Pasinex Announces 2018 Production Results and 2019 Guidance for the Pinargozu Mine

Pasinex (CSE:PSE, FSE:PNX) (FSE: PNX) (“the Company”) is pleased to announce its 2018 preliminary production and mining costs from its Pinargozu mine along with production and cost estimates for 2019.

Pasinex (CSE:PSE, FSE:PNX) (FSE: PNX) (“the Company”) is pleased to announce its 2018 preliminary production and mining costs from its Pinargozu mine along with production and cost estimates for 2019.

2018 operating highlights:

- Production in 2018 was 14% below our 2018 guidance (issued on April 30, 2018) due to difficult mining conditions as the mine operated in smaller discontinuous zones of mineralization impacting efficiency.

- Horzum AS sold approximately 38,800 wet tonnes of zinc oxide material and 4,056 wet tonnes of zinc sulphide material.

- Cost per tonne mined for 2018 is expected to be consistent with 2018 guidance at $200 to $220 per tonne, which should deliver a strong gross margin for Horzum AS.

2019 forecast:

- The production forecast for 2019 is significantly lower than 2018 production due to a transition from predominantly oxide material to the deeper, more valuable, sulphide material which requires considerable mine development to access this deeper mineralization.

- The mine development program commenced in October 2018 and will take approximately 9 months until June 2019 before the deeper sulphide zone is reached.

- The remaining resource of oxide product is currently being mined and will continue until approximately April of 2019. Production will be then be interrupted until completion of the mine development program with production commencing from the lower zinc sulphide mineralized zone in July/August 2019.

- It is expected that the deeper mineralization will be predominantly zinc sulphide which is higher grade and a more valuable product than the zinc oxide product (zinc sulphide demands a price about two times greater than zinc oxide).

- As development work is prioritized over production in 2019, the cost per tonne mined will increase because development costs are expensed against reduced production resulting in an estimated cost per tonne mined of between $450 and $500 per tonne. Costs incurred during the production downtime are not included in the cost per tonne mined guidance for 2019.

- It is expected that cash received from sales of production and opening inventories should sustain the Horzum AS operations during the downtime.

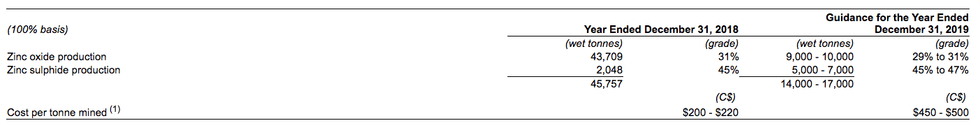

A summary of 2018 operating results and 2019 estimates for the Pinargozu mine are as follows:

(1) Cost per tonne mined is a non-IFRS measure and is calculated by taking the mine’s cost of sales, adding back inventory changes and dividing by total production. For the year ended December 31, 2018 the cost per tonne mined is an estimate using unaudited financial statements. The cost per tonne mined guidance for the year ended December 31, 2019 assumes a Turkish Lira to Canadian dollar exchange rate of 4 and does not include the development and standby costs while mining is interrupted.

This program should bring sulphide production on line in July / August 2019 but leave us with a few months without production as we complete the transition. This year (2019) cash flow will be significantly constricted due to a production hiatus to complete the mine development vital to sustain future mine production. The cash flow challenge and its impact will be actively and carefully managed with a focus on a commensurate reduction in noncritical expenditures.President and CEO of Pasinex Resources Limited, Mr. Steve Williams, said: “2018 was another strong production year at our joint venture company Horzum AS. However, 2019 will be a transition year for Horzum AS and Pasinex Resources. We are undertaking a large mine development program at the moment to open up deeper zinc sulphide mineralization at the Pinargozu mine.

We have been continuing our near-mine exploration extending into Pasinex’s adjacent Akkaya property where a recent 16 diamond drill-hole program clearly indicates a robust hydrothermal system along a splay of the Horzum Zinc Trend. Exploration will continue throughout 2019 but constrained by reduced cash flows from the mine and other critical spending requirements.”

A graphic showing the deeper sulphide mineralization is shown below:

https://www.globenewswire.com/NewsRoom/AttachmentNg/76154d1b-9233-4d2e-82e6-134f22a5ce88

The scientific and technical disclosure in this news release has been reviewed and approved by John Barry, M.Sc., P. Geo., who is the Company’s Vice President of Exploration and a Qualified Person under the definitions established by NI 43-101.

About Pasinex

Pasinex Resources Limited is a Toronto-based mining company which owns 50% of the producing Pinargozu high grade zinc mine and, under a Direct Shipping Program, sells to zinc smelters / refiners from its mine site in Turkey. The Company also holds an option to acquire 80% of the Gunman high-grade zinc exploration project in Nevada. Pasinex has a strong technical management team with many years of experience in mineral exploration and mining project development. The mission of Pasinex is to build a mid-tier zinc company based on its mining and exploration projects in Turkey and Nevada.

On Behalf of the Board of Directors

PASINEX RESOURCES LTD.

| Steve Williams | Evan White | |

| President/CEO | Manager of Corporate Communications | |

| Phone: 416 861 9659 | Phone: +1 416.906.3498 | |

| Email: info@pasinex.com | Email: evan.white@pasinex.com | |

The CSE does not accept responsibility for the adequacy or accuracy of this news release.

This news release includes forward-looking statements that are subject to risks and uncertainties. Forward-looking statements involve known and unknown risks, uncertainties, and other factors that could cause the actual results of the Company to be materially different from the historical results or from any future results expressed or implied by such forward-looking statements.

All statements within, other than statements of historical fact, are to be considered forward looking. Although Pasinex Resources Ltd. believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include: all exploration drilling results, and general economic, market or business conditions. There can be no assurances that such statements will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. We do not assume any obligation to update any forward-looking statements.

Click here to connect with Pasinex (CSE:PSE, FSE:PNX) for an Investor Presentation.

Source: globenewswire.ca