July 11, 2024

Premier1 Lithium Limited (ASX:PLC) (“Premier1” or the “Company”) is pleased to provide an update on the Company’s activities including a recently commenced strategic review of all exploration assets. The strategic review follows the recent refresh of the board and management including new Managing Director, Chair and Exploration Manager, as well as the relocation of all company functions to Perth.

HIGHLIGHTS

- Board and management refresh is complete with new Managing Director, Chair and Exploration Manager now in place

- First phase field work at Abbotts North, Montague and Yalgoo lithium projects completed

- Strategic review of the current portfolio underway to define follow up exploration targets

- Additional gold and copper potential within the Abbotts North, Yalgoo, Boodanoo and Mount Magnet North projects being assessed

- The Company supported by Deutsche Rohstoff AG continues to seek new opportunities to strengthen the portfolio and generate shareholder value

The focus of the review is to identify follow up exploration targets as well as complementary exploration potential outside of lithium to prioritise expenditures in the current subdued lithium market.

Whilst lithium remains a core focus of the Company, there remains considerable potential for gold and copper mineralisation within the existing exploration portfolio.

The Company and new management are strictly committed to maintaining a disciplined investment and financial returns framework for testing its exploration projects as well as identifying new project opportunities.

Managing Director Jason Froud commented:

“While we currently review our existing lithium portfolio for the next round of exploration work, early indications from our internal review of the Company’s tenure are also highly encouraging for gold and potentially copper mineralisation. This allows us to maintain a parallel focus on multiple commodities over our existing projects whilst the lithium market remains weak. The Company’s long-term view of lithium remains positive and we continue seeking further transactional opportunities to strengthen our portfolio and generate shareholder value going forward.”

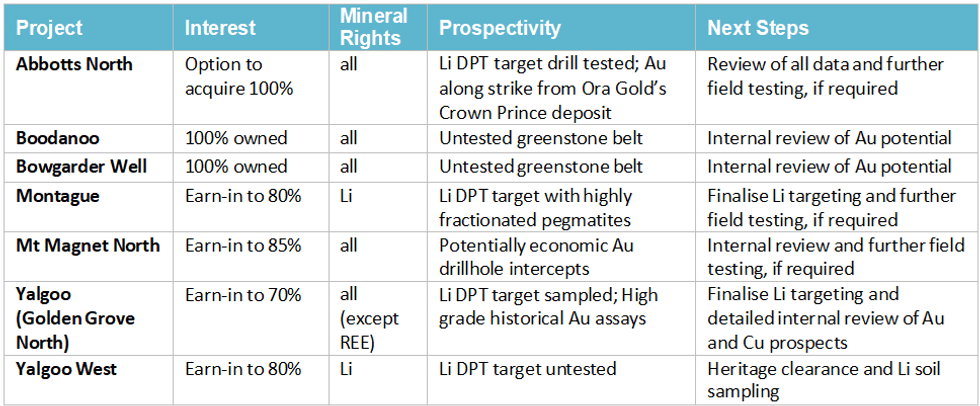

Following the completion of the first phase of field work at its main Abbotts North, Yalgoo and Montague projects, the Company is currently analysing all data including historic intercepts of pegmatites for interpretation and follow up lithium exploration targeting. As part of this, a strategic review of the current portfolio commenced to focus future exploration work on the most prospective areas and commodities (see Table 1 and Figure 1).

All recently collected data includes multielement analysis that allow for the review of other commodities at projects where the Company holds all mineral rights. This applies to Abbotts North, Yalgoo (except for REE), Mt Magnet North and Boodanoo. As part of the strategic review, Premier1 is focussing on the identification of gold and copper prospectivity within these projects. The gold and copper potential is considered to be a parallel work stream to the Company’s lithium exploration. The Company remains optimistic on the long-term outlook for lithium but expects a ‘U’ shaped recovery.

Yalgoo Project - Gold Occurrences within the Yalgoo-Singleton Greenstone Belt

At the Yalgoo project, a number of gold occurrences are known within the Yalgoo-Singleton Greenstone Belt. Within the Premier1 tenure, there are known gold occurrences at the Wadgingarra, Cumberland Well and Federal prospects among others (Figure 2). Between 1985 and 1989, the Wadgingarra area was explored by Mount Kersey Mining who completed a 73 hole (2,971 m) RC drilling program around the historical gold workings. The intersected gold mineralisation is associated with narrow, subvertical quartz veins which were exploited by late 19th and early 20th century workings. This work resulted in the reporting of a historical resource estimate extending to only 40m below surface1. Only minor follow- up exploration has been completed since this program concluded and further gold potential exists at Bridge Well, Bourkes United and Bridge Well to the south.

The Wadgingarra prospect area is located approximately 12km south and along strike from Spartan Resources’ Yalgoo Gold Project (5.3Mt at 1.45g/t Au2). In this context, the Yalgoo project warrants an additional detailed review of its gold potential which will be completed over the coming quarter.

Click here for the full ASX Release

This article includes content from Premier1 Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PLC:AU

The Conversation (0)

05 June 2024

Premier1 Lithium

AI-based and data-driven approach to lithium exploration in Western Australia

AI-based and data-driven approach to lithium exploration in Western Australia Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00