First Atlantic Nickel Corp. (TSXV: FAN,OTC:FANCF) (OTCQB: FANCF) (FSE: P21) ("First Atlantic" or the "Company") is pleased to announce the release of its Initial Phase 2 Drill Plan Map detailing the locations of the first five holes at the RPM Zone, within its 100%-owned Atlantic Nickel Project in central Newfoundland. The recently completed Phase 1 drilling program successfully defined a near-surface mineralized zone measuring approximately 400m x 500m containing magnetically recoverable awaruite nickel mineralization. All Phase 1 RPM Zone drill holes intersected broad, continuous zones of mineralization, yielding consistent grades and recoveries. Metallurgical testing via the Davis Tube Recovery (DTR) method yielded an average magnetically recoverable nickel grade (DTR Ni%) of 0.13%, with an average magnetic nickel concentrate of 1.41% Ni and an average mass pull of 9.1%. These results indicate an average total nickel recovery of 54% based on an initial total nickel grade of 0.24%. The mineralized system at the RPM Zone remains open in all directions, presenting significant exploration upside. The fully funded Phase 2 drilling program is now underway and designed to further expand on this discovery—the first widely disseminated, drilled awaruite discovery in the Atlantic.

The Atlantic Nickel Project comprises a large, continuous 30-kilometer belt of serpentinized ultramafic ophiolite hosting disseminated awaruite nickel mineralization within heavily serpentinized, fractured, and sheared peridotite rocks. These formations originated from a substantial segment of ancient oceanic crust that was tectonically emplaced onto the continental margin. Awaruite, a natural nickel-iron alloy (Ni₃Fe), is notable for its sulfur-free and magnetic properties, which facilitate straightforward processing through magnetic separation and flotation. This eliminates the need for downstream high-temperature smelting, roasting, or high-pressure acid leaching (HPAL), processes typically required for conventional nickel sulfide and laterite deposits.

Highlights

- Phase 1 Drilling Discovers Large Zone of Awaruite Nickel: Initial drilling has successfully delineated a substantial, continuous zone of disseminated awaruite nickel mineralization covering at least 400 meters by 500 meters. This mineralized zone remains open in all directions, with all drill holes ending in open mineralization, highlighting significant exploration potential.

- Metallurgical Results Demonstrate Excellent Concentration & Recovery: All four drill holes from the Phase 1 program delivered consistent Davis Tube Recovery (DTR) metallurgical results, producing an average magnetic concentrate grade of 1.41% nickel at a 9.1% mass pull. The average calculated magnetically recoverable nickel (DTR Ni%) grade was 0.13%, providing a strong foundation for Phase 2 expansion drilling.

- Phase 2 Expansion Drilling Underway: The fully-funded Phase 2 program is in process, featuring a systematic, widely spaced, grid-based drill plan designed to significantly expand the known footprint of the RPM Zone, building on the encouraging results from Phase 1.

- Mineralization Open for Expansion: With Phase 1 drill holes terminating in mineralization, the system demonstrates excellent potential for further growth in all directions and at depth. This geological profile suggests the possibility of a much larger mineralized body than currently delineated.

- First Drilled Large Large-Scale Awaruite Nickel Discovery in the Atlantic: The RPM Zone represents the first large-scale, drill-defined awaruite (Ni₃Fe) nickel discovery in the Atlantic region of North America. All drill holes have encountered visible awaruite nickel and yielded positive results for magnetically recoverable nickel (DTR Ni% grade).

For further information, questions, or investor inquiries, please contact Rob Guzman at First Atlantic Nickel by phone at +1-844-592-6337 or via email at rob@fanickel.com

CEO Quote

"The successful completion of our Phase 1 program validates our geological model, marking the first major drilled awaruite discovery in the Atlantic region," said Adrian Smith, CEO of First Atlantic. "Drilling intersecting a broad near-surface mineralized zone measuring 400-by-500-meters, with all drill holes ending in mineralization, clearly demonstrating the potential for significant scale. Davis Tube Metallurgical results have demonstrated the unique advantage of awaruite: the ability to produce a high-grade, smelter-free magnetic nickel concentrate through straightforward magnetic separation." Smith continued, "With Phase 2 drilling underway, our priority is to rapidly expand the known extent of this discovery and further assess the district-scale opportunity at the Atlantic Nickel Project. We believe this project has the potential to become a strategic supply of nickel for North America's critical minerals supply chain that can be both mined and fully processed domestically."

Phase 1 Program Defines Major Awaruite Discovery at RPM Zone

The inaugural Phase 1 drilling program at the RPM Zone consisted of four diamond drill holes (AN-24-02 to AN-24-05) totaling 1,363 meters. This program was designed to test areas with visible awaruite in surface rock samples discovered throughout Pipestone Ophiolite Complex. This 30-kilometer-long, highly magnetic ultramafic belt is considered prospective for awaruite mineralization.

All four holes successfully intersected their intended targets, cutting through broad, continuous intervals of serpentinized peridotite hosting visible disseminated, awaruite nickel-iron alloy (Ni3Fe) from near-surface to the end of each hole. The geology and style of mineralization were notably consistent across the 400-by-500-meter drilled area, indicating strong lateral and vertical continuity and suggesting the presence of a large, robust, and homogenous mineralizing system.

The DTR metallurgical results from all four RPM Zone holes averaged a magnetic concentrate grade of 1.41% nickel with an average mass pull of 9.10% resulting in a calculated average DTR Grade of 0.13% nickel.

A summary of the complete DTR metallurgical results from the Phase 1 program is summarized below.

Table 1. 2024 and 25 reported magnetically recovered nickel in diamond drill holes at the Atlantic Property.

| Drill Hole | Zone | Section | From meters | To meters | Interval meters | Magnetically Recovered (DTR) Nickel % | Magnetic Concentrate Nickel Grade (Ni %) | Mass Pull (%) | Comment |

| AN 24 - 01 | Super Gulp | 3.23 | 297.0 | 293.8 | 0.06 | 0.89 | 6.90 | NR - March 12, 2025 | |

| AN 24 - 02 | RPM | S1 | 11.0 | 394.1 | 383.1 | 0.13 | 1.37 | 9.50 | NR - March 12, 2025 |

| AN 24 - 03 | RPM | S1 | 18.0 | 234.0 | 216.0 | 0.11 | 1.32 | 9.12 | NR - April 15, 2025 |

| AN 24 - 04 | RPM | S1 | 12.0 | 378.0 | 366.0 | 0.14 | 1.46 | 9.53 | NR- June 24, 2025 |

| AN 24 - 05 | RPM | S2 | 6.0 | 357.0 | 351.0 | 0.12 | 1.47 | 8.21 | NR - July 9, 2025 |

| AN 25 - 06 | RPM | S2 | 453.0 | pending | pending | waiting analysis | |||

| AN 25 - 07 | RPM | S2 | 495.0 | pending | pending | waiting analysis | |||

| AN 25 - 08 | RPM | S3 | processing | ||||||

| AN 25 - 09 | RPM | S3 | processing | ||||||

| AN 25 - 10 | RPM | S1 | processing |

PHASE 2 DRILLING UNDERWAY TO EXPAND RPM ZONE MINERALIZATION

The RPM Zone is a new, large-scale, at-surface awaruite nickel discovery. Visible awaruite in surface rock samples was confirmed by Phase 1 drilling, which intersected mineralization in all four holes and defined a preliminary footprint of about 400 by 500 meters. This broad, at-surface zone features consistent DTR nickel grades from the surface and remains open at depth and in all directions. Every hole drilled to date has encountered awaruite nickel mineralization, underscoring the robustness of this near-surface system and its significant growth potential, with clear expansion opportunities north toward Pipestone Pond, east toward Chrome Pond, and west into the RPM fault zone.

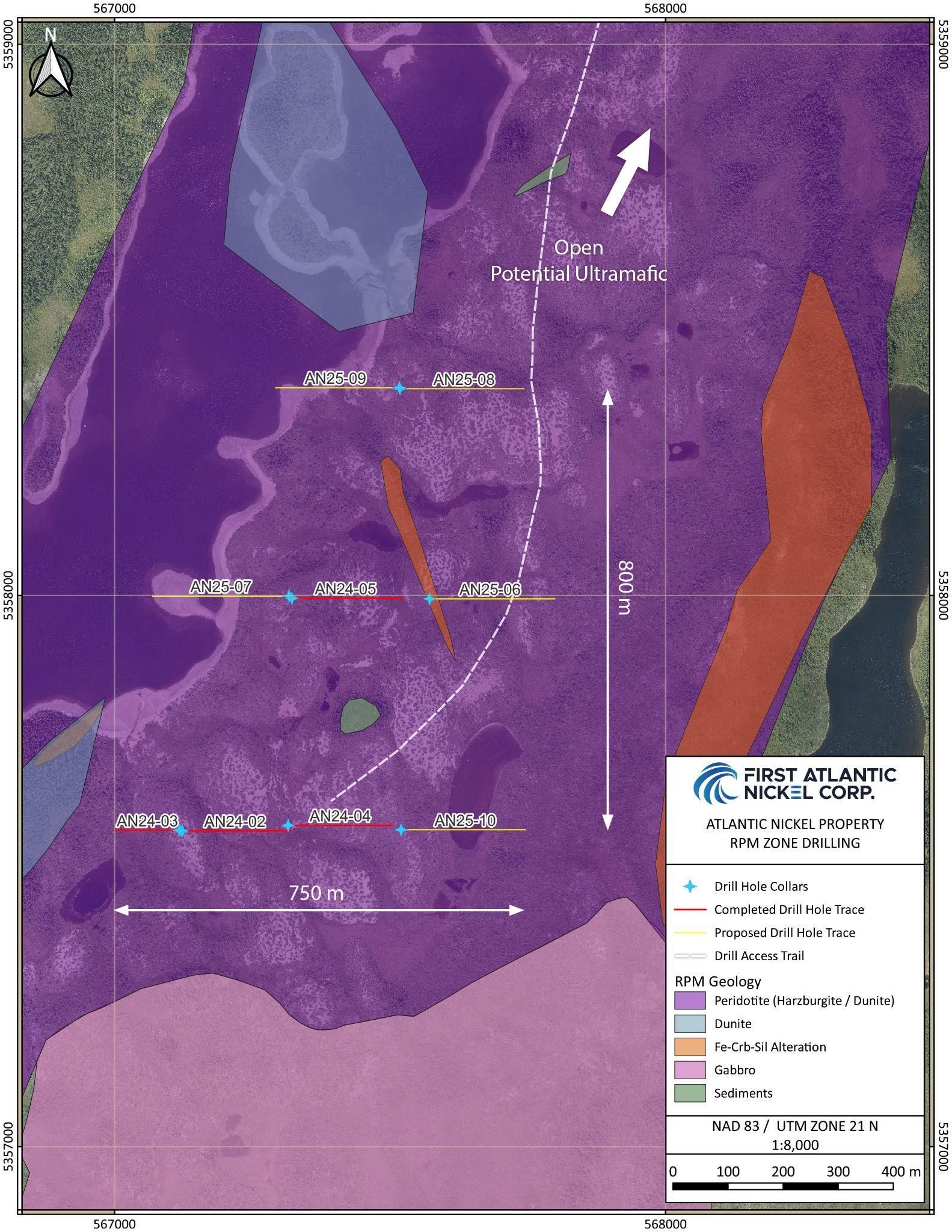

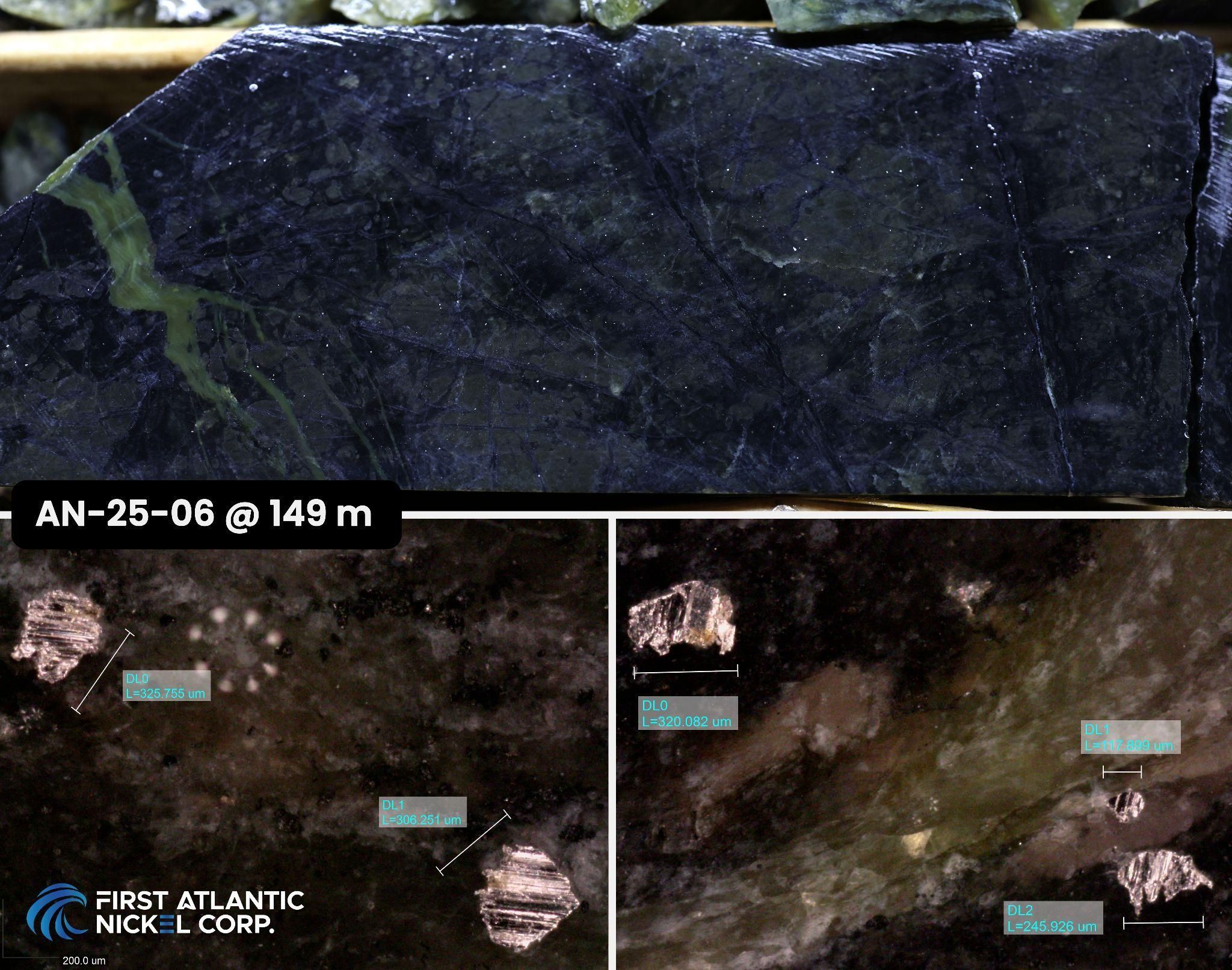

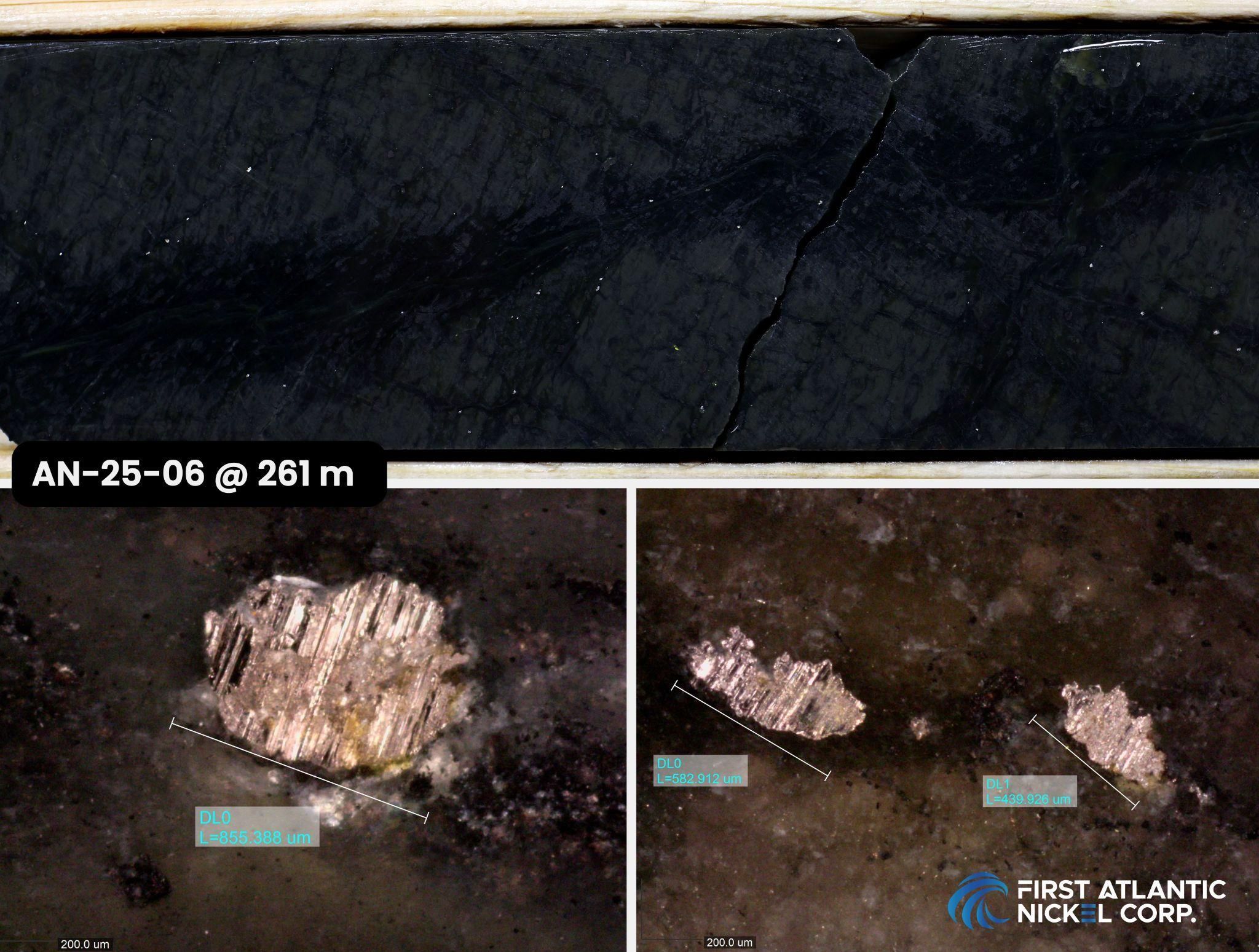

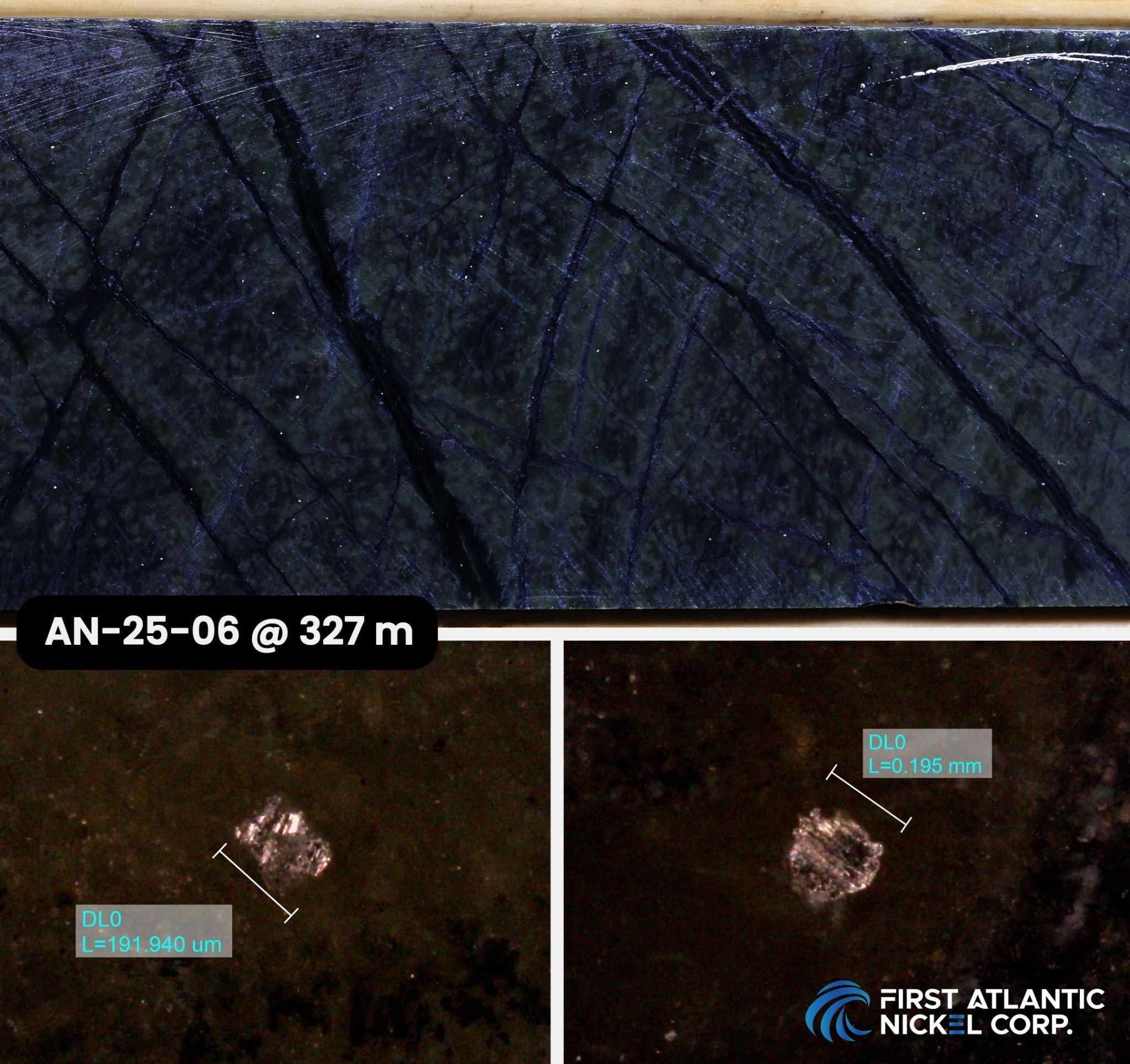

Phase 2 drilling is now underway with a strategic program designed to systematically expand beyond the initial footprint through step-out drilling targeting greater depths. The first hole of the Phase 2 program, drill hole AN-25-06, encountered large grain visibly disseminated awaruite within a continuous interval of serpentinized ultramafic peridotites (see figures 1-3) successfully extending the lateral strike of mineralization eastward beyond AN-24-04 and AN-24-05. The hole was collared 200 meters east of AN-24-05 and drilled in an eastward orientation towards Chrome Pond.

The fully funded Phase 2 campaign benefits from upgraded project infrastructure, including improved road access and expanded camp facilities, while equipment optimizations have enabled enhanced drilling capabilities to test the full vertical extent from surface and lateral extent of the mineralized system. These advancements position the Phase 2 program to meaningfully expand the RPM Zone's known footprint across all target directions, building on the exceptional foundation of this at-surface discovery.

- Northern Extension: Step-out drilling will target the area to the north towards Pipestone Pond, building on the results of hole AN-24-05. This hole represented a successful 400-meter step-out and confirmed that mineralization continues significantly in this direction.

- Eastern Extension: Drilling will test the lateral extent of the mineralized system towards Chrome Pond. This target has been prioritized following the results from hole AN-24-04, which returned the highest DTR nickel grade of the program, 0.14% over 366 meters. AN-25-06 has expanded visible awaruite mineralization further east of holes AN-24-04 & AN-24-05 with results pending.

- Western Extension: Drilling will evaluate the RPM fault zone to the west. Hole AN-24-03 intersected increasing nickel grades in its final 21 meters as it approached this structure, suggesting the fault may influence the localization or concentration of higher-grade mineralization.

- At Depth: The Company will systematically test the mineralization at greater depths to evaluate vertical continuity and assess the potential for a large scale, bulk-tonnage resource that may be amenable to open-pit mining methods.

Figure 1: RPM Expansion area drill plan map showing Phase 1 drill holes and ongoing Phase 2 drilling. Phase 1 drill holes (red) and Phase 2 proposed/in-progress drill holes (yellow).

Figure 2: AN-25-06 at 149 meters downhole showing disseminated awaruite nickel-alloy disseminated throughout serpentinized ultramafic peridotite. Bottom images show photomicroscope grains of nickel-alloy along the cut core surface.

Figure 3: AN-25-06 at 261 meters downhole showing disseminated awaruite nickel-alloy disseminated throughout serpentinized ultramafic peridotite. Bottom images show photomicroscope grains of nickel-alloy along the cut core surface.

Figure 4: AN-25-06 at 327 meters downhole showing disseminated awaruite nickel-alloy disseminated throughout serpentinized ultramafic peridotite. Bottom images show photomicroscope grains of nickel-alloy along the cut core surface.

Awaruite (Nickel-iron alloy Ni₂Fe, Ni₃Fe)

Awaruite, a naturally occurring sulfur-free nickel-iron alloy composed of Ni₃Fe or Ni₂Fe with approximately ~75% nickel content, offers a proven and environmentally safe solution to enhance the resilience and security of North America's domestic critical minerals supply chain. Unlike conventional nickel sources, awaruite can be processed into high-grade concentrates exceeding 60% nickel content through magnetic processing and simple floatation without the need for smelting, roasting, or high-pressure acid leaching 1 . Beginning in 2025, the US Inflation Reduction Act's (IRA) $7,500 electric vehicle (EV) tax credit mandates that eligible clean vehicles must not contain any critical minerals processed by foreign entities of concern (FEOC) 2 . These entities include Russia and China, which currently dominate the global nickel smelting industry. Awaruite's smelter-free processing approach could potentially help North American electric vehicle manufacturers meet the IRA's stringent critical mineral requirements and reduce dependence on FEOCs for nickel processing.

The U.S. Geological Survey (USGS) highlighted awaruite's potential, stating, "The development of awaruite deposits in other parts of Canada may help alleviate any prolonged shortage of nickel concentrate. Awaruite, a natural iron-nickel alloy, is much easier to concentrate than pentlandite, the principal sulfide of nickel" 3 . Awaruite's unique properties enable cleaner and safer processing compared to conventional sulfide and laterite nickel sources, which often involve smelting, roasting, or high-pressure acid leaching that can release toxic sulfur dioxide, generate hazardous waste, and lead to acid mine drainage. Awaruite's simpler processing, facilitated by its amenability to magnetic processing and lack of sulfur, eliminates these harmful methods, reducing greenhouse gas emissions and risks associated with toxic chemical release, addressing concerns about the large carbon footprint and toxic emissions linked to nickel refining.

Figure 5: Quote from USGS on Awaruite Deposits in Canada

The development of awaruite resources is crucial, given China's control in the global nickel market. Chinese companies refine and smelt 68% to 80% of the world's nickel 4 and control an estimated 84% of Indonesia's nickel output, the largest worldwide supply 5 . Awaruite is a cleaner source of nickel that reduces dependence on foreign processing controlled by China, leading to a more secure and reliable supply for North America's stainless steel and electric vehicle industries.

Investor Information

The Company's common shares trade on the TSX Venture Exchange under the symbol " FAN" , the American OTCQB Exchange under the symbol " FANCF " and on several German exchanges, including Frankfurt and Tradegate, under the symbol " P21" .

Investors can get updates about First Atlantic by signing up to receive news via email and SMS text at www.fanickel.com . Stay connected and learn more by following us on these social media platforms:

https://www.facebook.com/fanickelcorp

https://www.linkedin.com/company/firstatlanticnickel/

FOR MORE INFORMATION:

First Atlantic Investor Relations

Robert Guzman

Tel: +1 844 592 6337

rob@fanickel.com

Disclosure

Adrian Smith, P.Geo., a director and the Chief Executive Officer of the Company is a qualified person as defined by NI 43-101. The qualified person is a member in good standing of the Professional Engineers and Geoscientists Newfoundland and Labrador (PEGNL) and is a registered professional geoscientist (P.Geo.). Mr. Smith has reviewed and approved the technical information disclosed herein.

Analytical Method & QA/QC

Samples were split in half on site, with one half remaining in the core box for future reference and the other half securely packaged for laboratory analysis. The QA/QC protocol included the insertion of blanks, duplicates, and certified reference material (standards), with one QA/QC sample being inserted every 20 samples to monitor the precision and accuracy of the laboratory results. All analytical results successfully passed QA/QC screening at the laboratory, and all Company inserted standards and blanks returned results within acceptable limits.

Samples were submitted to Activation Laboratories Ltd. ("Actlabs") in Ancaster, Ontario, an ISO 17025 certified and accredited laboratory operating independently of First Atlantic. Each sample was crushed, with a 250 g sub-sample pulverized to 95% - 200 mesh. A magnetic separate was then generated by running the pulverized sub-sample through a magnetic separator which splits the sub-sample into magnetic and non-magnetic fractions. This involves running a 30 g split of the pulp through a Davis Tube magnetic separator as a slurry using a constant flow rate, a magnetic field strength of 3,500 Gauss, and a tube angle of 45 degrees to produce magnetic and non-magnetic fractions.

The magnetic fractions are collected, dried, weighed and the magnetic fraction is fused with a lithium metaborate/tetraborate flux and lithium bromide releasing agent and then analyzed on a wavelength dispersive XRF for multiple elements including nickel, cobalt, iron and chromium. The magnetically recovered nickel grade was then calculated by multiplying the XRF fusion nickel value by the weight of the magnetic fraction and dividing by the total recorded feed weight or magnetic mass pulled from the sample.

True widths are currently unknown. However, the nickel bearing ultramafic ophiolite and peridotite rocks being targeted and sampled in the Phase 1 drilling program at the Atlantic Nickel Project are mapped as several hundred meters to over 1 kilometer wide and approximately 30 kilometers long.

About First Atlantic Nickel Corp.

First Atlantic Nickel Corp. (TSXV: FAN,OTC:FANCF) (OTCQB: FANCF) (FSE: P21) is a Canadian mineral exploration company developing the 100%-owned Atlantic Nickel Project, a large-scale nickel project strategically located near existing infrastructure in Newfoundland, Canada. The Project's nickel occurs as awaruite, a natural nickel-iron alloy containing approximately 75% nickel with no-sulfur and no-sulfides. Awaruite's properties allow for smelter-free magnetic separation and concentration, which could strengthen North America's critical minerals supply chain by reducing foreign dependence on nickel smelting. This aligns with new US Electric Vehicle US IRA requirements, which stipulate that beginning in 2025, an eligible clean vehicle may not contain any critical minerals processed by a FEOC (Foreign Entities Of Concern) 6 .

First Atlantic aims to be a key input of a secure and reliable North American critical minerals supply chain for the stainless steel and electric vehicle industries in the USA and Canada. The company is positioned to meet the growing demand for responsibly sourced nickel that complies with the critical mineral requirements for eligible clean vehicles under the US IRA. With its commitment to responsible practices and experienced team, First Atlantic is poised to contribute significantly to the nickel industry's future, supporting the transition to a cleaner energy landscape. This mission gained importance when the US added nickel to its critical minerals list in 2022, recognizing it as a non-fuel mineral essential to economic and national security with a supply chain vulnerable to disruption.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking statements:

This news release may include "forward-looking information" under applicable Canadian securities legislation. Such forward-looking information reflects management's current beliefs and are based on a number of estimates and/or assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information.

Forward-looking information in this news release includes, but is not limited to: statements regarding: the timing, scope and results of the Company's Phase 1 and Phase 2 work and drilling programs; the potential for the RPM Zone to host a large-scale awaruite nickel deposit; interpretations of exploration and metallurgical data, including Davis Tube Recovery results; the viability of magnetic separation as a low-impact processing method; future exploration plans and expenditures; the potential economic and strategic significance of the Atlantic Nickel Project; the potential for domestic mining and processing of nickel; and other future plans, objectives or expectations of the Company. Readers are cautioned that such forward-looking information are neither promises nor guarantees and are subject to known and unknown risks and uncertainties including, but not limited to, general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets, lack of available capital, actual results of exploration activities, environmental risks, future prices of base and other metals, operating risks, accidents, labour issues, delays in obtaining governmental approvals and permits, and other risks in the mining and clean energy industries. Additional factors and risks including various risk factors discussed in the Company's disclosure documents which can be found under the Company's profile on http://www.sedarplus.ca. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected.

The Company is presently an exploration stage company. Exploration is highly speculative in nature, involves many risks, requires substantial expenditures, and may not result in the discovery of mineral deposits that can be mined profitably. Furthermore, the Company currently has no mineral reserves on any of its properties. As a result, there can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking information, except as required by applicable securities laws.

_____________________

1 https://fpxnickel.com/projects-overview/what-is-awaruite/

2 https://home.treasury.gov/news/press-releases/jy1939

3 https://d9-wret.s3.us-west-2.amazonaws.com/assets/palladium/production/mineral-pubs/nickel/mcs-2012-nicke.pdf

4 https://www.brookings.edu/wp-content/uploads/2022/08/LTRC_ChinaSupplyChain.pdf

5 https://web.archive.org/web/20250417033842/https://www.airuniversity.af.edu/JIPA/Display/Article/3703867/the-rise-of-great-mineral-powers/

6 https://home.treasury.gov/news/press-releases/jy1939

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/9180c577-5487-421f-a9ef-e6b14eebaa2c

https://www.globenewswire.com/NewsRoom/AttachmentNg/880fee0f-57bc-403e-9a80-c83b5ed8820e

https://www.globenewswire.com/NewsRoom/AttachmentNg/ce110533-2ba8-4ffd-a93a-36c1740db521

https://www.globenewswire.com/NewsRoom/AttachmentNg/38a9a609-2b04-4fca-b53f-50a83e78802c

https://www.globenewswire.com/NewsRoom/AttachmentNg/d851d017-a289-44e1-bfb3-02e4c69e334c