July 23, 2024

- A phased program of extensive field mapping, excavator trenching, and channel sampling testing high-grade gold and lithium targets across22km of strike within the prolific Lac Guyer Greenstone Belt

Metals Australia Ltd (ASX: MLS) has commenced phase one of its fully permitted1 Corvette River exploration program. The program includes detailed field mapping, extensive excavator trenching and channel sampling to firm up drilling targets for the anticipated drilling phase of the program.

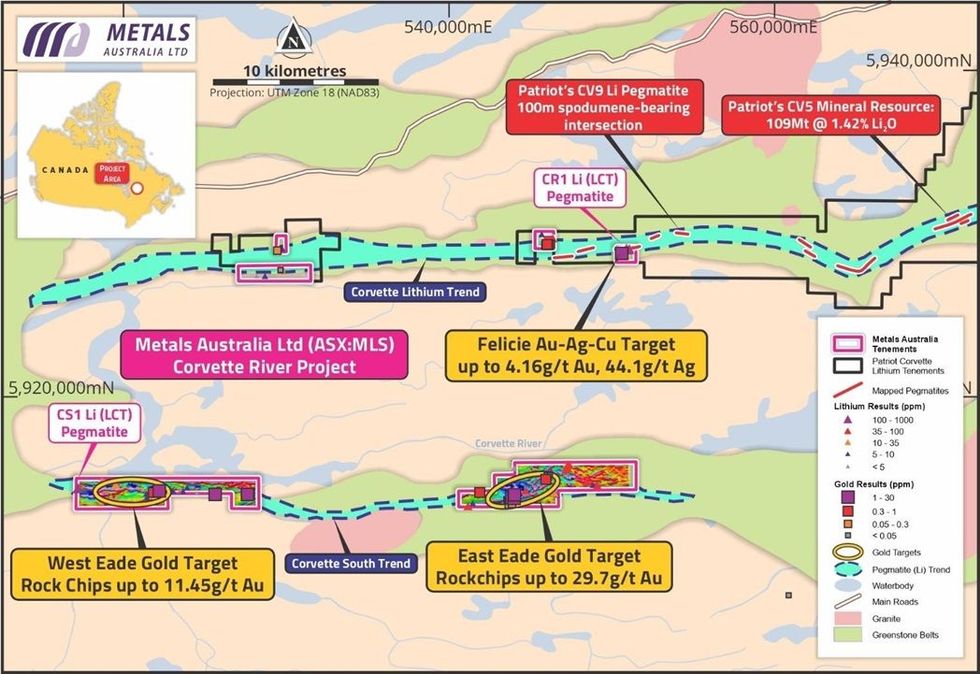

The Project consists of several claim areas, including Felicie on the Corvette Lithium Trend which hosts Patriot Battery Metals’ world-class Corvette Lithium Project2 and the West Eade and East Eade claims on the parallel Corvette South Trend, approximately 12 km to the south. Both trends are on the prolific Lac Guyer greenstone belt in the tier-one global mining jurisdiction of Quebec, Canada (see Figure 1).

Phase 1 of the program will investigate and prioritise zones across the extensive claims areas for further work and follow up drilling. The program will include extensive geological mapping, excavator trenching and channel sampling, for multi-element assaying, using a team of geologists, support staff, excavators and an air support team. Field logistics are supported by helicopters, including heavy lift helicopters, to move excavators, required equipment and personnel. The program is being phased, given the limited access to heavy lift helicopters during this period. The program is sequential, initially focussed in the Felicie area (see Figure 1), to be followed by the East Eade and then the West Eade claim areas.

The primary objectives of the program are to investigate identified target locations through field mapping of structures and outcrops, extensive excavator trenching and channel sampling to finalise planning positions and the priority of follow-on drill targets in the following project locations:

- Felicie Project – Field map, trench and sample structures and outcrops associated with previous rock chip sampling that included grades of up to 4.16 g/t Au, 44.1 g/t Ag and 0.23% Cu3 from a zone of 180m strike-length open in all direction.

- East Eade – Extensive investigation of an approximately 300m wide complex fold-closure, which included previous assays of up to 29.7 g/t Au and 12 g/t Au3 See photographs of East Eade below.

- West Eade – Further investigate areas around historical sample sites with assays of up to 11.45g/t Au3 and more recent rock chip sampling results including 3.37 g/t Au over 3m3.

- Lithium Targets – Follow up on Lithium bearing pegmatite targets that have been previously reported, including CR1 (mapped over 1.6 km4) at Felicie and CS15 at West Eade (see Figure 1)

Metals Australia CEO Paul Ferguson commented:

“It’s pleasing to be under way with phase 1 of our field exploration program at Corvette River. The commencement of this program is a result of a lot of great work by our team and our contractor, Magnor Exploration. We have developed a detailed and prioritised exploration program targeting lithium as well as gold, silver and copper and put in place a contract to allow this important work to be completed during the summer field season, when ground truthing is possible in Quebec. Importantly the program phasing recognises the challenges associated with accessing heavy lift helicopters during the peak summer period.

We are now on the ground with a dedicated team of geologists and field staff, including excavators. The team will be able to follow up on the targets, associated structures and outcrops that have been identified from previous sampling. This will allow accurate positioning of trenching and channel sampling. The outcomes of this work will result in a well-defined and prioritised list of drill targets – which will be the subject of phase 2 of the program.

This program will follow up on the highly prospective lithium pegmatite targets as well as high-grade gold and silver target zones we have communicated previously. I look forward to communicating the results of phase 1 when they are available.

We continue to aggressively progress all our high-quality projects on their pathway through exploration and, when results warrant, into development. Four of our projects are now pending government approval for their next phase of exploration, including Lac Carheil, which also has active prefeasibility study work underway. It’s been an incredibly active period of planning, permit applications and work-program contracting. We are now seeing the field exploration stages starting to emerge – with Corvette River now fully permitted for advanced exploration target testing.

We are only able to advance this work because we have a very supportive board, a dedicated and driven team and the financial capacity to fund the programs we have planned. Currently, there is no value ascribed to our projects by the market and we have a market capitalisation well below cash backing, which is highly unusual. Given the high-quality pipeline of projects we are progressing and the opportunities they represent, I expect the balance of 2024 and beyond to represent exciting times for the Company.”

Click here for the full ASX Release

This article includes content from Metals Australia Ltd, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MLS:AU

Sign up to get your FREE

Metals Australia Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

02 July 2025

Metals Australia

High-quality graphite development project with an accelerated pathway to production, complemented by a diversified portfolio of critical, precious and base metals assets in tier-1 jurisdictions across Canada and Australia.

High-quality graphite development project with an accelerated pathway to production, complemented by a diversified portfolio of critical, precious and base metals assets in tier-1 jurisdictions across Canada and Australia. Keep Reading...

17 February

High Grade Assays Verify the Emerging Manindi VTM Project

Metals Australia (MLS:AU) has announced High Grade Assays Verify the Emerging Manindi VTM ProjectDownload the PDF here. Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Metals Australia (MLS:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Graphite Project Links to Quebec's Critical Minerals Plan

Metals Australia (MLS:AU) has announced Graphite Project Links to Quebec's Critical Minerals PlanDownload the PDF here. Keep Reading...

18 December 2025

High Copper Anomalies Show Deeper Potential at Warrego East

Metals Australia (MLS:AU) has announced High Copper Anomalies Show Deeper Potential at Warrego EastDownload the PDF here. Keep Reading...

16 December 2025

Titanium-Vanadium-Magnetite Discovery Extended over 1km

Metals Australia (MLS:AU) has announced Titanium-Vanadium-Magnetite Discovery Extended over 1kmDownload the PDF here. Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Sign up to get your FREE

Metals Australia Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00