July 17, 2022

Valor Resources Limited (“Valor” or the “Company”) is pleased to announce the results of rock chip samples from the Ichucollo target at the Company’s Picha Project in southern Peru. A total of 113 channel and selective rock chip samples have been collected at Ichucollo between April and May this year, and assay results have now been received. Further sampling was undertaken at Ichucollo following assay results reported in the Company’s ASX announcement dated 3rd June titled “Significant Cu-Ag results over 2% copper and up to 929g/t silver”. The significant assay results (>0.5% Cu) from the Ichucollo area are shown in Table 1 and details of all sampling are provided in Appendix 1 below.

Highlights:

- Channel sample results from Ichucollo targetat the Picha Project include:

- 12m @ 1.1% Cu and 5.3g/t Ag;

- 30m @ 0.79% Cu and 7.56g/t Ag;

- 16m @ 0.60% Cu and 9.1g/t Ag; and

- 18m long zone of stratabound or “manto-type” mineralisation averaging 1.45% Cu

- Channel sampling results highlight an area over 350m in extent with significant copper mineralisation and open to the north and south

- Evidence of intrusive activity in the Ichucollo area in the form of magmatic breccias with intrusive clasts – suggests proximity to porphyry body

- Ground geophysics comprising IP/Resistivity survey planned for Ichucollo in August and further surface sampling and mapping

- High grade rock chip sample of 6.78% Cu and 25g/t Ag indicates a potential new target area 4.5km west of Cobremani

- Phase one maiden diamond drilling program at Cumbre Coya, Maricate, Fundicion and Cobremani targets planned to commence in October

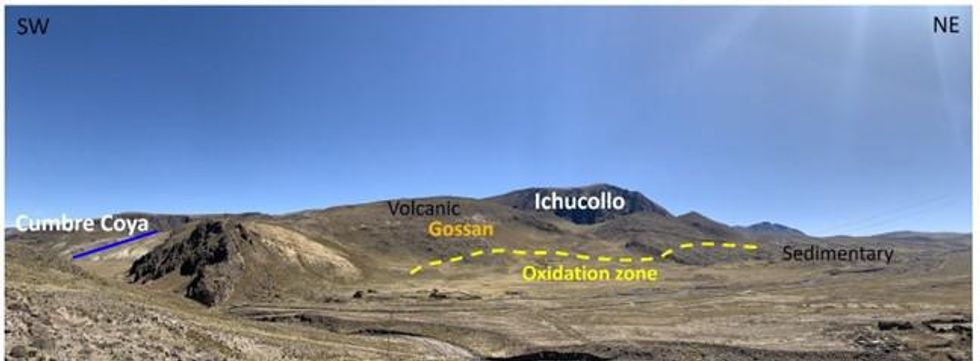

Figure 1: Sampling “manto-type” mineralisation at Ichucollo

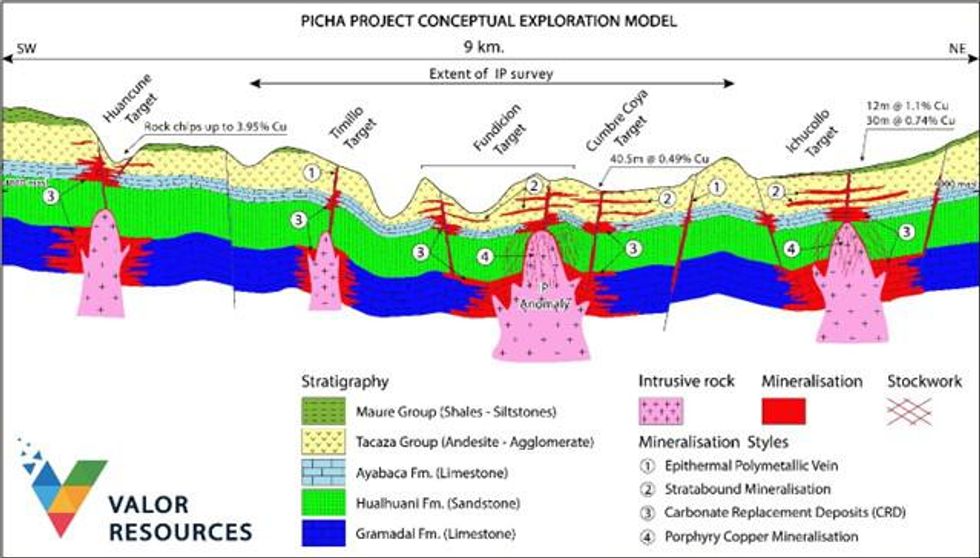

Of the 113 samples taken at Ichucollo, 32 assayed >0.5% Cu, all of which were channel samples, with individual channel samples up to 7.75% Cu and 99g/t Ag. Mineralisation is mostly associated with argillic altered andesitic volcanics (stratabound style) however there is potential for a porphyry at depth within this target area (see Figure 3 below). Many of the samples had elevated molybdenum (above 20ppm and up to 412ppm) providing further evidence for a potential porphyry copper mineralising system within the project area.

Figure 2: View looking northwest towards the Ichucollo target.

Figure 3: Picha Project Conceptual Exploration model

Executive Chairman George Bauk said “The latest assay results again demonstrate the untested potential of the Picha Project with widespread copper mineralisation discovered across the new Ichucollo target area. The evidence continues to mount that we have an exceptional project with large scale porphyry copper potential. Approvals for the maiden drilling program at Picha continue to advance with the current expectation that drilling will commence in October. Due to the timing of the approvals process, the maiden drilling program will not include Ichucollo, but following the ground geophysics survey there in August, we expect to be drill testing this exciting new target early next year.”

Click here for the full ASX Release

This article includes content from Valor Resources Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

VAL:AU

The Conversation (0)

4h

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

23 February

Basin Energy Hits 1,112 ppm TREO, Fast Tracks 2026 Uranium and REE Strategy at Sybella-Barkly

Basin Energy (ASX:BSN) is moving to accelerate its 2026 exploration efforts following "exciting" results from its maiden drilling program at the Sybella-Barkly project in Queensland. In a recent interview, Managing Director Pete Moorhouse revealed that the company has confirmed a significant... Keep Reading...

19 February

Drilling Confirms Potential REE System at Sybella Barkly

Basin Energy (BSN:AU) has announced Drilling Confirms Potential REE System at Sybella BarklyDownload the PDF here. Keep Reading...

18 February

Niger’s Seized Uranium Remains in Geopolitical Limbo

A stockpile of 1,000 metric tons of uranium seized from a French-operated mine in Niger is now sitting at a military airbase in Niamey that was recently attacked by Islamic State militants, raising fresh concerns over security and the material’s uncertain future.The uranium, which is processed... Keep Reading...

12 February

Deep Space Energy Secures US$1.1 Million to Advance Lunar Power and Satellite Resilience Goals

Latvian startup Deep Space Energy announced it has raised approximately US$1.1 million in a combination of private investment and public funding to advance a radioisotope-based power generator designed to operate on the Moon.The company closed a US$416,500 pre-seed round led by Outlast Fund and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00