July 15, 2024

Prismo Metals Inc. (the "Company") (CSE:PRIZ)(OTCQB:PMOMF)(FSE:7KU) is pleased to announce that it has received permit approval from the Bureau of Land Management ("BLM") for ten drill pads, at the Hot Breccia copper project in Southern Arizona.

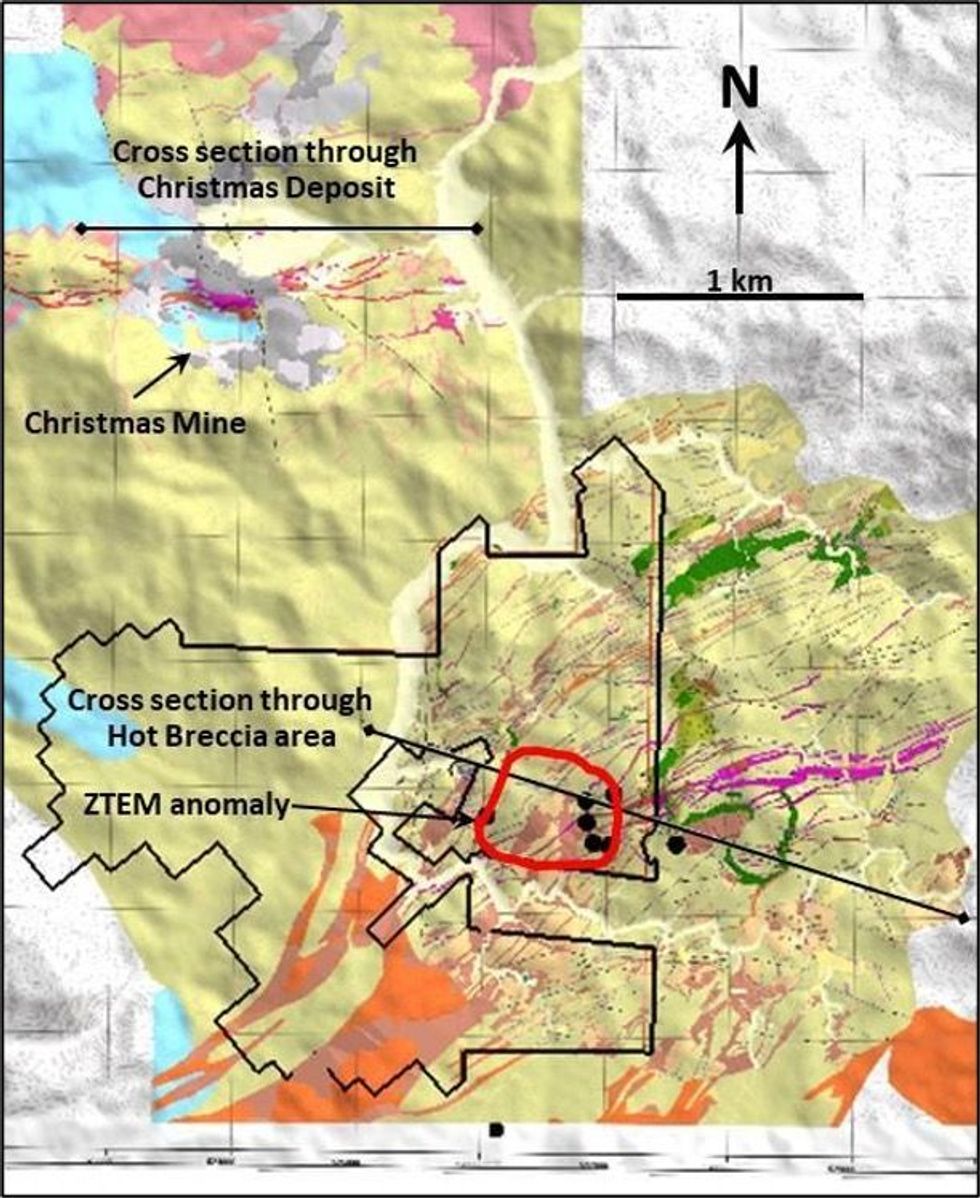

The drill pads will allow for drilling to test the prospective stratigraphy below the cover volcanic rock over a wide area, and in particular the large conductive anomaly identified by Prismo's 2023 ZTEM survey. Ground mapping, prospecting and sampling conducted earlier this year has supported the targeting process and target selection.

A bond has been posted with the Bureau of Land Management as the final step required before proceeding. Preparatory work in advance of drilling will be expedited by Prismo through the utilization of existing road infrastructure built in the 1970's, which requires only minor repair and maintenance. Upon confirmation and acceptance of the bond by BLM, road upkeep and maintenance will start to enable drilling to commence in Q3 2024.

Steve Robertson, President, commented "Getting the permit approval to proceed with this important drill program is a defining event for Prismo Metals as it marks the first time in five decades that exploration on this attractive target can be activated on a property where historical drillings reported several copper intercepts that exceeded 1% copper and elevated zinc .This 5,000-metre program will provide critical information on the vectoring needed to lead us to the heart of the yet another mineralizing system in one of the most prolific copper districts on the planet."

The Company has established a budget of $3.0 million to complete the proposed five drill hole, 5,000 metre program. Each drill hole is intended to drill through the entire Paleozoic carbonate stratigraphy and Prismo anticipates 1,000 metres per drill hole although the exploration team will take advantage of the geological information provided by each drill hole to determine if any holes require extended drilling.

Robertson added "The most recent exploration of this mineralized target was over 50 years ago. Since then, discovery of one of the world's most significant copper deposits 40 km away at Resolution has changed the "Art of the Possible" for exploration in the region. This amplifies our eagerness to initiate drilling in order to continue advancement of the exploration process."

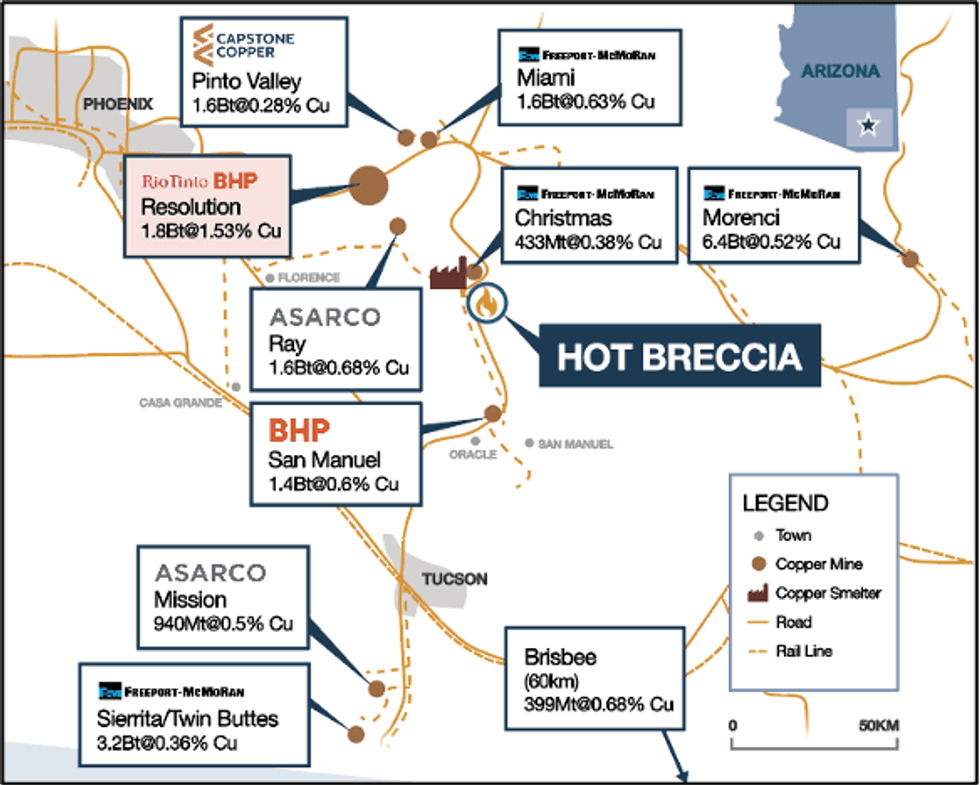

Figure 1. Location ofthe Hot Breccia Project in the Arizona Copper Belt.

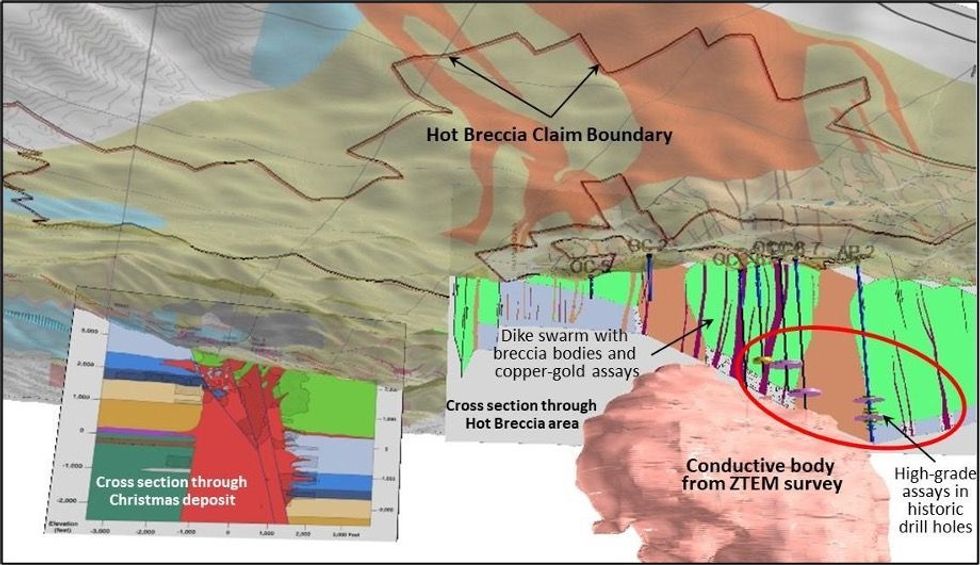

Figure 2.View of the subsurface looking northeasterly showing the conductive body from the ZTEM survey and cross sections of the Christmas deposit and the Hot Breccia area. Historic drill holes are shown with copper assays as disks within the red ellipse; the magenta color indicates > 1% Copper.

About Hot Breccia

The Hot Breccia property consists of 1,420 hectares 227 contiguous mining claims located in the world class Arizona Copper Belt between several very well understood world-class copper mines including Morenci, Ray and Resolution. (Figure 1) Hot Breccia shows many features in common with these neighboring systems, most prominently a swarm of porphyry dikes and series of breccia pipes containing numerous fragments of well copper-mineralized rocks mixed with fragments of volcanic and sedimentary derived from considerable depth. Prismo ran a ZTEM survey last year that identified a very large conductive anomaly directly beneath the breccia outcrops.

Sampling at the project has shown the presence of copper mineralization associated with polymictic breccia that has brought fragments of sedimentary rocks and mineralization to the surface from depths believed to be 400-1,000 meters below the surface, so drilling of deep holes, possibly including a twin of an historic hole, is planned.

Figure 3. Plan view of the surface geology showing the hot breccia land boundary in black and the cross sections from Fig. 2. The surface projection of the conductive body shown in Fig. 2 is roughly outlined in red.

Assay results from historic drill holes are unverified as the core has been destroyed, but information has been gathered from memos, photos and drill logs that contain some, but not all, of the assay results and descriptions.

QA/QC

Dr. Craig Gibson, PhD., CPG., a Qualified Person as defined by NI-43-01 regulations and Chief Exploration Officer and a director of the Company, has reviewed and approved the technical disclosures in this news release.

About Prismo Metals Inc.

Prismo (CSE:PRIZ) is mining exploration company focused on two precious metal projects in Mexico (Palos Verdes and Los Pavitos) and a copper project in Arizona (Hot Breccia).

Please follow @PrismoMetals on Twitter, Facebook, LinkedIn, Instagram, and YouTube

Prismo Metals Inc.

1100 - 1111 Melville St., Vancouver, British Columbia V6E 3V6

Contact:

Alain Lambert, Chief Executive Officer alambert@cpvcgroup.ca

Steve Robertson, President steve.robertson@prismometals.com

Jason Frame, Manager of Communications jason.frame@prismometals.com

Neither the Canadian Securities Exchange nor its Market Regulator (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as "intends" or "anticipates", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "should", "would" or "occur". This information and these statements, referred to herein as "forward‐looking statements", are not historical facts, are made as of the date of this news release and include without limitation, statements regarding discussions of future plans, estimates and forecasts and statements as to management's expectations and intentions with respect to, among other things: the timing, costs and results of drilling at Hot Breccia.

These forward‐looking statements involve numerous risks and uncertainties, and actual results might differ materially from results suggested in any forward-looking statements. These risks and uncertainties include, among other things: delays in obtaining or failure to obtain appropriate funding to finance the exploration program at Hot Breccia.

In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, that: the ability to raise capital to fund the drilling campaign at Hot Breccia and the timing of such drilling campaign.

Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws. We seek safe harbor.

silver-explorationsilver-investingcse-prizcopper-investinggold-investinggold-stockssilver-stockscse-stocks

PRIZ:CNX

Sign up to get your FREE

Prismo Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

14 October 2025

Prismo Metals

Advancing high-grade silver and copper discoveries in Arizona’s Copper Belt

Advancing high-grade silver and copper discoveries in Arizona’s Copper Belt Keep Reading...

06 February

After Major Gold Payout, Bian Ximing Turns Bearish Sights on Silver

A Chinese billionaire trader known for profiting from gold’s multi-year rally has turned sharply bearish on silver, building a short position now worth nearly US$300 million as prices slide.Bian Ximing, who earned billions riding gold’s multi-year rally and later turned aggressively bullish on... Keep Reading...

03 February

Silver Supply Tight, Demand Rising — What's Next? First Majestic's Mani Alkhafaji

Mani Alkhafaji, president of First Majestic Silver (TSX:AG,NYSE:AG), discusses silver supply, demand and price dynamics, as well as how the company is positioning for 2026.He also shares his thoughts on when silver stocks may catch up to the silver price: "You've got to give it a couple of... Keep Reading...

03 February

Rio Silver’s Path to Near-Term Cashflow

Rio Silver (TSXV:RYO,OTCPL:RYOOF) President and CEO Chris Verrico outlines the company’s transition into a pure-play silver developer. With the silver price reaching historic highs, Rio Silver is capitalizing on its strategic position in Peru — the world’s second largest silver producer — to... Keep Reading...

02 February

When Will Silver Stocks Catch Up to the Silver Price?

The silver price remains historically high despite a recent pullback, and many silver stocks haven't kept pace. Silver's strong performance over the past year is the result of a perfect storm of factors, including an entrenched supply deficit, growing industrial demand, a weakening US dollar and... Keep Reading...

Latest News

Sign up to get your FREE

Prismo Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00