October 29, 2024

Pursuit Minerals Ltd (ASX: PUR) (“PUR”, “Pursuit” or the “Company”) is pleased to provide the following update on its maiden Stage 1 Drilling Program with the first results and assay samples from Drill Hole 2 (“DDH- 2”) on the Sal Rio 02 tenement.

HIGHLIGHTS

- Drillhole 2 (DDH-2) at the Sal Rio 02 tenement of the Rio Grande Sur Project, has been completed with substantial high grade intercepts of lithium brine discovered at depths as low as 484m.

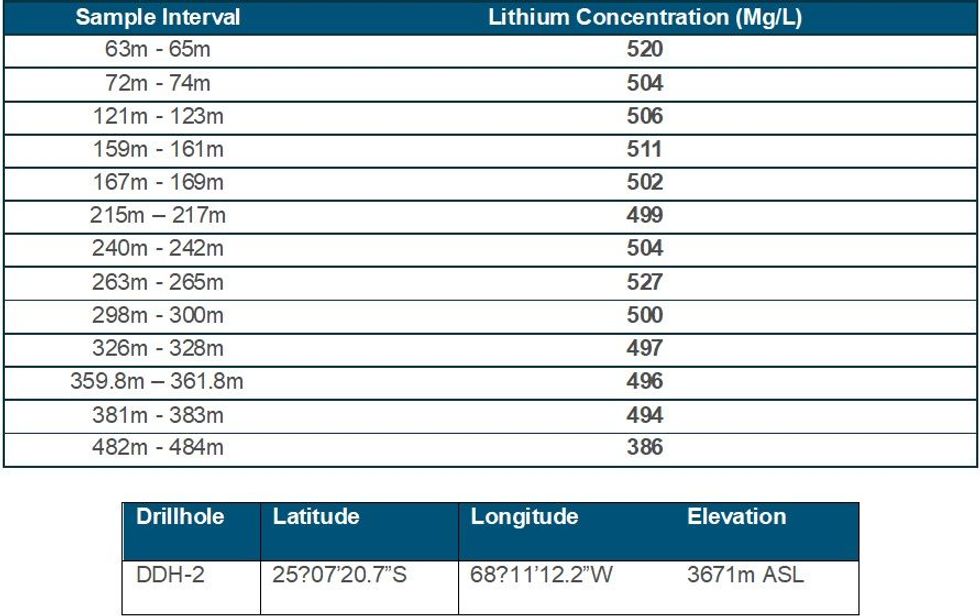

- High-grade assays include the following intervals:

- 527mg/L (“milligrams per liter of Lithium”) from an interval of 263m to 265m

- 520mg/L from an interval of 63m to 65m

- 511mg/L from an interval of 159m to 161m

- 506mg/L from an interval of 121m to 123m

- Importantly, some of these grades over 500mg/L were discovered at depth and are beneath the currently calculated mineral resource estimate and are expected to add to its size and grade.

- With completion of DDH-2 the drilling crew has demobilised from site. Demobilisation and suspension of drilling activities whilst interpretting the results from the first two holes has significantly reduced expenditure levels.

- The Stage 1 Drilling Program is targeting resource growth to the existing inferred JORC resource of 251.3kt LCE @ 351mg/L1.

- Following completion of DDH-2, Company’s focus is now on production of Lithium Carbonate from 250tpa Pilot Plant in Salta.

In relation to the completion of DDH-2 at the RGS Project, Pursuit Managing Director & CEO, Aaron Revelle, said:

“The results from DDH-2 continue to be significant as we demonstrate the world class potential of the Rio Grande Sur Lithium Project. With completion of DDH-2, we are seeing consistent increases in Lithium grades to depths both through and below the current mineral resource estimate with the results confirming the potential large scale of the project which the Company anticipates will support a significant low cost, high-grade long-term Lithium carbonate operation. With outstanding high grade brine intercepts of ~500mg/L at depths of ~60m and those grades continuing to ~380m, the project is continuing to exceed our expectations.

“We continue to progress with permitting at our highly prospective Mito tenement in the north of the Rio Grande Salar which will be the location of DDH-3, with the planned location of the hole less than 2km from a neighbouring companies drill hole which achieved 900mg/l Li intercepts being some of the highest grades achieved in Argentina. The decision to drill DDH-3 will be made in 2025, following completion of the permitting process as well as the interpretation of the first 2 drill holes into the resource model which is expected to yield a significant scale where future exploration expenditure may only be warranted in more favourable market conditions.

“In the immediate term we continue works at our Lithium Carbonate Pilot Plant which remains on track to produce our first Lithium Carbonate in the coming months, with Pursuit advancing off-take discussions with multiple requests for product samples from potential off-take partners.”

High-Grade, Deep Depth Lithium Brine Assay Results

Drillhole 2 (DDH-2) of the Stage 1 drilling program was completed on site at the Rio Grande Sur Project in October 2024 having reached a depth of 500m.

Throughout the progress of Drillhole 2, the on-site geologists and drilling team were extremely encouraged by the geological units encountered across the depths of the hole. Of particular interest were 2 sections, the first between 122 and 186 meters, where a sequence of porous sandstone, occasionally interbedded with anhydrite returned lithium grades up to 511 mg/L. A second significant interval was encountered between 240-300m formed by sandstone alternating with gravel, associated with grades up to 527 gm/L of lithium. Both sections returned highly positive results for RBRC (Relative Brine Release Capacity) and Specific Yield, important factors when taking into account locations of pumping well locations for production.

Intercepts from DDH-2 have shown highly favourable geology in line with, and exceeding expectations from historical drilling (to depths of 50m) carried out on the Rio Grande Salar. Lithium brine sample grades from the sampling of the hole are averaging above 500mg/L Li against the average grade of 351mg/L Li used to develop the current Mineral Resource Estimate (“MRE”). Additionally, the mineralisation extended to a depth of ~480m also well below the depth used to develop the MRE1.

Click here for the full ASX Release

This article includes content from Pursuit Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PUR:AU

The Conversation (0)

02 May 2024

Pursuit Minerals

Tier 1 lithium play in the prolific Lithium Triangle in Argentina

Tier 1 lithium play in the prolific Lithium Triangle in Argentina Keep Reading...

07 April 2025

First Production of Lithium Carbonate

Pursuit Minerals (PUR:AU) has announced First Production of Lithium CarbonateDownload the PDF here. Keep Reading...

30 March 2025

Completion of Capital Raise

Pursuit Minerals (PUR:AU) has announced Completion of Capital RaiseDownload the PDF here. Keep Reading...

24 March 2025

$1.1 Million Placement

Pursuit Minerals (PUR:AU) has announced $1.1 Million PlacementDownload the PDF here. Keep Reading...

19 March 2025

Trading Halt

Pursuit Minerals (PUR:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

06 March 2025

Lithium Carbonate Pilot Production Commences

Pursuit Minerals (PUR:AU) has announced Lithium Carbonate Pilot Production CommencesDownload the PDF here. Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00