December 18, 2023

Lithium Universe Limited (“Lithium Universe”, the “Company” or ASX: “LU7”) is pleased to report the excellent progress of the Engineering Study by Hatch Ltd (Hatch) on the Company’s Québec Lithium Processing Hub (QLPH) multi-purpose battery-grade lithium carbonate refinery. The Refinery is rated at 16,000 tpa with an assumed feed grade of spodumene at or around 5.5% Li2O. The final lithium carbonate product should be at least 99.5% and 99.9% grade. Target plant availability is 84% and target overall recovery rate for lithium is 85%. Anhydrous sodium sulphate, generally used in the textile industry, will be sold as a by-product. The alumina- silicate residue from the leached spodumene will be sold to the cement industry.

Highlights

- Hatch's outstanding progress in QLPH Li Carb Refinery engineering study

- Finalisation of design flow sheet and draft site layout

- Completion of Block Flow Diagram (BFD) and Process Flow Diagrams (PFD) and Mass Balance along with Process Design Criteria (PDC)

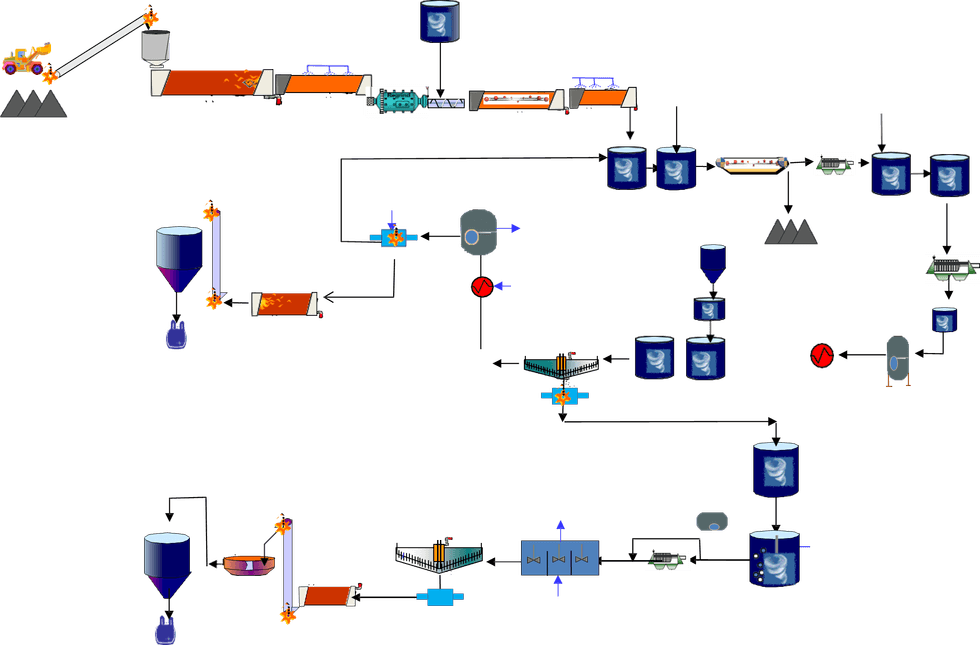

The finalized design flow sheet (See Figure 1) illustrates how the front end loader operation and belt conveyors feed spodumene concentrate from the stockpile area to the calciner. The concentrate is calcined at 1080°C in a direct-fired rotary kiln to convert the alpha spodumene to the leachable beta spodumene. The calcining kiln off-gases will pass through a cyclone and an electrostatic precipitator to comply with environmental emissions limits. The hot calcine is indirectly cooled and dry-milled to less than 300 µm. After storage in a surge bin, the beta spodumene is mixed with concentrated sulphuric acid and roasted at 250°C in an indirectly heated kiln. The sulphating kiln off-gases will be cleaned in a wet scrubber to meet site environmental emissions limits. The sulphated spodumene is cooled and fed to the leach circuit. The combined leached solids and precipitated impurities are thickened prior to being filtered in a belt filter. The filtrate is combined with the thickener overflow and passed through a polishing sand filter and an ion exchange column to remove residual calcium, magnesium and other multivalent cations before the lithium carbonate area.

The solution entering the lithium carbonate production area is heated and then reacted with a hot sodium carbonate solution in a single crystalliser operating at 95°C. The coarse crystals from the crystalliser are thickened before passing to the centrifuge circuit. Raw lithium carbonate is further purified to battery grade using the carbonation process. After slurried in demin water, soluble lithium bi-carbonate is formed from the bubbling of carbon dioxide gas. The solution is filtered, and lithium carbonate is re-crystalised when the solution is heated using injected steam. Carbon dioxide gas is re-generated which is recycled to the front end of the purification process. Battery-grade lithium carbonate is centrifuged and dried in an indirect-fired kiln at 120°C. The dry coarse lithium carbonate is air-milled to less than 6 µm in a microniser and then pneumatically conveyed to the storage bins and bagging stations. Anhydrous sodium sulphate is produced from the vacuum evaporative crystallisation, dried, packaged and sold to the textile industry as a by-product. The design closely resembles that of the Jiangsu Lithium Carbonate Plant but is more robust and capable of processing various types of spodumene concentrate from Canada and around the world.

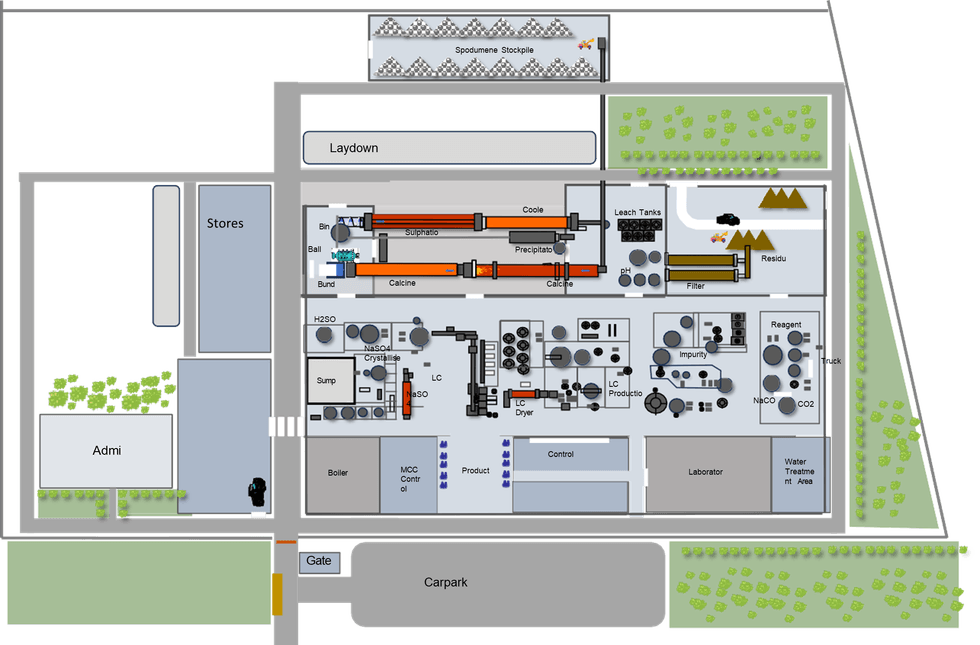

The company has developed a draft overall site layout to account for Canadian climate conditions, and defines roads required for delivery of raw materials and shipment of products and co-products. See Figure 2.

So far, the Hatch Study team has provided a Block Flow Diagram (BFD) and Process Flow Diagrams (PFD). They've also delivered a Mass Balance along with Process Design Criteria (PDC), which showcase mass flows, splits, and anticipated tonnages concerning significant equipment. The progress made thus far has been excellent. Hatch has also completed a location study for the optimal site selection for the Company’s proposed 16,000 ton per annum battery-grade lithium carbonate refinery, which is an integral part of the Company's Québec Lithium Processing Hub (QLPH). The location study involved an evaluation of various potential locations, with more than 20 municipalities contacted, and relied on recent site location benchmarks from both 2021 and 2023. Based on the location study, Lithium Universe has opted to concentrate on the Bécancour Industrial Park located between Québec City and Montreal. The company has initiated discussions with the Société du parc industriel et portuaire de Bécancour (SPIPB) concerning the Bécancour Industrial Park.

Mr Iggy Tan, the Chairman of LU7 said “The progress of the engineering study for the QLPH Lithium Refinery by Hatch has been excellent, setting the stage for the Definitive Feasibility Study (DFS). Considering our listing in early August this year, the pace and quality of work demonstrated by Hatch, guided by the Company's Lithium Dream Team, has been pleasing”.

Click here for the full ASX Release

This article includes content from Lithium Universe Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LU7:AU

The Conversation (0)

03 September 2025

Macquarie Electro Jet Silver Extraction Recovery

Lithium Universe (LU7:AU) has announced Macquarie Electro Jet Silver Extraction RecoveryDownload the PDF here. Keep Reading...

12 August 2025

Acquisition of Silver Extraction Technology

Lithium Universe (LU7:AU) has announced Acquisition of Silver Extraction TechnologyDownload the PDF here. Keep Reading...

30 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Lithium Universe (LU7:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

30 July 2025

Lithium Universe Ltd Quarterly Activities Report

Melbourne, Australia (ABN Newswire) - During the June quarter, Lithium Universe Ltd (ASX:LU7,OTC:LUVSF) (FRA:KU00) (OTCMKTS:LUVSF) announced the acquisition of the global rights to commercially exploit a patented photovoltaic solar panel recycling technology known as "Microwave Joule Heating... Keep Reading...

17 July 2025

Completion of PV Solar Cell Recycling Acquisition

Lithium Universe (LU7:AU) has announced Completion of PV Solar Cell Recycling AcquisitionDownload the PDF here. Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00