July 29, 2024

Metals Australia Limited (“Metals Australia”, the “Company” or “MLS”) is pleased to report its activities for the Quarter ended 30 June 2024 (“Quarter”):

Corporate

- Tanya Newby commenced as Company CFO and Joint Company Secretary1 on 27 May 2024. Tanya is a highly experienced finance executive with a broad background in the resources sector. Consistent with the strategy set by the board, Tanya’s appointment reflects the increased commercial and financial demands on the Company as it rapidly advances the Company’s portfolio of high quality critical and precious minerals on their exploration and development pathways.

- The Company’s cash balance at the end of the Quarter was $17.35 million (Q3 17.86 million), following net outflows of $510k, which included $601K spent on exploration, metallurgical test work and project studies, offset by net Canadian gains of $92K (tax benefits offset by small FX adjustment). All staffing, consultant and administration costs were completely offset by interest earned on fixed term deposits of $314K. Please see details in the Appendix 5b.

Exploration & Project Development

Canadian Projects:

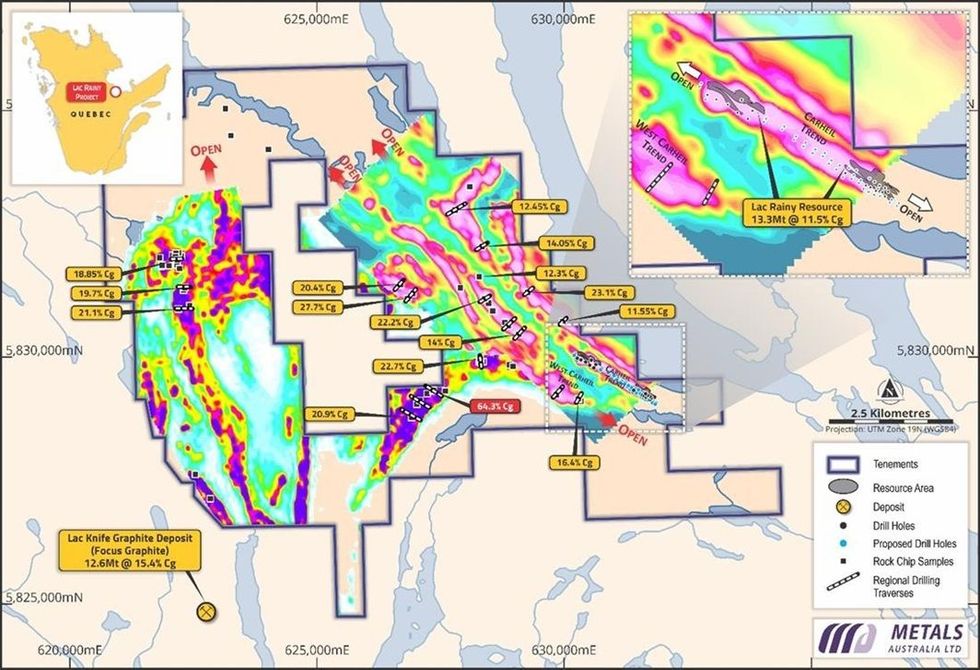

Lac Carheil Graphite – Critical Minerals Project, Quebec, Canada:

Development of Critical & Strategic Minerals 2020-20252. During the Quarter considerable effort was applied to increasing the Company’s profile with government agencies and stakeholders. The project name was changed to Lac Carheil to better reflect its proximity to the major water feature of the same name and to avoid confusion among stakeholders. Various engagements, including consultations, led directly to the submission of an exploration impact assessment for the planned drilling program, consistent with the government’s new regulatory requirements. The Company awaits approval for the program. The Company entered into a series of agreements and launched six work programs, all required as part of our prefeasibility assessment (PFS)3. Major work agreed, underway or planned, included:

- Metallurgical & Laboratory Services – The appointments of SGS Laboratories in Lakefield, Ontario and a specialist client advisor to oversee metallurgical test-work programs associated with the PFS. Test work is advancing with results informing the PFS design team.

- Pre-Feasibility Study (PFS) – Lycopodium Minerals, Canada have commenced design for a 100,000 tonnes per annum flake-graphite concentrate plant, building on the 2021 Scoping Study results4 that demonstrated Lac Carheils potential to generate high operating margins over an initial 14-year mine life - based on the current Mineral Resource alone.

- Downstream graphite purification processing assessment, plant location and Scoping Study to produce battery anode material. ANZAPLAN, a world-leading, German based, metallurgical test-work and process engineering design group will substantially advance on the outstanding results of previous downstream product test-work that produced battery grade (99.96% graphitic carbon (Cg)) spherical graphite (SpG) with excellent battery charging and discharge performance5.

- Drilling and full-service support contract signed with Magnor Exploration to complete the drilling and other exploration programs for Mineral Resource expansion and to test new regional targets at Lac Carheil, where the current Mineral Resource is contained within only 1km of a demonstrated 36km strike-length of high-grade graphitic trends6.

- Product marketing and pricing strategy – Lonestar Technical Minerals has been appointed to guide development of an overall marketing and pricing program for Lac Carheil graphite products.

- Social and stakeholder engagement services – An agreement has just commenced with Quebec based Transfert Environmental to assist with stakeholder engagement.

- Considerable progress was also made on the Mineral Resource estimation, mining, geotechnical, tailings and environmental scopes of work – which are all close to award, subject to a final drilling permit being awarded.

Corvette River Li, Au, Ag & Cu Project – Quebec, Canada

During the Quarter, the Company rapidly advanced planning, design and permitting for an extensive, phased, exploration program at Corvette River (see Figure 2). The aims of the exploration program are to follow up on promising Lithium bearing pegmatites, previously reported as the CR17 Pegmatite (adjacent to Patriot Battery Metals (ASX: PMT) CV9 discovery8,9) and the CS1 Pegmatite10, and historical field sampling with promising gold, silver and copper results11. The Company’s exploration permit, which includes trenching and drilling, was approved during the Quarter.

Click here for the full ASX Release

This article includes content from Metals Australia Ltd, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MLS:AU

Sign up to get your FREE

Metals Australia Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

02 July 2025

Metals Australia

High-quality graphite development project with an accelerated pathway to production, complemented by a diversified portfolio of critical, precious and base metals assets in tier-1 jurisdictions across Canada and Australia.

High-quality graphite development project with an accelerated pathway to production, complemented by a diversified portfolio of critical, precious and base metals assets in tier-1 jurisdictions across Canada and Australia. Keep Reading...

17 February

High Grade Assays Verify the Emerging Manindi VTM Project

Metals Australia (MLS:AU) has announced High Grade Assays Verify the Emerging Manindi VTM ProjectDownload the PDF here. Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Metals Australia (MLS:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Graphite Project Links to Quebec's Critical Minerals Plan

Metals Australia (MLS:AU) has announced Graphite Project Links to Quebec's Critical Minerals PlanDownload the PDF here. Keep Reading...

18 December 2025

High Copper Anomalies Show Deeper Potential at Warrego East

Metals Australia (MLS:AU) has announced High Copper Anomalies Show Deeper Potential at Warrego EastDownload the PDF here. Keep Reading...

16 December 2025

Titanium-Vanadium-Magnetite Discovery Extended over 1km

Metals Australia (MLS:AU) has announced Titanium-Vanadium-Magnetite Discovery Extended over 1kmDownload the PDF here. Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Sign up to get your FREE

Metals Australia Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00