- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

April 29, 2025

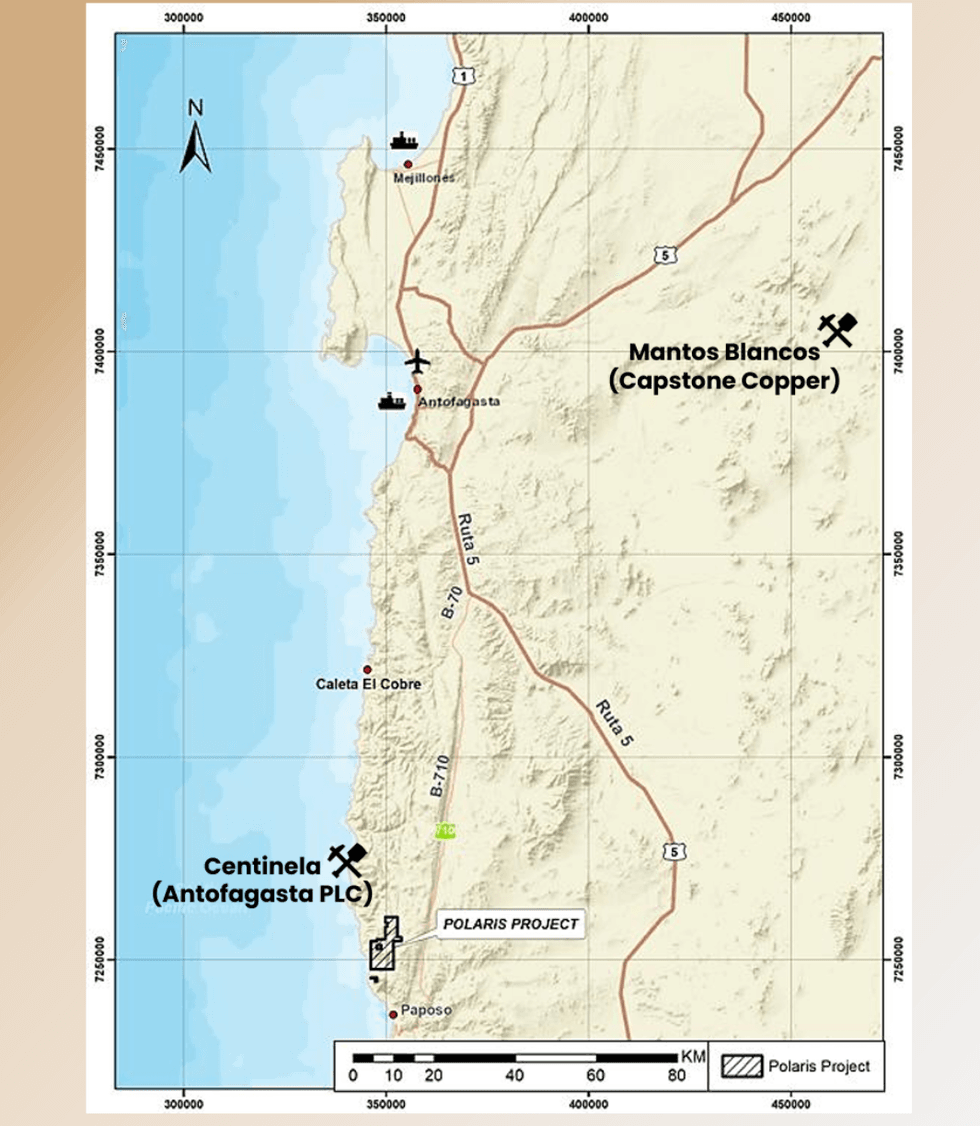

Halcones Precious Metals (TSXV:HPM) is a gold exploration company focused on advancing its high-grade Polaris project in northern Chile, a premier mining region with excellent infrastructure. Polaris hosts multiple surface targets with significant gold values across a large, underexplored property, offering investors exposure to a high-potential discovery in a mining-friendly jurisdiction.

The Polaris Project is located within the metallogenic belt of the Atacama Fault Zone, a major geological corridor known for hosting numerous significant mineral deposits across Chile. Gold mineralization at Polaris is largely controlled by major structures, including the Izcuña and Médano faults, which provided pathways for mineralizing fluids and led to the formation of vein-hosted and stockwork-style gold deposits.

Currently, exploration efforts are focused on two main target areas in the southern part of the property adjacent to the Atacama fault:

- North Zone: A historic mining district with excellent gold assay results at surface

- South Zone: Another area of historic mining activity with high-grade gold values

Company Highlights

- Strategic Land Position: Controls 5,777.5 hectares in a historically productive gold district with multiple high-grade surface targets

- Proven High-grade Gold at Surface: 30 samples returned assays above 10 g/t gold, with values up to 55 g/t gold

- Large Mineralized Footprint: Recent sampling extended the gold-bearing trend to 3.9 km, with potential for further expansion

- Bulk Tonnage Potential: Gold-bearing stockwork mapped over a 250 m x 500 m area, suggesting potential for a large-scale open-pit operation

- Favorable Project Economics: Low-to-moderate elevation project with year-round access and proximity to established infrastructure

- Experienced Leadership: Management team with extensive experience in geology, mining exploration, and capital markets

- Geological Setting: Mineralization similar to well-known Abitibi gold deposits like Sigma-Lamaque, Goldex and Dome

This Halcones Precious Metals profile is part of a paid investor education campaign.*

Click here to connect with Halcones Precious Metals (TSXV:HPM) to receive an Investor Presentation

HPM:CC

Sign up to get your FREE

Halcones Precious Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

28 April 2025

Halcones Precious Metals

Advancing a significant high-grade gold project in Northern Chile

Advancing a significant high-grade gold project in Northern Chile Keep Reading...

11h

David Erfle: Gold, Silver Under Pressure, Key Price Levels to Watch

David Erfle, editor and founder of Junior Miner Junky, explains why gold and silver prices took a hit not long after war in the Middle East was announced. While the near term could be volatile, he said the long-term outlook for precious metals is strong. Don't forget to follow us @INN_Resource... Keep Reading...

11h

Tavi Costa: Gold, Silver Stocks to Rerate, "Explosive" Energy, Copper Opportunities

Tavi Costa, CEO of Azuria Capital, explains where he's looking to deploy capital right now, mentioning mining, energy and emerging markets. "When I apply macro analysis into markets, there's a few things that look exceptionally cheap today that could be extremely asymmetric," he commented.... Keep Reading...

12h

One Bullion Advances Toward Drill-Ready Targets at Botswana Gold Assets

One Bullion (TSXV:OBUL,OTCPL:OBULF) CEO and President Adam Berk shared the advantages of working in the mining-friendly jurisdiction of Botswana and big milestones ahead in 2026.Surveys are expected to commence within the next few weeks at the company's Maitengwe and Vumba projects, which will... Keep Reading...

09 March

Byron King: Gold, Silver, Oil/Gas — Stock Ideas and Strategy Now

Byron King, editor at Paradigm Press, shares his approach to the gold and silver sectors as tensions in the Middle East intensify, also touching on oil and gas. Overall he sees hard assets becoming increasingly key as global uncertainty escalates."Own gold, own silver — physically own the metal... Keep Reading...

09 March

Jaime Carrasco: Gold Going "Much Higher," Silver Force Majeure Inevitable

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, shares his outlook for gold and silver, saying prices must rise much higher. He also talks about how to build a strong precious metals portfolio. "We're moving from a credit-based economy, a... Keep Reading...

Latest News

Sign up to get your FREE

Halcones Precious Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00