January 10, 2025

Boab Metals (ASX:BML) is a base and precious metals explorer and developer progressing toward a final investment decision (FID) on its Sorby Hills project, a world-class lead-silver deposit. Boab Metals is poised to capitalize on the rising demand for lead and silver, delivering value to shareholders and supporting the global transition to sustainable energy systems.

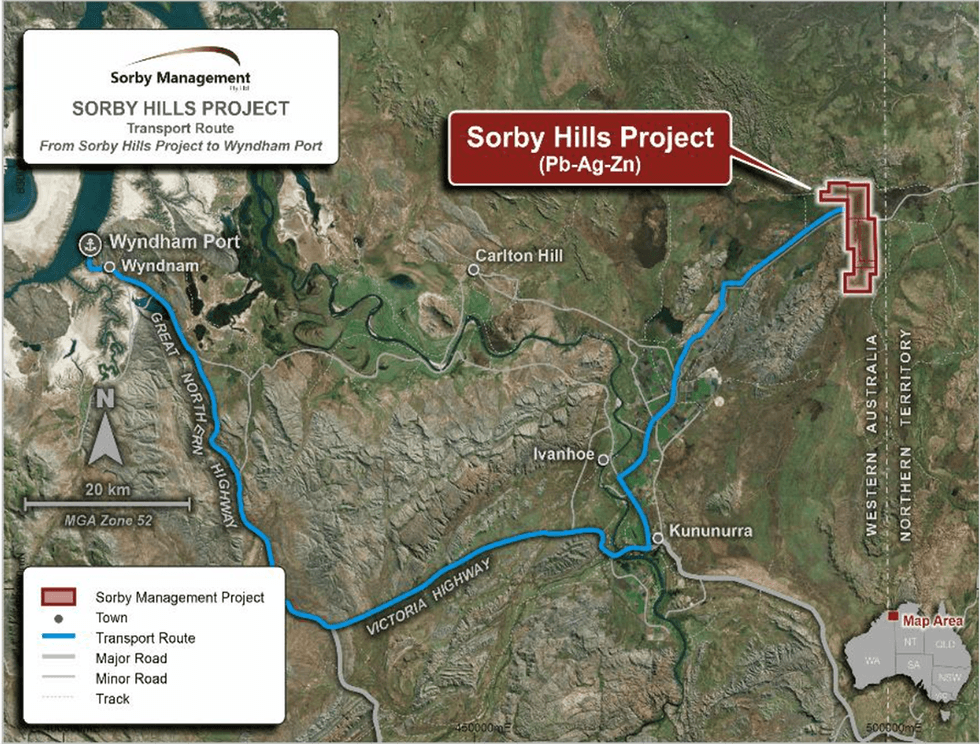

The Sorby Hills project is strategically located 150 km from Wyndham Port providing access to excellent infrastructure, and green power from the Ord River hydroelectric plant. Boab Metals combines technical expertise, sustainable practices, and robust financial planning to advance the Sorby Hills project, which is slated to produce high-grade lead-silver concentrate through conventional open-pit mining.

Boab Metals owns 75 percent of the Sorby Hills Project, with the remaining 25 percent held by Henan Yuguang Gold & Lead Co., China's largest lead smelting and silver producer. The project boasts a substantial, high-quality resource base of 47.3 million ton resource base at 4.3 percent lead equivalent (123 g/t silver equivalent), including 53 million ounces of contained silver, all with significant exploration upside.

Company Highlights

- Boab Metals is an ASX-listed base and precious metals explorer and developer with a flagship project poised for near-term production.

- The Sorby Hills project, Boab’s flagship asset, boasts a high-quality 47.3 Mt resource at 4.3 percent lead equivalent (123 g/t silver equivalent), including 53 Moz contained silver, and is in Western Australia, 50 km northeast of Kununurra.

- Strong economics underpin the project with an NPV (8 percent) of AU$411 million and an IRR of 37 percent, as confirmed by the completed FEED study. Life-of-mine operating cash flow of AU$1.1 billion with an average annual EBITDA of AU$126 million. Competitive C1 cash cost of US$0.36/lb payable lead (after considering silver credits).

- Binding offtake and prepayment agreements with Trafigura.

- Access to green hydroelectric power and existing environmental approvals enhance the project’s sustainability credentials and support reduced operational costs.

- Committed to community engagement, Boab Metals fosters strong relationships with local stakeholders and supports regional development initiatives.

- Expert leadership with a proven track record in exploration and development of mining assets

This Boab Metals profile is part of a paid investor education campaign.*

Click here to connect with Boab Metals (ASX:BML) to receive an Investor Presentation

BML:AU

The Conversation (0)

09 January 2025

Boab Metals Limited

Advancing toward near-term lead and silver production in Western Australia

Advancing toward near-term lead and silver production in Western Australia Keep Reading...

07 September 2025

Extension of Option to Acquire 100% of Sorby Hills

Boab Metals Limited (BML:AU) has announced Extension of Option to Acquire 100% of Sorby HillsDownload the PDF here. Keep Reading...

03 September 2025

EPBC Approval Granted for Sorby Hills

Boab Metals Limited (BML:AU) has announced EPBC Approval Granted for Sorby HillsDownload the PDF here. Keep Reading...

30 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Boab Metals Limited (BML:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

23 June 2025

Completion of Capital Raising

Boab Metals Limited (BML:AU) has announced Completion of Capital RaisingDownload the PDF here. Keep Reading...

16 June 2025

A$6 Million Placement to Advance the Sorby Hills Project

Boab Metals Limited (BML:AU) has announced A$6 Million Placement to Advance the Sorby Hills ProjectDownload the PDF here. Keep Reading...

17h

John Feneck: Gold, Silver to Retest Highs, "Don't Get Off the Horse"

John Feneck, portfolio manager and consultant at Feneck Consulting, explains why he expects gold and silver prices to retest January's highs, noting that he sees investors beginning to rotate away from the tech sector and toward commodities. "My suggestion is don't get off the horse, right?" he... Keep Reading...

17h

Silver Stocks: 5 Biggest Silver-mining Companies in 2026

Silver mining companies are being supported by a silver price bull run in 2026. After climbing through 2025, silver broke its all-time high set in 1980 in October before reaching a new high of US$121.62 per ounce on January 29.The factors driving the metal's rise remain, most notably tightening... Keep Reading...

18h

Brixton Metals Targets High-grade Silver and Copper in BC and Ontario

Brixton Metals (TSXV:BBB,OTCQB:BBBXF) Chairman, CEO, President and Director Gary Thompson revealed that following drilling commencement at Langis, the company is seeking to advance all its assets. Its flagship project, Thorn, is located in Northwest BC, and assays from recent sampling returned... Keep Reading...

09 March

ASX Silver Stocks: 5 Biggest Companies in 2026

The silver price rose to new highs this year, breaking well above its previous record set in 1980, as strong safe-haven demand for precious metals aligned with tightening supply.Over the years, silver supply has tightened alongside broadening industrial use, particularly in electronics and for... Keep Reading...

09 March

Silver Hammer Mining: Fully Financed for 2026 Exploration Program in Idaho and Nevada

Silver Hammer Mining (CSE:HAMR,OTCPL:HAMRF) President, CEO and Director Peter Ball outlined the company’s key objectives in 2026 following its successful closing of a C$3,913,617 non-brokered private placement.The company said it will first focus on evaluating results from the Silverton project... Keep Reading...

09 March

Nine Mile Metals: Unlocking High-grade Copper at Bathurst Mining Camp Projects

Nine Mile Metals (CSE:NINE,OTCQB:STVGF) is moving toward extensive drilling at its exploration portfolio following a recently completed placement of C$4 million and a new high-grade lens of 13.71 percent copper equivalent over 15.1 meters at its flagship Nine Mile Brook project at the Bathurst... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00