May 02, 2022

Auroch Minerals Limited (ASX:AOU) (Auroch or the Company) is pleased to advise that diamond drilling has commenced at the Company’s 100%-owned Leinster Nickel Project (Leinster) in Western Australia

Highlights

- Two hole diamond drill programme has commenced at the Leinster Nickel Project

- The programme is planned to test prospective geological positions and an off-hole down-hole electromagnetic (DHEM) conductor at the Woodwind and Brass Prospects for potential nickel sulphide mineralisation

- Drilling is expected to be completed within three weeks followed by DHEM surveys

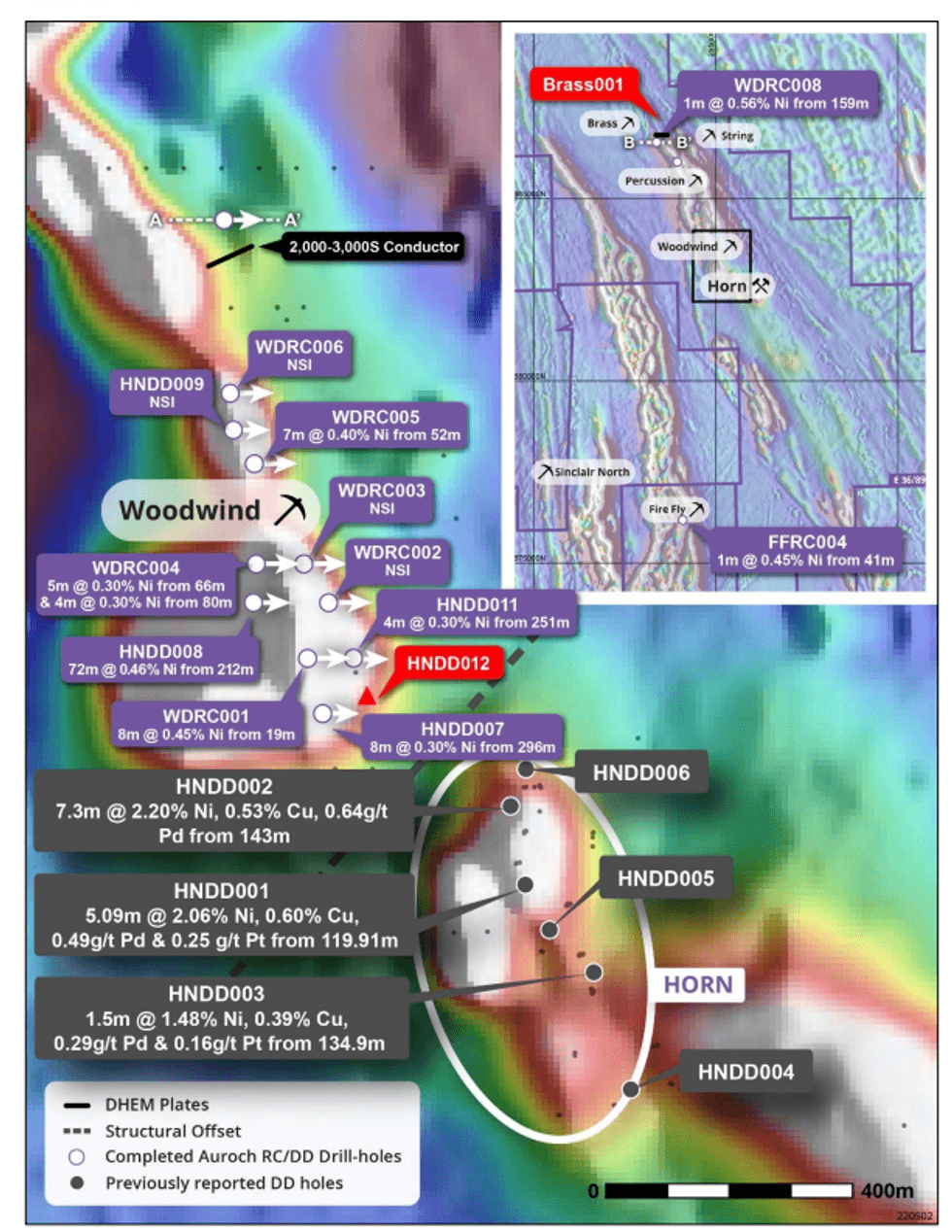

Drilling will comprise a two-hole programme to test nickel sulphide targets at the previously defined Brass and Woodwind Prospects. The drill-holes have been designed to test a DHEM conductor detected in the first phase of regional drilling at the Brass Prospect, as well as a potential structural offset or repetition of the massive nickel sulphides present at the Horn deposit on the eastern Woodwind Prospect.

Following on from the 2021 regional drill programmes, the Company aims to test the top ranked nickel sulphide targets identified in a recent technical review completed on the Leinster Nickel Project with external specialist consultants. At the Woodwind Prospect northwest of the Horn deposit, previous diamond drilling returned anomalous nickel intersections in multiple drill-holes, including the highly encouraging result of 72m @ 0.46% Ni from 212m in HNDD008 with cloud sulphide textures observed1 . Current drill-hole HNDD012 is planned to test a potential structural offset along strike northwest of the Horn Deposit, to the east of the Woodwind magnetic anomaly. The drill-hole will test for both the continuation of the overturned komatiite sequence and/or a potential repeat of the prospective stratigraphy through recumbent folding. The hole is planned to drill to approximately 400m, however the drill-hole maybe lengthened to test the lower komatiite-mafic contact.

At the Brass Prospect, an anomalous nickel result of 1m @ 0.56% Ni from 159m on a prospective basal ultramafic – basalt contact within WDRC008 is coincident with an off-hole DHEM conductor with a moderate to high conductance of 3,000-6,000S centred just north of the drill-hole1 . Proposed drillhole Brass001 will aim to intersect the three modelled plates between 195-220m depth to test for potential massive nickel sulphide mineralisation.

Auroch Managing Director Aidan Platel commented:

“The geological team are excited to have a diamond rig return to Leinster. Following the significant first pass results achieved in 2021, the team has conducted collaborative discussions with industry experts to help better understand the regional geology and mineralisation at the Horn and along strike.

The known sulphide mineralisation at the Horn is significant not only for its high-grade nickel content, but also for its elevated copper, cobalt and PGEs content as well its low magnesium to iron ratios.

The potential for similar nickel sulphide mineralisation to be discovered at Woodwind and Brass remains high and this programme will aim to test the top ranked targets.

” Seismic Drilling Australia are conducting the drill programme which is expected to be completed within three weeks, followed by logging, sampling and DHEM surveys of each hole.

Figure 1 – The Leinster Nickel Project showing the planned drilling in relation to the high-priority target areas and completed diamond and RC drill-hole collars and the aeromagnetic anomalies along trend from the Horn Prospec

Click here for the full ASX Release

This article includes content from Auroch Minerals Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AOU:AU

The Conversation (0)

23 September 2021

Auroch Minerals

Exploring High-Grade Nickel Sulfides in Western Australia

Exploring High-Grade Nickel Sulfides in Western Australia Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

22 December 2025

Nickel Price Forecast: Top Trends for Nickel in 2026

Nickel prices were stagnant in 2025, trading around US$15,000 per metric ton (MT) for much of the year.Weighing heavily on the metal was persistent oversupply from Indonesian operations. Meanwhile, sentiment remained weak amid soft demand growth from the construction and manufacturing sectors,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00