AU

Sign up to get your FREE

International Graphite Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

01 October 2025

International Graphite

Building a secure, high-value graphite supply from Australia to the world

Building a secure, high-value graphite supply from Australia to the world Keep Reading...

11 February

Purification testwork exceeds target specifications

International Graphite (IG6:AU) has announced Purification testwork exceeds target specificationsDownload the PDF here. Keep Reading...

30 January

Quarterly Activities/Appendix 5B Cash Flow Report

International Graphite (IG6:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

16 December 2025

Graphite Purification Tolling Services

International Graphite (IG6:AU) has announced Graphite Purification Tolling ServicesDownload the PDF here. Keep Reading...

09 December 2025

Expandable Graphite Facility techno-economic evaluation

International Graphite (IG6:AU) has announced Expandable Graphite Facility techno-economic evaluationDownload the PDF here. Keep Reading...

26 November 2025

Land purchased for Collie plant development

International Graphite (IG6:AU) has announced Land purchased for Collie plant developmentDownload the PDF here. Keep Reading...

24 February

Iyan Deposit Delivers Further Significant Graphite Intercepts from Surface in the Final Release of Assays

Final Assay Batch Again Reinforces Bulk Blending Strategy, Resource Growth and Imminent JORC

Blencowe Resources Plc (LSE: BRES) is pleased to report the final set of assay results completed from the 87 shallow holes drilled at the Iyan deposit, part of the Company's Orom-Cross Graphite Project in Uganda. These results represent the third batch from the Stage 7 drilling programme, with... Keep Reading...

18 February

US Slaps Higher Tariffs on Chinese Graphite Imports After Final Commerce Determination

The US Department of Commerce has sharply increased trade penalties on Chinese graphite anode materials, concluding that producers in China engaged in unfair pricing and subsidy practices that harmed the US market.In a final determination issued February 11, 2026, Commerce raised countervailing... Keep Reading...

27 January

Top 5 Canadian Graphite Stocks (Updated January 2026)

Graphite stocks and prices have experienced volatility in recent years recently due to bottlenecks in demand for electric vehicles, as graphite is used to create lithium-ion battery anode materials. One major factor experts are watching is the trade war between China and the US.China introduced... Keep Reading...

09 December 2025

Greenland Government Grants Exploitation Licence for Amitsoq

GreenRoc Strategic Materials Plc (AIM: GROC), a company focused on the development of critical mineral projects in Greenland, is delighted to announce that the Government of Greenland has granted an Exploitation Licence for the Amitsoq Graphite Project to Greenland Graphite a/s ("Greenland... Keep Reading...

30 November 2025

Altech - Board Renewal and Strategic Focus

Altech Batteries (ATC:AU) has announced Altech - Board Renewal and Strategic FocusDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

International Graphite Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00