- WORLD EDITIONAustraliaNorth AmericaWorld

Overview

The encouraging growth of electric vehicles (EVs) is having positive effects on the demand for battery metals such as lithium. Global lithium consumption is expected to reach 1,427 kt of lithium carbon equivalent (LCE) in 2025, up from 797 kt of production in 2022, according to a Q2 2023 report from Australia’s Office of the Chief Economist. Recent lower pricing of lithium in the spot market has not changed the underlying global growth of EV’s and the geopolitical supply risks in the supply chain.

EVs are driving the rising demand for lithium-ion batteries resulting in the growth of the market globally. This puts the focus on junior mining companies that are busy developing critical mineral projects around the world especially with potentially lower operating costs long term. With lithium prices experiencing a downward trend, now could be an opportune time for investors to get into the lithium space as it remains a critical element for batteries and electric vehicles. With lithium assets in Tier 1 mining jurisdictions, Australia-based QX Resources (ASX:QXR) offers investors exposure to this rapidly expanding market.

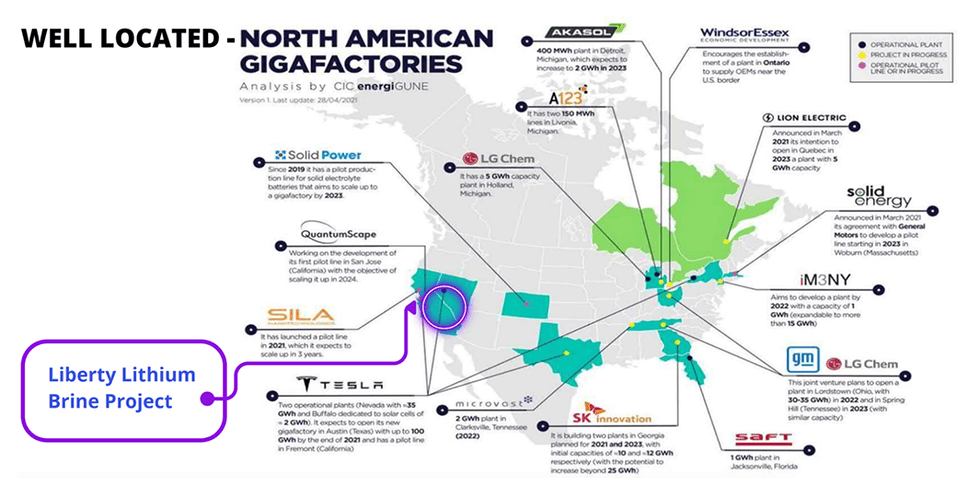

QXR’s lithium strategy is centered around the development of its Liberty Lithium Brine Project in California and a portfolio of lithium projects within the Pilbara region of Western Australia. Liberty Lithium is one of the largest single lithium brine projects in the US with contiguous claims over 102 square kilometres (equivalent to twice the area of Sydney Harbour). The geological setting of the project mirrors Albemarle’s Silver Peak lithium brine deposit in Clayton Valley, Nevada, and major Argentina brine projects. Like Silver Peak, QXR’s Liberty could be a large-scale, producing lithium brine asset.

Downstream producers in the US, including automakers, are in need of securing lithium supply, especially if domestic supply is available. As such, automakers in the US have been making significant investments in lithium projects. The most recent was a $100-million investment by Stellantis into Controlled Thermal Resources, which owns a lithium project in California. It is encouraging to note growing interest from end-users investing directly into projects making Liberty Lithium an attractive opportunity.

The company has an indicative development plan involving drilling, sampling and testwork starting with two permitted drill holes over the main part of the surface lithium anomaly, planned for November-December 2023. The aim is to identify lithium-bearing brine aquifers at depth, which is anticipated to lead to detailed drilling toward an initial resource by mid-2024. QXR has sufficient financial muscle to carry out the drilling and other work, especially with the recent AU$3 million raise via a private placement and access to an additional AU$3 million under an at-the-market (ATM) facility.

QXR intends to collect large volumes of lithium brines and submit them for testwork with various direct lithium extraction (DLE) providers. DLE technologies has the potential to significantly increase the supply of lithium from brine projects given higher recoveries, along with the bonus of sustainability and ESG benefits. A number of proven DLE technologies are emerging and being tested at scale, presenting an opportunity for QXR to find strategic partners.

The company is headed by managing director Steve Promnitz, who has a proven track record in the lithium sector. He successfully transformed Lake Resources, a lithium brine developer, from a $1-million market value private company to an ASX-listed company with an AU$2.1-billion market capitalization upon his departure in 2022. His geology and chemistry background along with experience of working in major mining companies, such as CRA and Rio Tinto, should prove beneficial for QXR.

Get access to more exclusive Gold Investing Stock profiles here