Sanatana Resources Up 25 Percent With High Volume on Maiden Resource Estimate for Watershed

Santana Resources (TSXV:STA) released its maiden resource estimate for its Watershed Property, located between Timmins and Sudbury in Ontario. Shares of the company were up 25 percent to $0.025 as of 10:46 a.m. EST on Tuesday, with 2.28 million shares trading hands, compared to a daily average of 88,968.

Santana Resources (TSXV:STA) released its maiden resource estimate for its Watershed Property, located between Timmins and Sudbury in Ontario. Shares of the company were up 25 percent to $0.025 as of 10:46 a.m. EST on Tuesday, with 2.28 million shares trading hands, compared to a daily average of 88,968.

As quoted in the press release:

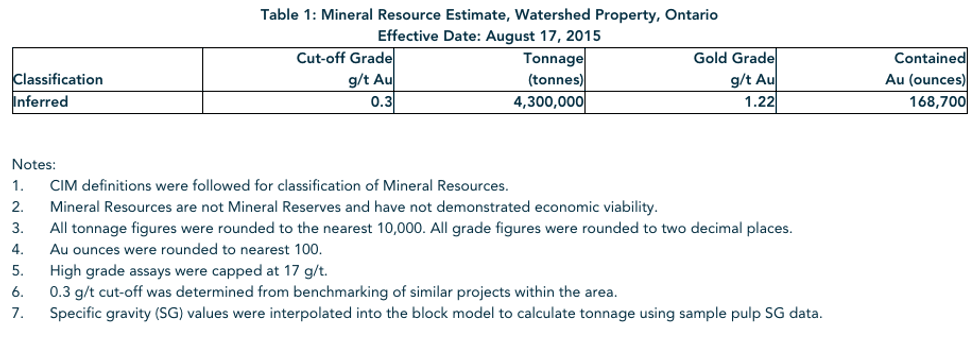

The Mineral Resource estimate incorporates assay results on mining claim 3011820 from 25 drill holes totaling approximately 9,000 metres (see Sanatana’s news releases dated February 9, 2012, March 1, 2012, April 20, 2012, and May 15, 2013) and was completed by Caracle Creek International Consulting Inc. (“Caracle Creek“). The Mineral Resource estimate, based on an open pit scenario, comprises an Inferred Resource of 4.3 million tonnes grading 1.22 grams of gold per tonne for 168,700 contained ounces, at a cut-off grade of 0.3 grams of gold per tonne (see Table 1 below).

Sanatana CEO, Peter Miles, said:

We are pleased to deliver this inferred resource estimate. Sanatana is now considering whether to form a 50/50 or a 51/49 joint venture with Trelawney Augen Acquisition Corp (TAAC), a wholly-owned subsidiary of IAMGOLD Corporation. In order to earn the extra 1% Sanatana is required to prepare and deliver to TAAC a ‘pre-feasibility study’ (as that term is defined in the underlying option and joint venture agreement) by March 23, 2016. We have incurred approximately $4,365,000 in excess work costs on the Watershed Property to date and we will assert that such excess work costs should be credited to Sanatana’s contribution to the first work program after formation of the joint venture. In either scenario (50/50 or 51/49), we will assert that TAAC will be required to contribute to the first work program of the joint venture in an amount equal to any bona fide excess work costs made by Sanatana.

Click here for the full press release.