November 11, 2024

- Metals Australia exploring the Warrego East Copper-Gold project as London-listed Pan African Resources acquires holder of adjacent tenement in an $82M deal

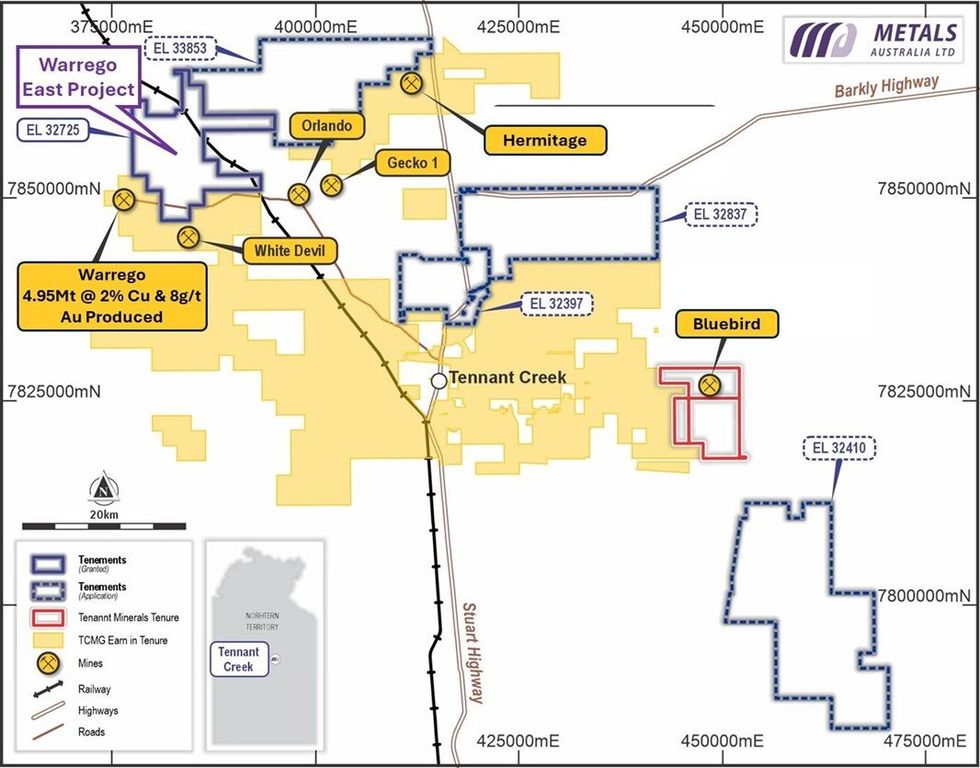

Metals Australia Ltd (ASX: MLS) (“the Company”) is pleased to announce that its Mine Management Plan for the upcoming field exploration program at the Warrego East copper-gold project in the Tennant Creek Mineral Field has been authorised by the Northern Territory Government (Refer to Figure 1 and 2). Weather permitting, the field exploration program will be scheduled as soon as a land holder access agreement is finalised.

- The $82M takeover of Tennant Creek Mining Group Pty Ltd (TCMG) by London-listed Pan African Resources PLC (AIM: PAF) has reignited interest in the underexplored Tennant Creek Mineral Field (TCMF)1

- The corporate activity comes as Metal Australia finalises plans for a substantial exploration program at its Warrego East copper-gold project2 after the Northern Territory Government authorised the Company’s Mine Management Plan. Warrego East is adjacent to, and immediately east of, the high- grade Warrego mine and Mineral Resource held by TCMG and its Joint Venture partner, Emmerson Resources (ASX: ERM)3

- The program will test a series of priority gravity and magnetics defined ironstone hosted copper- gold targets within a corridor which links the Warrego mine with the Gecko and Orlando copper- gold deposits4,5. The Warrego mine historically produced 4.95Mt @ 2.0% Cu and 8g/t Au6

- Weather permitting, the field exploration program will commence as soon as land holder access agreements are finalised.

Metals Australia CEO Paul Ferguson commented:

“We welcome the clear show of confidence Pan African Resources has demonstrated in the Tennant Creek Mineral Field via its $82 million takeover of TCMG, which is Emmerson Resources’ JV partner in the tenements hosting the Warrego copper-gold mine and various mineral resources. This comes as Metals Australia finalises plans for a substantial field exploration program at its Warrego East copper-gold project, located immediately adjacent to and east of those JV tenements.

The takeover of TCMG by Pan African Resources demonstrates the potential now being seen by bigger overseas players in the Tennant Creek Mineral Field. With a market cap of more than $1 billion, South African- based Pan African Resources has recognised the potential of this underexplored region to host significant mineral resources where less than 10% of drilling has extended beyond 150m in depth and where almost all significant deposits to date have been discovered under shallow cover.

The Warrego mine was identified undercover as a magnetic anomaly during an airborne survey conducted in 1956. Similar magnetic anomalies occur within a corridor through our Warrego East lease, with the Gekko and Orlando deposits discovered further to the east, within the same corridor.

Warrego went on to produce consistently between the early 1970s up until 1989 – averaging around 2% copper and 8gpt of gold during its production life.

We are working diligently to finalise the remaining requirements for our upcoming exploration program at Warrego East.

The planned program is a further illustration of Metals Australia’s status as one of the most active exploration companies, with field exploration programs recently completed at three projects and two more in the pipeline as we seek to unlock the true value of our portfolio in known mining districts in Australia and Canada.”

Figure 1: Metals Australia’s Tenements, TCMG tenements (acquired by PAF), Warrego Production6 in the TCMF.

This comes as the prospectivity of the Tennant Creek Mineral Field is further underlined by the $82 million takeover of TCMG announced on 5 November. Metals Australia’s Warrego East project is adjacent to, and immediately east of, the tenements hosting the Warrego mine and mineral resources held by TCMG and its JV partner Emmerson Resources.

The Tennant Creek Mineral Field has produced 25Mt @ 6.9 g/t gold (Au) & 2.8% copper (Cu)4, with historical production coming from deposits in outcropping areas – or undercover - such as the Warrego mine. Metals Australia’s tenements are located on Cu-Au trends in areas of shallow soil cover which have not been tested with modern exploration (see Figure 2 below). The tenements include EL32725 (granted) and EL32837, EL32937 and EL32410 (all under application), which were acquired by the Company as part of its 80% acquisition of Payne Gully Gold7 in 2022.

Click here for the full ASX Release

This article includes content from Metals Australia Ltd, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MLS:AU

Sign up to get your FREE

Metals Australia Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

02 July 2025

Metals Australia

High-quality graphite development project with an accelerated pathway to production, complemented by a diversified portfolio of critical, precious and base metals assets in tier-1 jurisdictions across Canada and Australia.

High-quality graphite development project with an accelerated pathway to production, complemented by a diversified portfolio of critical, precious and base metals assets in tier-1 jurisdictions across Canada and Australia. Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Metals Australia (MLS:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Graphite Project Links to Quebec's Critical Minerals Plan

Metals Australia (MLS:AU) has announced Graphite Project Links to Quebec's Critical Minerals PlanDownload the PDF here. Keep Reading...

18 December 2025

High Copper Anomalies Show Deeper Potential at Warrego East

Metals Australia (MLS:AU) has announced High Copper Anomalies Show Deeper Potential at Warrego EastDownload the PDF here. Keep Reading...

16 December 2025

Titanium-Vanadium-Magnetite Discovery Extended over 1km

Metals Australia (MLS:AU) has announced Titanium-Vanadium-Magnetite Discovery Extended over 1kmDownload the PDF here. Keep Reading...

05 November 2025

Drilling the Manindi Vanadium-Titanium-Magnetite Discovery

Metals Australia (MLS:AU) has announced Drilling the Manindi Vanadium-Titanium-Magnetite DiscoveryDownload the PDF here. Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Sign up to get your FREE

Metals Australia Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00