May 15, 2024

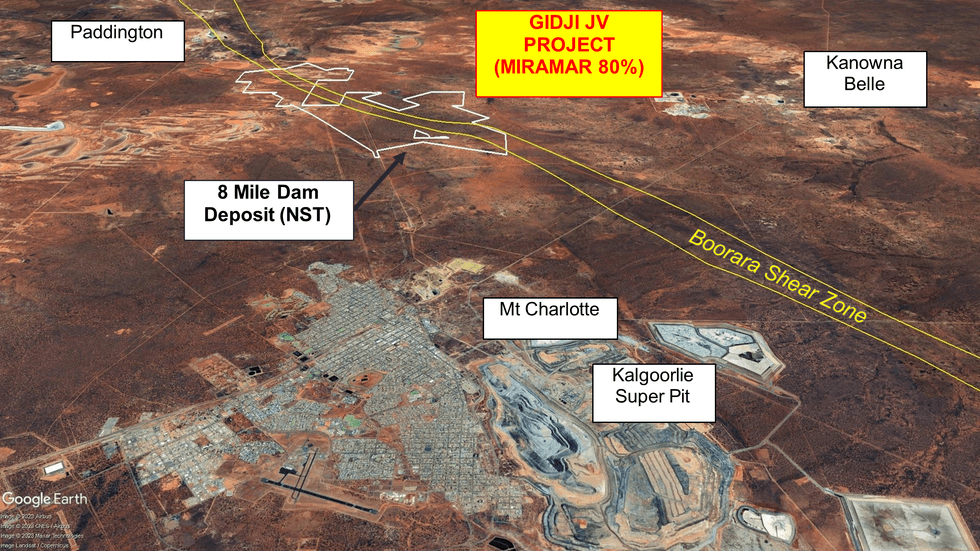

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) is pleased to advise that reprocessing of geophysical data has upgraded the 8-Mile target within the Gidji JV Project (“Gidji” or “the Project”), 15 kilometres north of Kalgoorlie, WA.

- Reprocessing of geophysical data increases potential for northern extension to NST’s 313koz “8 Mile Dam” Deposit at Miramar’s 8-Mile target

Miramar’s 8-Mile target is located at the southern boundary of the Gidji JV Project and abuts Northern Star Resources Limited’s 313koz “8 Mile Dam” gold deposit (Figure 1).

The reprocessed data shows a well-defined gravity and Induced Polarisation (IP) anomaly north of the 313koz “8 Mile Dam” Resource, which appears to have been offset by a SW-NE trending fault and underlies numerous significant aircore end of hole (EOH) results.

Miramar’s Executive Chairman, Mr Allan Kelly, said the combination of the multiple coincident datasets increased the potential for an extension to the 8 Mile Dam deposit within the Company’s Gidji JV Project.

“We have multiple high-grade end of hole aircore gold results overlying an IP and gravity anomaly which looks very similar to the 8 Mile Dam gold deposit immediately south of our tenement boundary,” he said.

“The geophysical data suggests that the deposit may extend into our ground but has been offset approximately 400 metres to the northeast by a fault,” he added.

“The 8-Mile offset target is within reach of RC drilling and, unlike the targets further north, there is no paleochannel covering the basement geology,” he said.

According to publicly available information, the 8 Mile Dam Project contains 7Mt @ 1.4g/t Au for 313,977 contained ounces1 with primary mineralisation hosted in a steep southwest-dipping mafic unit within volcanoclastic sediments of the Black Flag Beds. Figure 2 shows a cross section through the deposit approximately 40m south of the Gidji JV tenement boundary.

In March-April 2021, Miramar completed the second phase of aircore drilling across the Gidji JV Project, including several holes at the 8-Mile target. Significant results along strike from 8 Mile Dam included 1m @ 1.17g/t (GJAC092), 3m @ 1.22g/t Au (GJAC097) and 1m @ 1.78g/t Au (GJAC099). Other holes also intersected anomalous gold including at the end of hole (ASX Release 12 April 2021 and 29 June 2021).

In May 2021, Miramar completed three diamond drill holes targeting a strike extension to the 8 Mile Dam deposit. All three diamond holes intersected the same geological package as 8 Mile Dam but intersected only minor gold mineralisation within the mafic unit (ASX Release 11 May 2021).

At the same time, Miramar completed an orientation IP survey comprising one line of Dipole-Dipole IP just north of the tenement boundary. The survey highlighted a chargeability anomaly close to the projected position of the 8 Mile Dam deposit but underneath and south of Miramar’s diamond holes (Figure 3).

Given the interpreted depth of the IP anomaly, the limited potential strike length north of the tenement boundary and the disappointing diamond drilling results, the target was downgraded with the Company focussing on the Marylebone target where numerous high-grade aircore gold results were being received.

The Company subsequently received assay results from EOH samples from the second phase of aircore drilling. Several holes at 8-Mile returned significant fire assay gold results (see Table 1). The best EOH results were offset to the northeast of both the diamond drilling and the IP anomaly and did not correlate well with the original aqua-regia assay results.

In early 2022, following the takeover of KCGM, Northern Star Resources Limited commenced diamond drilling at the 8 Mile Dam deposit, immediately south of the tenement boundary. Miramar staff observed that the new drilling was oriented towards the southwest, in the opposite direction to most of the drilling conducted by KCGM, implying that Northern Star were targeting a different geological model.

To date, Northern Star have not announced any results from that drilling.

In May 2022, Miramar completed a follow-up IP survey comprising a central transmitter line and two receiver lines spaced approximately 350m apart and extending for 1600m.

This Pole-Dipole IP survey highlighted a NW-trending chargeability anomaly offset approximately 400m to the northeast of the diamond holes and the orientation IP anomaly and located underneath the significant EOH aircore results (Figure 4). The new IP anomaly has a strike length of at least 250m, is approximately 400m below surface and remains open to the northwest.

The Company also reprocessed open file gravity data which highlights NW-trending gravity anomalies underlying both the 8 Mile Dam deposit and Miramar’s 8-Mile target where the gravity anomaly is also offset approximately 400 metres to the northeast by a SW-NE-trending fault (Figure 5).

Miramar is reviewing options for testing the offset 8-Mile target including aircore drilling and/or RC drilling. The Company has Programme of Work (POW) approval for drilling at this target.

Click here for the full ASX Release

This article includes content from Miramar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

copper-stocksasx-m2rresource-stocksasx-stocksgold-explorationgold-stocksnickel-stockscopper-investingcopper-explorationnickel-exploration

M2R:AU

The Conversation (0)

06 February 2024

Miramar Resources

Aiming to create shareholder value through the discovery of world-class mineral deposits

Aiming to create shareholder value through the discovery of world-class mineral deposits Keep Reading...

22h

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

30 January

Top 5 Canadian Mining Stocks This Week: Vangaurd Mining Gains 141 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released November’s gross domestic product (GDP) data on Friday (January... Keep Reading...

30 January

Quarterly Activities and Cashflow Report

Redstone Resources (RDS:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

23 January

Freeport-McMoRan Plans 2026 Grasberg Restart After Deadly Mud Rush

Freeport-McMoRan (NYSE:FCX) is preparing to bring one of the world’s most important copper assets back online, laying out plans for a phased restart of the Grasberg mine in Indonesia following a deadly mud rush that halted operations late last year.The Arizona-based miner said remediation and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00