- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

July 23, 2023

GTI Energy Ltd (ASX: GTR) (GTI or Company) is pleased to advise that the data acquisition phase has been completed for the Company’s airborne geophysical surveys at its Lo Herma, Green Mountain and Loki West, ISR uranium exploration project areas in Wyoming. The survey was conducted using a twin- engine aircraft loaded with a suite of sensors that provide detailed radiometric, magnetic and electromagnetic data, allowing for correlation between the three products to further refine the Company’s high-priority targets and potentially locate new targets for upcoming drill programs.

- Aerial geophysics data acquisition completed

- Final report & imaging due September 2023

- AU$490,000 exploration drilling bond returned by the State of Wyoming LQD

The preliminary geophysical images require further processing, and any additional interpreted zones of radiometric anomalism will require corroboration by field exploration work including drilling. The final report and interpretations are expected to be available during September at which point the Company expects to provide an update.

EXPLORATION DRILLING BOND RETURN

Wyoming’s Department of Environmental Quality’s Land Quality Division (LQD) had advised that, after inspection of the Company’s drill hole reclamation and abandonment efforts at the Thor project area, drilling bonds of US$332,587.50 (AU$489,099 based on an exchange rate of US68¢per AU$1) were approved for release back to the Company.

GTI ENERGY LTD – PROJECT PORTFOLIO

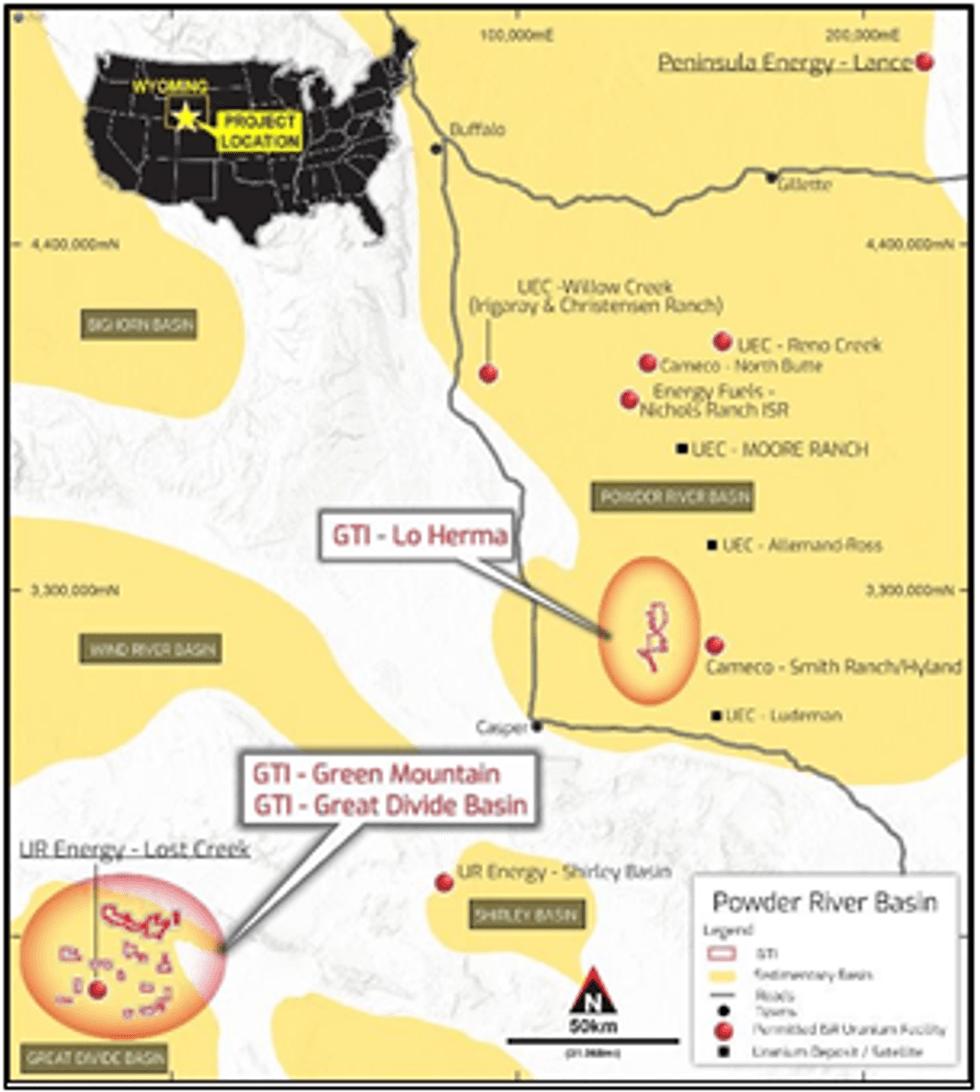

POWDER RIVER BASIN, ISR URANIUM, WYOMING, USA

GTI holds 100% of ~13,300 acres (~5,400 hectares) over a group of strategically located mineral lode claims (Claims) & 3.5 state leases (Leases) highly prospective for sandstone hosted uranium. The Lo Herma Project (Lo Herma) is located in Converse County, Powder River Basin, Wyoming. The project lies approximately ~15 miles north of Glenrock and within ~60 miles of 5 permitted ISR uranium production facilities & several satellite ISR uranium deposits. These facilities include UEC’s Willow Creek (Irigaray & Reno creek) ISR plant, Cameco’s Smith & Hyland Ranch ISR plants and Nichols Ranch ISR plant owned by Energy Fuels Inc. The Powder River Basin has an extensive ISR uranium production history and has been the backbone of the Wyoming uranium production business since the 1970s.

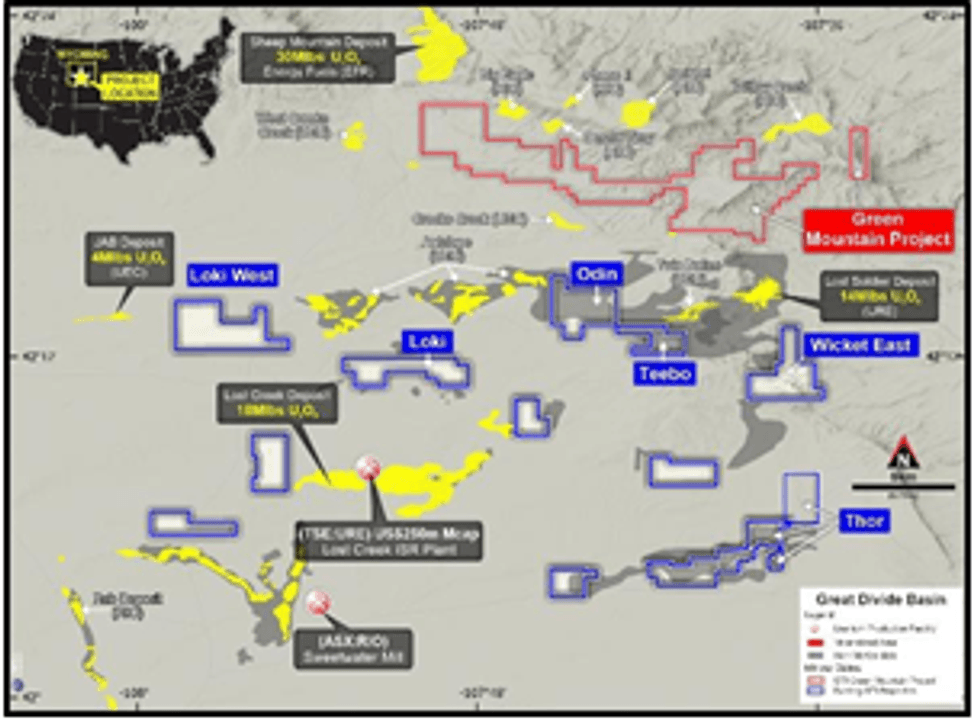

GREAT DIVIDE BASIN & GREEN MOUNTAIN ISR URANIUM, WYOMING, USA

GTI Energy holds 100% of ~34,000 acres (~13,500 hectares) over several groups of strategically located and underexplored mineral lode claims (Claims) & 2 state leases (Leases), prospective for sandstone hosted uranium that is amenable to low cost, low environmental impact ISR mining. The properties are located in the Great Divide Basin (GDB) and at Green Mountain1, Wyoming, USA. The properties are located in proximity to UR-Energy’s (URE) operating Lost Creek ISR Facility the GDB roll front REDOX boundary. The Green Mountain Project contains a number of uranium mineralised roll fronts hosted in the Battle Springs formation near several major uranium deposits held by Rio Tinto.

Click here for the full ASX Release

This article includes content from GTI Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GTR:AU

Sign up to get your FREE

American Uranium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

15 December 2025

American Uranium

Disrupting the uranium supply chain through highly prospective ISR projects in Wyoming

Disrupting the uranium supply chain through highly prospective ISR projects in Wyoming Keep Reading...

11 August 2025

Snow Lake Completes Due Diligence and Confirms Placement

GTI Energy (GTR:AU) has announced Snow Lake Completes Due Diligence and Confirms PlacementDownload the PDF here. Keep Reading...

28 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

GTI Energy (GTR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

23 July 2025

Lo Herma Drilling Permit & Contract Confirmed

GTI Energy (GTR:AU) has announced Lo Herma Drilling Permit & Contract ConfirmedDownload the PDF here. Keep Reading...

14 July 2025

Company Update - Name Change to 'American Uranium Limited'

GTI Energy (GTR:AU) has announced Company Update - Name Change to 'American Uranium Limited'Download the PDF here. Keep Reading...

10 July 2025

Placement Shares Issued & Drilling Approval Expected August

GTI Energy (GTR:AU) has announced Placement Shares Issued & Drilling Approval Expected AugustDownload the PDF here. Keep Reading...

23h

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Basin Energy Eyes Uranium Growth in Europe After Sweden Policy Shift

Basin Energy (ASX:BSN) is positioning for growth following Sweden’s significant shift in uranium policy, a move the company’s managing director, Pete Moorhouse, says has major implications not only for the company, but also for Europe’s broader energy strategy. In an interview with the Investing... Keep Reading...

27 January

American Uranium Exec Outlines Lo Herma ISR Progress, Resource Update

American Uranium (ASX:AMU,OTCID:AMUIF) Executive Director Bruce Lane says recent test work at the company’s Lo Herma uranium project in Wyoming has delivered an important proof of concept for its in situ recovery (ISR) development plans. The testing focused on validating aquifer performance, a... Keep Reading...

Latest News

Sign up to get your FREE

American Uranium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00