- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

October 20, 2024

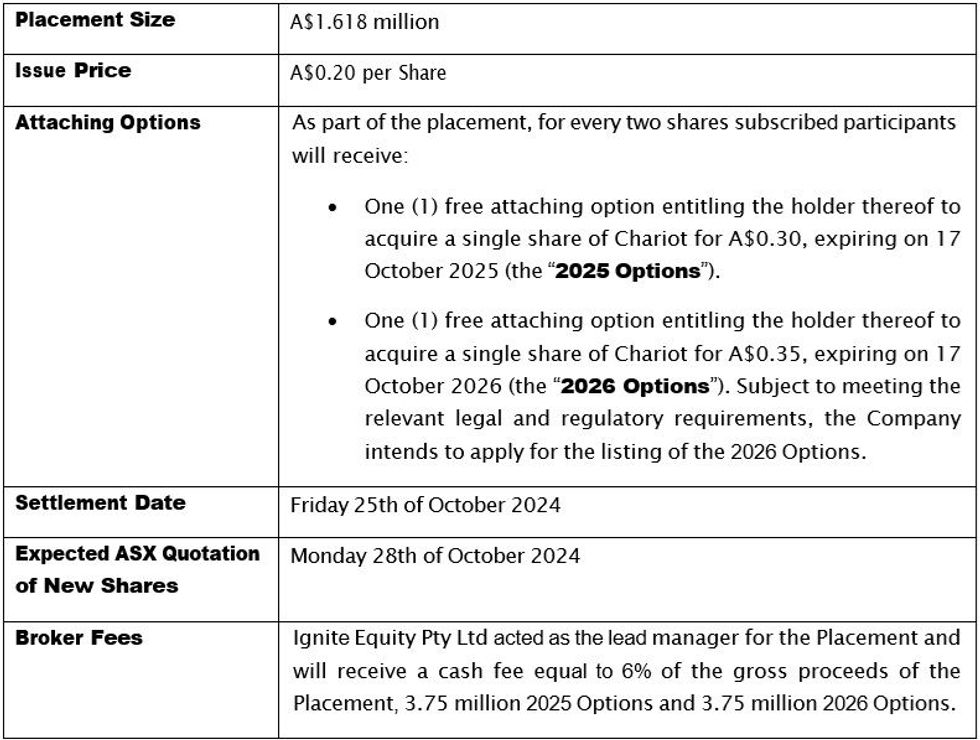

Chariot Corporation Limited (ASX:CC9) (“Chariot” or the “Company”) is pleased to announce that it has received firm commitments for a placement raising A$1.618 million (the “Placement”) before costs, though the issuance of approximately 8.09 million fully paid ordinary Chariot shares (“Shares”) at a price of A$0.20 per Share on the terms set out in this announcement.

HIGHLIGHTS:

- Successful Placement: Chariot has received firm commitments for a A$1.618 million placement of 8.09 million new shares at A$0.20 per share.

- Strong Investor Support: The placement was strongly backed by a group of institutional, sophisticated and professional investors with Ignite Equity Pty Ltd acting as lead manager.

- Directors’ Subscription: The Directors have subscribed for A$150,000 under the Placement (subject to shareholder approval at the next general meeting).

- Use of Placement Proceeds: The existing cash reserves combined with the proceeds of the placement will fund (i) phase 2 drilling at the Black Mountain Lithium Project, (ii) the 4th purchase price payment to Black Mountain Lithium Corp., one of the Black Mountain Project vendors, (iii) initial execution of the pilot mine strategy, including metallurgical testing in Perth and a scoping study for a pilot mine and general working capital.

- Upcoming Activities: Chariot is progressing with the phase 2 drilling program which seeks to define a maiden resource estimate to advance the pilot mine initiative at Black Mountain.

The placement was strongly supported by a group of institutional, sophisticated and professional investors, including existing shareholders and associates of Ignite Equity Pty Ltd, which acted as the lead manager for the placement.

Placement Terms

The placement terms are as follows:

Certain members of the Company’s Board of Directors have elected to subscribe for 750,000 shares, 375,000 2025 Options and 375,000 2026 Options. The issue of the shares and options under this Placement is subject to the approval of Chariot’s shareholders at the next general meeting.

Use of Proceeds

The Placement proceeds will be used to fund (i) phase 2 drilling at the Black Mountain Lithium Project, (ii) the 4th purchase price payment to Black Mountain Lithium Corp., one of the Black Mountain Project vendors, (iii) initial execution of the pilot mine strategy, including metallurgical testing in Perth and a scoping study for a pilot mine and general working capital.

Click here for the full ASX Release

This article includes content from Chariot Corporation, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CC9:AU

The Conversation (0)

07 February 2025

Chariot Corporation

Largest lithium exploration land holdings in the US

Largest lithium exploration land holdings in the US Keep Reading...

27 March 2025

Second Amendment to Black Mountain Purchase Option

Chariot Corporation (CC9:AU) has announced Second Amendment to Black Mountain Purchase OptionDownload the PDF here. Keep Reading...

26 March 2025

Convertible Note Financing of up to A$2.0 Million

Chariot Corporation (CC9:AU) has announced Convertible Note Financing of up to A$2.0 MillionDownload the PDF here. Keep Reading...

18 February 2025

High-Potential WA Lithium & Gold Tenements Secured

Chariot Corporation (CC9:AU) has announced High-Potential WA Lithium & Gold Tenements SecuredDownload the PDF here. Keep Reading...

31 January 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Chariot Corporation (CC9:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

26 November 2024

Black Mountain Phase 2 Program has Commenced

Chariot Corporation (CC9:AU) has announced Black Mountain Phase 2 Program has CommencedDownload the PDF here. Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00