July 30, 2024

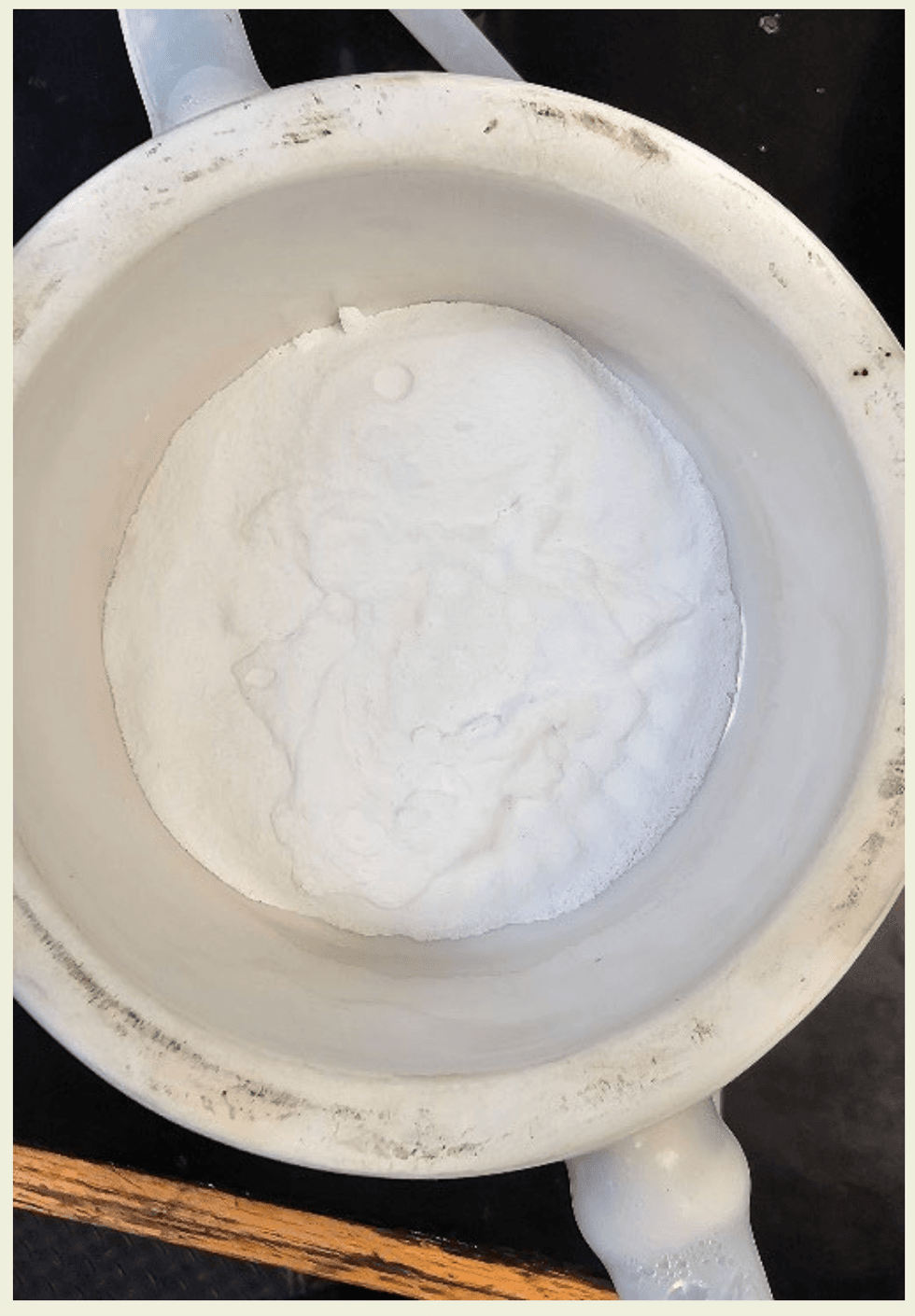

Jindalee Lithium Limited (Jindalee, the Company) is pleased to announce that battery-grade lithium carbonate has been successfully produced from ore from the McDermitt Lithium Project (the Project) (Figure 1). This marks an important milestone, with all steps of the processing flowsheet for the Project from ore beneficiation and leaching to purification and production of battery-grade lithium carbonate now validated (Figure 2).

HIGHLIGHTS:

- First production of Battery-Grade Lithium Carbonate (>99.5%) from test work completed at Hazen Research Inc. in collaboration with Fluor - lead engineer for the PFS underway at the McDermitt Lithium Project

- Production of Battery-Grade Lithium Carbonate marks a major milestone with all steps of the McDermitt flowsheet now validated

- Flowsheet for McDermitt is very similar to Lithium Americas’ Thacker Pass Project currently under construction 30km to the south of McDermitt

- Results will support the PFS, due for release in Q4 CY 2024

These findings, together with other recently identified value optimisation opportunities, will be incorporated in the Pre-Feasibility Study (PFS) currently underway and due for completion Q4 2024.

Jindalee’s CEO Ian Rodger commented:

"The successful production of battery-grade lithium carbonate from McDermitt ore is a major milestone for Jindalee. This achievement substantially de-risks our processing flowsheet and demonstrates the potential for McDermitt to supply high-quality lithium chemicals to the expanding US battery value chain.

We have been greatly encouraged by the exceptional results we have achieved since commencing the PFS metallurgical test work program with Fluor and Hazen in mid-2023 and anticipate that these results will meaningfully support the outcomes of the McDermitt Lithium Project PFS which is now due for release in Q4 CY 2024.”

Discussion

After investigating various alternatives, in March 2023 acid leaching with beneficiation (see Figure 2) was selected as the preferred flowsheet for the Project2. This decision followed a review of prior test work and high-level benchmarking of five comparator lithium projects by the global engineering, procurement, construction and maintenance company Fluor Corporation (Fluor), which indicated that acid leaching with beneficiation was expected to produce the best economic outcome for the Project. The resultant McDermitt flowsheet (Figure 2) is very similar to that utilised and extensively validated by Lithium Americas Corporation (TSX: LAC) at its Thacker Pass project, which is currently under construction and is also located in the McDermitt Caldera (~30km south of the McDermitt Lithium Project).

Fluor was subsequently appointed as lead engineer for the McDermitt PFS in June 20233, including managing an extensive bench scale metallurgical test work program at Hazen Research Inc. in Colorado, USA, aimed at validating the preferred flowsheet and providing data to inform the PFS (PFS Test Work). To date Jindalee has announced exceptional results from the McDermitt PFS Test Work including results from beneficiation test work in November 20234 and acid leaching in January 20245. Respective highlights include:

- Beneficiation: Beneficiation of a composite sample of McDermitt ore using attrition scrubbing (250μm cut-size), recorded 92.0% Li recovery with 25.3% mass rejection, demonstrating the excellent potential to remove acid consuming material and increase the Lithium grade of leach feed4.

- Acid Leaching: Excellent lithium (Li) extraction rates were achieved from sulphuric acid leaching of beneficiated McDermitt ore. Li extraction from composite samples averaged 93% (250μm) and 94% (75μm) using 500kg sulphuric acid per tonne of leach feed5.

Subsequent to the acid leaching test work described above, an additional 300 kg composite sample (250 µm, comprising Units 4, 6, 8, and 10) was leached, yielding lithium in solution (leachate) for downstream test work (post-leach process steps – see Figure 2). The purification of the lithium-rich solution was successfully completed, resulting in the first production of battery-grade lithium carbonate, assaying 99.8% Li₂CO₃ with acceptable levels of deleterious elements in accordance with a typical third-party contract specification. This achievement significantly de-risks the Project by demonstrating the effectiveness of all process steps of the flowsheet at bench scale. Reaching this milestone provides strong validation of the flowsheet developed for McDermitt.

This article includes content from Jindalee Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

JLL:AU

Sign up to get your FREE

Jindalee Lithium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

16 April 2025

Jindalee Lithium

Game-changing, economically significant lithium resource for North American battery supply chain

Game-changing, economically significant lithium resource for North American battery supply chain Keep Reading...

23 January

Quarterly Cashflow Report - December 2025

Jindalee Lithium (JLL:AU) has announced Quarterly Cashflow Report - December 2025Download the PDF here. Keep Reading...

23 January

Quarterly Activities Report - December 2025

Jindalee Lithium (JLL:AU) has announced Quarterly Activities Report - December 2025Download the PDF here. Keep Reading...

11 December 2025

US Government Approves Major Drilling Program at McDermitt

Jindalee Lithium (JLL:AU) has announced US Government Approves Major Drilling Program at McDermittDownload the PDF here. Keep Reading...

08 December 2025

Trading Halt

Jindalee Lithium (JLL:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

04 November 2025

Drilling Underway at McDermitt Lithium Project

Jindalee Lithium (JLL:AU) has announced Drilling Underway at McDermitt Lithium ProjectDownload the PDF here. Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Sign up to get your FREE

Jindalee Lithium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00