- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

January 10, 2025

Boab Metals (ASX:BML) is a base and precious metals explorer and developer progressing toward a final investment decision (FID) on its Sorby Hills project, a world-class lead-silver deposit. Boab Metals is poised to capitalize on the rising demand for lead and silver, delivering value to shareholders and supporting the global transition to sustainable energy systems.

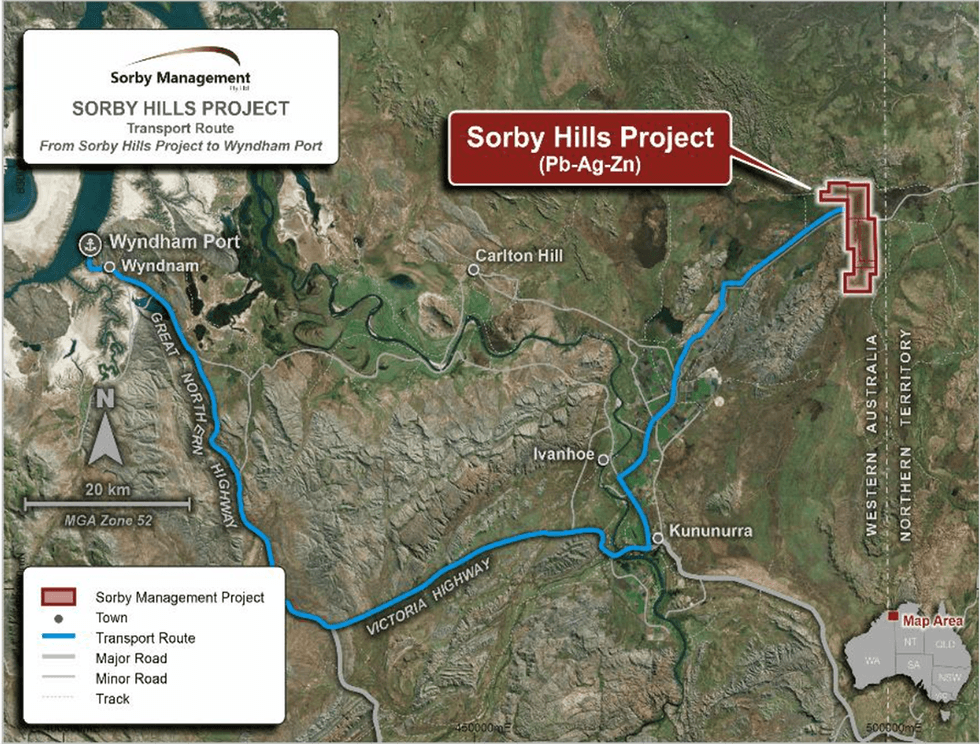

The Sorby Hills project is strategically located 150 km from Wyndham Port providing access to excellent infrastructure, and green power from the Ord River hydroelectric plant. Boab Metals combines technical expertise, sustainable practices, and robust financial planning to advance the Sorby Hills project, which is slated to produce high-grade lead-silver concentrate through conventional open-pit mining.

Boab Metals owns 75 percent of the Sorby Hills Project, with the remaining 25 percent held by Henan Yuguang Gold & Lead Co., China's largest lead smelting and silver producer. The project boasts a substantial, high-quality resource base of 47.3 million ton resource base at 4.3 percent lead equivalent (123 g/t silver equivalent), including 53 million ounces of contained silver, all with significant exploration upside.

Company Highlights

- Boab Metals is an ASX-listed base and precious metals explorer and developer with a flagship project poised for near-term production.

- The Sorby Hills project, Boab’s flagship asset, boasts a high-quality 47.3 Mt resource at 4.3 percent lead equivalent (123 g/t silver equivalent), including 53 Moz contained silver, and is in Western Australia, 50 km northeast of Kununurra.

- Strong economics underpin the project with an NPV (8 percent) of AU$411 million and an IRR of 37 percent, as confirmed by the completed FEED study. Life-of-mine operating cash flow of AU$1.1 billion with an average annual EBITDA of AU$126 million. Competitive C1 cash cost of US$0.36/lb payable lead (after considering silver credits).

- Binding offtake and prepayment agreements with Trafigura.

- Access to green hydroelectric power and existing environmental approvals enhance the project’s sustainability credentials and support reduced operational costs.

- Committed to community engagement, Boab Metals fosters strong relationships with local stakeholders and supports regional development initiatives.

- Expert leadership with a proven track record in exploration and development of mining assets

This Boab Metals profile is part of a paid investor education campaign.*

Click here to connect with Boab Metals (ASX:BML) to receive an Investor Presentation

BML:AU

The Conversation (0)

09 January 2025

Boab Metals Limited

Advancing toward near-term lead and silver production in Western Australia

Advancing toward near-term lead and silver production in Western Australia Keep Reading...

07 September 2025

Extension of Option to Acquire 100% of Sorby Hills

Boab Metals Limited (BML:AU) has announced Extension of Option to Acquire 100% of Sorby HillsDownload the PDF here. Keep Reading...

03 September 2025

EPBC Approval Granted for Sorby Hills

Boab Metals Limited (BML:AU) has announced EPBC Approval Granted for Sorby HillsDownload the PDF here. Keep Reading...

30 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Boab Metals Limited (BML:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

23 June 2025

Completion of Capital Raising

Boab Metals Limited (BML:AU) has announced Completion of Capital RaisingDownload the PDF here. Keep Reading...

16 June 2025

A$6 Million Placement to Advance the Sorby Hills Project

Boab Metals Limited (BML:AU) has announced A$6 Million Placement to Advance the Sorby Hills ProjectDownload the PDF here. Keep Reading...

27 February

Obonga Project: Wishbone VMS Update

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to provide an update for the Obonga Project's Wishbone Prospect which is an emerging and highly prospective base metal volcanogenic massive sulphide ("VMS") system in Ontario,... Keep Reading...

26 February

Agadir Melloul Mining Licence

Critical Mineral Resources is pleased to announce that a Mining Licence has been awarded for Agadir Melloul, marking an important step forward as the Company accelerates development towards production.The Mining License is 14.6km 2 and covers Zone 1 North and Zone 2, which remain the focus of... Keep Reading...

26 February

EIA Approval for Agdz Cu-Ag Project and Funding

Aterian plc (AIM: ATN), the Africa-focused critical metals exploration company, is pleased to announce the approval of it's recently commissioned Environmental Impact Assessment (''EIA'') for the 100%-owned Agdz Mining Licence, part of the Agdz ("Cu-Ag") Project ("Agdz" or the "Project") in the... Keep Reading...

25 February

Clem Chambers: I Sold My Gold and Silver, What I'm Buying Next

Clem Chambers, CEO of aNewFN.com, explains why he sold his gold and silver, and where he's looking next, mentioning the copper and oil sectors. He also speaks about the importance of staying positive as an investor: "The media negativity is the most wealth-crushing thing you can fall for. So be... Keep Reading...

25 February

What Was the Highest Price for Silver?

Like its sister metal gold, silver has been attracting renewed attention as a safe-haven asset. Although silver continues to exhibit its hallmark volatility, a silver bull market is well underway. Experts are optimistic about the future, and as the silver price's momentum continues in 2026,... Keep Reading...

23 February

Stefan Gleason: Silver Wakeup in the West — What's Happening, What's Next

Stefan Gleason, CEO of Money Metals, breaks down recent silver and gold dynamics, discussing trends in the US retail market, as well as backups at refineries. While the situation has begun to normalize, he sees potential for further disruptions in the future. Don't forget to follow us... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00