December 21, 2022

Balkan Mining and Minerals Ltd (ASX: BMM; “Balkan Mining” or “the Company”) advises that it has completed a high-resolution helicopter borne geomagnetic survey of the Tango lithium project located in the Georgia Lake Area, Thunder Bay North Mining District of Ontario, Canada (the "Tango Lithium Project" or "Project").

HIGHLIGHTS

- BMM has completed a heliborne geomagnetic survey over the Tango lithium project located in the Georgia Lake Area, Ontario.

- A total of 192 line kilometres were surveyed during three production flights.

- The objective of the survey was to define the extent and geometry of intrusions and structures, particularly in areas concealed by overburden.

- The results will be used to understand structural fabric of the project area and design a follow-up fieldwork program.

- BMM has dual-listed on the Frankfurt Stock Exchange (“FSE"), under the code “7JL” in order to broaden the Company’s stakeholder engagement.

The high-resolution heliborne magnetic survey was conducted by Prospectair Geoservices from Gatineau, Québec and the data was processed by Dynamic Discover Geoscience from Ottawa, Ontario.

In total, 192 line kilometres with traverse lines were flown at N000. Survey flight lines were 50m apart, and control lines were flown with a N090 orientation, spaced every 500m.

The survey resulted in highlighting and identifying key geologic boundaries, faults and favourable structures.

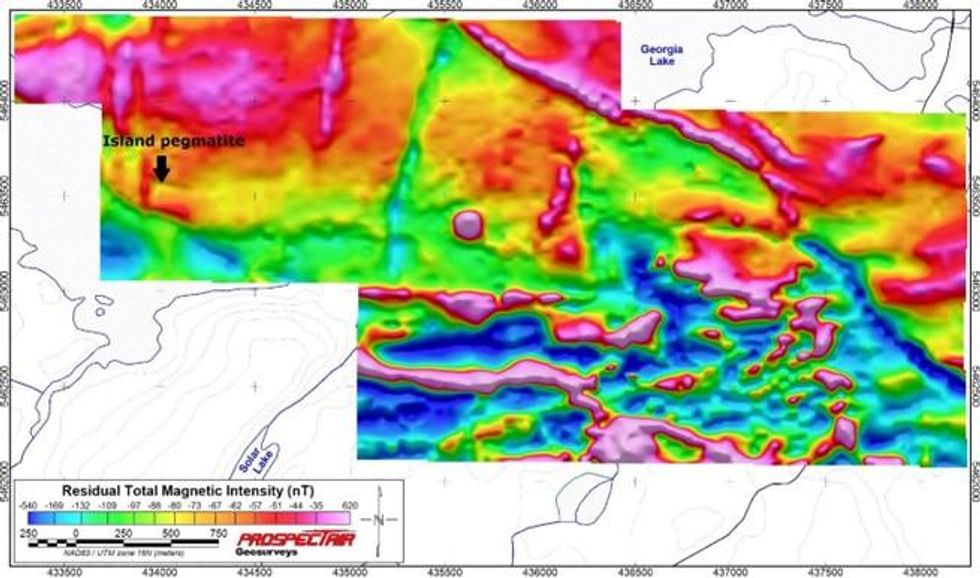

The Projects residual Total Magnetic Intensity (TMI) is slightly active and varies over a range of 1,160 nT, with an average of -86 nT and a standard deviation of 60 nT.

The northern half of the project area is dominated by magnetic domains with relatively settled signal variations mostly consisting of low amplitude anomalies. This is characteristic of areas dominated by meta-sedimentary or intermediate to intrusive felsic rocks. The remaining area to the south is rather characterised by active magnetic variations and stronger anomalies, which is typical of intrusive mafic rocks. The few magnetic features depicting strong magnetic low anomalies are likely caused by magnetic sources affected by remanent magnetisation.

Magnetic lineaments are variable in orientation throughout the block. They are generally trending E-W in the southern part of the project area but are more variable to the north. Some narrow anomalies striking N-S and NW-SE are found in the northern and eastern parts of the project area and possibly relate to mafic dykes.

Click here for the full ASX Release

This article includes content from Balkan Mining and Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BMM:AU

The Conversation (0)

05 September 2021

Bayan Mining and Minerals

Mining Critical Minerals from the Balkan Region

Mining Critical Minerals from the Balkan Region Keep Reading...

19 January 2025

Further Exploration Targets Identified at Bayan Springs

Bayan Mining and Minerals (BMM:AU) has announced Further Exploration Targets Identified at Bayan SpringsDownload the PDF here. Keep Reading...

31 October 2024

Quarterly Activities/Appendix 5B Cash Flow Report

Balkan Mining and Minerals (BMM:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00