- WORLD EDITIONAustraliaNorth AmericaWorld

April 18, 2023

Valor on track to earn 80 % interest in highly prospective Canadian project

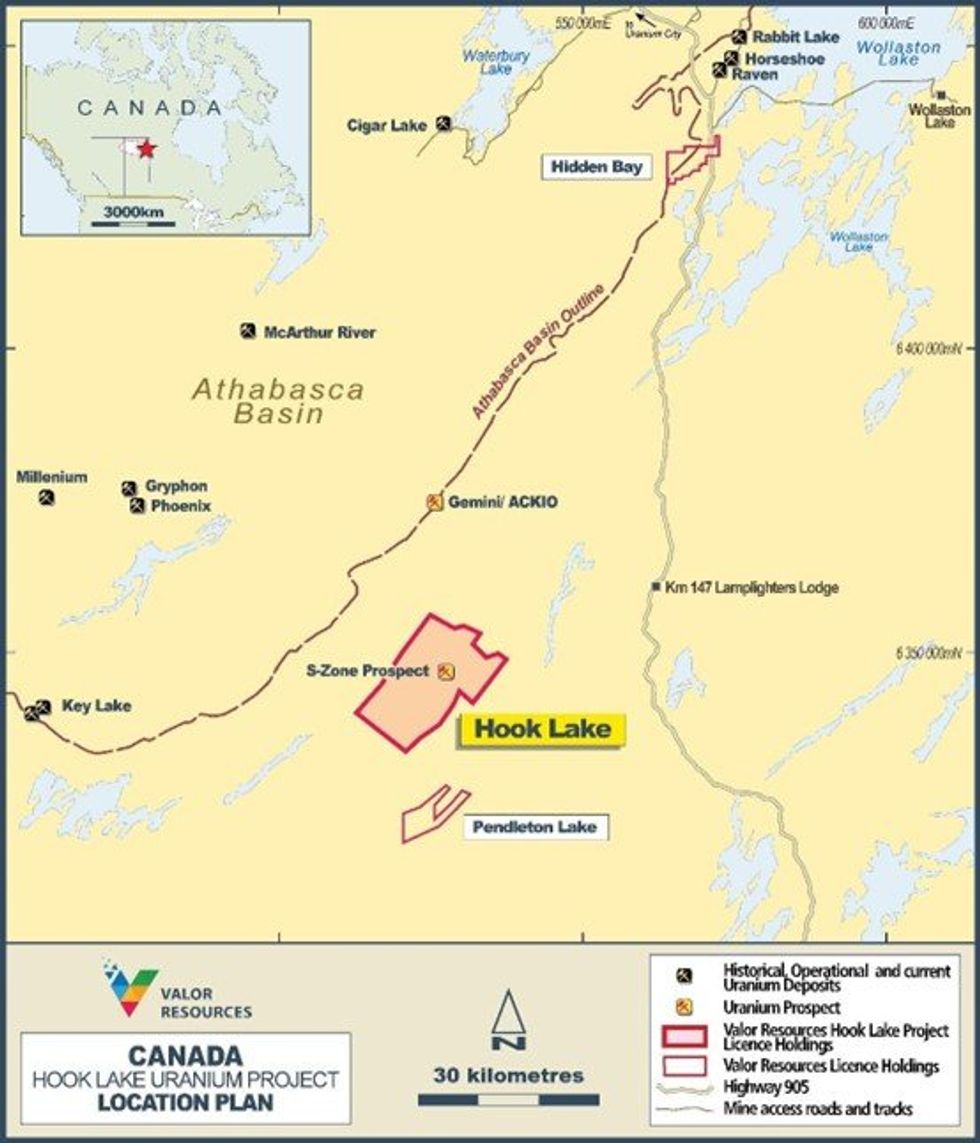

Valor Resources Limited (Valor) or (the Company) (ASX: VAL) is pleased to advise that it has completed the second anniversary payment to Skyharbour Resources Limited (TSXV: SYH) under its farm-in agreement at the Hook Lake Uranium Project located in northern Saskatchewan, Canada.

HIGHLIGHTS

- Valor has completed expenditure requirements totalling $3.5 million to date.

- Second Anniversary Payment has now been completed, comprising cash and shares.

- 80% interest to be completed following the final payment in February 2024.

Under revised terms negotiated with Skyharbour, Valor will issue SkyHarbour 30,000,000 shares and make a C$50,000 cash payment to complete the second earn-in milestone, with C$5,000 to be paid immediately and the balance within 60 days of this announcement.

Valor has also completed its expenditure commitments under the earn-in, being C$3.5 million over a 3-year period. Following the drill campaign completed in 2022, together with the airborne gravity survey completed last year, the Company has met its exploration expenditure commitments under the agreement.

The final payment of C$175,000, due in February 2024, is the last hurdle before the Company earns its 80% interest in the Hook Lake Project.

Valor Executive Chairman, George Bauk, said: “This part of the Athabasca Basin continues to be a focus of significant uranium exploration activity, particularly since the recent discoveries by 92 Energy (ASX:92E) and Baselode Energy (TSXV: FIND) at Gemini and ACKIO, located just 30km to the north of Hook Lake.

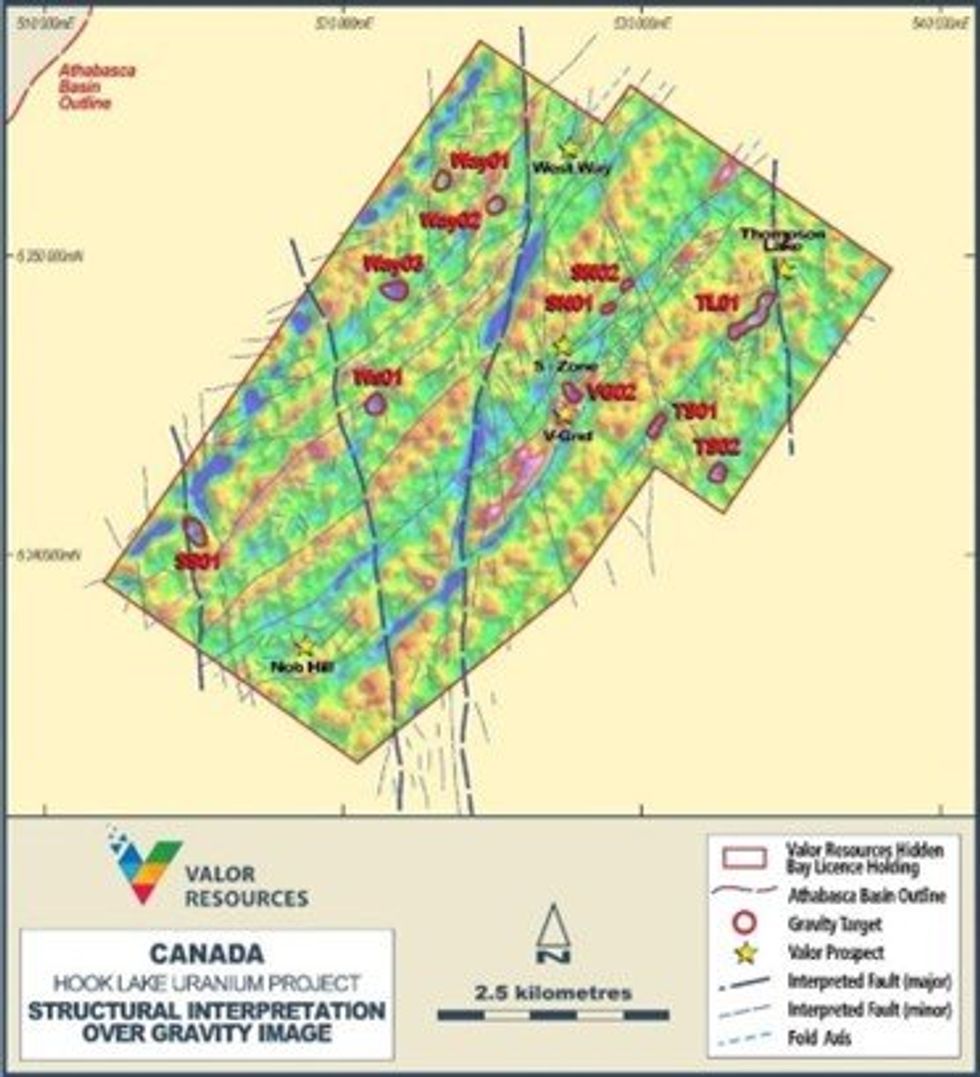

“The Hook Lake Project has a large number of prospective targets identified by last year’s airborne gravity survey (see announcement on 21 September 2022 titled “Eleven new targets in the Athabasca Basin uncovered through modern exploration surveys”). Work has been completed in 2022 to review all of the newly-acquired exploration data resulting in confirmation of a number of priority targets that will continue to be worked up to drill target status.

"The most significant of the 11 targets include V-Grid, West Way (-1, -2, -3) and Thompson Lake, where gravity lows have been identified and are near coincident with uranium radiometric anomalies or north-south Tabbernor fault structures, as shown in Figure 2 below.”

This announcement has been authorised for release by the Board of Directors.

Click here for the full ASX Release

This article includes content from Valor Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

VAL:AU

The Conversation (0)

04 March

Cameco Signs US$2.6 Billion Uranium Deal With India to Fuel Nuclear Expansion

Cameco (TSX:CCO,NYSE:CCJ) has secured a nine-year uranium supply agreement with India worth an estimated US$2.6 billion, accelerating its nuclear power expansion as it deepens critical mineral ties with the country.The Saskatoon-based uranium producer will supply nearly 22 million pounds of... Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00