July 27, 2022

Auroch Minerals Limited (ASX:AOU) (Auroch or the Company) is pleased to provide the following report on its activities during the June 2022 Quarter. The Company’s primary focus during the reporting period was the strategic acquisition of the Nevada Lithium Project (NLP) in the United States (USA) and continuing exploration activities at the Nepean Nickel Project (Nepean), Saints Nickel Project (Saints) and the Leinster Nickel Project (Leinster).

HIGHLIGHTS

NEVADA LITHIUM PROJECT, USA

- Strategic acquisition of 80% interest in the Nevada Lithium Project in the USA

- The project consists of four prospect areas comprising 65km2 covering the same geology that is known to host other major lithium deposits

SAINTS NICKEL PROJECT, WA

Assay results received from all infill and extensional diamond holes drilled into and around the modelled mineralised domains of the St Patricks and St Andrews channels, significant intercepts include:

- SNDD021: 3.01m @ 5.23% Ni, 0.69% Cu, 0.77g/t PGE from 177.08m;

- SNDD023: 2.40m @ 2.10% Ni, 0.14% Cu, 0.09% Co, 0.36g/t PGE from 263.78m and 2.21m @ 4.30% Ni, 0.37% Cu, 0.13% Co, 0.58g/t PGE from 268.18m;

- SNDD016: 1.00m @ 5.16% Ni, 0.06% Cu, 0.09% Co, 0.56g/t PGE from 73.10m;

- SNDD020: 1.62m @ 3.92% Ni, 0.42% Cu, 0.11% Co, 0.70g/t PGE from 217.35m1

- First pass metallurgical testwork produced very good concentrate grades over 14% with initial concentrate grades up to 24% Ni and 5% Cu1

NEPEAN NICKEL PROJECT, WA

- Re-assaying of pegmatite intersections from reverse circulation (RC) holes in northern Nepean further confirmed the presence of lithium mineralisation, with results including:

- 1m @ 0.88% Li2O from 78m within broader mineralised zone of 4m @ 0.35% Li2O from 78m

- Preliminary metallurgical testwork successfully completed on the shallow high- grade nickel sulphide mineralisation, which responds well to conventional floatation beneficiation with nickel recoveries between 85% to 97% to produce a saleable concentrate grade of >13%Ni

LEINSTER NICKEL PROJECT, WA

- Two-hole diamond drill programme completed, testing prospective geological positions and an off-hole down-hole electromagnetic (DHEM) conduction at the Woodwind and Brass Prospects for potential nickel sulphide mineralisation

CORPORATE

- Cash balance as at 30 June 2022 of $4.5 million- The in-house Chief Financial Officer role was made redundant, with all financial control requirements now outsourced to the Grange Consulting Group.

1Announced subsequent to the reporting period on 7 July 2022 – Saints Nickel Project Update

SEPTEMBER QUARTER PLANNED ACTIVITY

The upcoming work programmes and results for Auroch include the following:

- Updated Mineral Resources Estimate (MRE) for the Saints Nickel Project;

- Completion of preliminary metallurgical work for the Saints Nickel Project;

- Finalise Scoping Study for the Saints Nickel Project;

- Updated MRE for the shallow mineralisation at the Nepean Nickel Project;

- Preparation for maiden drill programme at the Nevada Lithium Project, including site visit and work permit applications;

- Mapping and surface sampling of diapiritic breccia zones across the Arden Project, and re-assaying for rare earth elements (REEs).

COMPANY PROJECTS – NEVADA, USA

Nevada Lithium ProjectDuring the reporting period, the Company successfully completed the strategic acquisition of an 80% interest in the Nevada Lithium Project in the USA, from Nevada Lithium Pty Ltd (Nevada Australia), the 100% shareholder of Nevada Li Corp (Nevada US), which has the rights to the Nevada Lithium Project (NLP).2

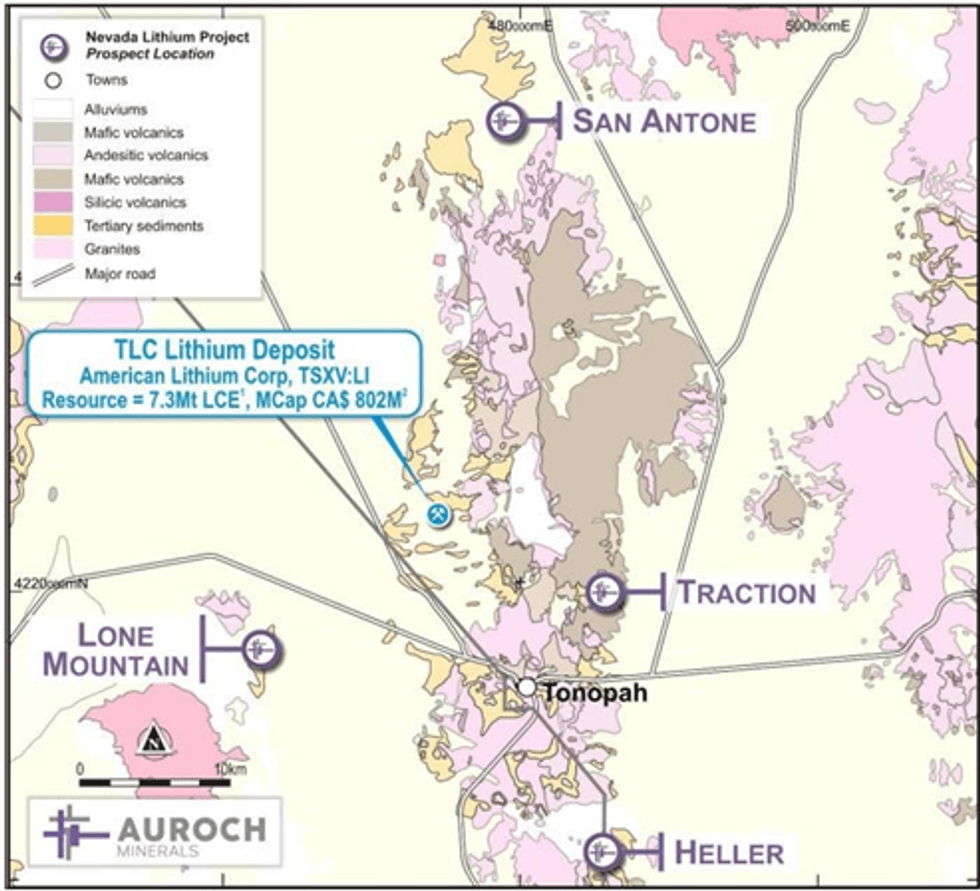

The NLP consists of four prospect areas – Traction, San Antone, Heller and Lone Mountain, comprising ~65 km2 of ground that is considered highly prospective for large sedimentary-hosted lithium deposits (Figure 1).

Figure 1 - Location of the Nevada Lithium Project (NLP) in relation to known large lithium deposits and regional geology (SGMC 1:350k, US Geological Survey Aug 2017)

2Refer to 8 June 2022 ASX Announcement - AUROCH COMPLETES ACQUISITION OF THE NEVADA LITHIUM PROJECT

The NLP is located close to the silver mining town of Tonopah in the mining-friendly counties of Nye and Esmeralda in the State of Nevada. The region is home to multiple large sedimentary-hosted lithium deposits including Ioneer Resources’ (ASX:INR) Rhyolite Ridge and American Lithium Corporation’s (TSX.V: LI) (US OTC: LIACF) (Frankfurt: 5LA1) TLC Lithium Project (Figure 1). Albemarle Corporation’s (NYSE:ALB) Silver Peak Lithium Mine is currently the only producing lithium mine in North America, and is approximately 45 km to the west of the NLP.

Click here for the full ASX Release

This article includes content from Auroch Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AOU:AU

The Conversation (0)

23 September 2021

Auroch Minerals

Exploring High-Grade Nickel Sulfides in Western Australia

Exploring High-Grade Nickel Sulfides in Western Australia Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00