- WORLD EDITIONAustraliaNorth AmericaWorld

July 04, 2023

Proposed Transaction will streamline Valor’ s global portfolio, allowing it to focus on its high- potential uranium assets in Canada’s Athabasca Basin

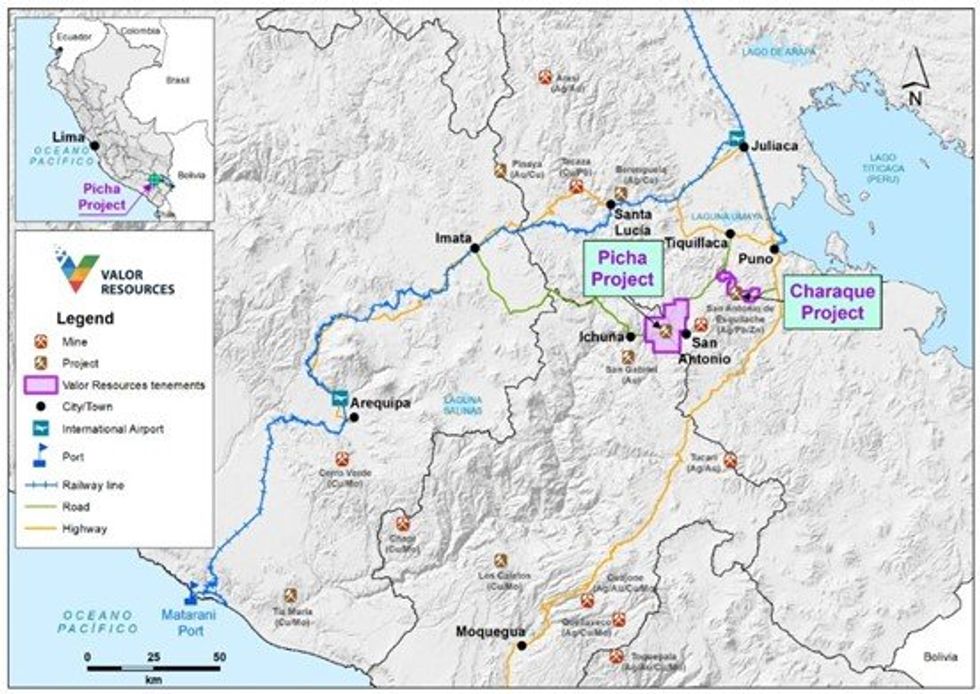

Valor Resources Limited (Valor or the Company) (ASX: VAL) is pleased to advise that it has executed a binding terms sheet (Terms Sheet) with Firetail Resources Limited (ASX: FTL) (Firetail) under which Firetail can acquire up to an 80% interest in its Picha Copper-Silver Project and Charaque Copper Project in southern Peru.

HIGHLIGHTS

- Binding Terms Sheet executed with ASX-listed Firetail Resources (ASX: FTL) for the divestment of up to an 80% interest in Valor’s Picha and Charaque Copper Projects in Peru to Firetail.

- Proposed Transaction follows the recently announced Earn-in Agreement with leading global gold and copper producer Barrick Gold Corporation covering the Charaque Project (see ASX announcement, 26th June 2023).

- $200,000 exclusivity fee paid to Valor in consideration of Firetail being provided an exclusive 90- day due diligence period.

- Consideration comprises $550,000 in cash and, subject to Firetail shareholder approval, 15 million Firetail shares and 20 million performance rights subject to certain vesting conditions. The equity consideration is equivalent to a 20.58% shareholding in Firetail on a fully-diluted basis.

- Valor also retains exposure to future exploration upside in Peru via a retained 20% project interest.

- Valor Executive Chairman George Bauk to be appointed to the Firetail board as a Director.

- The proposed divestment will streamline Valor’s portfolio, crystallising value from its Peruvian assets while allowing it to focus on its highly prospective, drill-ready uranium projects in Canada’s Athabasca Basin at a time of rising uranium prices and surging investor interest in the sector.

Under the Terms Sheet, Firetail proposes to acquire up to 80% of the issued share capital of Kiwanda S.A.C. (Kiwanda), a wholly-owned subsidiary of Valor which holds the mining concessions that make up the Picha and Charaque Projects (Proposed Transaction).

Firetail is a diversified ASX-listed exploration company with a portfolio of battery metal assets across Western Australia and Queensland, including the Yalgoo and Dalgaranga Lithium Projects in WA, the Mt Slopeaway Nickel-Copper-Manganese Project in Queensland and the Paterson Copper-Gold Project in WA.

As part of the Proposed Transaction, Firetail will inherit Valor’s experienced in-country management and technical team as well as the recently announced Earn-in Agreement with leading global gold and copper producer Barrick Gold Corporation covering the Charaque Project (see ASX announcement, 26th June 2023).

Drill permitting is well advanced at the Picha Project, with multiple high-priority targets identified by Valor over the past two years.

Once completed, the Proposed Transaction will simplify Valor’s global exploration portfolio, with the Peru assets to be housed in a focused ASX-listed explorer with the resources and financial capability to execute drilling programs and unlock the significant potential of these assets.

Valor will retain significant exposure to the upside potential of these assets via a 20.58% shareholding in Firetail on a fully-diluted basis as well as a retained 20% project-level interest.

Valor Executive Chairman, George Bauk, will join the Firetail Board as a Director following completion of the Proposed Transaction.

At the same time, the Proposed Transaction will allow Valor to focus on the substantial potential of its portfolio of high-grade uranium and rare earth assets in the Athabasca Basin in Canada at a very favourable time in the market cycle for these commodities.

The Athabasca Basin is the world’s highest-grade source of uranium, with an average grade of ~2% U3O8 across the basin, approximately 10-20 times the global average. Despite this, the area has only seen sporadic modern exploration over the past 40 years.

Valor holds four strategic projects within the Athabasca Basin, with a series of established drill-ready targets planned for testing in 2023/4.

The uranium market has experienced strong demand in recent years in response to growing recognition of its important role in achieving global decarbonisation, with spot prices doubling since mid-2019.

Valor’s Executive Chairman, George Bauk, commented:

“For some time, Valor has been distinguished by having an extraordinarily asset-rich portfolio which includes high-potential mineral assets in Canada’s Athabasca Basin and southern Peru. The Proposed Transaction delivers a necessary portfolio simplification that we believe will unlock significant value for our shareholders.

“Having identified significant potential across both the Picha and Charaque Copper Projects over the past few years, we believe that the best way to move these assets forward is via the divestments to Barrick and Firetail.

“This will allow us to focus on our high-potential Canadian uranium portfolio while retaining exposure to the upside in Peru via a free-carried interest in these assets. We believe that this structures the Company appropriately for the future while crystallising value for shareholders from our efforts in Peru over the past few years.

“Uranium is an essential part of the energy balance moving forward if the world is going to get anywhere near meeting its net-zero ambitions. The recent increases in the uranium spot price are indicative of the excitement that is rapidly building in the uranium sector globally.

“We are very excited about the opportunity to focus our full efforts on these outstanding assets and accelerate exploration activities at a time when investor interest in potential new uranium discoveries and resources has never been stronger. The future for Valor is very bright and I am looking forward to concluding this transaction and advancing the Company to the next level.”

Click here for the full ASX Release

This article includes content from Valor Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

VAL:AU

The Conversation (0)

5s

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten plans to expand US nuclear power, according to the chief executive of Centrus Energy Corp (NYSE:LEU), one of the country’s largest suppliers of enriched uranium fuel.Amir Vexler, chief executive of Centrus, warned that rising... Keep Reading...

17h

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

23 February

Basin Energy Hits 1,112 ppm TREO, Fast Tracks 2026 Uranium and REE Strategy at Sybella-Barkly

Basin Energy (ASX:BSN) is moving to accelerate its 2026 exploration efforts following "exciting" results from its maiden drilling program at the Sybella-Barkly project in Queensland. In a recent interview, Managing Director Pete Moorhouse revealed that the company has confirmed a significant... Keep Reading...

19 February

Drilling Confirms Potential REE System at Sybella Barkly

Basin Energy (BSN:AU) has announced Drilling Confirms Potential REE System at Sybella BarklyDownload the PDF here. Keep Reading...

18 February

Niger’s Seized Uranium Remains in Geopolitical Limbo

A stockpile of 1,000 metric tons of uranium seized from a French-operated mine in Niger is now sitting at a military airbase in Niamey that was recently attacked by Islamic State militants, raising fresh concerns over security and the material’s uncertain future.The uranium, which is processed... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00