July 04, 2022

Poseidon Nickel (ASX: POS) (“Poseidon” or “the Company”) is pleased to report an updated Mineral Resource Estimate (MRE) for the Black Swan disseminated sulphide deposit at Black Swan.

Key Points

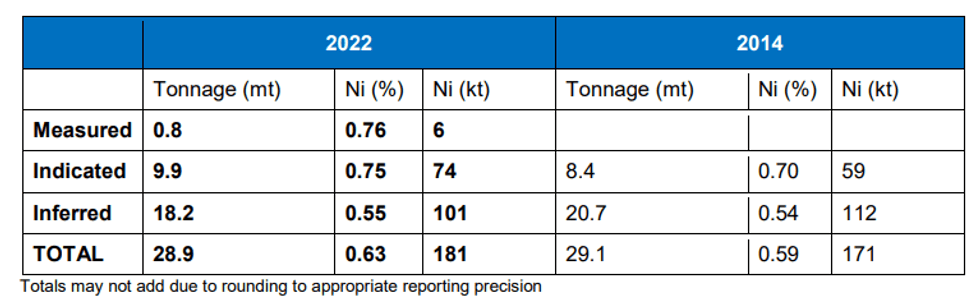

- Updated Black Swan Disseminated Mineral Resource Estimate reported as follows:

- 28.9Mt at 0.63% nickel containing 181kt nickel at a 0.4% cut off; including

- Measured and Indicated Resources of 10.7 Mt at 0.75% nickel containing 80kt nickel

- Measured and Indicated Resources now have 35% more contained nickel compared to the 2014 Resource

- Global Resource nickel inventory has increased by ~10kt contained nickel and is at a higher average grade

- The updated Black Swan Mineral Resource has significantly improved the confidence in the nickel grade and distribution of the metallurgically important serpentinite and talc-carbonated hosted disseminated mineralisation immediately below the Black Swan open pit

- The update Resource underpins the previously outlined “Fill the Mill” Strategy

Managing Director and CEO, Peter Harold, commented, “The update of the Black Swan Disseminated Resource is an important milestone for our Fill the Mill Strategy. Black Swan has a 2.2Mtpa process plant (mill) and our strategy is to “Fill the Mill” to leverage off the existing infrastructure and large resource base at Black Swan.

The latest MRE incorporates the results from the recent underground drill programs undertaken from the Gosling drill drive. We are pleased the update has resulted in both an increase in the overall tonnes of contained nickel together with an increase in the inventory of the Measured and Indicated Resources. Most importantly, the recent drilling has provided an improved understanding of the disseminated grade distribution within the metallurgically important serpentinite and talc-carbonate hosted ores below the existing Black Swan open pit. The improved metallurgical understanding is key to further de-risking the restart of Black Swan.

Work is well advanced on optimising the pit shell designs from the new MRE and from the underground mining studies at Silver Swan and Golden Swan. Once completed, this work will allow the updating of Ore Reserves for the Black Swan Project to underpin the Bankable Feasibility Study.”

The MRE was prepared for Poseidon by independent resource consultants Golder Associates Pty Ltd (Golder) using all available assay data as at June 2022. The updated MRE now totals 28.9 Mt @ 0.63% Ni for 181kt of nickel metal contained. The MRE replaces the previous Black Swan MRE completed by Golder in 2014 (refer to Company announcement “Black Swan Mineral Resource” dated 4 August 2014) which reported 29.1 Mt @ 0.59% Ni for 170.9kt of nickel metal contained excluding stockpiles which have not been updated at this time.

The updated 2022 Black Swan MRE is classified in accordance with the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC 2012) and are reported herein above a 0.4% Ni cut-off grade in Tables 1 and 2. The JORC 2012 Compliance tables (Sections 1, 2 and 3) that accompany this announcement are contained in Appendix 1.

Competent Persons for this updated 2022 MRE are Poseidon’s in-house geology team for providing the validated drill hole database and the lithological and mineralisation domains for the Black Swan deposit. Golder’s personnel were responsible for the estimation, reporting and classification of the MRE.

New Data

The updated MRE incorporates 5,144 metres of new drilling from 24 diamond drill holes (DDH) completed by Poseidon between October 2021 and March 2022 (refer to Table 2 and Appendix 2) and 14 RC holes (2,481 metres) completed in 2019 (refer to Company announcement “Black Swan underground RC Drilling – Final Assay Results” dated 27 November 2019). Both drill programs were completed from underground using the Gosling access drive. The recent 24-hole drill program was specifically undertaken to increase the confidence in the Black Swan MRE, by infilling the area extending approximately 125 metres immediately below the existing Black Swan open pit with the objective of better delineating the metallurgically important serpentinite and talccarbonate hosted resources in this area. Below this area, the MRE is based on the same historical drill hole data that was used in the August 2014 MRE.

Click here for the full ASX Release

This article includes content from Poseidon Nickel, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

POS:AU

The Conversation (0)

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

22 December 2025

Nickel Price Forecast: Top Trends for Nickel in 2026

Nickel prices were stagnant in 2025, trading around US$15,000 per metric ton (MT) for much of the year.Weighing heavily on the metal was persistent oversupply from Indonesian operations. Meanwhile, sentiment remained weak amid soft demand growth from the construction and manufacturing sectors,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00