February 07, 2023

Latin secures significant new tenement package in the highly prospective Bananal Valley region

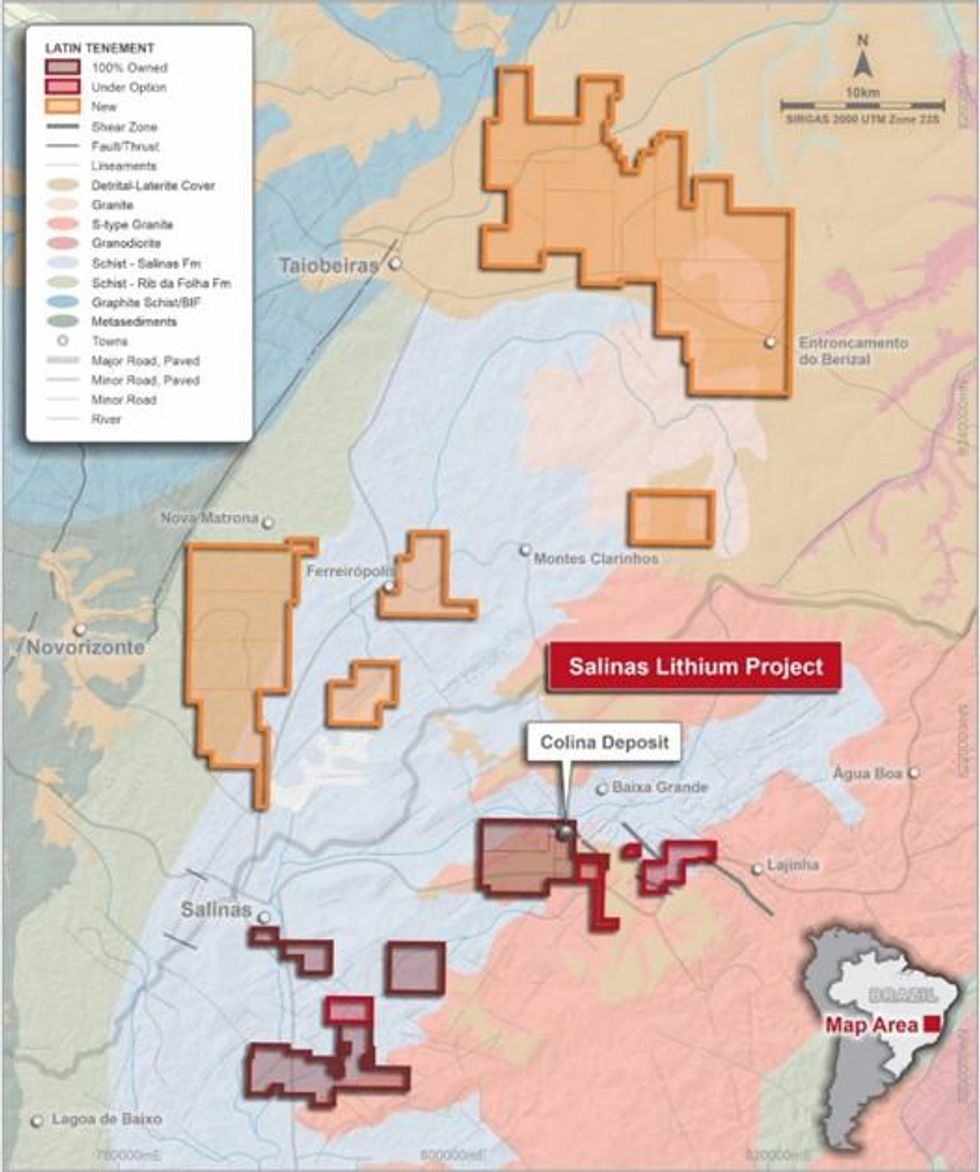

Latin Resources Limited (ASX: LRS) (“Latin” or “the Company”) is pleased to provide an update on the expansion of the Salinas Lithium Project (“Salinas”) in Brazil, which hosts the Company’s 100% owned Colina Lithium Deposit (“Colina”) (Appendix 1).

HIGHLIGHTS

- The Company has significantly expanded the Salinas Lithium Project tenure, by securing a large package of new tenements in the highly prospective region which hosts the Company’s 100% owned Colina Lithium Deposit.

- 17 new applications covering over 29,940 hectares have been lodged with the Brazilian National Mining Agency (ANM) over what the Company believes to be areas that contain favourable basement lithologies to host lithium bearing pegmatites, like those found at Colina.

- These new tenements represent an expansion of approximately 367% over the Company’s previous holdings, to a total of over 38,000 hectares now under Latin’s control.

- The Company has also secured the rights to additional mining rights directly adjacent to the South of Colina, where drilling by the Company has confirmed the extension of the Colina host lithologies and pegmatitic intrusive bodies (assay results pending), by signing a new option agreement.

- The current 65,000m diamond drilling program which commenced in early January, will focus on the expansion of the existing Colina Mineral Resource Estimate to the west and south. The Company is will also undertake first pass reconnaissance drilling at the existing Salinas South and Lajinha Prospect areas in the coming months.

- The Company’s regional exploration team will be undertaking initial reconnaissance mapping and geochemical sampling over the new project tenements as a part of its exploration strategy in the now expanded Salinas district.

Latin Resources’ Geology Manager, Tony Greenaway, commented:

“The Bananal Valley region is a highly prospective district, as we have proved with the discovery and delineation of the Colina Lithium Deposit. Our proprietary knowledge gained over the past 12 months throughout the resource definition drilling of Colina, coupled with our understanding of the wider regional controls to mineralisation in this area, has enabled us to identify these opportunities to secure what we believe are favourable exploration areas for the Company.”

Latin Resources’ Managing Director, Chris Gale, commented:

“The Salinas Lithium Project is continuing to grow to potentially become one of the world’s leading lithium projects with this expanded tenement package. With the recent publication of our Maiden JORC Lithium Resource, the aggressive 65,000 metres drill program planned for 2023 and feasibility studies well underway, we are extremely excited about this year for Latin Resources.”

New Tenement Applications

The Company significantly expanded its mineral exploration title holdings in the highly prospective Bananal Valley District in Minas Gerais, Brazil, through lodging 17 new applications with the Brazilian National Mining Agency (ANM), over an area of more than 29,940 hectares of what the Company believes to be favourable basement lithologies (Figure 1).

The Company now controls approximately 38,100 hectares (381km2), which represents a significant land position in the region.

The new tenements are located to the north of the Company’s existing land holdings where the Company has defined a maiden Mineral Resource Estimate (“MRE”), for the Colina Deposit 1 of 13.3 Mt @ 1.2% Li2O, along with a JORC Exploration Target Range1 (“ETR”) for Colina of 13.5 – 22 Mt with a grade range of 1.2 – 1.5% Li2O, in early December 2022.

Utilising the available government and other proprietary data sets, including regional magnetic data, mineral mapping and solid in-house geological interpretations, the Company has undertaken a regional desktop prospectivity review of the wider Bananal Valley District surrounding the Colina Deposit. The resulting new tenement applications cover areas that have been interpreted by the Company to be favourable for the presence of lithium bearing pegmatites.

The majority of these areas are considered by the Company to be ‘green-fields’ exploration areas. The Company will commence preliminary reconnaissance work including the ground truthing and geological mapping and regional scale geochemical sampling.

Other works including airborne geophysical and remote sensing survey may also be undertaken over specific areas highlighted as part of the initial reconnaissance work by the Company’s field exploration teams.

Click here for the full ASX Release

This article includes content from Latin Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LRS:AU

The Conversation (0)

02 February 2022

Latin Resources

Developing mineral projects to support the global decarbonization

Developing mineral projects to support the global decarbonization Keep Reading...

20h

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00