- WORLD EDITIONAustraliaNorth AmericaWorld

April 26, 2022

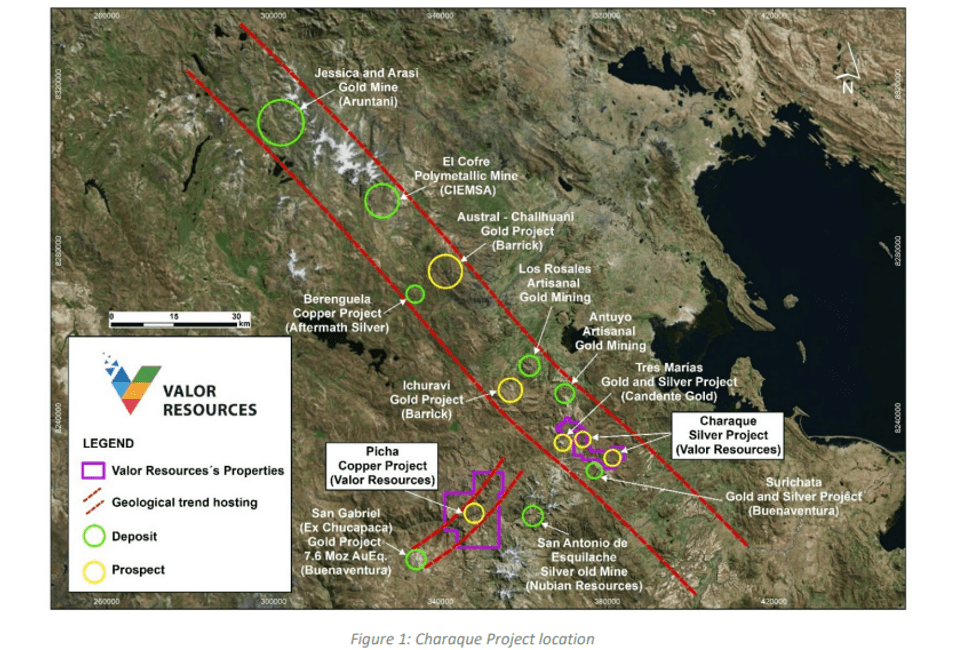

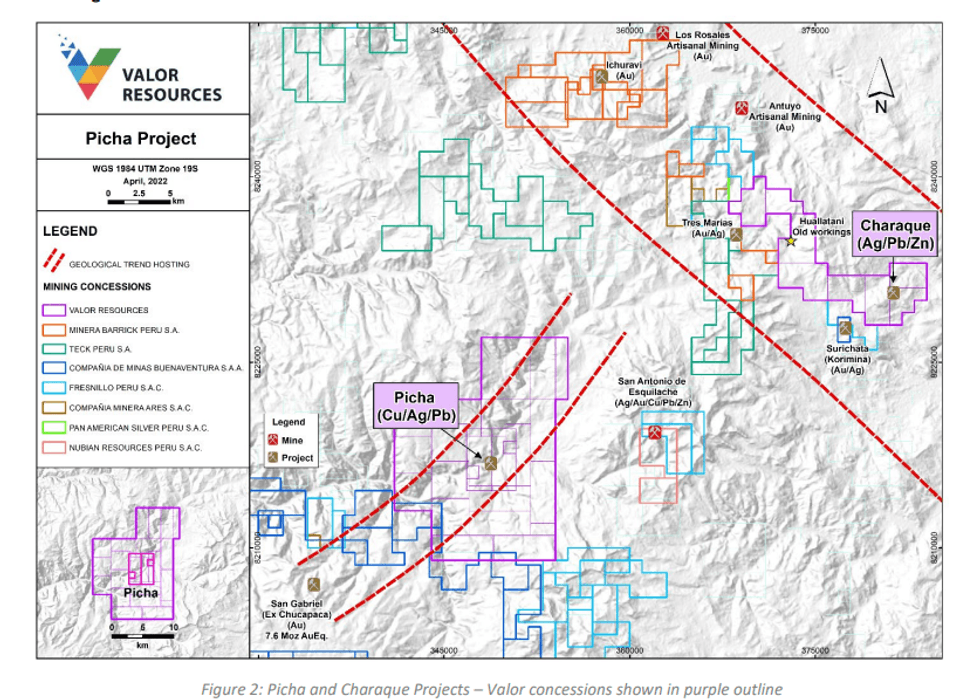

Valor Resources Limited (“Valor” or the “Company”) is pleased to announce that it has applied for additional tenure in an area located approximately 30km northeast of the Picha Project. The eight new concessions cover an area of approximately 6,000 hectares or 60km2 . The new project, to be titled Charaque Project, lies along a regional northwest-southeast geological trend which encompasses several deposits, including the Arasi and Jessica Gold mines (owned by Aruntani), the El Cofre polymetallic mine (owned by CIEMSA), Barrick’s Austral-Challhuani gold project and other prospects and historical mine workings.

HIGHLIGHTS

- New tenure applied for comprising around 6,000 hectares or 60km2 – Charaque Project

- Located along a regional northwest-southeast geological trend hosting several deposits and prospects

- Historical workings over an area 1km long, believed to have been mined some 500+ years ago

- Located 30km to the northeast of the Picha Project

Valor Executive Chairman Mr George Bauk comments, “Given the strength of the results coming from our exploration program to date at Picha, we have expanded our land holding within 30km of our existing project. It lies within a regional geological trend hosting a number of existing deposits and an area that has exploration underway. Secondly, the concessions we have applied for have historical mining on them which dates back over 500 years” (see Figure 4 below).

“This project compliments our Picha Project and provides the Company with an outstanding portfolio of projects in this highly prospective area. In the past few weeks, we have seen mining approvals for the San Gabriel Project (owned by Buenaventura) which is located within 10km south west of our Picha project.

Click here for the full ASX Release

This article includes content from Valor Resources Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

VAL:AU

The Conversation (0)

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

23 February

Basin Energy Hits 1,112 ppm TREO, Fast Tracks 2026 Uranium and REE Strategy at Sybella-Barkly

Basin Energy (ASX:BSN) is moving to accelerate its 2026 exploration efforts following "exciting" results from its maiden drilling program at the Sybella-Barkly project in Queensland. In a recent interview, Managing Director Pete Moorhouse revealed that the company has confirmed a significant... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00