January 17, 2025

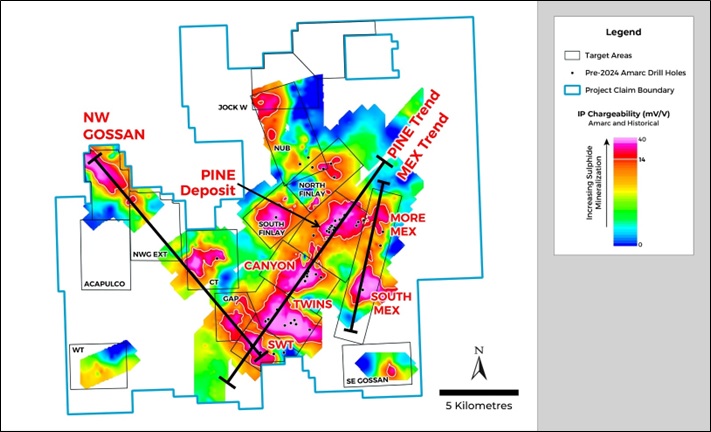

Amarc Resources Ltd. ("Amarc" or the "Company") (TSXV:AHR)(OTCQB:AXREF) is pleased to announce discovery of the new, high grade, gold-rich porphyry copper-gold-silver ("Cu-Au-Ag") AuRORA deposit at its 100% owned JOY Copper-Gold District ("JOY"), in the prolific Toodoggone-Kemess porphyry Cu-Au region of north-central British Columbia ("BC"). The AuRORA Deposit Discovery is located within an area of the 495 km 2 JOY District that had not previously been drill tested (see Figures 1, 2 and 3). Freeport-McMoRan Mineral Properties Canada Inc. ("Freeport") is fully funding work programs at JOY to earn an interest in the project, and Amarc is the operator of all programs.

Highlights from Initial AuRORA DEPOSIT Discovery Drill Holes Include:

Drill Hole | Int.1,2,3 (m) | From (m) | Incl. | Au (g/t) | Cu (%) | Ag (g/t) | CuEQ4 (%) |

JP24057 | 82 | 18 | 1.24 | 0.38 | 2.47 | 1.08 | |

42 | 58 | Incl. | 1.97 | 0.49 | 3.58 | 1.61 | |

JP24059 | 271 | 24 | 0.98 | 0.25 | 1.93 | 0.81 | |

171 | 24 | Incl. | 1.32 | 0.34 | 2.62 | 1.09 | |

89 | 106 | and | 2.29 | 0.46 | 3.65 | 1.76 | |

JP24071 | 212 | 21 | 1.36 | 0.40 | 3.35 | 1.18 | |

108 | 104 | Incl. | 2.38 | 0.60 | 5.17 | 1.96 | |

JP24074 | 162 | 69 | 2.19 | 0.63 | 6.95 | 1.90 | |

147 | 84 | Incl. | 2.40 | 0.69 | 7.60 | 2.08 | |

108 | 111 | and | 3.09 | 0.82 | 8.99 | 2.59 | |

81 | 135 | and | 3.69 | 0.92 | 9.72 | 3.04 |

Notes: See Table 1.

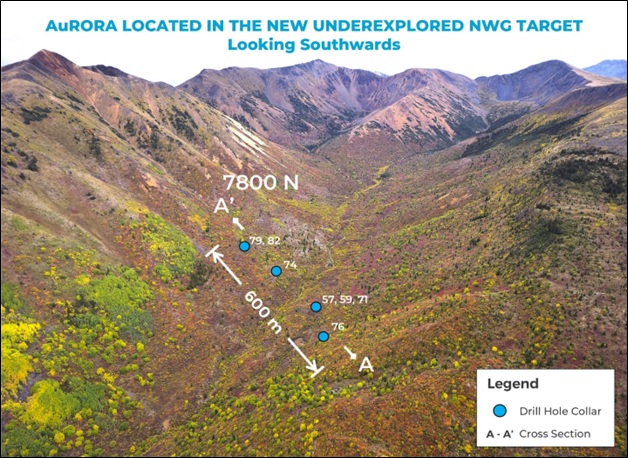

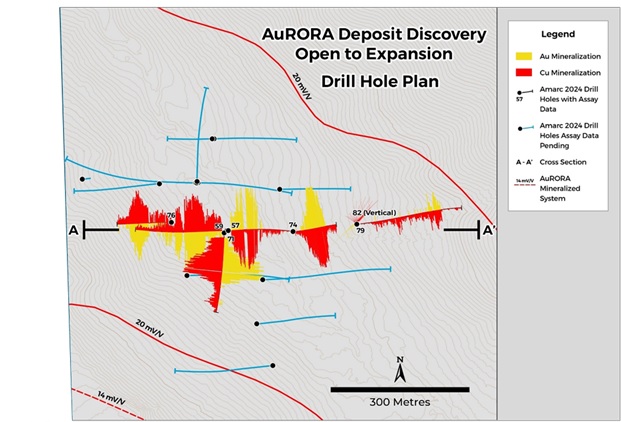

Hole JP24057, the first hole ever drilled at AuRORA, intersected a new porphyry Cu-Au-Ag system hosting high and continuous Au grades (see Tables 1, 2 and 3). Following completion of this discovery hole, Amarc, with Freeport, systematically stepped out, aggressively drilling with three core rigs, with a view to begin outlining an outstanding Cu-Au-Ag deposit and to confirm its high grade potential. This release details the results of discovery hole JP24057 and six other holes drilled at approximately 100 m intervals on east-west section 7800N (see Figures 2 and 3). Drilling on this section established a 600 m wide zone of porphyry mineralization encountered from near surface that is open to lateral expansion, and which is characterized by excellent lateral and vertical continuity. Final compilations and confirmatory analyses from six additional holes drilled at AuRORA along east-west section 7900N, a 100 m step out to the north of section 7800N, are near completion and will be released in the very near future. These additional results show similar very encouraging grades and characteristics to those reported in this release.

"This impressive new, high grade porphyry copper-gold-silver discovery is a pivotal moment for Amarc and its shareholders," said Dr. Diane Nicolson, Amarc President and CEO. "It represents a significant inflection point in the exploration of the JOY District with Freeport. Our discovery is the culmination of years of relentless groundwork by the Amarc team, coupled with the firm, unwavering belief, shared by Freeport, that the JOY District holds significant potential for high grade porphyry gold-copper deposits. This discovery comes during a period of positive market sentiment for gold, copper and silver, which we believe further increases the attractiveness of Amarc as an exciting investment opportunity."

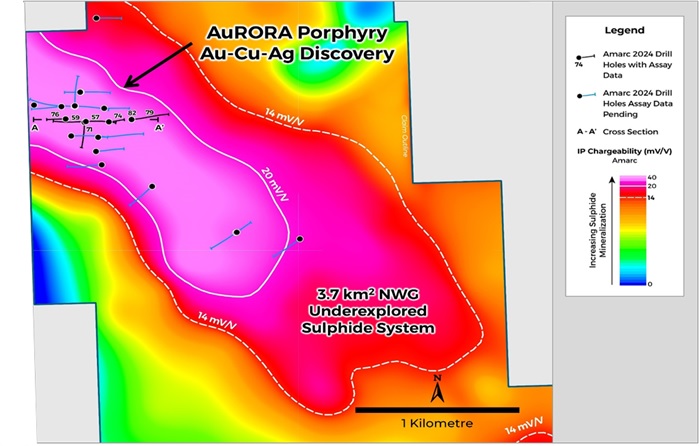

The AuRORA Deposit Discovery is located within the expansive Northwest Gossan ("NWG") Target area located at the northwest end of a possible 15 km mineralized trend that extends southeast toward the GAP and SWT Targets (see Figure 1). The NWG Target is outlined by a 3.7 km 2 Induced Polarization ("IP") anomaly (>14mV/V) (see Figure 3) with coincident Cu, Au, Mo and Ag anomalies outlined in soils and rocks (see Amarc releases May 2 and July 11, 2024). The 2024 initial drill testing of the NWG Target area focused primarily on an internal zone of higher (>20 mV/V) IP chargeability some 1,500 m long and 500 m wide. Much of the NWG Target area remains unexplored.

"The AuRORA Deposit Discovery has been made through the Amarc team's depth of knowledge and porphyry copper-gold discovery track record in BC and the Toodoggone region, combined with the support and insight from Freeport, based on its global capabilities as a top-tier copper and gold producer and discoverer. Together, our goal in 2024 was to focus on discovery and we are clearly on the right track with AuRORA. Notably, the AuRORA Deposit Discovery area is only one of eight large scale sulphide mineralized systems clustered along several mineralized trends drilled in 2024 at JOY. These important-scale sulphide systems have been established by district-wide geological, geochemical and geophysical ground IP surveys. Additional results from the 2024 drill program will be forthcoming. We are extremely optimistic about further important progress at JOY," concluded Nicolson.

In addition to today's announced drill holes, an additional 33 scout holes were also completed on eight porphyry Cu-Au targets, including at the AuRORA Deposit Discovery, PINE Deposit, Canyon Discovery and at the Twins Deposit Target within the JOY District (see Figure 1). These targets were established through 290 line-km of property wide IP surveying, the collection and analyses of 8,400 soil and 1,500 rock samples, and geological mapping and prospecting.

Figure 2: AuRORA Deposit Discovery: Located in the New Underexplored NWG Target

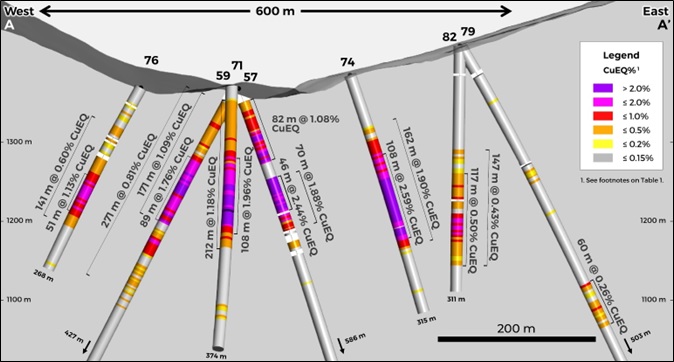

Figure 4: AuRORA Deposit Discovery Never Previously Drilled and Open to Expansion

Figure 5: AuRORA Deposit Discovery: Drilling Outlines Open-Ended, Near Surface, Continuous, High Grade Cu-Au-Ag Mineralization (Section 7800N)

Table 1: JOY AuRORA Porphyry Cu-Au-Ag Deposit Discovery Section 7800N Mineralized Intervals of Significance

Drill Hole | Incl. | From (m) | To | Int.1,2,3 (m) | Au (g/t) | Cu (%) | Ag (g/t) | CuEQ4 (%) |

JP24057 | 18.00 | 100.00 | 82.00 | 1.24 | 0.38 | 2.5 | 1.08 | |

Incl. | 58.00 | 100.00 | 42.00 | 1.97 | 0.49 | 3.6 | 1.61 | |

120.29 | 190.00 | 69.71 5 | 2.56 | 0.42 | 5.0 | 1.88 | ||

Incl. | 120.29 | 166.00 | 45.71 | 3.30 | 0.56 | 6.2 | 2.44 | |

And | 120.29 | 136.00 | 15.71 | 4.54 | 0.84 | 8.6 | 3.42 | |

JP24059 | 24.00 | 295.25 | 271.25 | 0.98 | 0.25 | 1.9 | 0.81 | |

Incl. | 24.00 | 194.50 | 170.50 | 1.32 | 0.34 | 2.6 | 1.09 | |

And | 106.00 | 194.50 | 88.50 | 2.29 | 0.46 | 3.7 | 1.76 | |

Incl. | 211.00 | 239.10 | 28.10 | 0.99 | 0.18 | 1.1 | 0.73 | |

JP24071 | 21.10 | 233.00 | 211.906 | 1.36 | 0.40 | 3.4 | 1.18 | |

Incl. | 104.00 | 212.00 | 108.00 | 2.38 | 0.60 | 5.2 | 1.96 | |

JP24074 | 69.00 | 231.00 | 162.00 | 2.19 | 0.63 | 7.0 | 1.90 | |

Incl. | 84.00 | 231.00 | 147.00 | 2.40 | 0.69 | 7.6 | 2.08 | |

And | 111.00 | 219.00 | 108.00 | 3.09 | 0.82 | 9.0 | 2.59 | |

And | 135.00 | 216.00 | 81.00 | 3.69 | 0.92 | 9.7 | 3.04 | |

JP24076 | 57.00 | 198.00 | 141.007 | 0.73 | 0.18 | 1.3 | 0.60 | |

Incl. | 102.00 | 198.00 | 96.00 | 1.00 | 0.24 | 1.8 | 0.81 | |

And | 129.00 | 180.00 | 51.00 | 1.44 | 0.31 | 2.2 | 1.13 | |

JP24079 | 179.00 | 189.50 | 10.50 | 0.06 | 0.24 | 2.7 | 0.29 | |

341.00 | 400.70 | 59.70 | 0.29 | 0.08 | 1.7 | 0.26 | ||

JP24082 | 131.00 | 277.95 | 146.95 | 0.34 | 0.22 | 3.2 | 0.43 | |

Incl. | 161.00 | 277.95 | 116.95 | 0.39 | 0.25 | 3.8 | 0.50 | |

And | 212.00 | 242.00 | 30.00 | 0.84 | 0.54 | 7.2 | 1.06 |

Notes to Table 1:

- Widths reported are drill widths, such that true thicknesses are unknown.

- All assay intervals represent length-weighted averages.

- Some figures may not sum exactly due to rounding.

- Copper equivalent (CuEQ) calculations use metal process prices of: Cu US$4.00/lb, Au US$1800/oz., and Ag US$24/oz. and conceptual recoveries of: Cu 85%, Au 72% and 67% Ag. Conversion of metals to an equivalent copper grade based on these metal prices is relative to the copper price per unit mass factored by conceptual recoveries for those metals normalized to the conceptualized copper recovery. The metal equivalencies for each metal are added to the copper grade. The general formula for this is: CuEQ% = Cu% + ((Au g/t * (Au recovery / Cu recovery) * (Au $ per oz./31.1034768 / Cu $ per lb. * 22.04623)) + ((Ag g/t * (Ag recovery / Cu recovery) * (Ag $ per oz./ 31.1034768 / Cu $ per lb. * 22.04623)).

- Drill hole JP24057 interval 166-169 m comprised broken ground, no core was recovered, and it was therefore averaged at zero grade.

- Drill hole JP24071 interval 179-182 m comprised broken ground, no core was recovered, and it was therefore averaged at zero grade.

- Drill hole JP24076 intervals 72-75 m, 78-81 m and 96-102 m comprised broken ground, no core was recovered, and each was therefore averaged at zero grade.

AuRORA Deposit Geological Information - Section 7800N

The geological and hydrothermal characteristics of AuRORA discovery hole JP24057, and other holes along the section, are broadly consistent with generalized models for porphyry Cu-Au deposits in the Kemess Mining District and in the wider Toodoggone Region. East-west cross section 7800N across the AuRORA Deposit Discovery highlights the excellent continuity of the near surface, high grade, Cu-Au-Ag mineralization discovered in hole JP24057, as well as consistent vertical and lateral patterns in the grade, hydrothermal and geological characteristics in the holes along the section (see Figures 4 and 5 and Table 2).

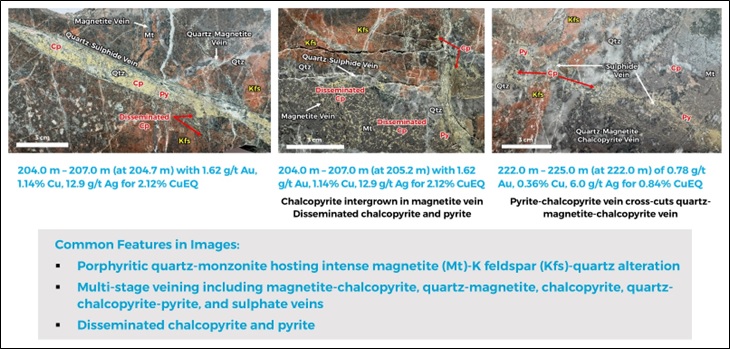

In the upper part of AuRORA, mineralization is hosted by andesitic tuff and in its lower part by quartz-monzonite intrusive rocks. The contact between the volcanic and intrusive rocks is typically masked by intense alteration that coincides with the highest-grade mineralization. High grade mineralization is associated with pervasive quartz-sericite/chlorite-pyrite alteration, which overprints potassic K-feldspar and magnetite alteration. Copper mineralization is mainly chalcopyrite and trace to minor bornite (see Figure 6).

About Amarc Resources Ltd

Amarc is a mineral exploration and development company with an experienced and successful management team focused on developing a new generation of long-life, high-value porphyry Cu-Au mines in BC. By combining high-demand projects with dynamic management, Amarc has created a solid platform to create value from its exploration and development-stage assets.

Amarc is advancing its 100%-owned JOY, DUKE and IKE porphyry Cu±Au Districts located in different prolific porphyry regions of northern, central and southern BC, respectively. Each District represents significant potential for the development of multiple and important-scale, porphyry Cu±Au deposits. Importantly, each of the three districts are located in proximity to industrial infrastructure - including power, highways and rail.

Amarc's exploration is led by an internationally successful team of experienced geologists specializing in porphyry Cu-Au deposits. Members of this team have been involved in and have tracked porphyry Cu-Au exploration advancements in the Toodoggone region since 1990. Their experience and early recognition of the porphyry potential at the NWG Target in terms of a shallowly overburden covered and underexplored transitional epithermal-porphyry geological setting, led to the discovery of the Au-rich AuRORA porphyry Cu-Au-Ag Deposit.

Freeport-McMoRan Mineral Properties Canada Inc. ("Freeport"), a wholly owned subsidiary of Freeport-McMoRan Inc. at JOY and Boliden Mineral Canada Ltd. ("Boliden"), an entity within the Boliden Group of companies at DUKE, can earn up to a 70% interest in each District through staged investments of $110 million and $90 million, respectively. Together this provides Amarc with potentially up to $200 million in non-share dilutive staged funding for these Districts. In addition, Amarc has completed self-funded drilling at its higher-grade Empress Deposit in the IKE District. Drill results from nine core holes drilled late in 2024 at Empress are being compiled and are expected to be released next month. Amarc is the operator of all programs.

Amarc is associated with HDI, a diversified, global mining company with a 35-year history of porphyry Cu deposit discovery, development and transaction success. Previous and current HDI projects include some of BC's and the world's most important porphyry deposits - such as Pebble, Mount Milligan, Southern Star, Kemess South, Kemess North, Gibraltar, Prosperity, Xietongmen, Newtongmen, Florence, Casino, Sisson, Maggie, AuRORA, PINE, IKE and DUKE. From its head office in Vancouver, Canada, HDI applies its unique strengths and capabilities to acquire, develop, operate and monetize mineral projects.

Amarc works closely with local governments, Indigenous groups and stakeholders in order to advance its mineral projects responsibly, and in a manner that contributes to sustainable community and economic development. We pursue early and meaningful engagement to ensure our mineral exploration and development activities are well coordinated and broadly supported, address local priorities and concerns, and optimize opportunities for collaboration. In particular, we seek to establish mutually beneficial partnerships with Indigenous groups within whose traditional territories our projects are located, through the provision of jobs, training programs, contract opportunities, capacity funding agreements and sponsorship of community events. All Amarc work programs are carefully planned to achieve high levels of environmental and social performance.

Qualified Person

Mark Rebagliati, P.Eng, a Qualified Person ("QP") as defined by National Instrument 43-101, has reviewed and approved all technical and scientific information related to the JOY Project contained in this news release. Mr. Rebagliati is not independent of the Company.

Quality Assurance/Quality Control Program

Amarc drilled NQv (48.1mm) and HQ (63.5mm) size core in 2024 at the JOY project. All drill core was logged, photographed, and cut in half with a diamond saw. Half core samples from the JOY drilling were sent to ALS Canada Ltd., Kamloops or Langley, Canada, for preparation and to North Vancouver, Canada for analysis. All facilities are ISO/IEC 17025:2017 accredited. At the laboratory, samples were dried, crushed to 70% passing -2mm, and either a 250 g split or 1,000 g split was pulverized to better than 85% passing 75 microns. Samples were analyzed for Au by fire assay fusion of a 30 g sub-sample with an ICP-AES finish, and for 60 elements including Cu, Mo and Ag by a four-acid digestion, multi-element ICP-MS package. Samples with Cu results > 10,000 ppm were reanalyzed by a single element four-acid digestion ICP-AES method for Cu. As part of a comprehensive Quality Assurance/Quality Control ("QAQC") program, Amarc control samples were inserted in each analytical batch of the core samples at the following rates: standards one in 20 regular samples, in-line replicates one in 20 regular samples and one coarse blank per hole. The control sample results were then checked to ensure proper QAQC.

The QP visited the site to verify location of drill holes, and review the core and logging, sampling and sample shipment processes. He also reviewed and assessed the assay results.

For further details on Amarc Resources Ltd., please visit the Company's website at www.amarcresources.com or contact Dr. Diane Nicolson, President and CEO, at (604) 684-6365 or within North America at 1-800-667-2114, or Kin Communications, at (604) 684-6730, Email: AHR@kincommunications.com.

ON BEHALF OF THE BOARD OF DIRECTORS OF AMARC RESOURCES LTD.

Dr. Diane Nicolson

President and CEO

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking and Other Cautionary Information

This news release includes certain statements that may be deemed "forward-looking statements". All such statements, other than statements of historical facts that address exploration plans and plans for enhanced relationships are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Assumptions used by the Company to develop forward-looking statements include the following: Amarc's projects will obtain all required environmental and other permits and all land use and other licenses, studies and exploration of Amarc's projects will continue to be positive, and no geological or technical problems will occur. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, potential environmental issues or liabilities associated with exploration, development and mining activities, exploitation and exploration successes, continuity of mineralization, uncertainties related to the ability to obtain necessary permits, licenses and tenure and delays due to third party opposition, changes in and the effect of government policies regarding mining and natural resource exploration and exploitation, exploration and development of properties located within Aboriginal groups asserted territories may affect or be perceived to affect asserted aboriginal rights and title, which may cause permitting delays or opposition by Aboriginal groups, continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. For more information on Amarc Resources Ltd., investors should review Amarc's annual Form 20-F filing with the United States Securities and Exchange Commission at www.sec.gov and its home jurisdiction filings that are available at www.sedarplus.ca.

Table 2: AuRORA Discovery Assay Data by Sample Interval for Drill Holes JP24059 and JP 24074

Hole JP24059

Sample | From (m) | To (m) | Int.1,2,3 (m) | Au (g/t) | Cu (%) | Ag (g/t) | CuEQ4 (%) |

732288 | 106.00 | 109.00 | 3.00 | 1.38 | 0.49 | 2.9 | 1.28 |

732289 | 109.00 | 112.00 | 3.00 | 1.22 | 0.36 | 2.2 | 1.06 |

732291 | 112.00 | 115.00 | 3.00 | 1.44 | 0.52 | 2.9 | 1.34 |

732292 | 115.00 | 118.00 | 3.00 | 1.37 | 0.44 | 2.6 | 1.22 |

732293 | 118.00 | 121.00 | 3.00 | 1.43 | 0.45 | 3.5 | 1.27 |

732294 | 121.00 | 124.00 | 3.00 | 2.12 | 0.59 | 4.3 | 1.80 |

732295 | 124.00 | 127.00 | 3.00 | 3.04 | 0.83 | 6.1 | 2.56 |

732296 | 127.00 | 129.00 | 2.00 | 2.02 | 0.52 | 5.4 | 1.68 |

732297 | 129.00 | 130.90 | 1.90 | 1.74 | 0.73 | 5.0 | 1.73 |

732298 | 130.90 | 133.00 | 2.10 | 2.37 | 0.58 | 4.4 | 1.92 |

732299 | 133.00 | 136.00 | 3.00 | 2.56 | 0.79 | 4.8 | 2.24 |

732300 | 136.00 | 139.00 | 3.00 | 1.92 | 0.51 | 4.1 | 1.60 |

732301 | 139.00 | 142.00 | 3.00 | 2.77 | 0.61 | 4.6 | 2.18 |

732302 | 142.00 | 145.00 | 3.00 | 3.63 | 0.61 | 4.6 | 2.66 |

732303 | 145.00 | 148.00 | 3.00 | 3.87 | 0.62 | 4.6 | 2.80 |

732304 | 148.00 | 149.50 | 1.50 | 4.65 | 0.72 | 6.0 | 3.35 |

732305 | 149.50 | 151.00 | 1.50 | 4.82 | 0.86 | 6.6 | 3.59 |

732306 | 151.00 | 154.00 | 3.00 | 2.85 | 0.72 | 4.7 | 2.34 |

732307 | 154.00 | 157.00 | 3.00 | 1.01 | 0.21 | 1.7 | 0.78 |

732308 | 157.00 | 160.00 | 3.00 | 2.70 | 0.32 | 2.7 | 1.84 |

732309 | 160.00 | 163.00 | 3.00 | 2.78 | 0.31 | 2.6 | 1.87 |

732311 | 163.00 | 166.00 | 3.00 | 2.15 | 0.38 | 3.5 | 1.60 |

732312 | 166.00 | 169.00 | 3.00 | 2.71 | 0.42 | 3.6 | 1.96 |

732313 | 169.00 | 172.00 | 3.00 | 2.06 | 0.37 | 4.0 | 1.54 |

732314 | 172.00 | 175.00 | 3.00 | 1.93 | 0.33 | 4.4 | 1.43 |

732315 | 175.00 | 178.00 | 3.00 | 1.36 | 0.16 | 2.8 | 0.94 |

732316 | 178.00 | 180.30 | 2.30 | 2.54 | 0.27 | 4.6 | 1.72 |

732317 | 180.30 | 182.25 | 1.95 | 1.54 | 0.21 | 2.9 | 1.09 |

732318 | 182.25 | 184.75 | 2.50 | 4.03 | 0.38 | 4.2 | 2.65 |

732319 | 184.75 | 187.00 | 2.25 | 0.90 | 0.19 | 1.8 | 0.70 |

732320 | 187.00 | 190.00 | 3.00 | 0.90 | 0.19 | 1.4 | 0.70 |

732321 | 190.00 | 192.25 | 2.25 | 3.05 | 0.32 | 1.9 | 2.02 |

732322 | 192.25 | 194.50 | 2.25 | 2.99 | 0.31 | 2.5 | 1.99 |

See Table 1 for Notes.

Hole JP24074

Sample | From (m) | To | Int.1,2,3 (m) | Au (g/t) | Cu (%) | Ag (g/t) | CuEQ4 (%) |

|---|---|---|---|---|---|---|---|

731140 | 111.00 | 114.00 | 3.00 | 1.00 | 0.65 | 8.1 | 1.26 |

731141 | 114.00 | 117.00 | 3.00 | 1.26 | 0.55 | 8.0 | 1.30 |

731142 | 117.00 | 120.00 | 3.00 | 0.64 | 0.27 | 4.1 | 0.65 |

731143 | 120.00 | 123.00 | 3.00 | 1.48 | 0.49 | 8.1 | 1.36 |

731144 | 123.00 | 126.00 | 3.00 | 1.47 | 0.48 | 6.6 | 1.34 |

731145 | 126.00 | 129.00 | 3.00 | 1.01 | 0.40 | 4.9 | 1.00 |

731146 | 129.00 | 132.00 | 3.00 | 1.59 | 0.59 | 6.3 | 1.51 |

731147 | 132.00 | 135.00 | 3.00 | 2.02 | 0.62 | 6.6 | 1.79 |

731148 | 135.00 | 138.00 | 3.00 | 1.48 | 0.53 | 5.2 | 1.39 |

731149 | 138.00 | 141.00 | 3.00 | 4.01 | 0.84 | 10.5 | 3.14 |

731151 | 141.00 | 144.00 | 3.00 | 4.94 | 1.16 | 14.2 | 4.00 |

731152 | 144.00 | 147.00 | 3.00 | 4.32 | 0.99 | 8.8 | 3.45 |

731153 | 147.00 | 150.00 | 3.00 | 3.02 | 0.78 | 6.8 | 2.50 |

731154 | 150.00 | 153.00 | 3.00 | 3.63 | 1.31 | 11.3 | 3.40 |

731155 | 153.00 | 156.00 | 3.00 | 5.35 | 1.18 | 9.6 | 4.22 |

731156 | 156.00 | 159.00 | 3.00 | 3.33 | 0.98 | 8.0 | 2.89 |

731157 | 159.00 | 162.00 | 3.00 | 5.25 | 1.05 | 9.8 | 4.03 |

731158 | 162.00 | 165.00 | 3.00 | 3.49 | 0.90 | 10.3 | 2.91 |

731159 | 165.00 | 168.00 | 3.00 | 2.47 | 1.14 | 13.8 | 2.60 |

731160 | 168.00 | 171.00 | 3.00 | 5.86 | 1.36 | 10.3 | 4.68 |

731161 | 171.00 | 174.00 | 3.00 | 4.78 | 0.88 | 9.6 | 3.61 |

731162 | 174.00 | 177.00 | 3.00 | 7.73 | 1.28 | 11.1 | 5.65 |

731163 | 177.00 | 180.00 | 3.00 | 8.00 | 1.34 | 11.2 | 5.86 |

731164 | 180.00 | 183.00 | 3.00 | 6.33 | 0.93 | 8.6 | 4.51 |

731165 | 183.00 | 186.00 | 3.00 | 3.52 | 0.75 | 7.2 | 2.75 |

731166 | 186.00 | 189.00 | 3.00 | 3.25 | 0.66 | 7.5 | 2.52 |

731167 | 189.00 | 192.00 | 3.00 | 2.39 | 0.69 | 7.9 | 2.08 |

731168 | 192.00 | 195.00 | 3.00 | 3.84 | 0.57 | 4.6 | 2.74 |

731169 | 195.00 | 198.00 | 3.00 | 2.07 | 0.64 | 6.4 | 1.83 |

731171 | 198.00 | 201.00 | 3.00 | 1.09 | 0.97 | 11.4 | 1.65 |

731172 | 201.00 | 201.70 | 0.70 | 2.05 | 0.65 | 8.0 | 1.84 |

731173 | 201.70 | 202.90 | 1.20 | 0.06 | 0.03 | 0.6 | 0.06 |

731174 | 202.90 | 204.00 | 1.10 | 2.74 | 0.75 | 8.9 | 2.33 |

731175 | 204.00 | 207.00 | 3.00 | 1.62 | 1.14 | 12.9 | 2.12 |

731176 | 207.00 | 210.00 | 3.00 | 1.84 | 0.89 | 15.1 | 2.01 |

731177 | 210.00 | 213.00 | 3.00 | 2.41 | 0.90 | 15.4 | 2.34 |

731178 | 213.00 | 216.00 | 3.00 | 2.06 | 0.61 | 10.0 | 1.82 |

731179 | 216.00 | 219.00 | 3.00 | 1.10 | 0.51 | 8.3 | 1.17 |

731180 | 219.00 | 222.00 | 3.00 | 0.58 | 0.32 | 6.6 | 0.69 |

731181 | 222.00 | 225.00 | 3.00 | 0.78 | 0.36 | 6.0 | 0.84 |

See Table 1 for Notes.

Table 3: AuRORA Drill Hole Information Section N7800

Drill Hole | Easting | Northing | Elevation | Azim (°) | Dip (°) | EOH (m) |

JP24057 | 622779 | 6347801 | 1368 | 90 | -70 | 586 |

JP24059 | 622776 | 6347801 | 1369 | 270 | -60 | 427.4 |

JP24071 | 622770 | 6347796 | 1370 | 180 | -60 | 374 |

JP24074 | 622920 | 6347799 | 1385 | 90 | -70 | 315 |

JP24076 | 622655 | 6347819 | 1369 | 270 | -60 | 258 |

JP24079 | 623060 | 6347815 | 1422 | 88 | -60 | 503 |

JP24082 | 623059 | 6347815 | 1422 | 0 | -90 | 311 |

Note: Collar locations are in UTM NAD83, Zone 9N coordinates.

Figure 2: AuRORA Deposit Discovery: Located in the New Underexplored NWG Target

Figure 3: AuRORA Deposit Discovery: Hosted Within the Exciting New NWG Target Area

IP-Chargeability Anomaly Never Previously Drilled

Figure 4: AuRORA Deposit Discovery Never Previously Drilled and Open to Expansion

Figure 5: AuRORA Deposit Discovery: Drilling Outlines Open-Ended, Near Surface, Continuous,

High Grade Cu-Au-Ag Mineralization (Section 7800N)

AHR:CA

The Conversation (0)

11 February

Is Now a Good Time to Invest in Copper? Experts Tout Bullish Fundamentals

Copper prices surged to an all-time high in January after a tumultuous 2025. Although there was some panic buying in the sector at a couple of points last year, prices began to trade on market fundamentals in the third and fourth quarters, driven by significant supply disruptions.At this year's... Keep Reading...

10 February

Nine Mile Metals Intersects 44 Meters of Copper Mineralization and Provides Drill Program Update

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to provide the details of drill hole WD-25-05 in addition to a summary of the 2025 drill program completed in December at the Wedge Project.Drillhole WD-25-05:DDH WD-25-05 collared... Keep Reading...

09 February

Rio Tinto and Glencore Walk Away from Mega-Merger, but Mining M&A Marches On

The collapse of merger talks between Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) and Glencore (LSE:GLEN,OTCPL:GLCNF) has ended what would have been the mining industry’s largest-ever deal.The two companies confirmed last week that discussions over a potential US$260 billion combination have been... Keep Reading...

06 February

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data shows that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00