May 04, 2022

Auroch Minerals Limited (ASX:AOU) (Auroch or the Company) is pleased to announce that assay results have been received for a further three drill-holes at the St Andrews Prospect and one drillhole at the St Patricks Prospect (Figure 1) at the Saints Nickel Project (Saints; Auroch Minerals 100%) in Western Australia, with all four drill-holesintersecting high-grade massive nickel sulphides. These high-grade intersections are in addition to the high-grade mineralisation intersected in drill-holes SNDD021 and SNDD022 announced on 16th March 2022 and SNDD018 announced on 9 th March 2022

Highlights

- Assays have been received for four more drill-holes of the diamond drill programme completed earlier this year at the Saints Nickel Project in Western Australia

- All four drill-holes intersected high-grade massive nickel sulphides, including:

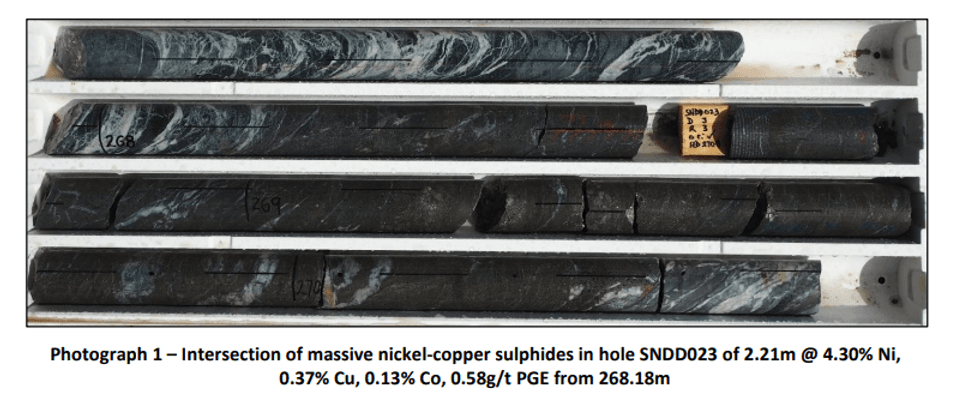

- SNDD023: 2.40m @ 2.10% Ni, 0.14% Cu, 0.09% Co, 0.36g/t PGE from 263.78m and 2.21m @ 4.30% Ni, 0.37% Cu, 0.13% Co, 0.58g/t PGE from 268.18m

- SNDD016: 1.00m @ 5.16% Ni, 0.06% Cu, 0.09% Co, 0.56g/t PGE from 73.10m

- SNDD020: 1.62m @ 3.92% Ni, 0.42% Cu, 0.11% Co, 0.70g/t PGE from 217.35m

- SNDD017: 0.30m @ 6.49% Ni, 0.17% Cu, 0.16% Co, 2.58g/t PGE from 61.50m 1

- Results are from infill drilling into modelled mineralised domains and will be used to upgrade and potentially extend the current Saints Inferred Mineral Resources of 1.02Mt @ 2.0% Ni for 21,400t of contained nickel 2

- Assay results pending for the final three drill-holes: SNDD019, SNDD025 and SNDD026

- Metallurgical testwork underway on the Saints nickel sulphide mineralisation as part of the ongoing Saints Scoping Study

Table 1 shows all significant intersections received so far from the Saints diamond drill programme, with new results including:

- SNDD023: 2.40m @ 2.10% Ni, 0.14% Cu, 0.09% Co, 0.36g/t PGE from 263.78m and 2.21m @ 4.30% Ni, 0.37% Cu, 0.13% Co, 0.58g/t PGE from 268.18m

- SNDD016: 1.00m @ 5.16% Ni, 0.06% Cu, 0.09% Co, 0.56g/t PGE from 73.10m

- SNDD020: 1.62m @ 3.92% Ni, 0.42% Cu, 0.11% Co, 0.70g/t PGE from 217.35m

- SNDD017: 0.30m @ 6.49% Ni, 0.17% Cu, 0.16% Co, 2.58g/t PGE from 61.50m.

Additional assays were also received for the upper zone of massive nickel sulphides intersected in drillhole SNDD018 at St Andrews, increasing the width of the significant intersection previously reported to:

- SNDD018: 5.12m @ 2.33% Ni, 0.14% Cu, 0.06% Co, 0.82g/t PGE from 165.00m and 4.79m @ 2.05% Ni, 0.16% Cu, 0.08% Co, 0.36g/t PGE from 311.98m. 1

All results received are from infill and extensional diamond holes drilled into and around the modelled mineralised domains of the St Patricks and St Andrews channels (Figure 2), both in the upper hangingwall mineralised zone and the lower mineralised zone just above the basal contact. Importantly, the results from this drill programme will be used to upgrade the Saints Mineral Resource Estimate (MRE) later this quarter, which is aimed at increasing the confidence level of the MRE from an Inferred Resource category to predominantly an Indicated Resource category. Currently the Saints MRE comprises Inferred Resources of 1.02Mt @ 2.0% Ni for 21,400t of contained nickel.

Metallurgical testwork has commenced on two samples of nickel sulphide mineralisation from the specific met holes drilled in the recent programme. The work will be undertaken by Strategic Metallurgy and will follow the traditional flow sheet of “Kambalda-style” nickel sulphide deposits.

Auroch Managing Director Aidan Platel commented:

“The results from the recent diamond drill programme at Saints continue to confirm the modelled zones of thick high-grade nickel sulphides, which also include significant grades of copper, cobalt and PGEs (Pt & Pd). This bodes well for upgrading the confidence level of the Saints MRE, which we are aiming to do later this quarter once all results have been received from this drill programme.

The key metallurgical testwork has commenced on samples of massive nickel sulphide mineralisation intersected in the recent drill programme, and is one of the final critical work programmes required for the ongoing Saints Scoping Study. We look forward to finalising the study which we expect will highlight the significant value of the Saints Nickel Project.”

Click here for the full ASX Release

This article includes content from Auroch Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AOU:AU

The Conversation (0)

23 September 2021

Auroch Minerals

Exploring High-Grade Nickel Sulfides in Western Australia

Exploring High-Grade Nickel Sulfides in Western Australia Keep Reading...

11h

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

18h

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

23 February

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00