What Was the Highest Price for Uranium?

Uranium is finally seeing growth after being in a low price environment for years. It's a good time to ask, "What was the highest price for uranium?"

Uranium is an important commodity in the energy sector because it provides fuel for nuclear power generation, which supplies 10 percent of global energy needs.

However, its price performance has often been coupled to sentiment, which was illustrated following the 2011 Fukushima nuclear disaster, when a massive earthquake and subsequent tsunami severely damaged several Japanese nuclear reactors, leading to radioactive materials releasing into the environment.

Demand for new nuclear reactors fell drastically as public fears over their risks understandably rose. This lack of demand growth coupled with excess supply weighed heavily on both the uranium spot price and uranium contract prices for nearly a decade, and prices fell as low as under US$20 per pound in 2016.

But in September 2021, uranium market watchers started to see some light at the end of the tunnel as supply cuts from major producers like Kazakhstan's Kazatomprom (LSE:KAP,OTC Pink:NATKY) and Canada's Cameco (TSX:CCO,NYSE:CCJ), alongside the emergence of the Sprott Physical Uranium Trust (TSX:U.U,OTCQX:SRUUF), set the stage for uranium prices to finally make gains.

In 2022, Russia's invasion of Ukraine, uranium supply challenges related to conversion and enrichment and the realization that nuclear energy is fundamental to combating climate change helped to light a fire under uranium prices, which hit US$64.61 in mid-April — at the time, its highest price point in 11 years. However, by the end of the year, the uranium spot price was back down to below US$50.

Low prices have hamstrung uranium exploration and mine production in recent years, with many major companies placing their operations on care and maintenance until uranium production becomes economically viable. The US$50 to US$60 per pound level was previously cited as the tipping point, but with inflation running hot analysts began pointing out that the key price point would need to be higher — especially when it comes to developing new greenfield uranium projects.

“The costs have gone up significantly,” John Ciampaglia, CEO of Sprott Asset Management, told the Investing News Network (INN) in a late 2022 conversation. “We think the cost — or the price that you would need to see in uranium to incent development of any new greenfield project — is somewhere between US$75 and US$100.”

That's why uranium market watchers have found reason to cheer in 2024, as news that top producer Kazatomprom's may miss its production targets for 2024 and 2025 pushed uranium prices up past the US$100 level to reach a 16 year high of US$106 per pound U3O8 in late January. Prices for the energy commodity have since pulled back to the US$85 range as of late March.

If the minimum price for a return to good times in the uranium sector is US$75 to US$100, what was the highest price for uranium? Read on for the answer to that question, as well as a look at what factors have shaped historical prices. We'll also consider what all this means for the uranium price now and in the future.

How is uranium traded?

Before discovering the highest price for uranium, it's worth looking at how this commodity is traded. To truly understand how prices are set, investors need to know how yellowcake is bought and sold.

While it is possible to trade uranium futures on the NYMEX or through CME Group (NASDAQ:CME), investors can't take actual possession of the metal as they can with precious metals. The obvious reason is that uranium is highly radioactive; therefore, international laws exist that regulate all aspects of the uranium supply chain, from how it is mined and refined to how it is transported and stored, as well as how it changes hands in the marketplace.

Unlike other commodities such as gold and silver, physical uranium does not trade on the open market. Buyers are often utilities companies that purchase enriched uranium for use as nuclear fuel through privately negotiated contracts with sellers. Uranium contracts often range between two and 10 years and are either set at a long-term fixed price or use the current uranium spot price as a base price, with economic corrections to be made at later dates based on an agreed-upon formula.

A one time uranium delivery can be bought based on the spot price at the time of purchase, but this only occurs in about 15 percent of uranium deals. Uranium spot market buying is often conducted by producers looking to fulfil contracts in the face of output shortfalls, as Kazatomprom did in August 2020.

What factors drive uranium supply and demand?

The uranium spot price is mostly influenced by supply and demand dynamics. Bullish experts believe we've seen the bottom of the uranium market cycle and that price increases are supported by attractive supply and demand fundamentals.

About 10 percent of the world's energy needs are met by nuclear energy generated by the 440 existing reactors. With 62 nuclear reactors in various stages of construction worldwide, the nuclear energy sector is the key driver of demand for uranium.

China alone is constructing 27 new reactors, and four new reactors are under construction in Russia with another 11 planned; India has eight nuclear reactors under construction.

On the supply side, years of ultra-low uranium prices have meant fewer companies are searching out new uranium resources to bring to market, while major producers have shuttered mines and mothballed expansion projects.

For example, Cameco had to shutter its operations at the Saskatchewan-based McArthur River mine in 2018 and the uranium giant's temporary closure at Cigar Lake in response to the COVID-19 pandemic. Cameco announced a return to normal operations at McArthur River in November 2022.

McArthur River and Cigar Lake are considered the world's top two uranium-producing mines. Both are located in Canada, which ranks as the world's second largest uranium-producing country after Kazakhstan.

In 2023, Cameco produced 17.6 million pounds of uranium, and has set its guidance at 22.4 million pounds for 2024. It's should be noted that last year's production was lower than the company's revised September guidance of 18.7 million pounds. The company originally planned to produce 20.3 million pounds for the year.

Responsible for more than 43 percent of global uranium production, Kazakhstan began cutting its annual production levels in 2018. An improving uranium market in 2022 led Kazatomprom, the country's top uranium-producing company, to reverse temporarily direction and announce a planned increase to its production levels for 2023 and 2024.

However, in early February of this year, Kazatomprom officially cut its 2024 production guidance due to issues obtaining sulfuric acid and development delays. The company is now expecting to produce 54 million to 58 million pounds of U3O8 for the year, down from its previous forecast of 65 million to 66 million pounds.

What was the highest price for uranium?

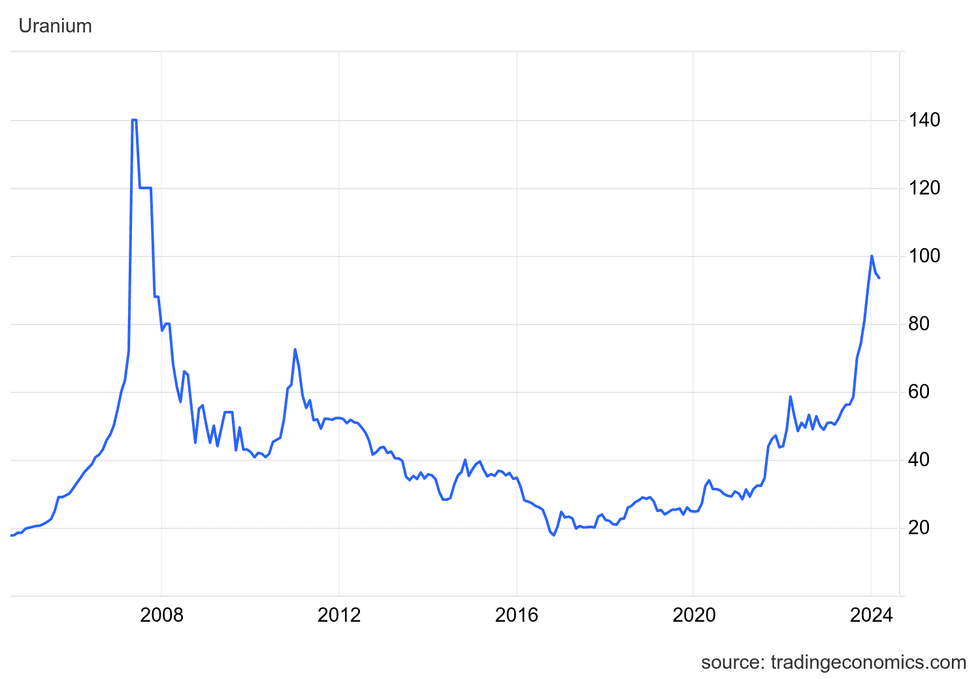

The uranium price peaked at US$136.22 in early June 2007, an impressive increase after it started the year at US$72.

Uranium's top price is a far cry from where it was at the dawn of the 21st century, trading at a low of US$7. The commodity began its upward trend in 2003 as nuclear power took a larger role in meeting global energy demand, especially in China and India.

Part of what caused the massive price uptick came from the supply side — Cameco's massive Cigar Lake mine in Saskatchewan flooded in 2006, delaying the start of production for several years. At the time it was one of the largest undeveloped uranium deposits in the world, and the unexpected delay took a serious toll on the market and contributed to the exponential growth in prices in 2007.

Uranium price chart, 2004 to 2024.

Chart via TradingEconomics.

However, the high price levels seen in 2007 didn't last. The 2008 economic crisis sent prices for uranium crashing alongside other commodities. By early 2009, prices had fallen below the key US$50 level and slid further in 2010 to the US$40 range. Signs of a global economic recovery and the coinciding rising demand for energy metals in 2011 was very price positive for uranium.

Still, the low price environment over the years prior significantly sidelined uranium exploration and development, heightening supply-side concerns. As a result, prior to Fukushima uranium prices were shooting up past the US$70 level.

After the Fukushima fallout, the U3O8 spot price was on a slow slide to lows not seen since the start of the century, bottoming below US$18 in 2016. For the next three years, the price of uranium struggled to break US$25.

As mentioned, in 2020, the uranium spot price began moving higher, increasing more than 30 percent in the first half of the year. By September 2021, prices had hit a nine year high of US$50.80.

Uranium kicked off 2022 at US$43.66. Civil unrest in Kazakhstan due to mounting energy prices in the nation, along with the launch of Russia’s invasion of Ukraine, were behind the positive performance for uranium in the first few months of the year. Between late February and mid-April, uranium prices rose from US$43.94 to hit an 11 year high of US$64.61.

At that time, it seemed utilities companies were finally returning to the uranium market to boost their fuel supplies. Uranium supply challenges related to conversion and enrichment also aided in pushing uranium prices higher. From April 2021 to April 2022, the price of uranium climbed by a massive 106.47 percent.

However, by the end of June 2022, uranium had fallen to the US$50 range as the broader commodities market faced economic turbulence brought on by the US Federal Reserve's efforts to curtail rising inflation by hiking interest rates.

Even so, uranium prices did see support as countries around the world look to nuclear power to help bridge the gap in the transition to cleaner energy sources. This is evidenced by the market’s ability to sustain a significant upward trend in uranium prices that began near the end of the first quarter of 2023 and culminated in triple digit prices by the first month of 2024.

During the second half of 2023, the most favorable supply and demand fundamentals in more than a decade, began to take shape and that reflected in the performance the uranium price.

“What has been clear for some time is utility uncertainty around future supply as secondary supplies are drawn down and primary supplies tighten; this resulted in increased utility purchasing in the spot market in Q2 and Q3 of this year," Ben Finegold, who runs uranium research at Ocean Wall, commented to INN via email in October 2023. "The coup in Niger, production cuts from Cameco and increased activity from financial speculators and traders have put further pressure on prices.”

Chris Temple of the National Investor told the Investing News Network in mid-2023 that investors are "going to see US$100 a pound again for uranium inside of two years." Temple's prediction would come true much sooner as the spot price of uranium breached the US$100 mark in January 2024 following news that top producer Kazatomprom expects to miss its production targets for 2024 and 2025.

Will the uranium price climb even higher? That question is still to be answered, although Justin Huhn, founder and publisher of Uranium Insider, had some advice for uranium market watchers when INN spoke with him in early 2023. He highlighted his positive long-term outlook by comparing the current uranium market cycle to the nine innings of a baseball game.

"We're probably somewhere on the tail end of inning three," he said. "I think we've got a long ways to go, and in these types of markets the mania phase usually happens in inning eight and nine. So there's a lot of excitement ahead of us still."

Investor takeaway

We've answered the question, "What was the highest price for uranium?" But it remains to be seen if uranium will continue its rebound. The main factors to watch continue to be growth in the number of nuclear reactors online and under construction, as well as decreasing mine supply.

For more information on entering the uranium market, click here to read our overview of stocks, uranium exchange-traded funds and uranium futures.

This is an updated version of an article first published by the Investing News Network in 2020.

Don't forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Uranium Stocks: 5 Biggest Companies in 2025 ›

- 5 Best-performing Canadian Uranium Stocks of 2025 ›

- Uranium Price Update: Q2 2025 in Review ›

- When Will Uranium Prices Go Up? ›

- Top 10 Uranium-producing Countries ›