- WORLD EDITIONAustraliaNorth AmericaWorld

November 09, 2023

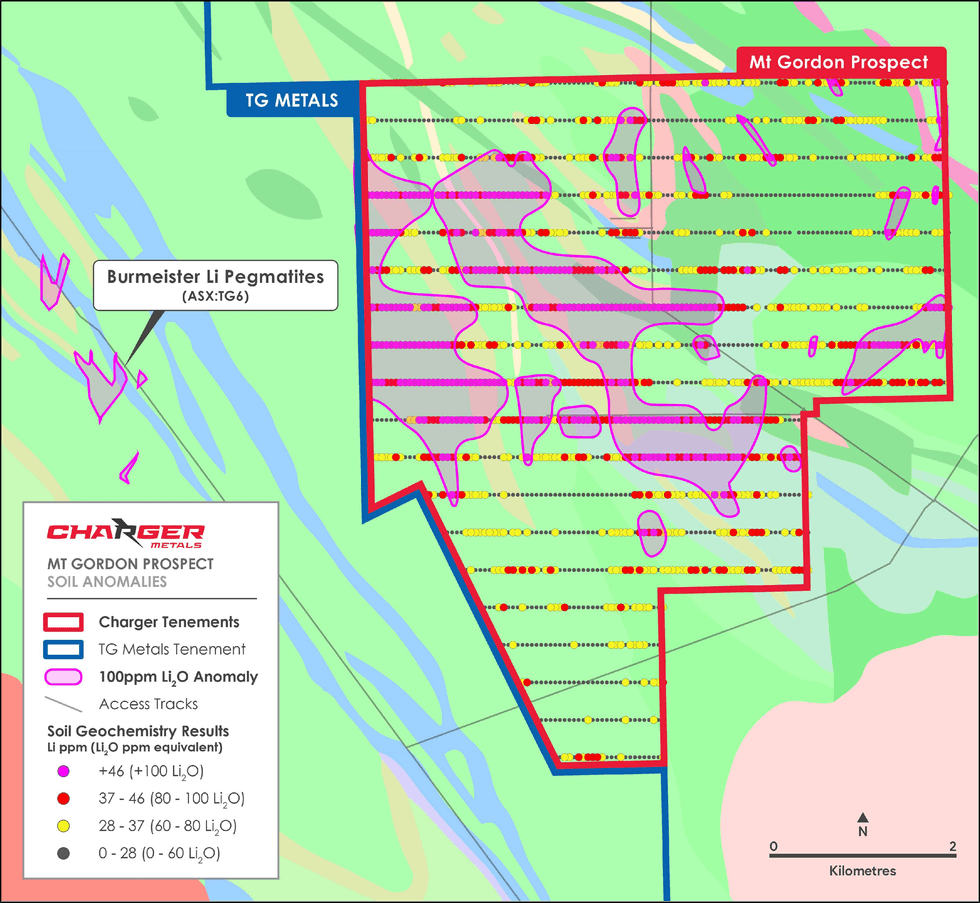

Charger Metals NL (ASX: CHR, ‘Charger’ or ‘the Company’) is pleased to announce that assay results from soil sampling completed earlier this year have identified several new lithium targets at the Mt Gordon tenement of the Lake Johnston Lithium Project, Western Australia.

- Latest soil sampling programme across the Mt Gordon tenement (100% Charger) of the Lake Johnston Project has identified several new lithium targets for follow-up exploration

- Largest identified soil anomaly (>100ppm Li2O) extends for over 3km and lies adjacent to the tenement boundary with TG Metals Ltd (ASX:TG6) which hosts the recent Burmeister lithium discovery1

- Planning and permitting has commenced for follow-up air-core (AC) and reverse circulation (RC) drilling on the Mt Gordon tenement

- Preparation is ongoing for further drill programmes at the Lake Johnston Project, including diamond drilling at the Medcalf Spodumene Prospect

The results show large expanses of the tenement are anomalous for lithium in soils. Of note, several of these areas contain lithium in soils over 46 ppm Li (>100 ppm Li2O), including one anomaly that extends for more than 3km along the tenement’s western boundary which is immediately adjacent to TG Metal Ltd.’s (ASX:TG6) recent Burmeister lithium discovery (Figure 1).1

Charger’s Managing Director, Aidan Platel, commented:

“The soil geochemistry results from our 100% owned Mt Gordon tenement are very encouraging. The size and strength of the lithium soil anomalies are significant, especially in the context of the successful Burmeister lithium discovery on the adjacent tenement (TG Metals Ltd) which resulted from drilling of a lithium soil anomaly. 1

Our technical team will now expedite plans and permitting for follow-up exploration at Mt Gordon, including AC and RC drilling. In parallel we continue to work towards further planned drill programmes for the Lake Johnston Project, including diamond drilling at the Medcalf Spodumene Prospect and a maiden RC drill programme at the Mt Day Prospect.”

Technical Discussion

Soil sampling was completed in the June Quarter 2023 across the Mt Gordon tenement area, sampling at 50m east-west spacings on lines 400m apart. The samples were sieved to 250µm (i.e. fine-fraction soil samples) and assayed at Intertek for a full multi-element suite. The results show several lithium in soils anomalies that warrant further exploration, including a large (3km long) anomaly over 46 ppm Li (>100 ppm Li2O) that trends sub-parallel to the geology (NNW-SSE) along the western tenement boundary.

The results also demonstrate a dendritic pattern in places that suggests transported cover in the form of a historic alluvial channel. In these areas AC or shallow RC drilling will be necessary to assess the underlying basement geology for potential lithium-bearing pegmatites.

Click here for the full ASX Release

This article includes content from Charger Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CHR:AU

The Conversation (0)

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00