September 22, 2024

Cobre Limited (ASX: CBE, Cobre or Company) is pleased to announce that it has executed a letter of intent to negotiate exclusively with a wholly owned subsidiary of BHP Group Ltd (BHP) for a material earn-in joint venture agreement over Cobre's Kitlanya West and East Copper Projects (Kitlanya Projects), located on the northern and southern basin margins of the Kalahari Copper Belt in Botswana (Proposed Transaction). The Proposed Transaction follows on from Cobre's successful participation in the BHP Xplor program which also provided funding for the recently completed seismic survey on the Kitlanya West project (see ASX announcements of 23 January 2024 and 22 August 2024)

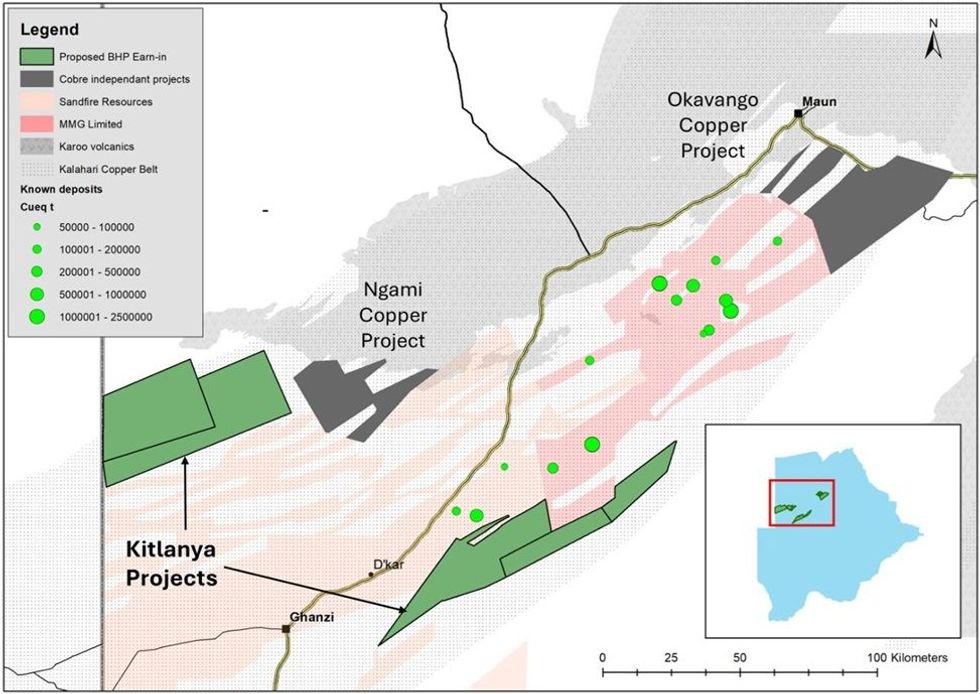

The Proposed Transaction underscores Cobre's confidence in the potential for its projects to host Tier 1 copper-silver deposits. A partnership with BHP would provide the exploration scale and expertise to maximise our chances of making significant new discoveries on our basin margin exploration ground while retaining 100% ownership of our Ngami and Okavango Copper Projects which are excluded from the Proposed Transaction.

The Proposed Transaction is subject to approval and execution of formal binding documents (Definitive Agreements) and the completion of BHP's due diligence investigations within the exclusivity period. Final details of the Proposed Transaction will be released to the market following completion of the long-form documents.

Commenting on the Proposed Transaction, Adam Wooldridge, Cobre’s Chief Executive Officer, said:

“Successful negotiation and completion of this significant transaction with BHP, one of the world’s leading mining companies, will be a major moment in time for Cobre as a company. Participating in the BHP 2024 Xplor cohort has provided the opportunity to do a belt scale review of the Kalahari Copper Belt, culminating with the collection of seismic data over the prospective northern margin of the belt. The Proposed Transaction with BHP would allow us to fully fund our follow-on exploration programmes and focus on discovering the Tier 1 deposits we believe may be hosted in our Kitlanya West and East Projects.

Independently, Cobre will continue advancing its 100% owned in-situ copper recovery development at Ngami – with a scoping study due in early October - along with further drilling at Cobre’s 100% owned Okavango project. This combined strategy provides exposure to potential Tier 1 discoveries, a development opportunity at Ngami and short-term discoveries on our Okavango project.”

A locality map illustrating the project locations is provided in Figure 1.

Cobre will continue to provide shareholders with further updates on material developments in respect of the Proposed Transaction.

This ASX release was authorised on behalf of the Cobre Board by: Adam Wooldridge, Chief Executive Officer.

Click here for the full ASX Release

This article includes content from Cobre Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

18h

BHP: Targeted AI Platforms Boost Efficiency, Safety and More

Modern society has a metals problem. The demands of modern consumer culture, the energy transition and the emergence of artificial intelligence (AI) and robotics have created a dilemma.As demand rises, the supply of many metals is at a bottleneck brought about by a number of factors, from... Keep Reading...

04 March

Teck VP Highlights China's Major Role in Evolving Copper Markets

Copper prices have surged since the middle of 2025, as tariffs, rising demand and supply disruptions came together to create the perfect storm for metals traders.These factors are helping raise awareness of the challenges copper producers will face in the coming years, as supply deficits are... Keep Reading...

04 March

VIDEO - BTV Visits Atlas Salt, Graphene Manufacturing, Telescope Innovations, Nevada Organic Phosphate, Maple Gold, Intrepid Metals and Nine Mile Metals

Watch on BNN Bloomberg nationalWednesday, March 4 at 7:30 PM EST & Saturday, March 7 at 8 PM EST Tune into BTV and Discover Investment Opportunities. As the resource cycle accelerates, BTV Business Television highlights companies turning exploration, innovation and strategic growth into... Keep Reading...

03 March

Hudbay to Acquire Arizona Sonoran, Creating North America’s Third Largest Copper District

Hudbay Minerals (TSX:HBM,NYSE:HBM) is doubling down on Arizona, striking a deal to acquire Arizona Sonoran Copper Company in a transaction that would create North America’s third-largest copper district.The deal gives Hudbay 100 percent ownership of the Cactus project in southern Arizona, adding... Keep Reading...

03 March

Top 10 Copper Producers by Country

In 2025, supply disruptions highlighted a growing concern as copper mines in the top copper-producing countries were aging without new mines to replace them.Additionally, copper demand from electrification is expected to rise significantly in the coming years.The competing forces of the global... Keep Reading...

02 March

Nine Mile Metals Announces Phase 1 Bulk Sample Update at Nine Mile Brook High Grade Lens of 13.71% CuEq over 15.10m

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce that it is conducting Bulk Sample Metallurgical Analysis on the Nine Mile Brook VMS High Grade Lens with SGS Canada and Glencore Canada. Glencore and SGS will be... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00