February 26, 2024

Pilot Plant to unlock further value at Wiluna by testing potential ore from Lake Maitland, Lake Way and Centipede-Millipede Deposits

Toro Energy Limited (ASX: TOE) (‘the Company’ or ‘Toro’) is pleased to announce that the Company is advancing the design phase of its beneficiation and hydrometallurgical pilot plant in line with plans to begin its operation in the second half of 2024.

- Design phase for the pilot plant commissioned by Toro continues on-track.

- Pilot plant will test the improved beneficiation and hydrometallurgical circuit developed by Toro over recent years from bench scale research at a closer to production scale and as single streams.

- Pilot plant will test potential ore from the three uranium-vanadium deposits that Toro believes will make up an extended Lake Maitland operation – these include Lake Maitland, Lake Way and Centipede-Millipede.

- The pilot plant will be equipped to take at least 20 dry tonnes of potential ore through two campaigns of testing the beneficiation circuit and two campaigns of testing the hydrometallurgical circuit.

- Toro will proceed to planning the drilling required to collect the bulk ore (potential) samples ready for piloting early in the second half of 2024.

- Refresh and update of Lake Maitland Scoping Study (first completed in 2022) currently underway to evaluate financial outcomes using the latest more favourable commodity pricing and exchange rate guidance.

Management Commentary

Commenting on the update Toro’s Executive Chairman, Richard Homsany, said:

“As Toro continues to advance the Wiluna Uranium Project towards production, the potential value of the Project, amidst the backdrop of a strengthening global uranium market, keeps growing. The Wiluna Uranium Project is an asset of global significance. Toro remains committed to developing the asset so that it can be brought into production when government policy and uranium markets align. The pilot plant is an important step towards further demonstrating the potential scale and value of this asset, and developing it to production.”

The pilot plant will test the entirety of the successful bench scale research completed by Toro do date at a closer to production scale. The pilot plant will also test all of the components of the newly proposed processing circuit that were tested successfully on an individual basis, within a production flow stream for the first time.

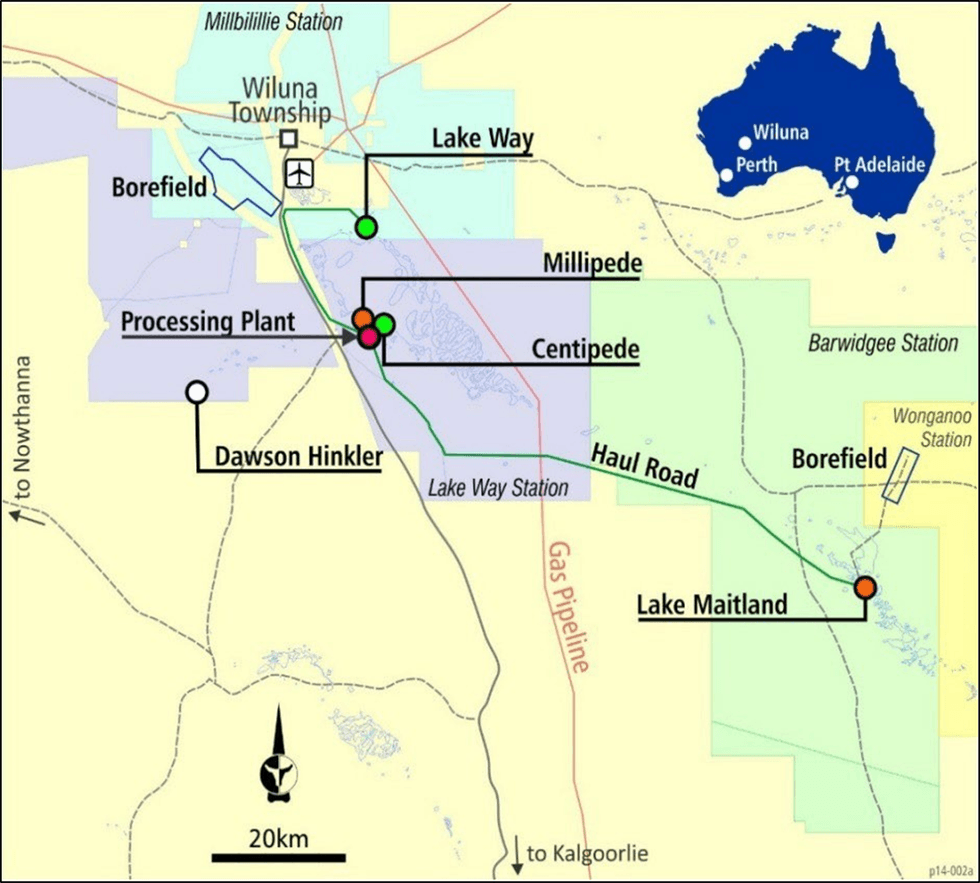

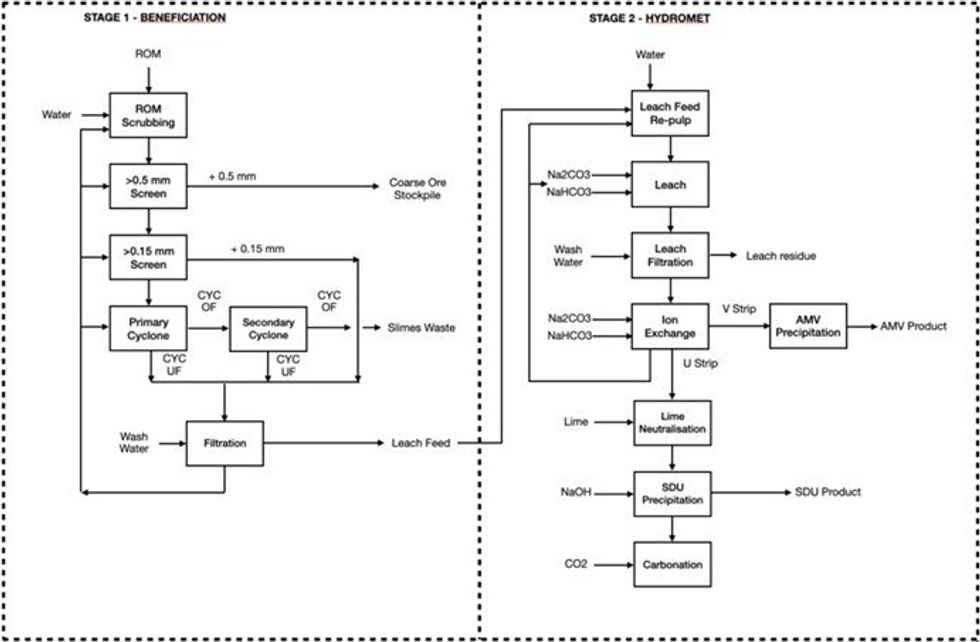

Importantly, the pilot plant will be designed to go beyond the Lake Maitland stand-alone operation and assume an extended mining operation to the Lake Way and Centipede-Millipede deposits (see Figure 1). So, in addition to potential bulk ore from Lake Maitland, the plant will be testing the new processing technique on potential bulk ore from Centipede-Millipede as well as Lake Way. The pilot plant will be equipped to take at least 20 dry tonnes of potential ore through two campaigns of testing, both on the proposed beneficiation circuit and the proposed hydrometallurgical circuit. The plant will be constructed, commissioned and operated at Strategic Metallurgy’s facility in Perth. A block flow diagram of the proposed pilot plant is presented in Figure 2.

Toro will proceed to plan the drilling required to collect the bulk ore (potential) samples ready for piloting early in the second half of 2024, after design and construction of the plant.

Wiluna Project Summary

Toro’s 100%-owned Wiluna Uranium Project is located near Wiluna on the Goldfields Highway, some 750km NE of Perth in Western Australia. The Wiluna Uranium Project consists of the Lake Maitland, Lake Way, and Centipede- Millipede deposits (see Figure 1).

Together, these deposits of the Wiluna Uranium Project contain some 52 Mt grading 548ppm U3O8 for 62.7 Mlbs of contained U3O8 at a 200ppm U3O8 cut-off (JORC 2012 – refer to ASX announcements of 15 October 2015, 1 February 2016, 21 October 2019 and 30 November 2021).

This is in addition to the vanadium resource of 96.3Mt grading 322ppm V2O5 for 68.3Mlbs of contained V2O5 at a 200ppm V2O5 cut-off as referred to above (JORC2012 – Inferred – refer to the Company’s ASX announcement of 21 October 2019).

This article includes content from Toro Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TOE:AU

The Conversation (0)

12 October 2025

IsoEnergy to Acquire Toro Energy

Toro Energy (TOE:AU) has announced IsoEnergy to Acquire Toro EnergyDownload the PDF here. Keep Reading...

12 October 2025

Joint Investor Presentation

Toro Energy (TOE:AU) has announced Joint Investor PresentationDownload the PDF here. Keep Reading...

31 July 2025

Quarterly Activities and Cashflow Report June 2025

Toro Energy (TOE:AU) has announced Quarterly Activities and Cashflow Report June 2025Download the PDF here. Keep Reading...

27 May 2025

Updated Scoping Study Results Lake Maitland Uranium Project

Toro Energy (TOE:AU) has announced Updated Scoping Study Results Lake Maitland Uranium ProjectDownload the PDF here. Keep Reading...

30 April 2025

Quarterly Activities and Cashflow Report March 2025

Toro Energy (TOE:AU) has announced Quarterly Activities and Cashflow Report March 2025Download the PDF here. Keep Reading...

04 March

Cameco Signs US$2.6 Billion Uranium Deal With India to Fuel Nuclear Expansion

Cameco (TSX:CCO,NYSE:CCJ) has secured a nine-year uranium supply agreement with India worth an estimated US$2.6 billion, accelerating its nuclear power expansion as it deepens critical mineral ties with the country.The Saskatoon-based uranium producer will supply nearly 22 million pounds of... Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00