May 16, 2023

Queensland Pacific Metals Ltd (“QPM”) and Incitec Pivot Ltd (“IPL”) have finalised commercial agreements (“Agreements”) to support the completion of the Moranbah Project acquisition (“Transaction”) and to fast track gas production growth.

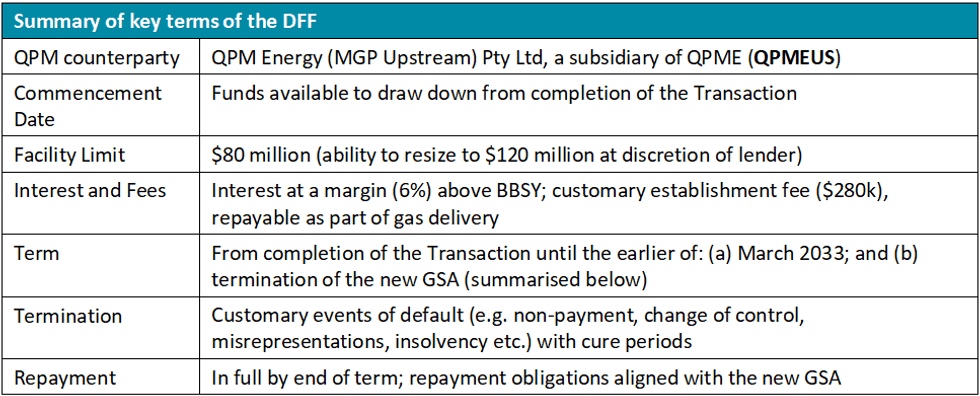

- Dyno Nobel, a wholly owned subsidiary of IPL, will provide an initial development funding facility of up to $80m, with an ability to increase this to $120m, if required. This facility will be used to accelerate development of the Moranbah Project by funding the capital costs of new infill production wells.

- QPM Energy (“QPME”) and Dyno Nobel have entered into a new Gas Supply Agreement (“GSA”), commencing in April 2026 upon the expiry of the existing GSA.

- IPL to provide Corporate Guarantees to cover fixed charge obligations under key Moranbah Project agreements.

- Completion of the Agreements is subject to a number of customary conditions for a transaction of this nature.

As foreshadowed in its announcement of 5 April 2023, Queensland Pacific Metals Limited (ASX:QPM) has now finalised negotiations with IPL regarding a package of financing support in connection with the Moranbah Project and entry into a new long term gas supply agreement, details of which are set out below.

Background

IPL’s wholly owned subsidiary Dyno Nobel, owns the Dyno Nobel Ammonium Nitrate plant located in Moranbah. Dyno Nobel currently purchases 7PJ gas per annum from the Project, under an existing gas supply agreement (GSA) expiring in March 2026. This GSA will be novated to QPME on completion of the Transaction.

Long term gas supply from the Project is a critical element of both QPM’s TECH Project and Dyno Nobel’s Moranbah operations. The two parties have now formalised strategic arrangements that secure this economical and long term gas supply following the execution of several commercial agreements:

- A Development Funding Facility under which Dyno Nobel will provide funding to QPME for the drilling of new infill wells to underpin and expand gas production from the Project;

- A new GSA between QPME and Dyno Nobel; and

- A Corporate Guarantee under which IPL will issue guarantees to enable consent for the novation of key commercial contracts for the Moranbah Project to QPME;

Development Funding Facility (“DFF”)

Current gas production at the Moranbah Project is approximately 10PJ per annum. Following completion of the Transaction, QPM is targeting an increase in gas production to 12-13PJ per annum within six months. This would allow higher quantities of gas to be sent to Townsville Power Station (“TPS”), resulting in increased revenue from electricity generation.

In order to fund the capital costs associated with increasing gas production, Dyno Nobel will provide a facility with an initial aggregate limit of $80m with an ability to increase this to $120m, if required. This facility will be repaid by the delivery of gas over the term of the new GSA (summarised below)

The DFF will fund the drilling of 16 new wells over a 2 year period. QPME intends to commence development works as soon as possible following completion of the Transaction.

Click here for the full ASX Release

This article includes content from Queensland Pacific Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

QPM:AU

Sign up to get your FREE

Queensland Pacific Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

20 April 2022

Queensland Pacific Metals

Developing a Sustainable and High-Purity Battery Materials Refinery Project

Developing a Sustainable and High-Purity Battery Materials Refinery Project Keep Reading...

Keep reading...Show less

25 February

Oregon: America’s Premier Domestic Nickel Opportunity

The global race for critical minerals has begun. As the US stares down a future of massive industrial shifts, the strategy is clear: secure the supply chain or get left behind. Demand for nickel is hitting overdrive, fueled by its role in electric vehicle (EV) batteries, high-strength stainless... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

23 February

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Latest News

Sign up to get your FREE

Queensland Pacific Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00