April 30, 2025

Empire Metals (LON:EEE, OTCQB:EPMLF) is an exploration and resource development company focused on Australia, gaining global recognition for its discovery and swift advancement of what is believed to be the world’s largest titanium deposit.

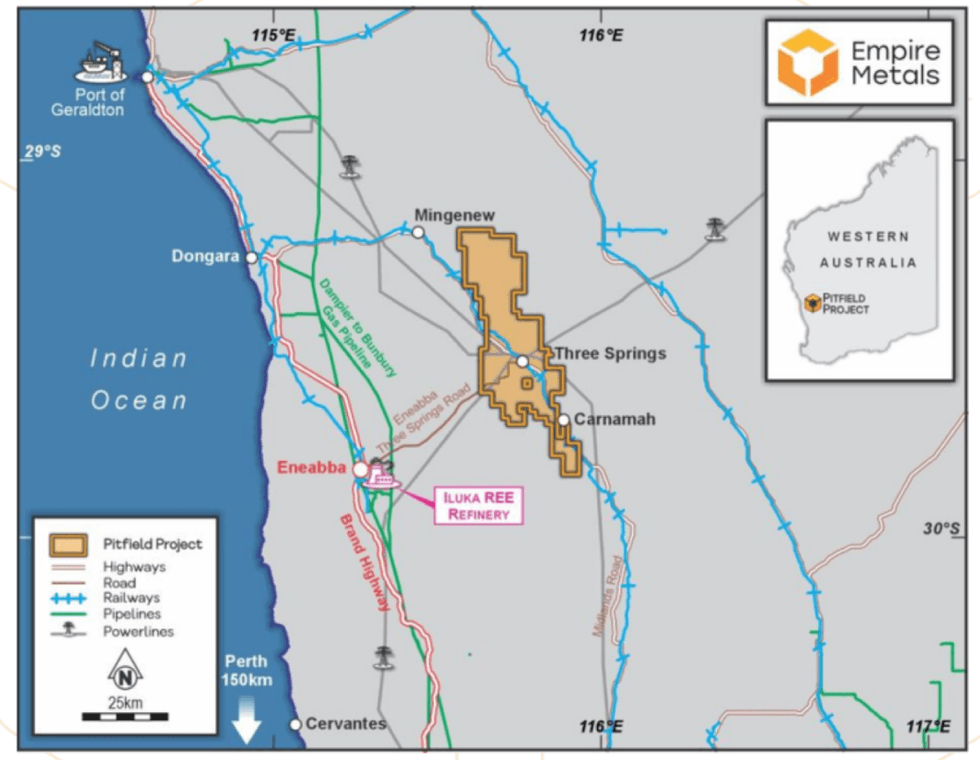

The company’s primary focus is the Pitfield project in Western Australia — a premier mining jurisdiction. With over 1,000 square kilometres of land and a titanium-rich mineral system extending 40 kilometres in strike length, Pitfield is shaping up to be a district-scale discovery with the potential to significantly influence the global titanium supply chain.

Pitfield’s prime location in Western Australia

Pitfield’s prime location in Western AustraliaEmpire’s focus on titanium comes at a pivotal time, as it is officially recognized as a critical mineral by both the EU and the US for its essential role in aerospace, defence, medical, clean energy, and advanced industrial applications. Demand for titanium dioxide — the most widely used form — is surging, while global supply is increasingly constrained by geopolitical risks, resource depletion, and environmental challenges. With over 60 percent of supply concentrated in countries like China and Russia, Western markets face growing vulnerabilities.

Company Highlights

- The flagship Pitfield project is the world’s largest known titanium discovery. It’s a district-scale “giant” titanium mineral system, characterised by high-grade, high-purity titanium mineralisation exhibiting exceptional continuity.

- Titanium is in a global supply deficit and recognized as a critical mineral by the EU and US.

- Drill intercepts at Pitfield include up to 202 meters at 6.32 percent titanium dioxide (TiO2) from surface, confirming vast scale and grade.

- Empire Metals operates in one of the world’s most secure, mining-friendly jurisdictions: Western Australia.

- The company is led by an experienced, agile team, with proven expertise in exploration, mine development, and value creation across multiple commodities.

- With a number of key development catalysts planned for 2025, including a maiden resource estimate, bulk sampling for scale-up of metallurgical testwork, and product optimisation, Empire remains significantly undervalued relative to its peers.

This Empire Metals profile is part of a paid investor education campaign.*

Click here to connect with Empire Metals (LON:EEE) to receive an Investor Presentation

EPMLF

Sign up to get your FREE

Empire Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

14 October 2025

Empire Metals

Advancing a game-changing, globally significant titanium project in Western Australia.

Advancing a game-changing, globally significant titanium project in Western Australia. Keep Reading...

27 January

Empire Metals Limited Announces Pitfield Project Development Update

LONDON, UNITED KINGDOM / ACCESS Newswire / January 27, 2026 / Empire Metals Limited (AIM:EEE)(OTCQX:EPMLF), the AIM-quoted and OTCQX-traded leading exploration and development company, is pleased to provide an update on the Pitfield titanium Project in Western Australia ('Pitfield' or the... Keep Reading...

30 December 2025

Empire Metals Limited Announces Conditional Sale of 75% of Eclipse Gold Project

LONDON, UNITED KINGDOM / ACCESS Newswire / December 30, 2025 / Empire Metals Limited (AIM:EEE)(OTCQX:EPMLF), the AIM-quoted and OTCQX-traded exploration and development company, is pleased to announce that it has entered into a conditional sale and purchase agreement for its 75% interest in the... Keep Reading...

01 December 2025

Empire to Present at the Precious Metals & Critical Minerals Virtual Investor Conference

Empire Metals Limited (AIM: EEE, OTCQX: EPMLF), announces that Greg Kuenzel (Finance Director) will present live at the Precious Metals & Critical Minerals Virtual Day Conference in partnership with OTC Markets and hosted by VirtualInvestorConferences.com, on December 4 th at 9am ET. The... Keep Reading...

13 November 2025

Empire Metals Limited Announces Appointment of Joint Corporate Broker

Empire Metals Limited, the AIM-quoted and OTCQX-traded exploration and development company, is pleased to announce the appointment of Canaccord Genuity Limited ("Canaccord") as joint corporate broker with immediate effect. Canaccord will work alongside S. P. Angel Corporate Finance LLP and Shard... Keep Reading...

13 November 2025

Empire Metals Limited Announces Appointment of Joint Corporate Broker

LONDON, UK / ACCESS Newswire / November 13, 2025 / Empire Metals Limited, the AIM-quoted and OTCQX-traded exploration and development company, is pleased to announce the appointment of Canaccord Genuity Limited ("Canaccord") as joint corporate broker with immediate effect. Canaccord will work... Keep Reading...

1h

Rio Tinto and Glencore Walk Away From Megamerger, but Mining M&A Marches On

The collapse of merger talks between Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) and Glencore (LSE:GLEN,OTCPL:GLCNF) has ended what would have been the mining industry’s largest-ever deal.The two companies confirmed last week that discussions over a potential US$260 billion combination had been... Keep Reading...

06 February

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data shows that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

Latest News

Sign up to get your FREE

Empire Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00