January 05, 2025

Galan Lithium Limited (ASX: GLN) (Galan or the Company) is pleased to announce that the Catamarca Ministro – Ministerio de Mineria (Mines Department Minister) has granted Galan the full Phase 2 mining permit for 21ktpa LCE production at its 100% owned HMW lithium brine project in Argentina. The grant of the permit means Galan has the ability to expand production up to 21ktpa LCE, subject to securing project finance and following the delivery of Phase 1 (up to 5.4ktpa LCE).

Highlights

- Phase 2 Hombre Muerto West (HMW) mining permit has been granted, securing the pathway for Galan’s continued development at HMW at an efficient commercial scale up to 21,000 tpa LCE

- The granted permit includes all construction activities including ponds, plant, onsite laboratory, power and other required infrastructure

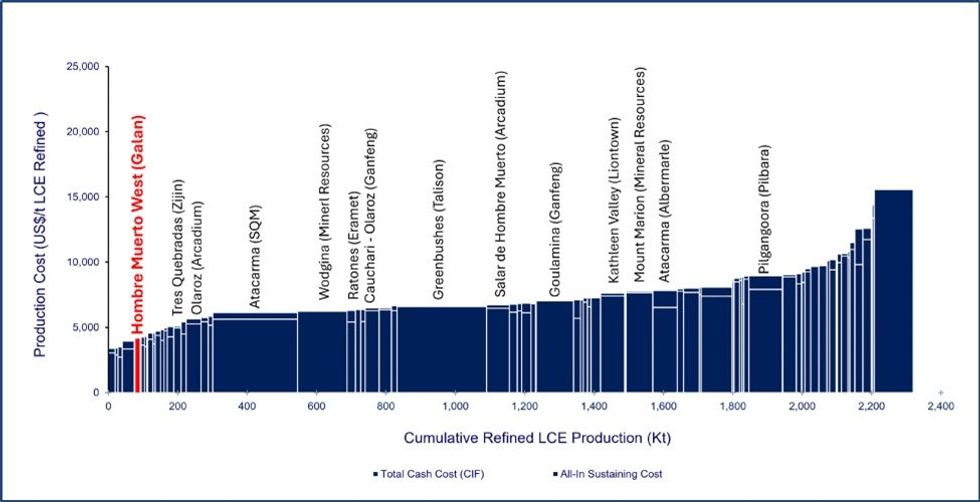

- HMW Phase 2 production would be cash flow positive at today’s lithium carbonate prices. Independent benchmarking highlights HMW as being within the first quartile of the lithium industry AISC cost curve

- The granting of Phase 2 permits supports Galan’s application for the RIGI, Argentina’s new incentive regime for large scale investments

Galan’s Managing Director, Juan Pablo (JP) Vargas de la Vega, commented:

“We are delighted with the grant of the Phase 2 mining permit which continues to solidify our strong relationship with the local Catamarcan authorities. It will allow Galan to increase production over threefold from Phase 1 and produce a premium quality lithium chloride product, which is in high demand.

Importantly, HMW is positioned in the first quartile of the cost curve and Phase 2 production would be cash flow positive even at today’s prevailing lithium carbonate prices. HMW is now poised to be a long term and resilient globally significant source of lithium supply.”

Wood Mackenzie’s emissions benchmarking service has also placed HMW within the first quartile of the industry greenhouse gas emissions curve. Strong environmental, social and governance principles have been a governing tenet of the development strategy for HMW, which focuses on the production of a lithium chloride concentrate from conventional evaporation allowing for significantly reduced energy and water consumption. In line with Galan’s commitment to social principles, at least 70% local content in employment and contracting opportunities has been targeted at HMW and remains a keen focus for the Government of Catamarca and Galan. Skills and training opportunities have been provided to increase local participation, with a view to creating a skilled local workforce and supply chain for sustainable long-term operations.

Galan has demonstrated considerable progress on the HMW project, including:

- 2019: Discovery well drilled, marking the inception of the HMW project.

- 2020-2024: Mineral Resource established and expanded, now ranked as a global Top 20 lithium resource.

- 2023: Completion of Phase 1 and Phase 2 Definitive Feasibility Studies (DFS), validating the project's technical and economic viability (https://wcsecure.weblink.com.au/pdf/GLN/02720109.pdf).

- 2023: Secured all required approvals for Phase 1 construction and commenced construction.

- 2024: Continued construction and built a lithium inventory in the ponds of over 6,000 tonnes LCE.

- 2025: Full mining permit for Phase 2 granted, securing the pathway for continued development.

Chairman of Galan, Richard Homsany, commented:

“The grant of the Phase 2 mining permit is testament to the hard work and commitment of our dedicated team, and also highlights the strong long-term relationships we have fostered with the Government of Catamarca and local communities, who we sincerely thank for their continued ongoing support. Through action we have demonstrated the benefits of our HMW operations: economically though the generation of employment, procurement and trade opportunities and socially through education, community programs and training opportunities. We look forward to continuing to work in co-operation with the Government of Catamarca and all stakeholders to maximise the benefits of Galan’s operations in the community, and ensure they are sustainable.”

The HMW project is separated into four production phases. The Phase 1 DFS is based on the production of 5.4ktpa LCE of lithium chloride concentrate, with production anticipated in the second half of 2025.

The Phase 2 DFS, announced on 3 October 2023, targets medium-term production of 21ktpa LCE of lithium chloride concentrate. Arcadium Lithium Plc, which is subject to a change of control transaction from Rio Tinto Limited, produced around 20ktpa LCE from the adjacent mining permit at Salar de Hombre Muerto in 2023.

Phase 3 at HMW aims to achieve 40ktpa LCE within a 2-5 year horizon whilst Phase 4 represents a longer-term target of 60ktpa LCE, leveraging lithium brine sourced from both HMW and Galan’s other 100%-owned project in Argentina, Candelas.

The phased development of the HMW and Candelas Mineral Resources mitigates funding and execution risk and allows for continuous process improvement. The production of lithium chloride as a product is in demand from lithium converters as battery chemistry is trending towards lithium iron phosphate technology. Galan received permission to sell lithium chloride from the Catamarca Government earlier in 2024.

The Phase 2 mining permit also supports Galan’s application for the Argentinian Régimen de Incentivo para Grandes Inversiones (RIGI). Subject to meeting the eligibility criteria for RIGI, the RIGI can provide the following key incentives:

- The corporate income tax rate is set at 25% (ordinarily 35%)

- Accelerated depreciation

- Absence of time limits in the computation of tax loss carry forwards

- Concessions on import duty, VAT and withholding tax

- Greater flexibility on foreign exchange movements

- Fiscal stability for a period of 30 years

Galan’s JP Vargas de la Vega further stated:

“Our plan for HMW is unchanged, beginning with Phase 1. Our immediate focus is finalising the financing and offtake arrangements for Phase 1. Once secured, our operations team will complete construction and commence first production of lithium chloride concentrate. While the operations team advances Phase 1 construction our corporate team, supported by advisors, will commence a project financing process for Phase 2.”

Click here for the full ASX Release

This article includes content from Galan Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLN:AU

The Conversation (0)

20 April 2025

Galan Lithium

Developing high-grade lithium brine projects in Argentina

Developing high-grade lithium brine projects in Argentina Keep Reading...

24 August 2025

Successful Due Diligence Ends - $20M Placement To Proceed

Galan Lithium (GLN:AU) has announced Successful Due Diligence Ends - $20m Placement To ProceedDownload the PDF here. Keep Reading...

01 August 2025

Final At-The-Market Raise for 2025

Galan Lithium (GLN:AU) has announced Final At-The-Market Raise for 2025Download the PDF here. Keep Reading...

30 July 2025

Quarterly Activities and Cash Flow Report

Galan Lithium (GLN:AU) has announced Quarterly Activities and Cash Flow ReportDownload the PDF here. Keep Reading...

25 July 2025

Incentive Regime for HMW Project in Argentina

Galan Lithium (GLN:AU) has announced Incentive Regime for HMW Project in ArgentinaDownload the PDF here. Keep Reading...

24 July 2025

Trading Halt

Galan Lithium (GLN:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00