July 19, 2022

Rafaella Resources Limited (ASX:RFR) (‘Rafaella’ or the ‘Company’) is pleased to announce the results of its first field mapping program recently completed by Orix Geoscience, in conjunction with a desk-top review of existing data by SRK Exploration Services on its Canadian projects. This follows the acquisition of the Alotta and Lorraine PGM-Ni-Cu tenement packages (‘Alotta and Lorraine’) located adjacent to Rafaella’s existing Midrim and Laforce PGM-Ni-Cu projects (‘Midrim and Laforce’) in Quebec, Canada (together the ‘Belleterre-Angliers Project’). These programs will focus on high priority magmatic PGM-Ni-Cu mineralisation targets. Early indications suggest these targets lie deeper than those identified through historic exploration.

Highlights

- Field site visit by Orix Geoscience has validated certain high priority targets and other geophysical anomalies in the Alotta and Midrim areas.

- Preliminary geophysical work has reprioritised the exploration targets, focusing on those previously overlooked for lying greater than 300m in depth. 137 new and reclassified EM anomalies have been identified with 20 of these being classified as Priority 1 for further investigation.

- The acquisition of the Alotta and Lorraine licences has delivered more underexplored targets to the existing asset portfolio. Lorraine, in particular, provides many targets which have been modelled and drill tested. Down hole geophysics has already identified off-hole conductors for priority follow-up work.

- Confirmation of high-grade mineralisation within the magmatic system demonstrates a highly prospective geological environment with the potential to produce larger and deeper sulphide accumulations within the tenement portfolio.

- Confirmation of high-grade mineralisation within the magmatic system demonstrates a highly prospective geological environment with the potential to produce larger and deeper sulphide accumulations within the tenement portfolio.

Managing Director Steven Turner said: “Exploration work in Canada on our exciting PGM- Ni-Cu Belleterre-Angliers Projects is ramping up with field mapping activity validating some of our existing high priority targets and desk top work continuing to reprocess historical data, generating new and highly attractive targets conforming to a new geological model. The Company’s geological model suggests the relatively small but high- grade gabbroic intrusions point to a broader intrusive complex that could host substantial massive and semi-massive sulphide accumulations.

The Company knows that the Belt is fertile with high tenor magmatic PGM-Ni-Cu deposits such as Midrim, Laforce and Alotta. Crucially however, the re-assessment and re- modelling of the underlying feeder zone is creating new excitement internally. We are looking forward to updating the market on the results of the next stage of our focussed high-impact programme.”

Enhanced Canadian Portfolio with Substantial Sulphide Mineralisation

The Company is operating under a geological targeting model that prospective gabbroic intrusions may be mineralised at various positions within and adjacent to the intrusive chonolithic conduit, with relatively small gabbroic intrusions hosting substantial massive and semi-massive sulphide accumulations.

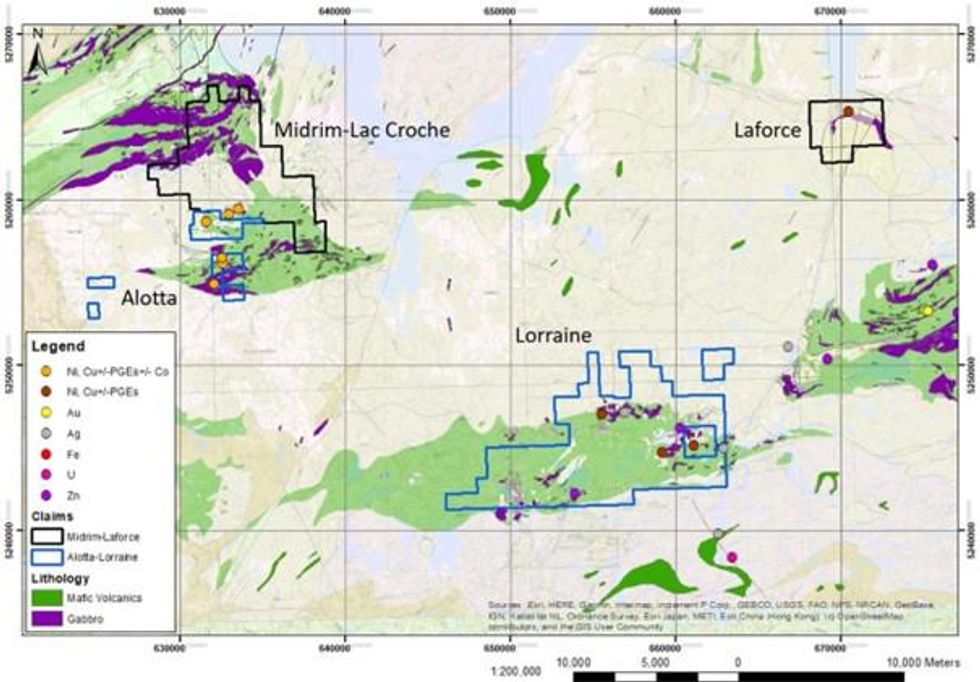

The consolidated Rafaella portfolio consisting of the Midrim, Laforce, Alotta and Lorraine licences covers 157.4 km2 of the eastern part of the Belleterre-Angliers Greenstone Belt (‘BAGB’), located in the Abitibi-Pontiac Greenstone Sub-Province (Figure 1).

Figure 1. Regional Geology of the Belleterre Angliers Project, compiled by SRK ES.

Field Validation of Geophysical Anomalies

A field site visit was undertaken by Orix Geoscience in July 2022 to validate a number of targets defined by VTEM and IP geophysical anomalies in the Midrim and Alotta licence areas (Figure 2). Included in these were two priority 1 targets identified in a recent review undertaken by SRK Exploration in January 2022.

The MRB-01 target lies in the south-eastern portion of the Midrim licence which was defined around a moderate- strength near surface conductor identified in Rafaella’s 2021 VTEM survey. A Maxwell Plate model was generated for this target and a phased drill test program has been planned for the target in the next phase of drilling. No outcrop was observed at the locality, but it was confirmed that there were no obvious cultural sources for the EM anomaly and the target remains a priority.

Click here for the full ASX Release

This article includes content from Rafaella Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

RFR:AU

The Conversation (0)

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00