February 07, 2023

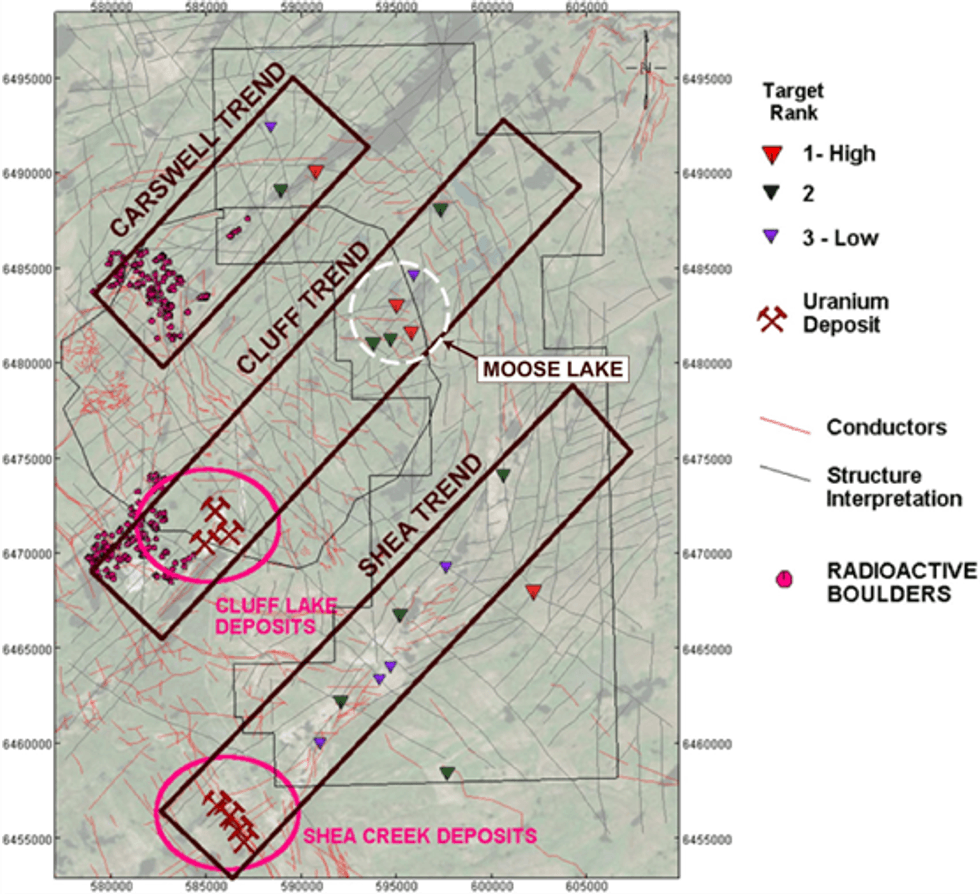

Valor Resources Limited (Valor) or (the Company) (ASX: VAL) is pleased to advise that it has confirmed several priority drill targets for the upcoming 2023 field season at the Cluff Lake Uranium Project, located 7km east of the Cluff Lake Uranium deposits on the western flank of Canada’s world-classAthabasca Basin (Figure 2).

HIGHLIGHTS

- Four priority targets identified at the Cluff Lake Uranium Project in Canada’s Athabasca Basin following a comprehensive review of all available exploration data, including data obtained from the extensive airborne gravity survey completed last year.

- Two of the targets located at the Moose Lake prospect are prioritised for drill testing.

- Structural interpretation combined with geophysical inversion models, all available surface geochemistry and drill-hole information have been used to rank and prioritise the targets for basement-hosted and unconformity-type uranium deposits.

- The depth to the top of the Athabasca Basin/basement unconformity has been derived from historical airborne EM (MEGATEM) magnetic and drilling data, as well as Valor’s 2022 airborne gravity gradiometry (AGG) survey data.

- Exceptionally high-grade rare earth element (REE) assays of up to 9.15% TREO1 returned from on- ground field checking of targets and surface sampling of historic trenches at the Moose Lake prospect.

- The Cluff Lake Project is located 7km east of Orano’s Cluff Lake Mine, which produced 62.5Mlbs @ 0.92% U3O8 and 5km from Orano’s/UEX’s Shea Creek deposits, which combine to form one of the largest undeveloped uranium resources in the Athabasca Basin.

- Follow-up field program proposed including radon surveys over targets before drilling later in 2023.

The targets have been refined following the interpretation of new airborne gravity gradiometry (AGG) and magnetic data, re-processing of historical airborne EM data (MEGATEM) and initial fieldwork at the Cluff Lake Project.

An earlier review of historic exploration data from the Cluff Lake area identified seven prospective targets from geological mapping, surface sampling, diamond drilling and re-processed historical geophysical data. The results of this review were reported on 7th June 2022 in the ASX announcement titled “Highly prospective Uranium targets identified at Cluff Lake Project near historical uranium mine”.

Subsequent to that, the Company completed an airborne gravity gradiometry survey in June 2022 and, following an interpretation of these and other data, high-priority targets have been defined (Figure 1).

The airborne gravity survey was designed to identify gravity lows which can be caused by clay alteration of the host rock, potentially due to hydrothermal fluids associated with unconformity uranium deposits (see Figure 3).

Click here for the full ASX Release

This article includes content from Valor Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

VAL:AU

The Conversation (0)

04 March

Cameco Signs US$2.6 Billion Uranium Deal With India to Fuel Nuclear Expansion

Cameco (TSX:CCO,NYSE:CCJ) has secured a nine-year uranium supply agreement with India worth an estimated US$2.6 billion, accelerating its nuclear power expansion as it deepens critical mineral ties with the country.The Saskatoon-based uranium producer will supply nearly 22 million pounds of... Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00