- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

June 25, 2024

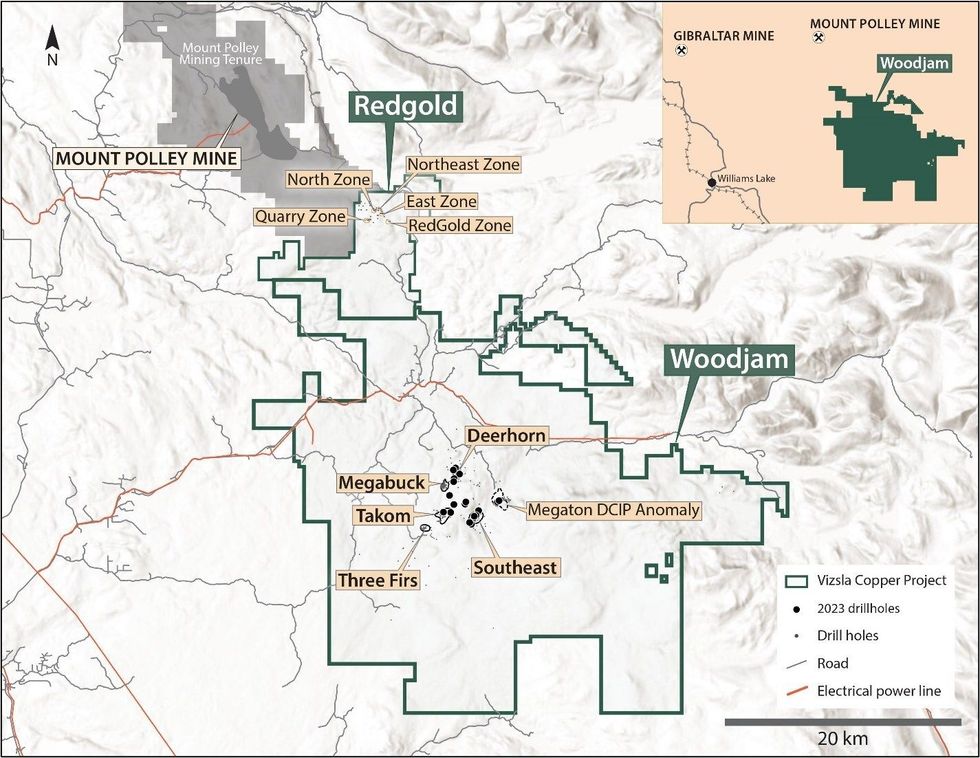

Vizsla Copper Corp. (TSXV: VCU) (OTCQB: VCUFF) (FRANKFURT: 97E0) ("Vizsla Copper" or the "Company") is pleased to announce the start of the summer core drilling program at the Woodjam copper-gold project (the "Woodjam Project" or "Woodjam") in south-central BC (Figure 1).

HIGHLIGHTS- The Targets: Core drilling will evaluate the potential for: (1) extensions of high-grade gold mineralization at the Deerhorn deposit, (2) extensions of gold-rich copper mineralization at the Three Firs zone, and (3) extensions of higher gold mineralization at the Southeast deposit.

- The Program: Approximately 3,600m of core drilling in 9 drill holes is planned, some of which will be on the contiguous Redgold property.

"With our financing freshly closed, I'm excited about the start of drilling at Woodjam," commented Craig Parry, Executive Chairman. "Strong copper prices are expected to continue over the long term and Vizsla Copper is executing on its strategy of acquiring undervalued copper assets and completing selective, high-impact exploration programs on our best targets."

"Well mineralized and highly prospective for exploration success, Woodjam remains our highest priority project," commented Steve Blower, Vice President of Exploration. "I'm looking forward to evaluating all of the target areas, especially Three Firs, as this is our first opportunity to expand the wide-open mineralization there."

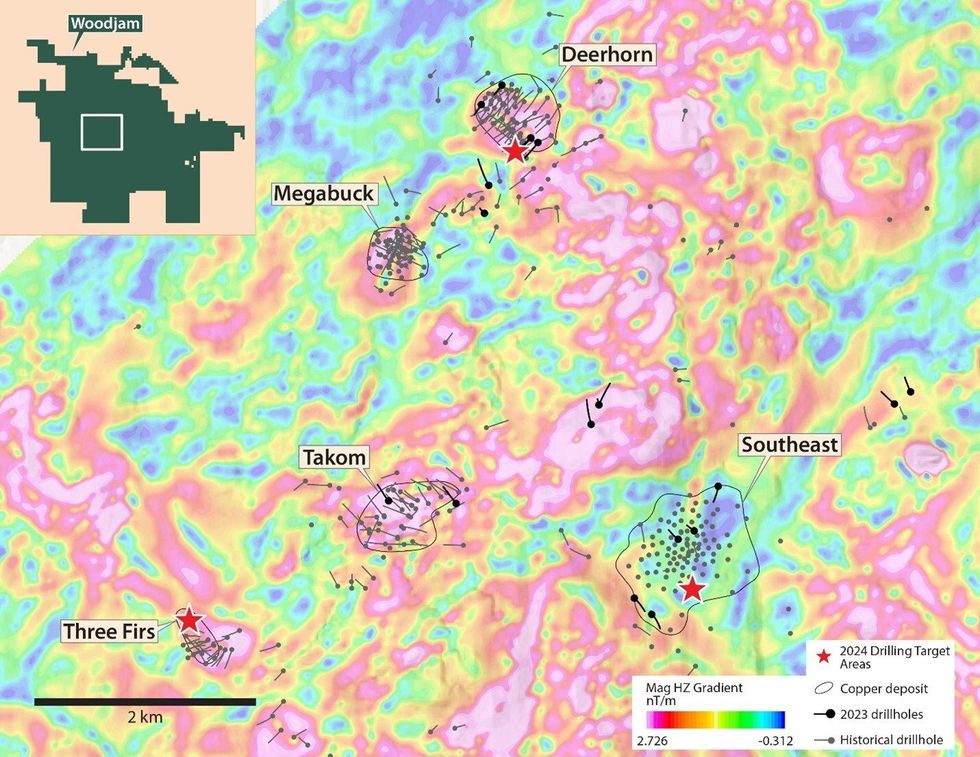

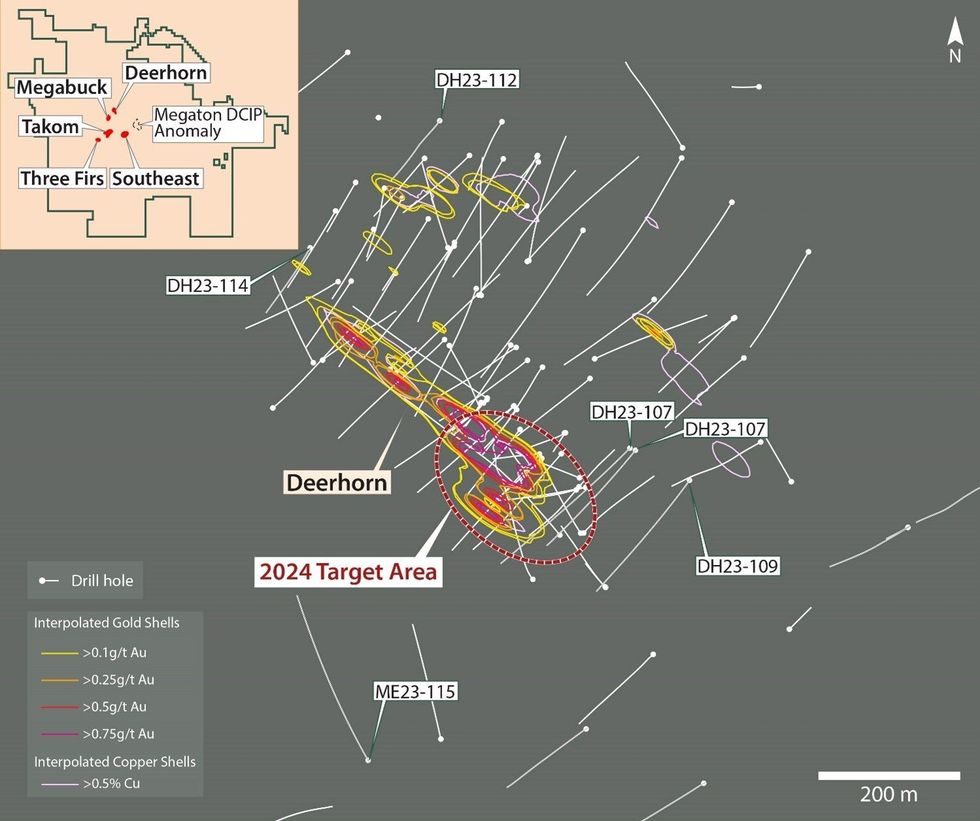

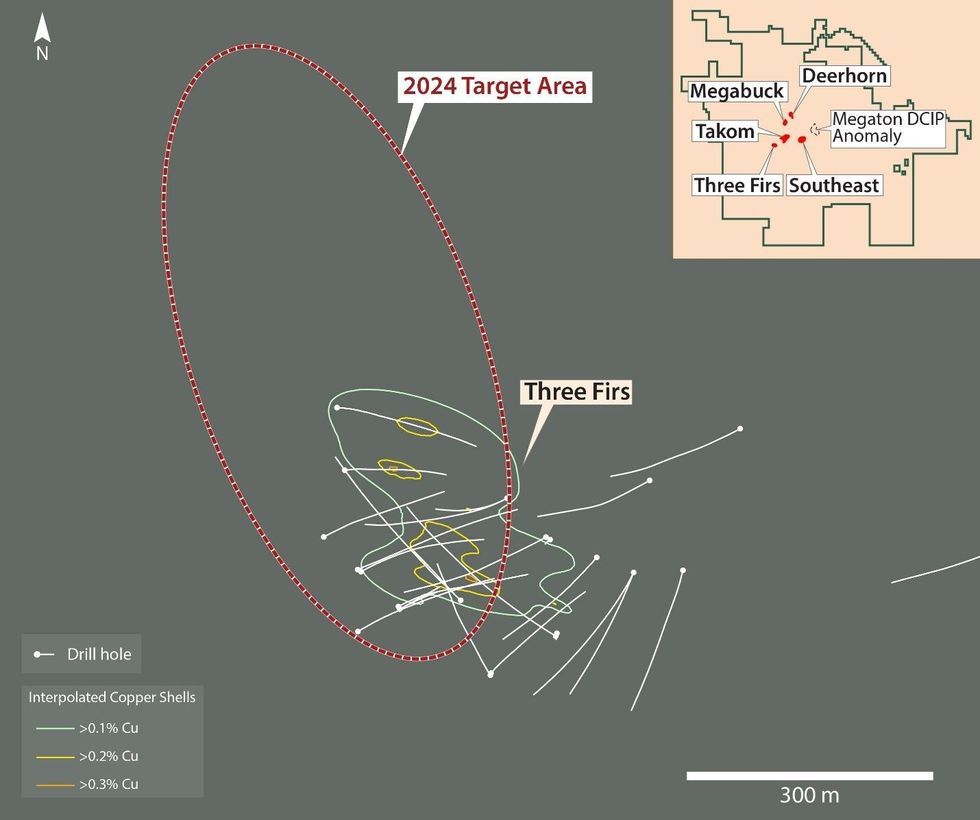

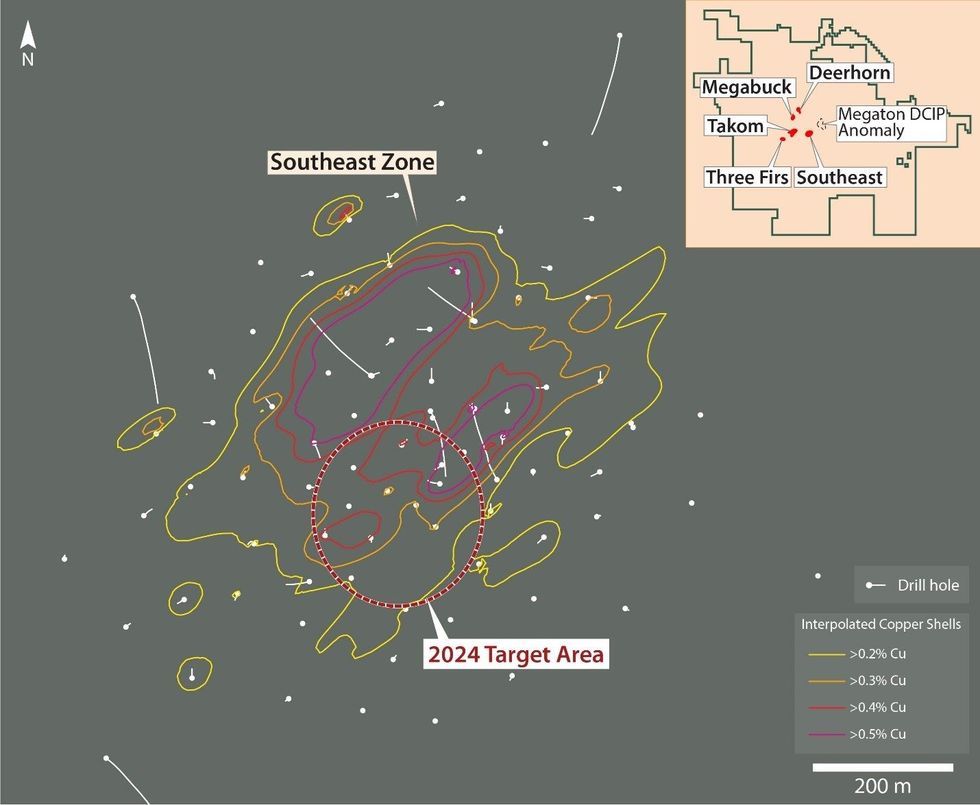

The ProgramHigh priority targets will be evaluated in 3 areas – the Deerhorn deposit, the Three Firs zone and the Southeast deposit (Figure 2). At the Deerhorn copper-gold deposit, at least two drill holes will evaluate the potential to expand the higher-grade southern gold-rich portion of the deposit (Figure 3). At the copper-gold Three Firs zone, one drill hole will evaluate potential extensions to the southwest of the zone and another will evaluate a large circular magnetic anomaly northwest of the zone (Figure 4). Finally, drilling at the large Southeast copper deposit will attempt to expand the area of higher-grade gold mineralization along the south end of the deposit (Figure 5).

Approximately 3,600m of drilling is planned in 9 drill holes – some of which will be completed on the contiguous Redgold property. More information on the Redgold portion of the drilling program will follow as targets are finalized. The program will take approximately 6 to 8 weeks to complete. Samples will be submitted for assay regularly through the program, and analytical results will be disclosed in due course.

About Vizsla Copper

Vizsla Copper is a Cu-Au-Mo focused mineral exploration and development company headquartered in Vancouver, Canada. The Company is primarily focused on its flagship Woodjam project, located within the prolific Quesnel Terrane, 55 kilometers east of the community of Williams Lake, British Columbia. It has three additional copper properties: Poplar, Copperview, and Redgold, all well situated amongst significant infrastructure in British Columbia. The Company's growth strategy is focused on the exploration and development of its copper properties within its portfolio in addition to value accretive acquisitions. Vizsla Copper's vision is to be a responsible copper explorer and developer in the stable mining jurisdiction of British Columbia, Canada and it is committed to socially responsible exploration and development, working safely, ethically and with integrity.

Vizsla Copper is a spin-out of Vizsla Silver (TSX.V: VZLA) (NYSE: VZLA) and is backed by Inventa Capital Corp., a premier investment group founded in 2017 with the goal of discovering and funding opportunities in the resource sector. Additional information about the Company is available on SEDAR+ (www.sedarplus.ca) and the Company's website (www.vizslacopper.com).

Qualified Person

The Company's disclosure of technical or scientific information in this press release has been reviewed and approved by Ian Borg, P.Geo., Senior Geologist for Vizsla Copper. Mr. Borg is a Qualified Person as defined under the terms of National Instrument 43-101.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FORWARD LOOKING STATEMENTS

The information contained herein contains "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation. "Forward-looking information" includes, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future, including, without limitation, planned exploration activities. Generally, but not always, forward-looking information and statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connotation thereof. Forward-looking statements in this news release include, among others, statements relating to: obtaining required regulator approvals for the Copperview Acquisition and the RG Copper Acquisition; satisfying the requirements of the Underlying Option Agreement; the exploration and development of the Woodjam Project, Redgold Project and Copperview Project; and the Company's growth and business strategies.

Such forward-looking information and statements are based on numerous assumptions, including among others, that the results of planned exploration activities are as anticipated, the anticipated cost of planned exploration activities, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms, that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Company's planned exploration activities will be available on reasonable terms and in a timely manner. Although the assumptions made by the Company in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual events or results in future periods to differ materially from any projections of future events or results expressed or implied by such forward-looking information or statements, including, among others: negative operating cash flow and dependence on third party financing, uncertainty of additional financing, no known mineral reserves or resources, the limited operating history of the Company, the influence of a large shareholder, aboriginal title and consultation issues, reliance on key management and other personnel, actual results of exploration activities being different than anticipated, changes in exploration programs based upon results, availability of third party contractors, availability of equipment and supplies, failure of equipment to operate as anticipated; accidents, effects of weather and other natural phenomena and other risks associated with the mineral exploration industry, environmental risks, changes in laws and regulations, community relations and delays in obtaining governmental or other approvals.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.

Click here to connect with Vizsla Copper Corp. (TSXV: VCU) (OTCQB: VCUFF) (FRANKFURT: 97E0), to receive an Investor Presentation

VCU:CA

The Conversation (0)

15 January 2024

Vizsla Copper

Exploring District-scale Copper Opportunities in British Columbia

Exploring District-scale Copper Opportunities in British Columbia Keep Reading...

24 January 2023

VIZSLA COPPER ACQUIRES ADDITIONAL CLAIMS AT THE WOODJAM COPPER PROJECT

Vizsla Copper Corp. (TSXV: VCU) (OTQB: VCUFF) (" Vizsla Copper " or the " Company ") is pleased to report the acquisition of additional claims at the Woodjam Copper Project (" Woodjam " or the " Project "). Woodjam is prospective for copper and copper-gold porphyry style mineralization and is... Keep Reading...

5h

Rio Tinto and Glencore Walk Away from Mega-Merger, but Mining M&A Marches On

The collapse of merger talks between Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) and Glencore (LSE:GLEN,OTCPL:GLCNF) has ended what would have been the mining industry’s largest-ever deal.The two companies confirmed last week that discussions over a potential US$260 billion combination have been... Keep Reading...

06 February

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data shows that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00