March 08, 2023

Blackstone Minerals Limited (ASX:BSX) (“Blackstone” or the “Company”) has completed its second Digbee ESGTM assessment to support the development of the Ta Khoa Project in northern Vietnam.

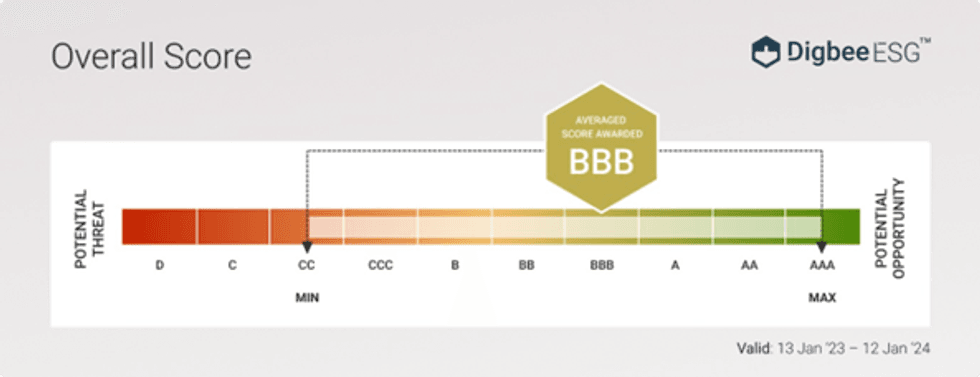

Blackstone is pleased to announce that the overall score for the assessment was BBB (refer Figure 1). This is an improvement from an overarching score of BB in 2021.

The assessment emphasises that clear improvements at all levels of the Company have been made since the inaugural submission in December 2021, showing that Blackstone holds sustainability as a core value within the organisation.

Design changes such as the change in location for the Refinery for the Nickel Project show that sustainability is included alongside financial and technical decision making.

Blackstone Minerals’ Managing Director, Scott Williamson, commented:

“Further to being awarded the 2022 Mines and Money ESG Explorer and Developer of the Year Award late last year, the improved overall Digbee ESGTM assessment score of BBB clearly shows our ongoing commitment to transparent reporting of our performance and progress as we continue our journey to becoming a Green Nickel™ producer.

It’s very exciting to see the ESG credentials of our Green Nickel™ strategy being recognised by the independent team of experts and we will continue to incorporate the recommendations in order to assist with further improving our ESG programs.”

Key areas for attention, where the issues raised have been resolved or significant progress is being made include:

- A lifecycle assessment (LCA) was conducted by a third-party consultant (Minviro), enabling the Company to plan for what the operation will look like once constructed, and therefore adapt any design aspects prior to construction.

- Evidence of plans to further reduce emissions was provided in this years’ submission. These included the potential to make use of hydroelectric power and hydrogen power, together with the option to produce cobalt sulphate rather than cobalt hydroxide, thereby reducing the carbon footprint per 1kg of product by 0.7kg.

- The location of the TKR was moved during 2022 as a result of ongoing engagement with the Son La Province People’s Committee and after further technical and financial assessment. The new location boasts strong support at both government and district levels, a reduced need for resettlement, lower impact of noise on people, superior residue storage facility placement and better logistics regarding the option for river transport when compared to the previous potential location of the refinery.

- Stakeholder engagement on ESG issues has improved through the establishment of an Audit, Risk and ESG Committee to support the Board’s understanding of sustainability concerns of shareholders.

- In Q3 2022 a Representative Office was established in Vietnam and led by the in country General Director for the Ta Khoa Refinery Project.

- Review of anti-corruption and bribery procedures was undertaken during 2022. This resulted in an update of the Whistleblower Policy and the introduction of the Whispli platform, which provides an avenue for employees to anonymously report issues.

- A detailed in-country process has been established for permitting for each project. This is supported by the multi-party working group established in June 2022, comprising representatives with an interest in the permitting process and outcomes. It is also supported by the Permitting Committee who have the mandate to monitor progress of the permits. Progress is reported to the Board every quarter.

Jamie Strauss, CEO & Founder, Digbee commented:

“Management action to acknowledge and address areas of improvement within the scope of ESG has led Blackstone to further underline its commitment to incorporating sustainability at the heart of its corporate goals and on the ground in Vietnam.”

The full report for the Digbee ESGTM assessment can be found on our website.

Click here for the full ASX Release

This article includes content from Blackstone Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BSX:AU

Sign up to get your FREE

Blackstone Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

25 July 2025

Blackstone Minerals

A diversified developer of battery-grade nickel and copper-gold assets in Southeast Asia

A diversified developer of battery-grade nickel and copper-gold assets in Southeast Asia Keep Reading...

27 January

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

28 December 2025

Managing Director Resignation and Board Changes

Blackstone Minerals (BSX:AU) has announced Managing Director Resignation and Board ChangesDownload the PDF here. Keep Reading...

24 October 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 August 2025

BSX Secures JV Partner & Funding for Ta Khoa Nickel Project

Blackstone Minerals (BSX:AU) has announced BSX Secures JV Partner & Funding for Ta Khoa Nickel ProjectDownload the PDF here. Keep Reading...

25 August 2025

Trading Halt

Blackstone Minerals (BSX:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

Latest News

Sign up to get your FREE

Blackstone Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00